Author: Zuo Ye

The Great Depression of 1929 led to the Securities Exchange Act of 1934 and the establishment of the SEC (U.S. Securities and Exchange Commission), but unfortunately or fortunately, depending on whether you are an e/acc accelerationist or a liberal perspective under regulation, the SEC has never prevented financial innovation or crisis since then.

In 1998, LTCM (Long-Term Capital Management) failed in its quantitative investment in Russian bonds, nearly causing a repeat of the Great Depression of 1929. However, this did not prevent the ATS (Electronic Trading System) regulations from taking effect in 1999, and quantitative, hedging, and arbitrage completely embraced information technology.

After the 2008 financial crisis, regulation was initiated against dark pool trading, but dark pools still exist. In 2025, after Gary Gensler left, the SEC was determined to embrace the new trend of the future - everything can be on-chain and everything can be compliant.

- On-chain: RWA is just the starting point. Future transactions, asset allocation, and interest generation will all be conducted on-chain. Embrace blockchain just like using a computer.

- Compliance: Airdrops, staking, IXO and Rewards, creating a Super App with American characteristics (Reg Super-App), and re-Americanizing all DeFi.

The SEC's Existential Crisis

The Great Depression created the SEC; cryptocurrency will end the SEC.

SEC Regulatory Shift Timeline: Gary Gensler Resigns —> Crypto Task Force —> Project Crypto

There are traces of the SEC's changes in regulatory activities, which can be divided into Gary's departure in January, and the new crypto policy after the current chairman Atkins took office in April, marked by the establishment of the Crypto Task Force, and the completion of the all-round "surrender" to crypto with Project Crypto at the end of July.

To understand why Project Crypto emerged, we need to find the answer from the SEC regulatory dynamics from April to July. During this period, there were frequent actions. On the one hand, the lawsuits against Ripple, Kraken and others were to end in a decent manner. On the other hand, companies such as Coinbase and Grayscale became increasingly powerful and actively asked the SEC to relax its supervision.

In particular, the Ripple case marked the SEC's shift from "enforcement-style supervision" to "regulatory services." Kraken's subsequent restart of its IPO process proved that the concept of encryption was completely accepted by US regulators, and Robinhood also began to promote tokenized stocks.

The approval of physical pledge and redemption of BTC/ETH ETF is the most significant progress, but more currencies and more forms are still in a case-by-case review state. For example, Trump’s own Trump Group’s ETF is also in the queue.

Dare to obstruct the encryption journey of American Sun, this is no longer an ordinary SEC, and must be dealt with severely!

Image caption: SEC 2025 Crypto Regulatory Paradigm Change, Image Source: @zuoyeweb3

So Trump chose to play by his own rules, supporting the CFTC and launching legislative actions such as the Genius Act. The CFTC is already on the road to expanding its powers, and the White House cryptocurrency report even announced that it would essentially accept everything about existing DeFi.

The SEC has previously "transferred" stablecoin supervision to banking regulators, and more digital asset regulatory powers have been assigned to the CFTC. Where the SEC will go has become a practical issue that must be considered.

The more significant Clarity Act has not yet officially become law. If the SEC does not take proactive action, it will be completely taken over by the CFTC. In particular, the issuance of stablecoins has essentially touched the core of securities law. The SEC must start with administrative practice before the Clarity Act is fully enacted, preemptively dividing the scope of regulatory influence and creating a fait accompli.

However, under the current framework, the SEC can do very little. For example, regarding topics such as approving more collateralized ETFs (such as SOL), issuing any type of currency ETFs, tokenized stocks and securities, as well as the approval of crypto companies’ listings and treasury (DATCO) companies, the SEC’s attitude is to wait and see, repeatedly delaying and suspending various issues.

On July 17, there were already rumors that the SEC was planning to merge with the CFTC. Just after the launch of the SEC's Project Crypto, the CFTC's Crypto Sprint plan followed suit. The details are not important.

The division of SEC and CFTC will end in the cryptocurrency era. The only option for the SEC to maximize its interests is to embrace the new era and abandon all the dogmas of the old world.

On-chainization of the real world

DeFi is fully compliant, and the era of offshore arbitrage has come to an end.

As I’ve written before, neither the Genius Act nor the Clarity Act involves specific DeFi regulation. The former only covers stablecoins, while the latter is too macro. Now the SEC’s Project Crypto provides detailed regulations from an administrative perspective, framing all aspects of DeFi from the three aspects of personnel, finance, and regulations.

There is no need to go overseas, just come back to the United States.

To sum up, everything that offshore exchanges and overseas foundations can do can now be done in the United States.

Whether it is stablecoins, IXOs or tokenization (stocks, bonds), although the regulatory authorities are different, the SEC will not arbitrarily prosecute for illegal securities issuance as long as good communication is carried out.

Secondly, the founder of Tornado Cash ruled that the SEC has no right to interfere, but the SEC can ensure the safety of developers, ensure that builders prefer to develop in the United States, and encourage healthy and orderly competition.

DeFi has rules, and the money comes back to the United States.

To sum it up in one sentence, don’t set up overseas shells, and don’t worry too much about the degree of decentralization.

The token issuance, on-chain activities (staking, lending, trading, investment) and reward distribution involved in DeFi are all compliant, especially self-custodial transactions are elevated to the level of "American liberal values", and all types of crypto-staking ETFs will be fully liberalized.

