Author: Coinmonks

Compiled by: Vernacular Blockchain

The year began with a clear public signal that the center of gravity was shifting.

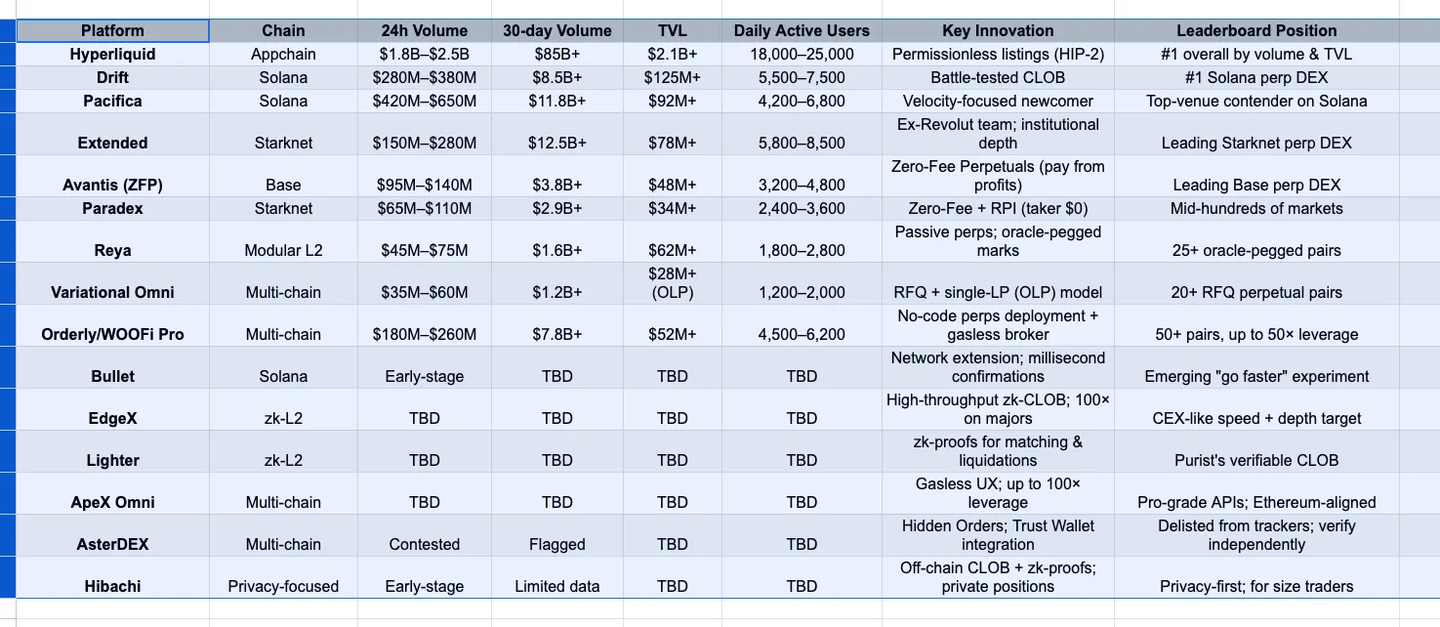

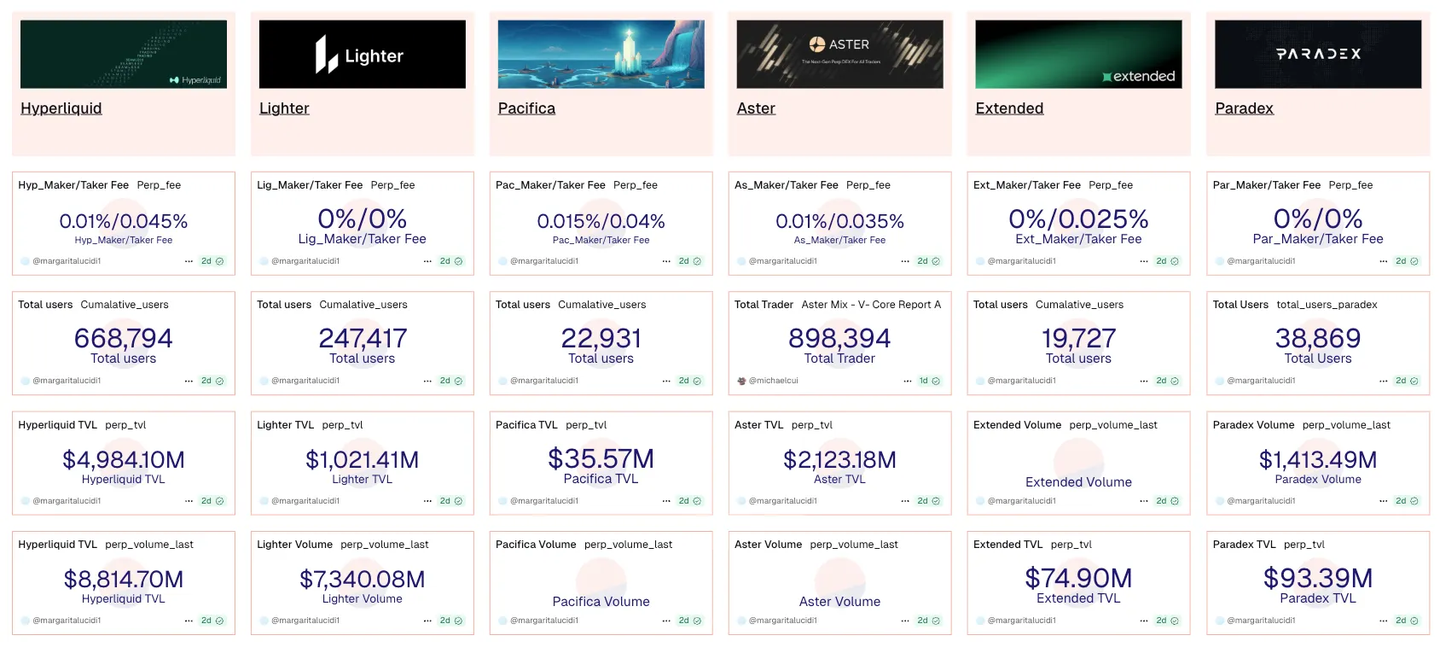

In early October, Hyperliquid launched permissionless listings (HIP-3). Now, builders can list perpetual swaps by staking 500,000 HYPE, with restrictions such as validator penalties and open interest caps. This move comes as decentralized perpetual swaps are reaching new highs in their battle for market share with CEXs, fueling the narrative that "on-chain is winning."

Meanwhile, CZ (the founder of Binance) responded to rumors about Hyperliquid connections on X, even intervening in a widely discussed thread about "shorting $1 billion on Hyperliquid." Whether you interpret this as concern or simple rumor control, the Binance founder's public mention of a DEX is enough to show where attention has shifted.

