Stablecoins have evolved from crypto trading tools to infrastructure. Key questions we're asked daily include: What are the specific use cases for stablecoins? What capabilities can they offer that traditional fiat currencies can't? The most natural starting point is to consider stablecoins as a new type of payment infrastructure and assess their potential benefits—such as instant, 24/7 settlement—particularly in cross-border payments and remittances.

While clear opportunities exist within the existing payment ecosystem, stablecoins are empowered to drive the modernization and automation of global lending and capital markets.

Stablecoins are unique in that they sit at the intersection of three massive markets: payments, lending, and capital markets.

As stablecoins improve the efficiency of cross-border payments, they may become the cornerstone of the emerging cross-border lending and global credit system: using smart contracts to connect global funding parties and demand parties and automate the entire life cycle of loan agreements.

While the integration of stablecoins as "programmable money" into mainstream finance is still in its early stages, the underlying smart contract infrastructure has been publicly deployed, battle-tested, and continuously expanded within the decentralized finance (DeFi) ecosystem. Leveraging the public, verifiable nature of blockchain, we can observe and track the scale and performance of loans denominated in stablecoins issued through smart contracts. For example, over the past five years, stablecoin-denominated loans have accumulated over $670 billion, with significant annual growth.

It is said that the end of payment is lending. Therefore, stablecoins based on blockchain and smart contracts are extremely attractive for their potential as programmable currencies, their innovation in lending models, and their improvement in global credit accessibility.

If on-chain lending was previously more suitable for cryptocurrency trading, then with the passage of stablecoin legislation, it will gradually become deeply embedded in real-world financial payment scenarios. Visa's recent announcement of Visa Direct's prefunding service using stablecoins is prime evidence of this. Visa also released a research report exploring how programmable money, when integrated with smart contract-based lending protocols, can reshape the global lending ecosystem—making it more transparent, efficient, and accessible.

This is also a direction we've been actively exploring recently, both in the context of consumer finance (2C) and cross-border supply chain finance (2B). Through these explorations, we've discovered that demand for lending in the Global South is far from being met! Meanwhile, stablecoin payment channels can greatly facilitate these needs. Perhaps the convergence of financial payments and the on-chain future of inclusive finance are just around the corner.

“The real revolution is not in electronic money, but in electronic trust.”

—Dee Hock, Founder of Visa

1. What is On-Chain Lending?

On-chain lending is a key application scenario in the crypto ecosystem. Both on-chain and off-chain platforms have successfully found strong product-market fit. On-chain lending is a crucial component of building a digital asset financial ecosystem and a subset of on-chain finance: a global credit market driven by stablecoins, operating 24/7 and always open.

On-chain lending completely reshapes financial services by using smart contracts to replace traditional financial institutions and automate financial intermediaries. It allows users to obtain liquidity through collateralized assets, enabling deployment in the decentralized finance (DeFi) space and trading on-chain and off-chain platforms.

When combined with stablecoins, these protocols can enable new lending models with automated execution, near-instant settlement, and borderless capital movement—essentially creating a global credit market that never closes.

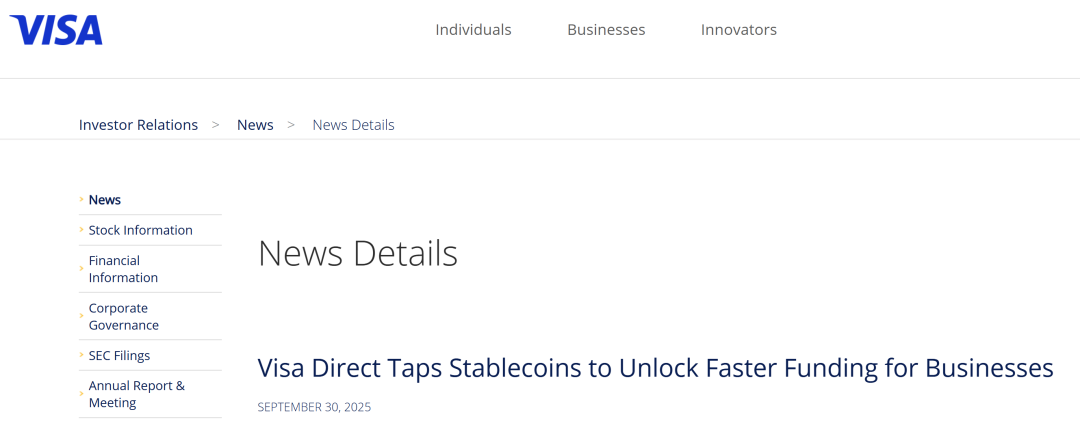

On-chain stablecoin lending works as follows:

- Lenders deposit stablecoins (such as USDC, USDT) into a lending pool managed by a smart contract and receive interest on their deposits.

- Smart contracts automatically complete the entire process of traditional loan services: calculating interest rates, monitoring the value of collateral in real time, executing liquidation when the collateral ratio falls below the required threshold, and distributing profits to lenders.

- Borrowers are required to provide collateral (usually crypto assets or tokenized real-world assets) to obtain funds, and the collateral is locked in a smart contract.

1.1 The Role of Stablecoins & New Risk Models

- Improving capital market efficiency

- Smart contracts continuously monitor the value of collateral and automatically adjust interest rates based on a supply and demand algorithm—lowering interest rates when capital utilization is low and rising when liquidity is tight.

