NFT trading activity showed signs of recovery in the third quarter of 2025, breaking the long-term downward trend in the post-hype period.

After two years of market contraction and narrative shift, on-chain markets have found a new foothold, with growth no longer driven by blue-chip collectibles or speculative art, but by lower-cost infrastructure, loyalty programs, and sports-related assets.

These assets are traded for utility, not status.

NFT transaction volume rebounds, sales hit record high

As Ethereum's scaling upgrades drive transaction activity to L2, Solana has established itself with its high throughput and compression technology, while Bitcoin inscriptions have evolved into a collectible culture that rises and falls in tandem with the transaction fee market. The focus of the NFT market has shifted to low-cost infrastructure and practical application scenarios.

Today, the key to driving market growth is the level of transaction fees and distribution channels, rather than avatar-based NFTs.

The Dencun upgrade reshaped the economic landscape. Ethereum's EIP-4844 proposal reduced the data costs of rollups, lowered L2 transaction fees to a few cents, and supported gas-free or sponsored minting processes for mainstream users.

After the upgrade, L2 layer transaction fees have decreased by more than 90%, a change that has been reflected in minting behavior and has also driven Base to become a core distribution channel.

Within the Solana ecosystem, compression technology enables large-scale NFT issuance for loyalty programs and access-based applications.

The deployment cost of 10 million compressed NFTs is approximately 7.7 SOL, and even under high load, the median transaction fee is close to $0.003.

Bitcoin Inscriptions, on the other hand, have developed independently, with their development closely tied to the memory pool cycle and miner revenue. As of February 2025, the number of Inscriptions has exceeded 80 million, ranking among the top three in terms of historical NFT sales.

Demand rebounds but concerns remain

According to DappRadar data, NFT transaction volume nearly doubled in the third quarter of 2025, reaching $1.58 billion, with 18.1 million transactions, setting a new record for the number of quarterly transactions.

Sports NFTs performed particularly well, with trading volume surging 337% month-over-month to $71.1 million. The cyclical utility value, rights, and loyalty benefits of these assets decouple consumption behavior from floor prices.

The market initially rebounded rapidly in the summer, but then cooled down: According to CryptoSlam, sales reached $574 million in July 2025 (the second highest for the year), but in September, sales fell by about 25% month-on-month due to a decline in risk appetite in the overall crypto market.

This trend confirms that the market has entered a new phase of "lower average selling prices," and also indicates that even if the number of unique users and the category of utility applications remain stable, the total transaction value of NFTs will still fluctuate with the overall crypto market.

The crucial role of distribution channels is becoming increasingly apparent. Wallets with built-in key functionality and sponsorship fee mechanisms eliminate the friction costs that previously hindered user adoption.

Coinbase smart wallets offer key login and gas fee sponsorship services in supported apps; Phantom announced 15 million monthly active users in January 2025, a user base that provides traffic support for mobile and social minting channels.

In blockchain networks where culture and social traffic mutually empower each other, this distribution and reach capability is crucial, and Base is a typical example.

This year, thanks to low-cost minting, Zora's rapid minting pace, and distribution channels associated with Farcaster, Base has surpassed Solana in NFT transaction volume on some metrics.

This trend means that creators are now starting to model distribution data and then match fee schemes when choosing a distribution platform.

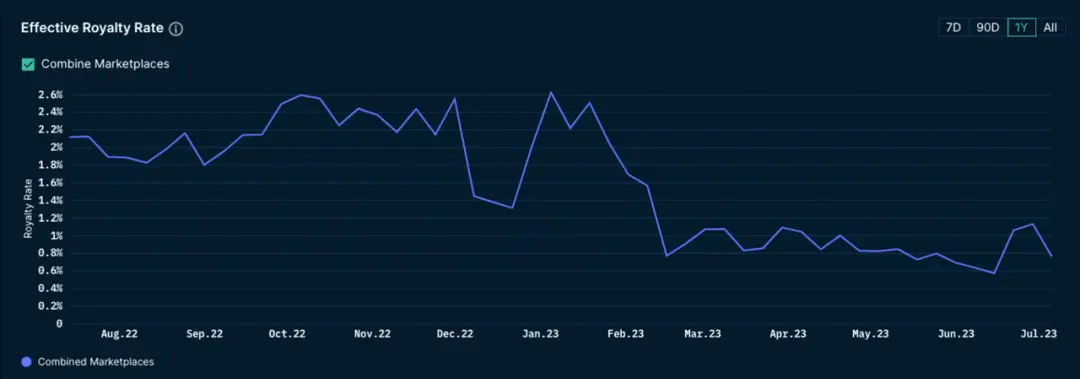

Royalties are no longer the core of the revenue structure

After the market peak in 2022, creators' royalty income fell sharply as competition among trading platforms made royalties optional in most markets.