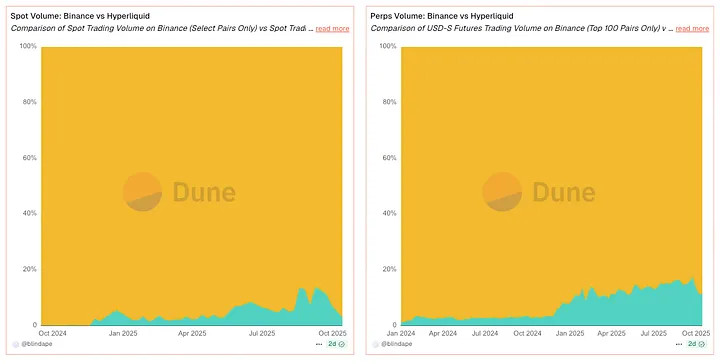

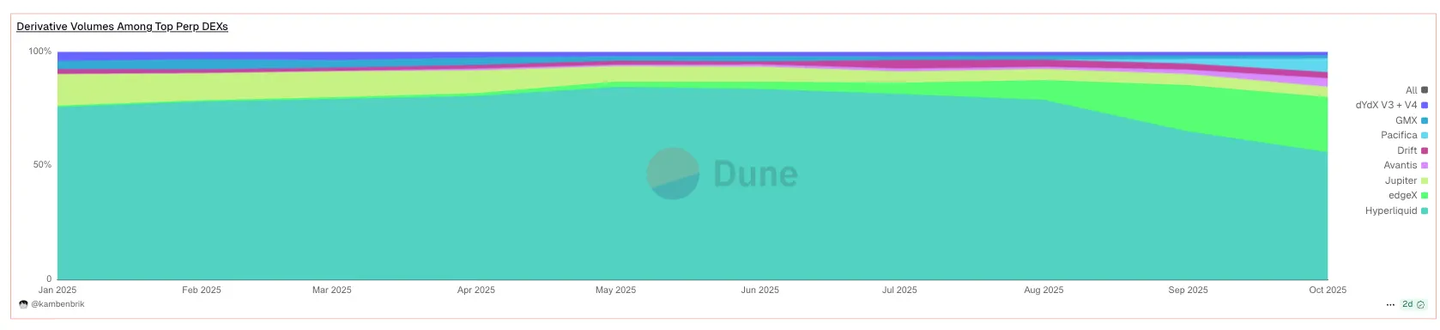

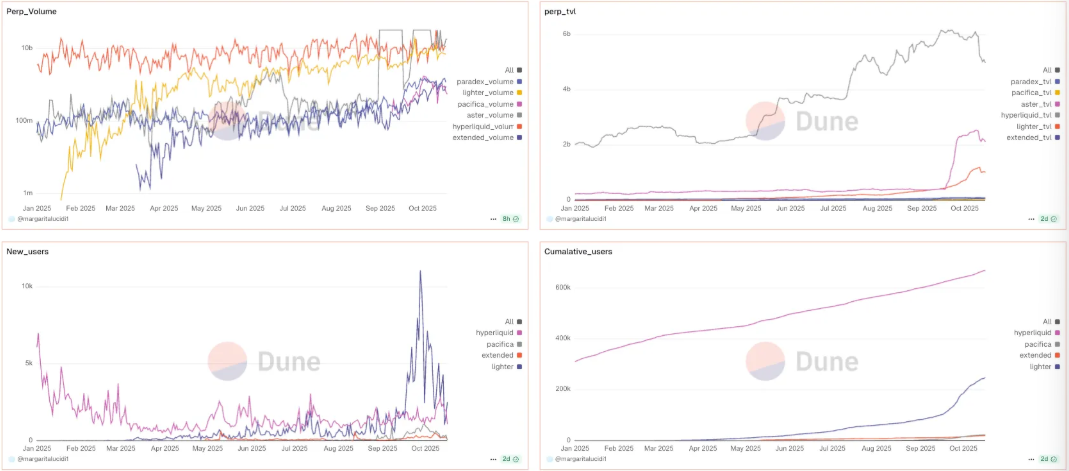

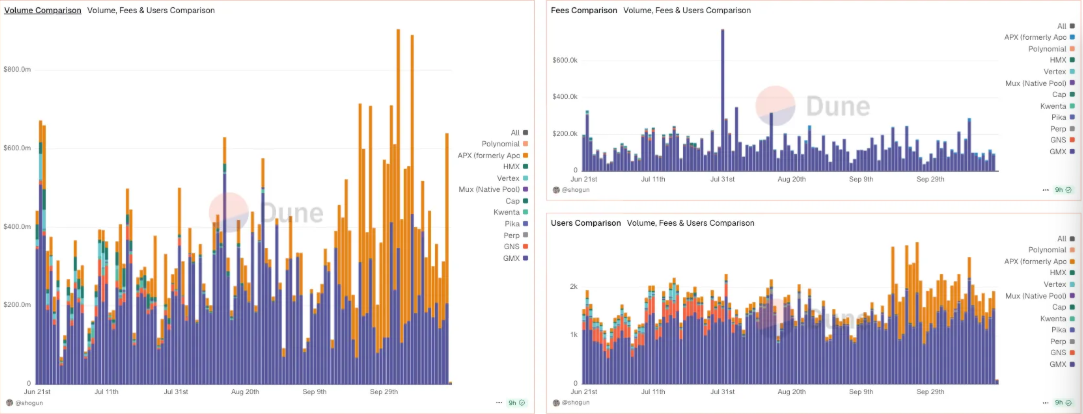

Zooming in on market structure: By mid-2025, DEX perpetual swaps accounted for approximately 20%–26% of global perpetual swap volume, up from single-digit figures two years prior. The DEX-to-CEX futures trading volume ratio hit a record high of approximately 0.23 in the second quarter of 2025, a clear, directional signal that liquidity and users are migrating on-chain.