- Creating an accessible 24×7 credit market

- These global markets never close, operate automatically, and offer transparent pricing to all participants. Anyone with internet access can borrow and lend without the permission of a central authority.

- Provide a reliable value anchor

- Stablecoins are denominated in fiat currency to maintain stability, while having the flexibility and efficiency of programmable currency, providing a reliable pricing and settlement unit for borrowers and lenders.

On-chain lending fundamentally changes the way risk is managed. Traditional lending typically assesses counterparty risk through credit checks and contract terms; on-chain lending mitigates this specific risk through automated liquidation. Instead of trusting the borrower’s willingness to repay, the protocol trusts the smart contract code to enforce the loan terms.

This does not eliminate the risk, but rather transforms it:

- Counterparty risk can be managed with the help of smart contracts;

- Technical risks have become a key focus. Instead of analyzing balance sheets, liquidity providers must assess the protocol’s security audits, governance structure, and data source reliability.

1.2 Business Model of On-Chain Lending

On-chain lending services are primarily provided through two channels: decentralized finance (DeFi) and centralized finance (CeFi), each with its own unique characteristics and products.

Here’s a quick overview of CeFi and DeFi lending:

A. Centralized Finance (CeFi)

CeFi refers to off-chain centralized financial institutions that provide lending services for cryptocurrencies and related assets. Some of these institutions use on-chain infrastructure or even run their entire operations on-chain. There are three main types of CeFi lending:

- Over-the-counter (OTC) transactions are conducted bilaterally, allowing borrowers and lenders to reach customized agreements. Transaction terms, including interest rate, maturity date, and loan-to-value (LTV), can be tailored to the specific needs of both parties. These services are typically only available to accredited investors and institutions.

- Prime Brokerage: A comprehensive trading platform offering margin financing, trade execution, and custody services. Users can withdraw margin financing from the broker for other purposes or retain it on the platform for trading. Brokerages typically offer financing services only for a limited number of crypto assets and crypto ETFs.

- Onchain Private Credit: This allows users to pool funds on-chain and deploy them through off-chain protocols and accounts. In this scenario, the underlying blockchain effectively becomes a crowdfunding and accounting platform for off-chain credit needs. Debt is typically tokenized, either as collateral or directly through tokens representing shares of the debt pool. The funds are typically used for a narrow range of purposes.

B. Decentralized Finance (DeFi)

DeFi refers to applications running on blockchains and powered by smart contracts, allowing users to borrow and lend crypto assets as collateral, earn returns through lending, and even gain leverage in trading. DeFi lending is characterized by 24/7 operation, a wide selection of borrowable assets and collateral, and full transparency that can be audited by anyone.

- Lending Applications: On-chain applications allow users to deposit collateral (such as BTC and ETH) and use that collateral to borrow other cryptocurrencies. Loan terms are pre-determined based on the provided collateral and borrowed assets, using the application's risk assessment. Lending through these applications is similar to traditional overcollateralized lending.

- Collateralized Debt Position Stablecoins (CDPS): USD stablecoins that are overcollateralized by a single cryptocurrency or a combination of cryptocurrencies. They work similarly to overcollateralized lending, but users deposit collateral to generate a synthetic asset.

- Decentralized Exchanges: Some DEXs allow users to obtain leverage to magnify trading positions. While DEX functionality varies, the role of providing margin trading services is similar to that of CeFi brokers. However, funds cannot generally be transferred off a DEX.

2. Key Data and Insights

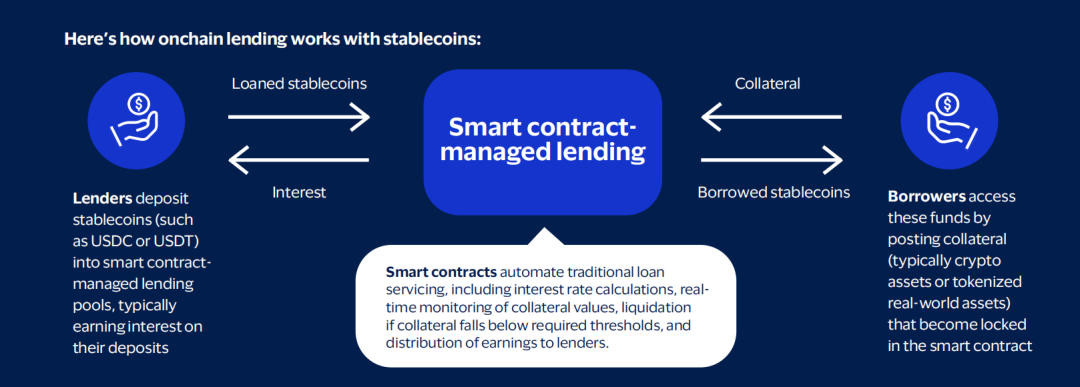

The global on-chain lending market is expanding rapidly, reaching a monthly scale of US$51.7 billion in August 2025, with more than 81,000 active borrowers, demonstrating the size and growth rate of the credit market driven by stablecoins.

2.1 Trading Volume and Borrowers

In August 2025, a total of $51.7 billion in stablecoins were loaned out, bringing the cumulative total of stablecoin loans since January 2020 to over $670 billion.

