Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

On the macroeconomic front, US President Trump said on Tuesday that Washington is considering terminating some trade with China, including trade related to edible oil, as the Sino-US trade war continues. Meanwhile, Federal Reserve Chairman Powell delivered a speech on the US economic outlook and monetary policy. In his speech, Powell elaborated on the role of the Fed's balance sheet and its policy tools during the pandemic. He emphasized that the Fed will continue to adjust monetary policy based on the economic outlook and the balance of risks, rather than following a pre-set path. Powell also indicated that balance sheet reduction could end in the coming months. The market generally viewed Powell's remarks as dovish, somewhat mitigating the impact of the trade war.

Over the past 24 hours, the crypto market has experienced renewed volatility, with total market capitalization falling 2.03%. Bitcoin prices briefly approached $110,000 before rebounding alongside gains in US stocks. This decline follows last week's sharp sell-off, highlighting the market's volatility and fragility. Renowned trader and chart analyst Peter Brandt stated that Bitcoin could re-reach its all-time high of $125,100 next week, but will experience a significant correction before then. He also remains cautious about a more pessimistic market trend. K33 Research Director Vetle Lunde expressed constructive optimism for Bitcoin following recent leveraged liquidations, but cautioned against excessive patience. While traders are recovering from forced selling, short-term liquidity may remain low. However, such leveraged liquidations often signal a market bottom. The current price is attractive for increasing BTC spot positions. Coupled with favorable factors including expectations of looser policy, strong institutional demand, and ETF-related catalysts, the current situation favors a gradual accumulation of Bitcoin. Glassnode's weekly market report also noted that despite the significant impact of the market crash, the overall market structure remains intact. Bitcoin spot trading volumes remain high, ETFs continue to inflow, and physical-adjusted transfer volumes indicate robust on-chain activity. These dynamics suggest that while leveraged participants are being forced to exit, structural capital and institutional demand remain. The market is currently entering a period of consolidation, characterized by renewed caution, selective risk-taking, and a more measured rebuilding of confidence in both spot and derivatives markets.

Ethereum is currently trading at $4,114, almost below the average cost of all Ethereum treasury companies. However, some treasuries are still increasing their holdings against the trend, such as SharpLink, which increased its holdings to 840,124 ETH, and BitMine, which added 26,199 ETH. However, on-chain activity has declined significantly since the October 11th crash. The current average Ethereum gas fee is only 0.11 Gwei, indicating a decline in trading activity. Regarding market sentiment, BitMine Chairman Tom Lee and BitMEX co-founder Arthur Hayes, in a recent podcast interview, maintained their prediction that the ETH price will reach $10,000 this year. Cointelegraph also cited that currently, 29.39% of the total Ethereum supply is staked, while spot ETFs and Ethereum DATs hold 5.66% and 4.88%, respectively. Combined, these three account for 39.93% of the total Ethereum supply. Meanwhile, this week, the Kingdom of Bhutan announced that it would build its national identity system on Ethereum. However, the country currently holds no ETH. Therefore, there is reason to expect that national reserves may join the bidding for Ethereum.

Over the past week, CEXs (centralized exchanges) experienced massive asset outflows, with Binance seeing $21.75 billion in outflows over seven days. Investors remain in a state of panic, and recovery will take time. Matrixport, in a chart published today, analyzed that despite recent heightened market volatility, stablecoin inflows continue, demonstrating the market's resilience. Furthermore, Bitcoin and Ethereum spot ETFs saw net inflows on October 14th: Bitcoin spot ETFs saw a total net inflow of $103 million, while Ethereum spot ETFs saw a total net inflow of $236 million. Capital flows and structural demand indicate that the crypto market is currently in a transitional phase of adjustment and recovery.

2. Key Data (as of 13:00 HKT, October 10)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin: $112,475 (+20.21% YTD), daily spot trading volume $90.82 billion

- Ethereum: $4,118 (+23.37% YTD), with a daily spot trading volume of $63.26 billion

- Fear and Corruption Index: 34 (panic)

