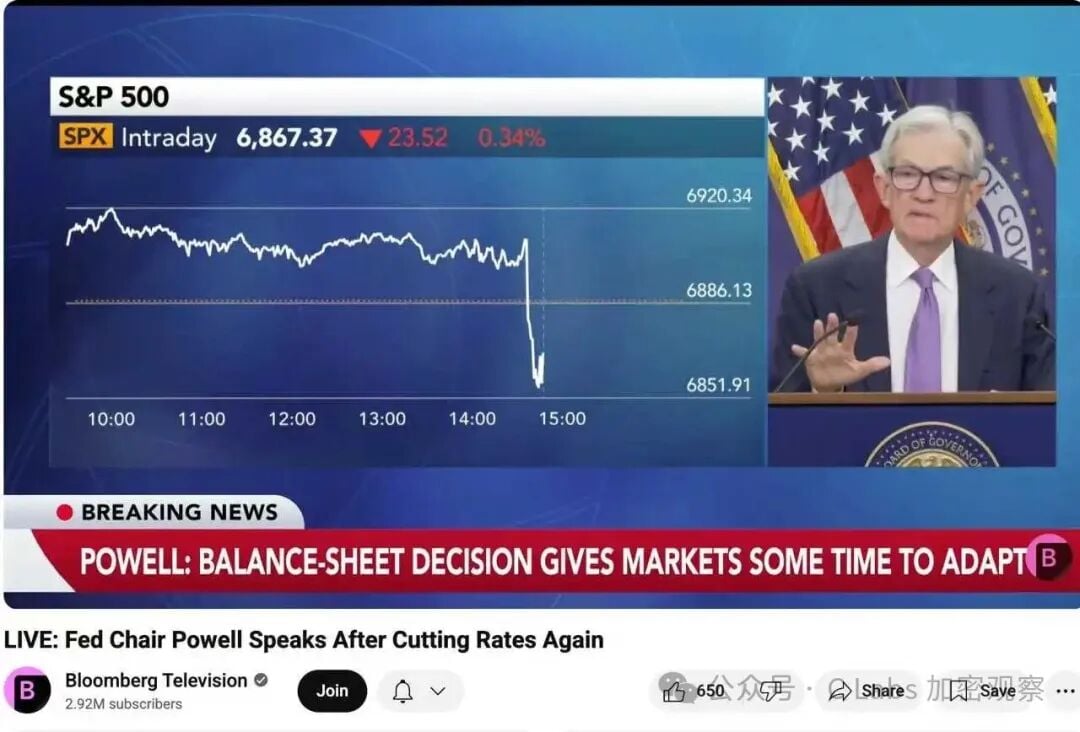

Early this morning Beijing time, the Federal Reserve announced a 25 basis point rate cut, lowering the federal funds rate range to 4.00%–4.25%.

Meanwhile, the Federal Reserve also stated that quantitative tightening (QT) will officially end on December 1.

Logically, this should have been a "positive" development: interest rate cuts, the end of balance sheet reduction, and improved liquidity expectations. However, the result has left many puzzled—why didn't the stock market, cryptocurrencies, or even gold rise, but instead experienced widespread declines?

01. The market's "positive expectations" have already been exhausted.

In fact, the market had already "bet" on this rate cut earlier this month. According to CME FedWatch data, prior to the meeting, the market believed:

The probability of a 25bp rate cut is as high as 95%, and about 40% of investors expect the Federal Reserve to immediately announce the start of QE (re-expansion of the balance sheet).

As a result, the Federal Reserve opted for a "moderate" rate cut.

in other words:

This interest rate cut is not a "new positive development," but rather "below expectations."

When expectations are met but there are no surprises, the market often chooses to take profits. This is a typical "buy the rumor, sell the news" market trend.

02. Stopping the meter reading does not mean starting to release water.

Many people, seeing "QT ended," assumed it meant a massive influx of liquidity was coming. However, the Federal Reserve's statement this time was actually very cautious:

"We will end the balance sheet reduction, but will not launch a new asset purchase program for the time being."

That is to say:

The market has shifted from the "collecting water" phase to the "wait and see" phase.

In the language of financial markets, this is called:

Liquidity has stopped worsening, but it hasn't improved either.

For the investment market to rise, simply "stopping the decline" is not enough—it also needs "increased capital." This is currently the biggest gap.

03. The interest rate cut has not translated into "real funding rates".

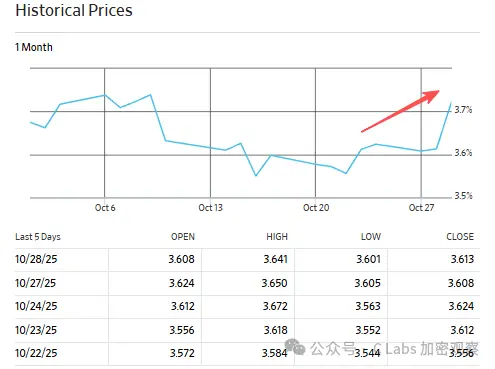

In theory, interest rate cuts should lower short-term rates, leading to lower funding costs. However, this situation is somewhat unusual—although the nominal policy rate has decreased by 25 basis points, medium- and long-term funding costs have not decreased accordingly.

For example, the yield on five-year Treasury bonds rose from 3.6% to 3.7%.

The yield on 10-year Treasury bonds has surged to over 4%.

What does this mean? It means that real liquidity in the market remains tight, and investment institutions have not felt an increase in "money." The Federal Reserve's interest rate cuts are still just talk and haven't actually "flowed into the market."

04. Hidden Concerns Behind the "Interest Rate Cut": Downward Economic Pressure Remains High

From a broader perspective, the Federal Reserve's rate cut is actually a "defensive measure." Recent US economic data shows:

- The real estate and manufacturing sectors experienced negative growth for two consecutive quarters.

- The job market slowed, and the unemployment rate rose again to 4.6%.

- Corporate profit growth has almost stagnated.

This means that the Federal Reserve has opted for a slight easing of monetary policy to buffer downside risks, choosing between "maintaining growth" and "controlling inflation."

But this operation also sends a signal:

The US economy may have entered a period of "slow decline".

In this situation, the market prefers to lock in profits rather than easily increase its holdings in risky assets.

05. Summary: Interest rate cuts ≠ bull market; liquidity is the core variable.

The market's reaction to this interest rate cut actually reveals the clearest logic:

Short-term policy easing ≠ ample liquidity ≠ asset price increases.

What could truly drive a full-blown reversal in the stock and crypto markets is the central bank restarting asset expansion (QE), or fiscal stimulus coupled with large-scale capital inflows.

Before that, interest rate cuts were only "neutral to slightly positive"—enough to stabilize confidence, but not enough to trigger a new bull market.

What the market wants is not a 25-point interest rate cut, but a real injection of liquidity.

Until then, 'risky assets' will have to wait.