From 2022 to early 2024, on-chain stablecoin lending activities fell sharply due to the collapse of Terra Luna, FTX and several centralized crypto lending institutions; but it began to recover at the end of 2024 and hit new highs in recent months.

This recovery is also reflected in the number of loans and unique borrower addresses: in August 2025, the number of loans reached 427,000 and the number of borrower addresses reached 81,000.

2.2 Trading Volume by Sector

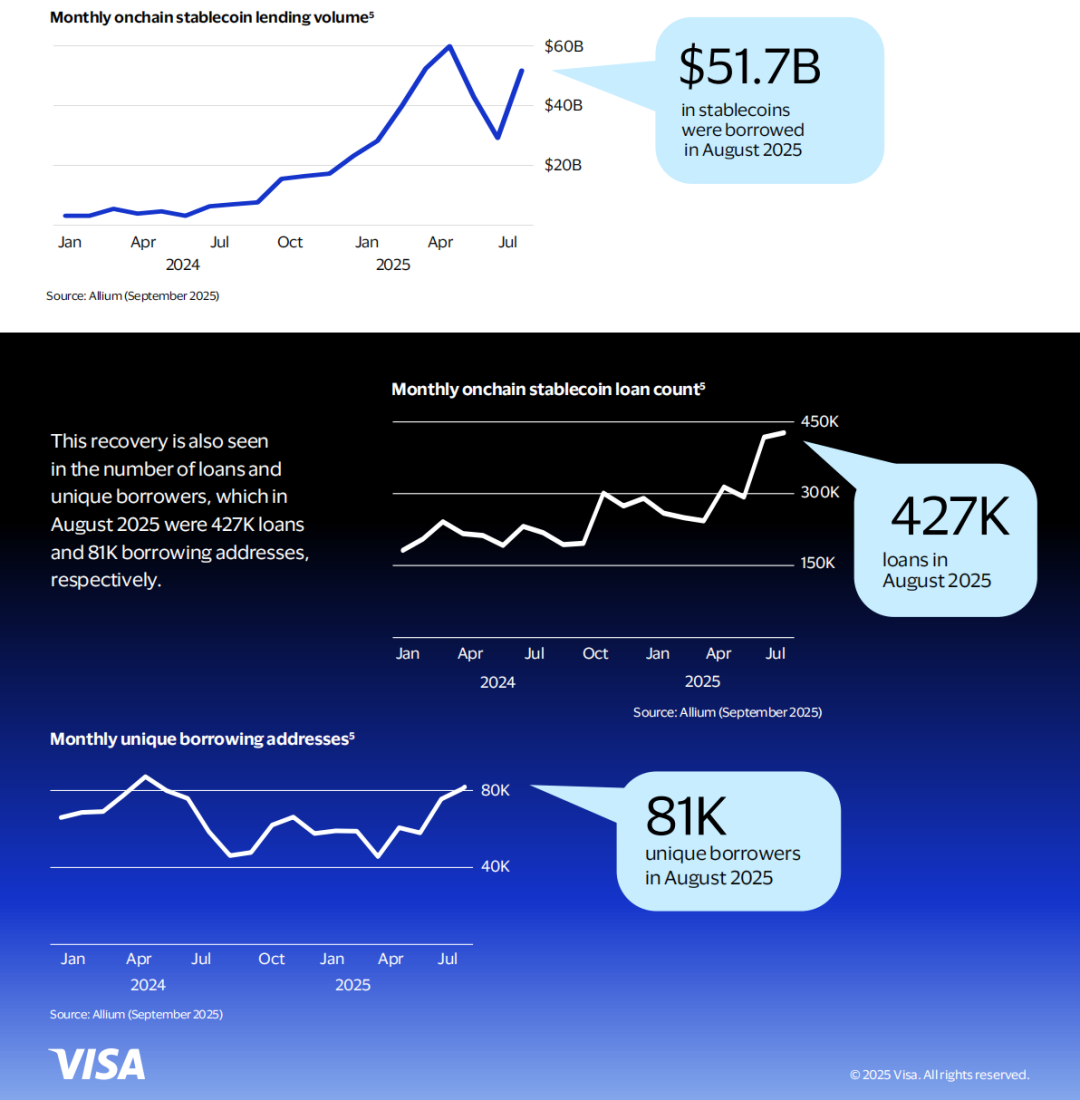

In terms of details, USDC and USDT occupy an absolute dominant position, accounting for more than 99% of the historical cumulative lending volume, which is consistent with the fact that the two account for more than 98% of the total supply of the surveyed stablecoins.

In the previous cycle, lending primarily occurred on Ethereum, Avalanche, BSC, and Polygon. So far in this cycle, Ethereum and Polygon maintain their lead, accounting for a combined 85% in August 2025. Base, Arbitrum, and Solana have seen their share rise, reaching a combined 11% over the same period.

At the protocol level, Aave and Compound accounted for 89% of the monthly trading volume in August 2025, ranking first in history for a long time; after Morpho launched V1 in early 2024 and V2 in June 2025, its share increased to 4%.

2.3 Single Loan Size

During the last trough, the average loan amount also declined, but has rebounded to US$121,000 in August 2025 as the market has recovered, reflecting a possible increase in institutional lending demand.