According to Nansen data, royalty revenue hit a two-year low in 2023 and failed to recover to previous levels.

In contrast, a growing trend is the emergence of trading platforms that support mandatory royalty collection. In late 2023, Magic Eden and Yuga Labs jointly launched an Ethereum trading platform that mandates royalty collection from creators, providing a protected distribution channel for influential brands.

The current market has formed a dual-track structure: in the open market, low commission rates, primary market sales, intellectual property (IP) cooperation, and retail linkage constitute the main sources of profit for creators; while the closed ecosystem mandates royalties through contractual agreements and undertakes the issuance of high-end NFTs.

In areas where incentive mechanisms drive fund flows, the market share of trading platforms remains dynamic.

In the Solana ecosystem, Magic Eden and Tensor form a duopoly, with their market share fluctuating depending on the rewards program and program design. Their respective market share usually ranges from 40% to 60% at different times.

This is not a structural change, but rather the result of the incentive cycle; the market share chart may appear to be shifting, but it will eventually revert to the mean.

For creators, the key takeaway is to negotiate distribution plans during the distribution planning stage, rather than defaulting to a single platform.

User flow reveals short-term development path

The reason why sports, ticketing and loyalty programs can scale up is because their benefits are cyclical and repetitive, and the core on-chain functions are already embedded in existing ticketing and e-commerce processes.

DappRadar's data for the third quarter of 2025 shows that the growth rate of sports NFT trading volume has surpassed the overall market, and this does not yet include full season or league-level collaboration projects.

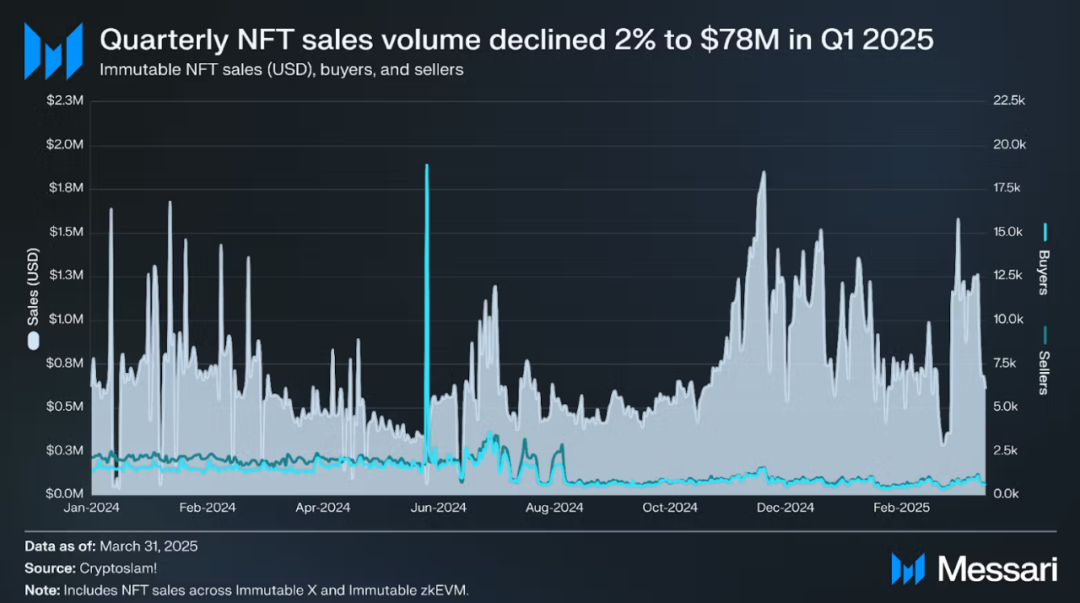

The growth in the gaming sector has been more robust. According to Messari data, Immutable's zkEVM architecture and real-time data show continued transaction growth. Its design, which "ensures security at the Ethereum level and optimizes user experience at the L2 layer," is highly compatible with the needs of asset custody and continuous secondary transaction fees.

Intellectual property and licensing partnerships are another important bridge for NFTs to move from digital collectibles (JPEGs) to consumer channels. Pudgy Penguins has entered more than 3,000 Walmart stores, building a channel from NFTs to physical retail and licensing revenue.

For creators, the costs and user experience of various blockchains are now clearly discernible:

Ethereum's L1 layer still dominates the fields of traceability authentication and high-value artworks. Gas fees on most platforms fluctuate greatly, and royalty collection is an optional model.