- Average GAS: BTC: 1sat/vB, ETH: 0.11Gwei

- Market share: BTC 58.5%, ETH 13.0%

- Upbit 24-hour trading volume rankings: ETH, XRP, BTC, SOL, DOGE

- 24-hour BTC long-short ratio: 49.45%/50.55%

- Sector gains and losses: AI sector rose 11.27%, NFT sector rose 2.33%

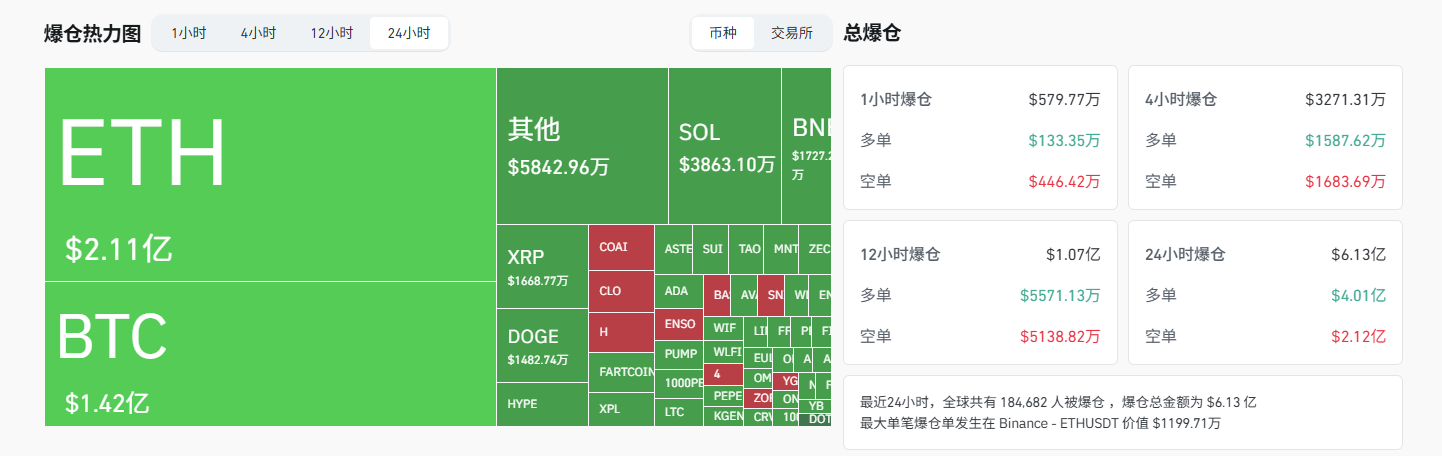

- 24-hour liquidation data: A total of 184,803 people were liquidated worldwide, with a total liquidation amount of US$614 million, including US$142 million in BTC, US$211 million in ETH, and US$38.63 million in SOL.

- BTC medium- and long-term trend channel: upper channel line ($117,145.37), lower channel line ($114,825.66)

- ETH medium- and long-term trend channel: upper line of the channel ($4252.15), lower line ($4167.95)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price is within the range or repeatedly passes through the cost range in the short term, it is in a bottoming or topping state.

3. ETF flows (as of October 14)

- Bitcoin ETF: +$102 million

- Ethereum ETF: +$236 million

4. Today's Outlook

- The BNB Chain Wallet browser extension will be officially deactivated on October 15th.

- Kinto Announces Closure and Initiates Orderly Liquidation

- Ark of Panda (AOP) unlocked approximately 640 million tokens, representing 32% of the current circulating supply and valued at approximately $38.6 million.

- Sei (SEI) will unlock approximately 121 million tokens, accounting for 1.21% of the current circulating supply, with a value of approximately $32.76 million.

- KULA (KULA) unlocked approximately 526 million tokens, accounting for 5.26% of the current circulating supply, with a value of approximately US$268 million.

- Starknet (STRK) unlocked approximately 163 million tokens, representing 1.63% of the current circulating supply, valued at approximately $19.39 million.

- Sign (SIGN) unlocked approximately 290 million tokens, accounting for 2.9% of the current circulating supply, with a value of approximately US$21.31 million.

- US releases CPI data

The largest increases in the top 100 cryptocurrencies by market capitalization today: COAI up 123%, ZEC up 12.8%, TAO up 11.5%, XPL up 8.1%, and 2Z up 5.1%.

5. Hot News

- New York City Mayor Eric Adams establishes the nation’s first mayoral-level Office of Digital Assets and Blockchain

- New US Republican bill aims to legalize Trump's executive order allowing 401(k)s to invest in cryptocurrencies

- Japanese regulators plan to ban cryptocurrency insider trading

- Citigroup CEO says he supports tokenized deposits, stresses market focus on stablecoins

- After the 1011 flash crash, the open interest of Perp DEX plummeted from $26 billion to less than $14 billion.

- Analysis: The US government may have been behind the LuBian mining pool theft, which, if true, would be the largest financial hack in history.

- SBF published a statement accusing the Biden administration of political persecution

- Crypto-native tipping protocol Noice reveals investment from Coinbase Ventures and Network School