2.4 Outstanding Loans and Deposits

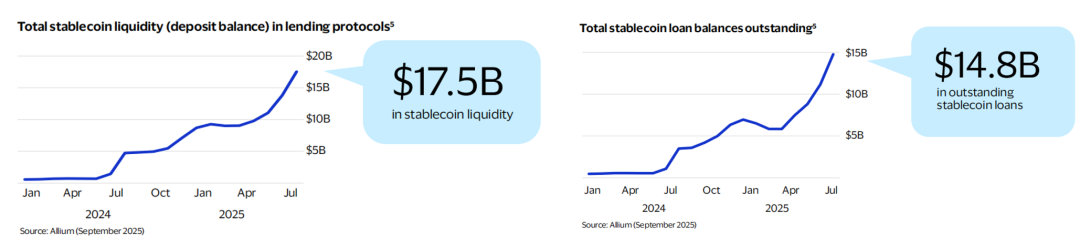

Active loan balances and the supply of stablecoins deposited in lending protocols also rebounded, exceeding their previous peaks. In August 2025, an average of $17.5 billion in stablecoins remained in the protocols, of which $14.8 billion (84%) was actively lent out as loans.

2.5 Interest Rate Level

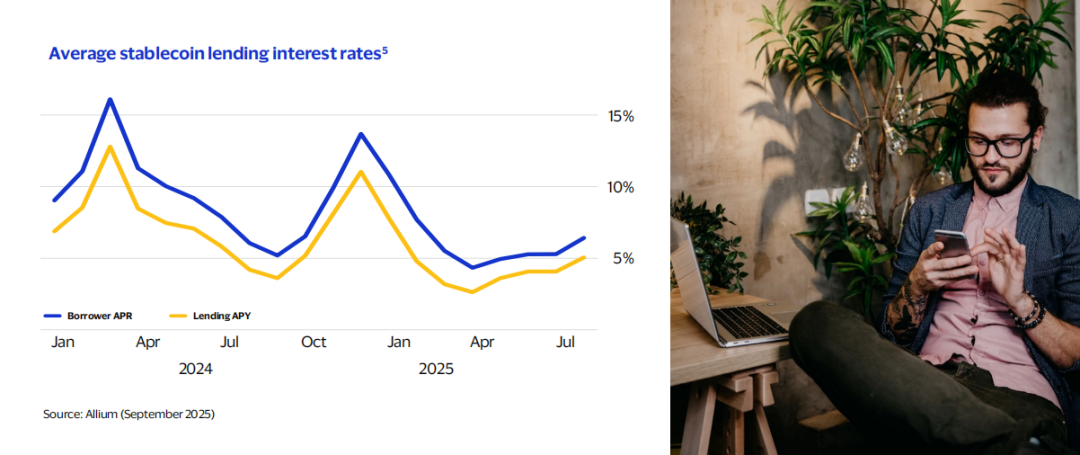

Affected by the price fluctuations of non-stablecoin collateral such as ETH and BTC, the lending rates of stablecoins on the chain fluctuate, and the annualized interest rate (APR) for borrowers ranges from less than 2% to more than 16%.

The average interest rates in August 2025 were: 6.4% APR for loans and 5.1% APY for deposits. This is close to the historical averages of 6.7% APR for loans and 5.0% APY for deposits over the past 12 months, and 6.4% APR for loans and 4.8% APY for deposits. This demonstrates that, with high-quality collateral, on-chain interest rates can be within a few percentage points of traditional market lending rates.

