Author: Bubblemaps

Compiled by: TechFlow

Did Ocean Protocol sell off over $100 million worth of community tokens?

Fetch AI publicly accused them of inappropriate behavior.

The following is a detailed account of the incident:

In March 2024, Ocean Protocol, Fetch AI, and SingularityNET announced the joint formation of the ASI Alliance.

These three previously independent projects merged to adopt a unified token: $FET.

After the merger, $OCEAN holders can convert $OCEAN into $FET at a fixed exchange rate.

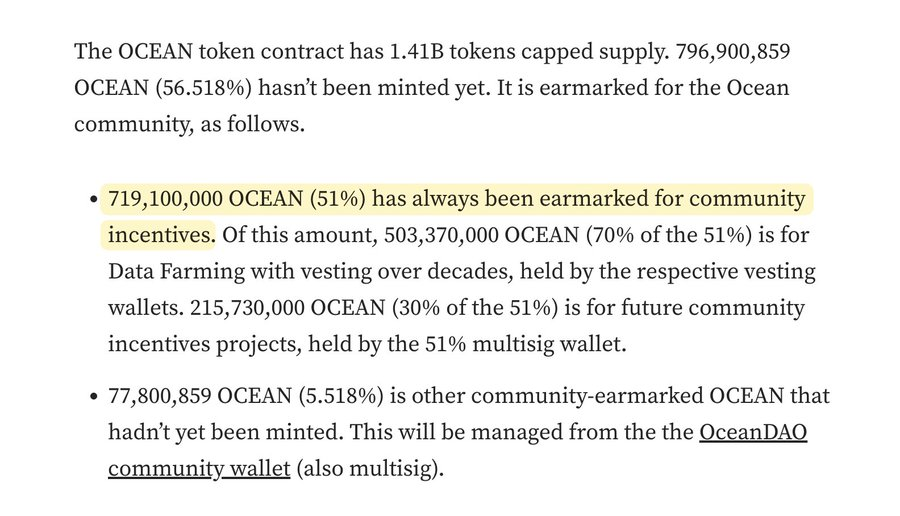

The Ocean Protocol team still retains a large number of $OCEAN tokens, claiming that these tokens will be used for "community incentives" and "data mining."