After the Dencun upgrade, transaction fees on Ethereum L2 layers (such as Base) dropped to a few cents, supporting sponsored or gas-free transactions, and Base and the Farcaster ecosystem provide social distribution channels.

Solana's compression technology keeps the issuance cost of millions of NFTs at the dollar level, and it achieves wide reach by relying on a mobile-first wallet ecosystem.

Bitcoin inscriptions focus on the realm of scarce collectibles, and rising transaction fees are a characteristic of the market rather than a flaw.

Evolution of the macro-environment

The annualized transaction volume of the NFT market is expected to be between $5 billion and $6.5 billion in 2025, with the average selling price remaining between $80 and $100 in the first half of the year. This level forms the baseline for the market scenario next year.

Taking CryptoSlam’s monthly sales as the core data, combined with DappRadar’s category analysis:

Bear Market Scenario: If the crypto market stagnates and the average selling price falls, the total NFT transaction volume may drop to $4 billion to $5 billion. Fee-sensitive applications will be concentrated in Solana and Ethereum L2 layer, the Ethereum L1 layer art market will remain stable, and the inscription market will fluctuate with the Bitcoin transaction fee cycle.

Baseline Scenario: If embedded wallets and social minting channels continue to expand, sports and live events projects scale up across seasons, and brands try to issue new products on mandatory royalty platforms, the total NFT transaction volume is expected to reach $6 billion to $9 billion.

Bull Market Scenario: If mobile distribution achieves breakthrough growth (Base and key login become the standard for minting processes, Phantom's monthly active users exceed 20 million, ticketing pilot projects become the mainstream solution, and game assets generate continuous trading), the total NFT transaction volume could reach $10 billion to $14 billion.

In all three scenarios, Ethereum L2 and Solana will dominate market share, Ethereum L1 will focus on niche markets, and Bitcoin inscriptions will remain a stable sector as a scarce collectible.

Six key variables determine the pace of growth

1. Wallet User Experience and Distribution Capabilities: Key metrics include key adoption rate, sponsorship fee usage, and monthly active users of Phantom and Coinbase smart wallets.

2. The scope of mandatory royalty collection: affecting the issuance of high-end NFTs, including OpenSea’s policy shift and the health of trading platforms in the Ethereum ecosystem that support creators.

3. Scaling sports and ticketing partnerships: Expanding from pilot projects to full-season partnerships, converting one-time transactions into recurring revenue.

4. The issuance pace of Base and Zora: The sustainability of social distribution channels can be judged by the monthly minting volume, the proportion of Base in the total NFT transaction volume, and the linkage effect of Farcaster Frames.

5. Solana compression technology adoption rate: By compressing the amount of NFT minted and the deployment cost per million assets, we can determine whether loyalty programs and media applications have moved from pilot programs to normalization.

6. Bitcoin transaction fee cycle: Its correlation with inscriptions and runes will vary depending on the congestion of the mempool, continuously affecting the pricing of collectibles.

However, two risks remain. Wash trading and spam can still distort GMV and sales, so it’s safer to look at the dashboard filtered by average sales and organic search.

Trading platform incentive mechanisms can create the illusion of a “market share shift” on market share charts (which is actually the effect of airdrop cycles), especially in Solana’s duopoly.

Therefore, creators should take this volatility into account in their distribution planning from the outset.

Another operational constraint is revenue design: in an open market where royalties are mostly optional, primary market sales, intellectual property licensing, and retail partnerships bear a greater share of the revenue burden.

Closed platforms with mandatory royalties can only provide high-end distribution channels for a few brands, which are difficult for most creators to use.

Industry transformation from "end game" to "migration"

The hype surrounding JPEG has subsided, NFT infrastructure costs have decreased significantly, and applications are shifting towards ticketing, sports, gaming, and intellectual property. Wallets and distribution systems are also beginning to penetrate users' existing scenarios.

The blue-chip NFT flagship project, "Boring Ape Yacht Club," remains in a precarious position for investors who poured six figures into purchasing AWS-hosted JPEGs.

An NFT from this series that was sold for over 74 ETH in 2021 is now worth only 9 ETH, a drop of 87% in three years.

The speculative frenzy in the non-fungible token space may have ended, but will this allow the underlying technology to gain acceptance in real-world practical applications?

The answer remains to be seen, but the existing signs are encouraging, though this hope is irrelevant to those who are trapped at high prices.

In the third quarter of 2025, the NFT market closed with a transaction volume of US$1.58 billion and 18.1 million sales, and the market structure has continued to evolve towards practicality.