3. Major Market Participants

3.1 Major historical players

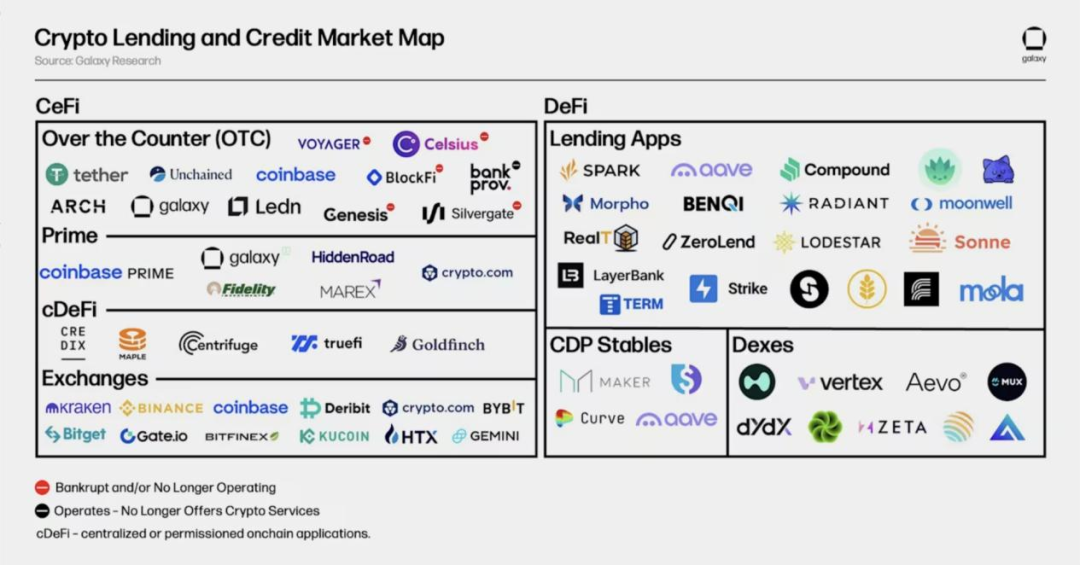

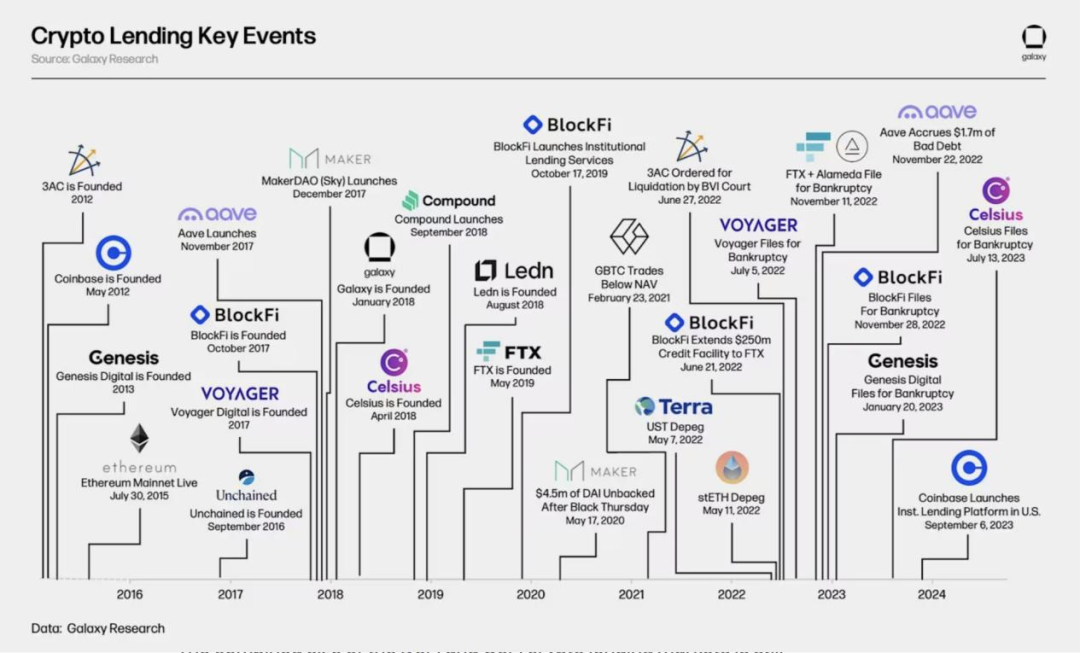

The above chart highlights some of the major past and present players in the CeFi and DeFi crypto lending markets. In 2022 and 2023, as crypto asset prices plummeted and market liquidity dried up, some of the largest CeFi lenders collapsed. Most notably, Genesis, Celsius Network, BlockFi, and Voyager all filed for bankruptcy within two years. This resulted in an estimated 78% decline in the total size of the CeFi and DeFi lending markets from their peak in 2022 to the trough of the bear market, with outstanding CeFi loans decreasing by 82%.

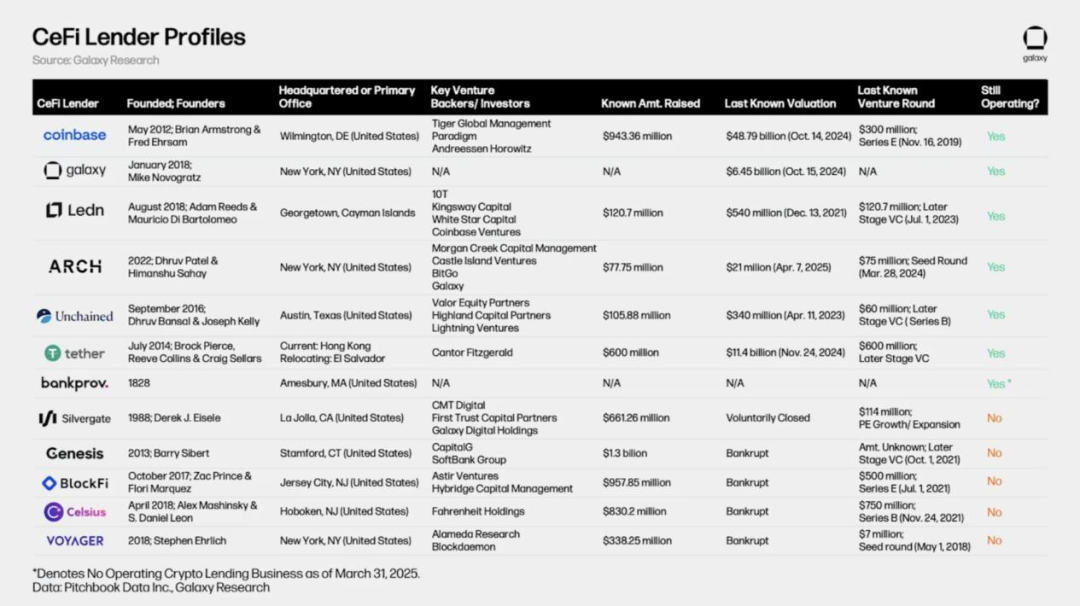

The chart below compares some of the largest CeFi crypto lenders in history. Some companies offer multiple services to investors. For example, Coinbase, while primarily an exchange, also provides credit services to investors through over-the-counter cryptocurrency loans and margin financing.