Finally, instead of engaging in offshore regulatory arbitrage, you can return to the United States to invest, develop, and start businesses, ensuring that encryption happens in the United States.

RWA has regulations that the currency should be listed on the US chain.

To sum it up in one sentence, on-chainization has officially become the main theme.

Compared with DeFi, RWA has more separate regulations and is divided into various types such as stocks, bonds, equities and physical assets. The window for tokenized stocks and tokenization of private markets (Pre-IPO) is open.

This will be a more profound change than computerization. From paper certificates to electronic transactions and then to full chain-based operations, any asset that can be financialized will be tokenized, and the information gap between the minority and the majority will be completely eliminated. Of course, this may take many years.

Ultimately, DeFi will become a new form of finance rather than a supplement to TradFi, and ETH will become a new carrier of US financial hegemony.

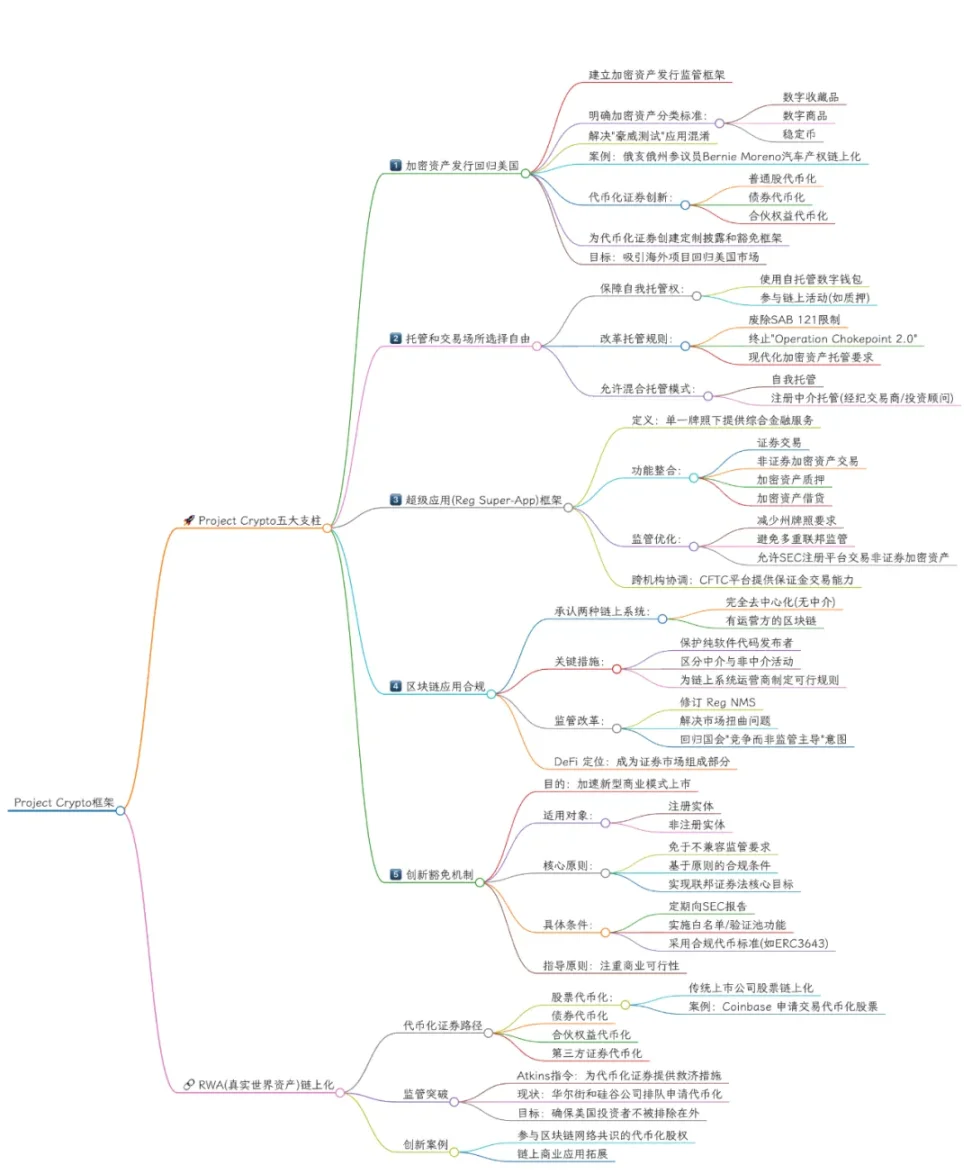

Image caption: SEC Project Crypto framework, Image source: @zuoyeweb3

The title of this section is inspired by the slogan of RWA L1 Rialo, developed by Subzero Labs. This time, RWA will no longer be a synthetic asset or a virtualized custodial issuance, but will directly open up the possibility of any asset being on the chain. For example, the newly listed Figma also retains the option of issuing tokenized stocks.

Stocks are tokenized stocks, and assets are tokenized assets.

Conclusion

It is not only a booster of financial bubbles, but also a necessary path to asset innovation.

After today, Project Crypto can be said to be DeFi’s securities law moment, but how much of the department’s principles can be implemented and how much it can be accepted by Trump and Capitol Hill can only be left to fate.

However, the CFTC and SEC will be completely integrated, as digital commodities and digital securities will be indistinguishable from each other in the future.