Matt Hougan, Chief Investment Officer, Bitwise

Compiled by: Golden Finance

There are two core questions about Bitcoin in the current crypto market:

1. Why does the price of gold far outperform Bitcoin?

2. Given the massive buying from ETFs and corporations, why is Bitcoin’s price still stagnant?

In fact, a careful answer to the first question reveals the answer to the second—and this answer paints a potentially extremely bullish picture for Bitcoin’s future.

Next I will analyze it in detail.

Question 1: Why does the price of gold far outperform Bitcoin?

Despite a pullback, gold prices have surged this year, rising 57% so far in 2025 and on track for their second-best annual performance in US dollar terms. Meanwhile, Bitcoin has stagnated near $110,000, remaining roughly flat since May.

This is frustrating for investors who view Bitcoin as "digital gold," but there's a simple explanation: the discrepancy stems from the actions of central banks.

Central banks have been increasing their gold holdings since the US froze Russia's holdings of US Treasuries following Russia's invasion of Ukraine. According to Metals Focus, central bank gold purchases have nearly doubled since the outbreak of the Russo-Ukrainian war, from approximately 467 tons per year to around 1,000 tons today. This is roughly double the estimated purchases of gold ETPs (Exchange Traded Products).

Bitcoin doesn't enjoy this same treatment. While some central banks are researching Bitcoin, none have actually purchased it. Therefore, if central banks are the primary driver of the current gold price rally, it makes sense that Bitcoin hasn't followed suit.

This view is not new. Whether it is Morgan Stanley, JPMorgan or Mohamed El-Erian, institutions and individuals have pointed out that central bank gold purchases are the key driver of the surge in gold prices.

Question 2: Why does the price of Bitcoin remain stagnant despite large purchases by ETFs and companies?

How does this relate to the second question?

The answer is: a huge correlation.

The biggest mystery in the Bitcoin market is why its price has remained relatively stable despite massive purchases by ETFs and corporations. Since the launch of Bitcoin ETFs in January 2024, ETFs and corporations have accumulated 1.39 million Bitcoins, while the Bitcoin network has added less than a quarter of that amount over the same period. Despite an impressive 135% price increase since then, many still wonder: shouldn't it go even higher?

I once had the same question: Who is selling Bitcoin in large quantities? What is preventing it from breaking through the $200,000 mark?

The current rise in gold prices provides the answer.

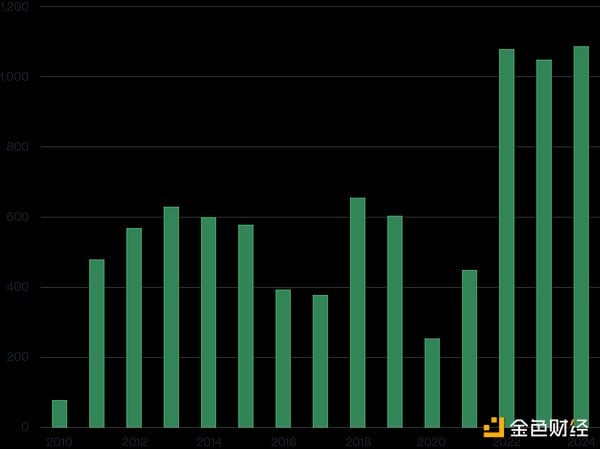

See the table below, which shows annual central bank gold purchases from 2010 to 2024. Central bank purchases were 467 tonnes in 2021, jumping to 1,080 tonnes in 2022, and have remained at this high level since then (forecasts show demand in 2025 will be slightly lower than in 2024).

Gold purchases by central banks from 2010 to 2024 (in tons):

Source: World Gold Council

In short, although central bank gold purchases are an important catalyst for the rise in gold prices this year, such purchases did not begin this year, but began in 2022.

This also provides an answer to the current situation of Bitcoin.

When central bank gold purchases began to increase significantly in 2022, gold prices rose more slowly: averaging $1,800 in 2022, rising to $1,941 in 2023 (a mere 8%), and $2,386 in 2024 (a 23%) increase. It wasn’t until this year that gold prices exploded, rising nearly 60% to around $4,200.

In other words: the central bank will start purchasing gold in 2022, and the price of gold will only rise parabolicly in 2025.

I think the logic is clear: in any market, there is a segment of price-sensitive investors—those who tend to take action when prices rise or fall by 10%-15%. When central banks begin buying gold in 2022, driving up prices, these investors will take advantage of the increased demand and sell gold. Eventually, however, this selling pressure will be exhausted, and prices will then rise significantly.

I suspect Bitcoin is currently in a similar phase.

As mentioned earlier, Bitcoin prices have increased 2.3 times since ETFs and companies began buying heavily in 2024. During this period, price-sensitive holders seized profit opportunities and sold out.

But as the gold price example shows, there will come a time when these selling forces will be exhausted. As long as the combined buying momentum of ETFs and companies continues (which I think is highly likely), Bitcoin will usher in its "golden moment in 2025."

My advice is: be patient.

Don’t envy the surge in gold prices, but rather view it as a foreshadowing – it may be showing us where Bitcoin is headed in the future.