Although on-chain and off-chain crypto lending didn't become widely used until late 2019/early 2020, some current and historically significant players were founded as early as 2012. Genesis, founded in 2013, is particularly noteworthy, having once handled $14.6 billion in loans. On-chain lending giants like Aave, Sky (formerly MakerDAO), and Compound Finance launched on Ethereum between 2017 and 2018. The emergence of these on-chain lending/borrowing solutions was made possible by the advent of Ethereum and smart contracts, which officially launched in July 2015.

The end of the 2020-2021 bull run marked the beginning of a turbulent 18-month period for on-chain lending markets, marked by numerous bankruptcies. Key events during this period included the depegging of Terra's stablecoin, UST, which ultimately became worthless along with LUNA; the depegging of stETH, the largest liquid staking token on Ethereum (LST); and the trading of shares of Grayscale Bitcoin Trust (GBTC) at a discount to its net asset value (NAV) after years of trading at a premium.

3.2 Innovative lending models under stablecoin legislation

The recent surge in stablecoin lending has highlighted new use cases for stablecoins in on-chain finance. Protocols like Morpho are aggregating global liquidity through stablecoins to optimize lending markets. Rain, a stablecoin-connected card issuer, is leveraging platforms like Credit Coop and Huma Finance to fund its credit programs. In addition to card solutions, Credit Coop also offers cash flow and income-based loans, while Huma leverages stablecoins for more efficient trade finance and faster cross-border payments. Leading lending protocols are using stablecoins to power card programs, cross-border payment financing, and aggregated lending markets, demonstrating viable commercial applications beyond crypto capital markets use cases.

A. Morpho

Morpho is a lending protocol that aggregates demand and liquidity across platforms. As its backend lending infrastructure, Morpho integrates with third-party platforms and wallets such as Coinbase, BitPanda, Safe, Ledger, and Trust Wallet, as well as banks like Societe Generale. With Morpho's "engine," users of these platforms can share demand and liquidity from the same pool of funds: for example, a USDC borrowed on Coinbase might have originally been deposited by another Ledger wallet user. This model replaces traditional fragmented bilateral or tripartite lending relationships with a single multilateral lending market, thereby improving lending rates and capital efficiency.