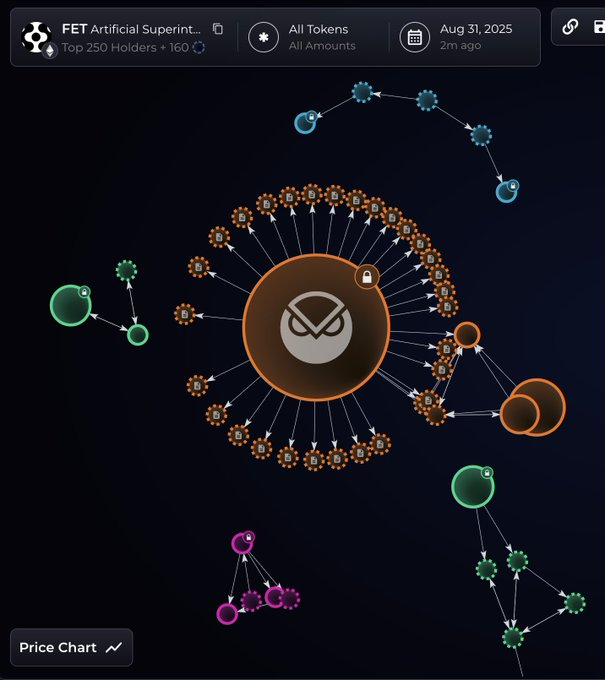

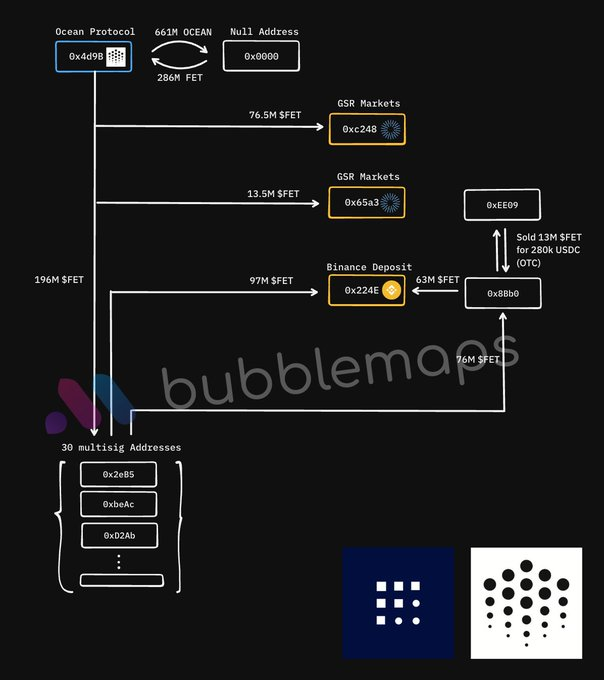

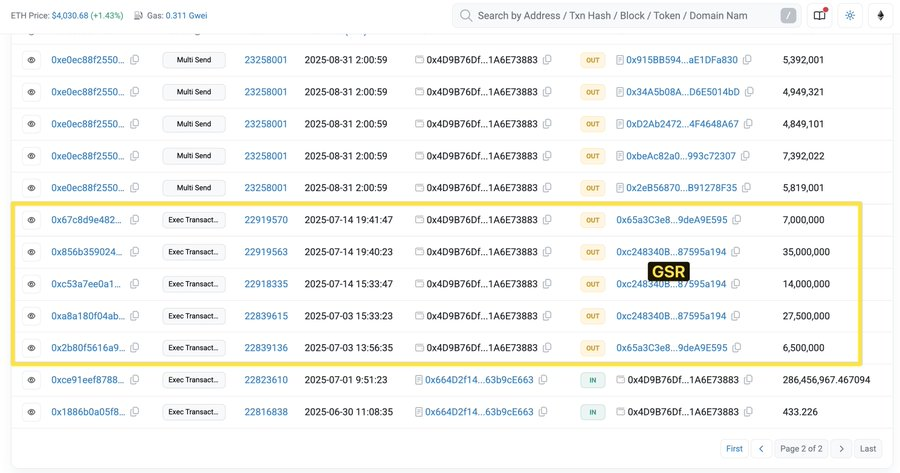

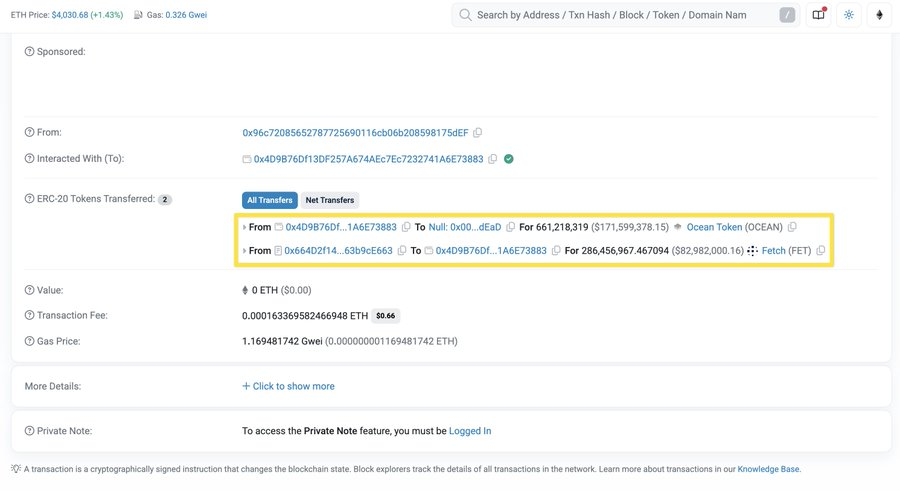

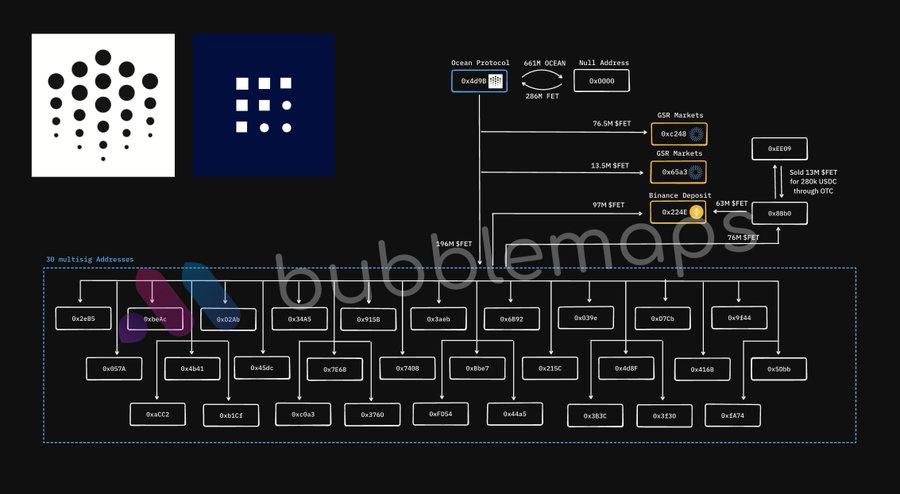

However, on July 1st, a wallet address associated with the Ocean Protocol team (0x4D9B) performed the following operations:

- Convert 661 million $OCEAN tokens into 286 million $FET tokens (approximately $191 million);

- 90 million $FET was transferred to over-the-counter (OTC) provider GSR Markets.