Execution determines your advantage

There are three levers that drive Profit and Loss (PnL):

- Execution and Slippage (Latency, Depth, Queuing)

- Liquidation design (mark price vs index price; automatic deleveraging ADL vs insurance fund)

- Fee Surface (Classic Maker/Taker vs. Zero Fee/Profit Sharing)

The following will be organized according to how each platform uses these levers, interspersed with indicators to explain their behavior, rather than simply listing them in a table.

Lisk CLOBs: When Latency Becomes a Feature (and Reflects It in PnL)

Hyperliquid's HIP-3 transformed the supply side of liquidity. With listing permissionless (requiring only a 500,000 HYPE deposit), the long-tail market is no longer a flash in the pan. You can see that open interest survived the first funding cycle without evaporating, and liquidity on days three and seven remains sufficient to support large trades. This stickiness, combined with consistently high daily trading volumes, explains why traders now plan their trades assuming Hyperliquid has depth in "niche" trading pairs—because it often does.

On Solana, Bullet prioritizes speed. Its "network scaling" design maintains confirmation times in the low milliseconds during periods of intense volatility, typically two minutes (using Celestia DA and application-specific optimizations). The net effect is tighter slippage in fast-moving markets: when SOL increases by a few tenths of a percent in a matter of seconds, the transaction price is closer to the intended price than on slower blockchains. This isn't fancy marketing; it's the basis points saved on every trade.

EdgeX is a zk implementation of the same concept. During macro data releases, takers typically face a single-digit spread cost because its matching engine actually reserves queue positions. After a month of news-driven trading, this gap accumulates into a meaningful advantage—one reason why trading desks offer it as a "fast lane" backup option.

A Solana story ties all this together. When Drift hit a billion dollars in daily trading volume, market makers compared prices across different platforms within the same minute; Pacifica, even though still invite-only, had a comparable impact on BTC/SOL during those windows. The takeaway: Solana's throughput is now shared across multiple platforms, rather than unique to a single one—routing trades based on strategy, not loyalty.

The zk-L2 Order Book: Verifying Not Just the Results, But the Engine

Lighter turns "believe it or not, verify it" into its infrastructure. Matching and liquidation are both covered by ZK proofs, so price-time priority and ADL paths are auditable state transitions, not policy documents. You can see this during market sell-offs: liquidations unfold as documented, and insurance fund usage aligns with the stress path. This is why the backtest results here are more resilient to real-world testing.

ApeX (Omni) emphasizes user experience without sacrificing custody: a gas-free frontend, up to 100x leverage on major trading pairs, and a CEX-grade API—all backed by a stable daily trading volume of hundreds of millions of dollars, ensuring that order cancellation/replacement latency remains responsive even during funding rate inversions. For high-frequency traders, the key metric isn't notional value, but whether sub-second cancellations remain effective when the order book fluctuates drastically.

Cost Alchemy: Zero Actually Means Different

There are two designs that force you to update your spreadsheet:

- Avantis (Base) removes fees for opening, closing, and borrowing positions, charging only for profitable closings (ZFP, meaning zero fees or profit sharing). Over a month of high-leverage, high-frequency trading, you'll see a tightening of your PnL variance, as the fee drag ceases to weigh on you during volatile market conditions. Analysts believe ZFP differs significantly from "discounts": it changes the optimal holding period, particularly for short-term trade flow.

- Paradex (Starknet) maintains $0 taker fees through Retail Price Improvement (RPI). Whether this is cheaper depends on the spread. During quiet periods, a $0 taker fee + improvement often outperforms the classic maker/taker model; during breaking news, spreads widen and the calculation reverses. Paradex's own RPI post is a good starting point—the right metric to track is the effective cost per trade (spread ± improvement), not the promotional banner.

A noteworthy development on X is that quantitative traders, after Paradex explained RPI, published their volume-adjusted spread costs. For volumes below five figures, RPI generally prevails; above this, depth dominates the fee tag. Consequently, real-time adjustments to trading routes are necessary.

Marked price and passive liquidity (fewer “why was I liquidated?” moments)

Reya optimizes for clean mark prices, not raw speed. By anchoring unrealized profits and losses to a hybrid oracle basket, the gap between mark price and index price is smaller during price spikes. In volatile markets, you experience several more notches of liquidation distance—which could be the difference between being wiped out and surviving to see the next candlestick.