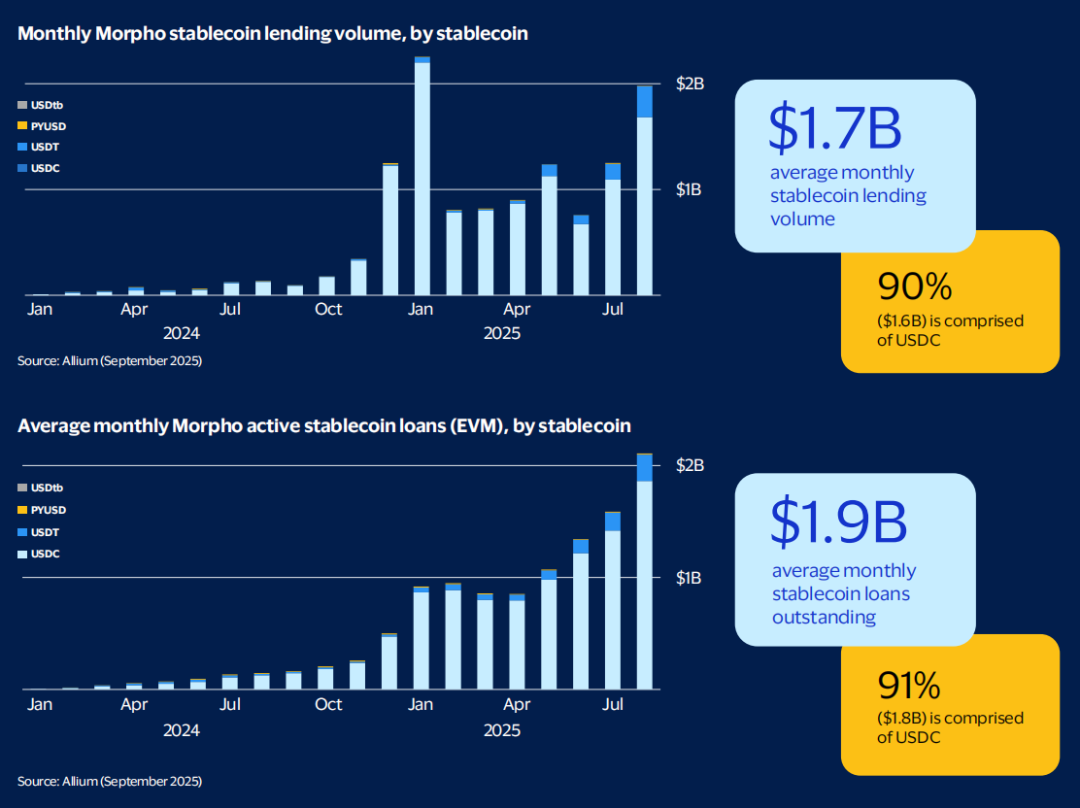

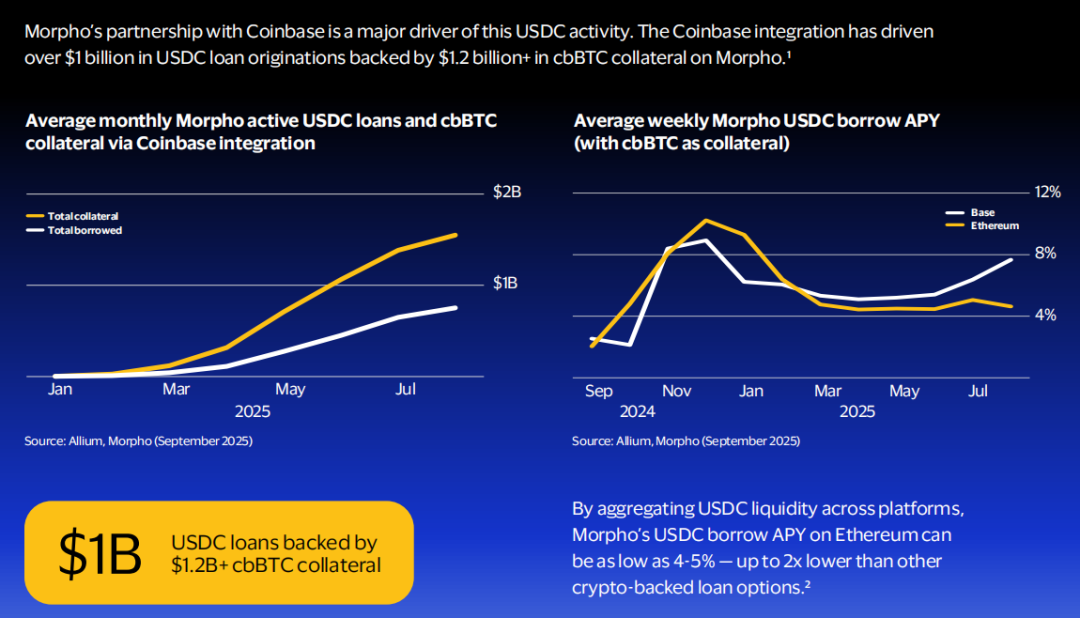

Currently, Morpho's monthly stablecoin lending volume reaches $1.7 billion, with $1.9 billion in outstanding stablecoin loans. USDC accounts for $1.6 billion (90%) of this lending volume and $1.8 billion (91%) of outstanding loans. This USDC activity is primarily driven by its partnership with Coinbase: through the Coinbase integration, Morpho has facilitated over $1 billion in USDC loans, collateralized by over $1.2 billion in cbBTC.

By aggregating USDC liquidity across platforms, Morpho can achieve an annualized yield of as low as 4–5% on USDC borrowing on Ethereum, which is about half the cost of other crypto-collateralized loan options.

For exchanges, wallets, and fintech companies that partner with Morpho, the protocol also improves user retention: in-app financial services allow users to borrow without having to move their assets, rather than sell them. Because Morpho's marketplace operates autonomously on-chain, with full transparency into loans and collateral, participants gain greater trust and better information to manage market and counterparty risk.

B. Credit Coop

Credit Coop is a structured finance protocol that supports lending against on-chain cash flows. Its smart contracts enable lenders to automatically share profits from borrowers' income-generating contracts. If a borrower defaults, the contract immediately transfers 100% of that income stream to the lender, enabling trustless recovery.

Rain, a stablecoin credit card issuer and Visa partner, accesses liquidity through Credit Coop: borrowing funds against future cardholder repayment receivables to fund daily operations. As the card issuer, Rain must settle cardholder spending with Visa daily, but user repayments are typically not received until the end of the month. Credit Coop's "Spigot" technology creates a programmable lockbox for these future repayment streams, allowing Rain to borrow funds in advance without additional collateral, addressing the timing mismatch of working capital. To date, Rain has borrowed or repaid over 175 million USDC through Credit Coop, and this figure is accelerating as Rain's user base expands.

On the acquirer side, crypto-native payment processor Coinflow also uses Credit Coop to provide merchants with an instant advance payment service using USDC, where "card payments have not yet been settled but funds have already been received."

Overall, Credit Coop's business volume has increased significantly in recent months: the amount of loans issued in August 2025 exceeded US$30 million, and the outstanding loan balance exceeded US$8.8 million; there was a particular surge in August, the scale on Ethereum expanded, and the Base chain also began to contribute the main new growth.

Credit Coop's repayment stream closely matches the amount loaned (over $29 million repaid in August 2025) because the agreement continuously collects from the borrower's income stream and distributes it to the lender instantly.

For lenders, Credit Coop offers an annualized yield of 12–15%, complete on-chain transparency, and real-time visibility into loan performance. Programmatic control over revenue-generating contracts also enables trustless recourse. The protocol also natively integrates deposit channels, allowing institutions to conveniently start lending and earn on-chain returns via bank wire transfers.

C.HumaFinance

Huma Finance is a blockchain-based and stablecoin-based "payment financing" platform specializing in compliant cross-border payment financing, stablecoin credit card financing, trade financing, and other financing solutions. Its PayFi network offers businesses three types of stablecoin-based credit lines: revolving lines of credit, receivables-backed lines of credit, and receivables factoring lines. Currently, approved businesses primarily use Huma to accelerate cross-border payments and supplier payments. Recipients receive stablecoin funds immediately, eliminating pre-funded capital, capital lock-up, and the associated costs and delays.