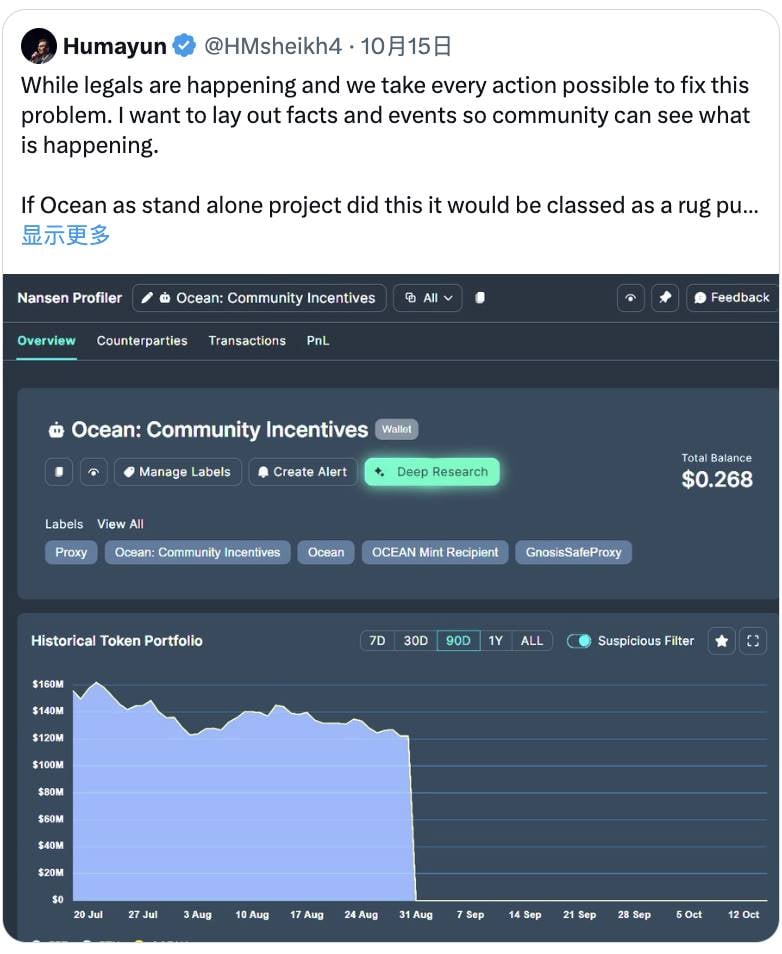

On August 31, the wallet distributed the remaining 196 million $FET to 30 newly created wallet addresses.

By October 14, almost all of these new addresses had moved funds to Binance or over-the-counter trading providers.

Related links: Click here

According to statistics, a total of approximately 270 million $FET was sent to Binance or OTC providers, of which:

- 160 million $FET sent to Binance;

- 109 million $FET were sent to GSR Markets.

The total value is approximately US$120 million.

In total, approximately 270 million $FET tokens were sent to Binance or OTC providers • 160 million to Binance • 109 million to GSR Markets Total value: approximately $120 million.

On October 9, Ocean Protocol announced its withdrawal from the ASI Alliance, but did not clearly state the reason for the withdrawal, nor did it mention the transfer of these $FET to centralized exchanges (CEX) and over-the-counter trading providers.

The FET team publicly accused Ocean Protocol of selling community tokens on social media platform X.

Original tweet link: Click here

In response, Ocean Protocol’s CEO called FET’s allegations “baseless rumors,” adding that the team is preparing a formal response to the allegations.

Original tweet link: Click here

While we cannot confirm whether these $FET were sold by the Ocean Protocol team, such token transfers are often associated with liquidations. On-chain activity indicates the following actions:

A multi-signature wallet related to Ocean Protocol:

- Convert 661 million $OCEAN into 286 million $FET;

- Transferred 270 million $FET to Binance and GSR Markets.

We have reached out to the Ocean Protocol team for a response, but have not yet received one.

This case has now been posted on the Intel Desk platform for further community investigation.