RFQ: When Certainty trumps Time

Variational's Omni replaces open order book trading with requests for quotes (RFQs), quoted by an Omni LP that hedges across CEX/DEX/OTC and shares the market maker's PnL with depositors. The important number isn't the notional value, but the rate at which orders are filled at the quoted size when the order book is thin. During rapid two-minute BTC fluctuations, takers report higher fill rates than on sparse CLOBs—precisely when certainty is more valuable than a basis point.

The shift in market share (and why it's sticky)

Three data points form the structural argument:

- By mid-2025, DEX perpetual contracts climb to a low-to-mid 20% market share — up from ~4%–6% in 2024. This isn’t seasonality, this is a growth curve.

- The DEX to CEX futures trading volume ratio hit a record high of approximately 0.23 in the second quarter of 2025, echoing multiple market data sources.

- Hyperliquid’s permissionless listing and public CZ discussions amplified this narrative as these ratios hit new highs. The timing was unmistakable: DEXs are no longer fringe players—they have entered the main conversation.

Solana’s Three-Rail Ecosystem (How to Plan Transaction Flow)

Drift is a durable platform—maintaining stable depth, low slippage across margins, and major trading pairs at approximately $300 million in daily trading volume. When it reached over $1 billion in 24-hour trading volume, traders using the same order volume compared prices across platforms and used Drift as a benchmark.

Pacifica is about speed — even in its invite-only beta phase, it achieved over $600 million in daily trading volume, with transaction prices rivaling Drift within the same hour, making it a true alternative rather than a “points-based” alternative.

Bullet is the raw speed type - it is a millisecond channel for event trading. When the slippage of a basis point is the profit of the entire trade, you need to route the trade here.

Starknet's CLOB cluster (no longer a science project)

Extended and Paradex regularly reach hundreds of millions of dollars in daily trading volume and tens of billions of dollars within a 30-day window. Their characteristics are crucial: Extended exhibits shallower slippage on major trading pairs than a younger platform, while Paradex's $0 taker fee is actually cheaper during off-peak hours—until spreads widen around news events, requiring real-time adjustments to trade routing.

AsterDEX: Features vs. Depth

Hidden orders are now live. Trust Wallet integration broadens the user funnel. During the same window, third-party trackers flagged suspicious trading volume patterns and removed perpetual contract data feeds. The mature approach is simple: enjoy the rapid feature iteration, but only invest significant capital once depth, open interest, and fees meet your order volume requirements.

Privacy without sacrificing transactional value

Hibachi combines an off-chain CLOB with Succinct-style ZK proofs and encrypted data availability on Celestia, so balances/positions remain private and provable. The key performance indicator (KPI) isn't TVL; it's execution quality in privacy—when you don't broadcast your inventory, are your fill prices and slippages as expected?

Extreme leverage is a slogan, not a plan

"Up to 1000x" sounds exciting; at this leverage, a 0.10% adverse move will result in automatic liquidation. If you really want to test it, keep your position size very small and set hard stops. In practice, using a clean 25–50x leverage on a gas-free CLOB (like WOOFi Pro on Orderly) is sufficient—and much easier to manage risk.

How to choose - practical and indicator-driven

- Prioritize execution. Measure realized slippage and order cancellation/replacement latency during CPI/FOMC/ETF meeting minute releases. If milliseconds and queue position matter, Lisk/zk CLOBs—Hyperliquid, EdgeX, Bullet, Lighter, ApeX—tend to win.

- Fees are second. Backtest ZFP (pay from profit) vs. RPI ($0 taker fee) based on order size and volatility; the "cheapest" platform varies by hour, not month.

- Liquidation is third. When depth thins out, tend to choose small markers - index price gaps (Reya), proven liquidation paths (Lighter), or RFQ hedges (Variational).

- Always verify liquidity. Use 24/7/30 day volume and open interest (OI) for a common sense check — then send real test orders for your trading pairs (not just BTC/ETH).

Configuration in 2026, a summary in one sentence

Run a speed platform (Hyperliquid/EdgeX/Bullet), a fee model hedging platform (Avantis ZFP or Paradex RPI), and a chain-native option you trust (Drift/Pacifica on Solana; Extended/Paradex on Starknet). Then let latency, proofs, effective fees, and liquidation logic—measured by your order volume—determine where you click to open a position.