Companies only need to pay daily fees (usually 6-10 basis points) while the loan balance remains. Since funds are quickly recovered (usually 1-5 days), the same capital can be reinvested frequently, so investors on Huma can obtain an annualized return of more than 10%.

Huma's business has significantly accelerated since the second half of 2024. Current monthly transaction volume is approximately $500 million, with lending and repayments accounting for roughly half. Active liquidity has reached $140 million, of which $98 million in PayFi assets are currently outstanding, the vast majority of which is used for cross-border payment financing.

IV. Outlook for Future Opportunities

The intersection of stablecoins and on-chain lending presents three cutting-edge opportunities that we expect to reshape traditional finance over the next decade.

4.1 Tokenizing assets to unlock collateral pools

The tokenization of real-world assets (RWAs) is opening up a new blue ocean for on-chain lending collateral. The market has grown from $5 billion in December 2023 to $12.7 billion today; McKinsey predicts that the total amount of tokenized assets could reach $1-4 trillion by 2030.

BlackRock's BUIDL Fund is a prime example of institutional adoption. Its tokenized US Treasury holdings reached a record market value of $2.9 billion in May 2025, with several on-chain lending protocols becoming its revenue sharing partners. Franklin Templeton's OnChain U.S. Government Money Fund (BENJI) brought in an additional $800 million in tokenized bonds, while MakerDAO already has nearly 30% of its $6.6 billion balance sheet in real-world assets.

Traditional assets like corporate bonds, private credit, and real estate will soon become collateral in a 24/7 global lending market, connecting the over $40 trillion traditional credit market with the efficiency and transparency of programmable money, creating a new source of liquidity for traditional assets. Major asset managers are already piloting scalable solutions, and over the next decade, they are expected to tokenize hundreds of trillions of dollars in addressable traditional assets.

4.2 Crypto-asset collateralization empowers the next generation of credit programs

Credit card programs are about to expand to include a new "crypto-asset collateralized" model, opening up new market potential. Ether.fi, a pioneer, is launching a non-custodial credit card, allowing users to access liquidity for their crypto holdings while retaining asset ownership, avoiding capital gains tax, and maintaining upside exposure. Smart contracts monitor collateral in real time, automatically triggering margin calls and risk management. Banks and private credit funds can act as liquidity providers, channeling institutional funds to these programs through programmable lending protocols rather than traditional credit facilities. This creates new income opportunities for institutional investors while mitigating counterparty risk through transparent and automated collateral management.

4.3 On-chain identity facilitates large-scale unsecured lending

One of the most transformative opportunities lies in uncollateralized lending based on on-chain behavior and digital identity. While the current overcollateralization model is secure, it is capital inefficient and limits the market to borrowers with significant assets. The next wave of innovation will focus on addressing this challenge through on-chain identity and credit scoring systems.

Emerging solutions build credit profiles by analyzing a wallet's transaction history, asset holdings, and interactions with other protocols, while also leveraging technologies like zero-knowledge proofs to protect user privacy. Platforms like 3Jane, Providence, and Credora are experimenting with credit assessment methods based on verifiable on-chain behavior. In the future, protocols could offer unsecured or even pure credit loans based on reputation and credit history, potentially opening up new serviceable markets and bringing the full spectrum of traditional credit products to this efficient on-chain architecture.

4.4 Fintech’s New Spring

Whether it's the aforementioned collateralized lending of tokenized/cryptoassets (on-chain clearing logic) or the credit lending logic that connects on-chain and off-chain digital identities, the upgrades, iterations, and evolution of these technologies ultimately need to serve the largest use cases. This logic aligns with the issuance and distribution of stablecoins. Therefore, we believe that flexible Fintech will integrate innovative technologies within its use cases to create greater value, while financial institutions will need to strike a balance between regulatory compliance and innovative growth.

V. Summary

The evolution of on-chain lending markets represents a significant milestone in the maturation of digital asset infrastructure. Lending and borrowing capabilities have become a foundational pillar of both decentralized and centralized crypto finance, creating a vital market mechanism alongside the traditional financial system while introducing novel technological innovations.

The autonomous and algorithmic nature of on-chain lending infrastructure establishes a new paradigm for market operations that operates continuously and transparently while implementing programmatic risk management. This technical framework represents a significant breakthrough in the traditional financial system, potentially increasing efficiency and reducing intermediary risk.

Looking ahead, the on-chain lending market appears poised for a new phase of growth, characterized by improved risk management frameworks, increased institutional participation, and clearer regulatory guidelines. The fusion of traditional financial expertise and blockchain innovation bodes well for a future where on-chain lending services will become increasingly mature and reliable, more deeply integrated into real-world business scenarios, while retaining the unique advantages of blockchain technology.

As the industry continues to mature, it is likely to become a bridge between traditional finance and the emerging digital asset ecosystem, promoting the wider application of on-chain financial services.

Reference:

Visa Direct Taps Stablecoins to Unlock Faster Funding for Businesses

The State of Crypto Lending and Borrowing | Galaxy Research

Stablecoins Beyond Payments: The Onchain Lending Opportunity (in partnership with Visa)