By Stephen Katte

Compiled by: TechFlow

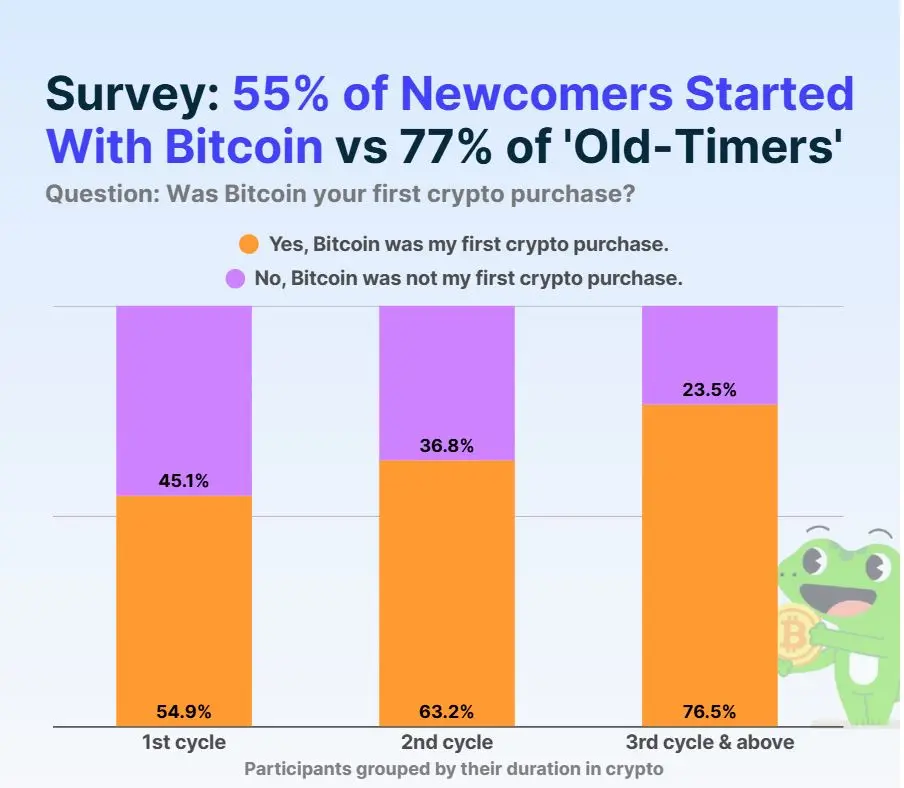

A Coingecko survey released on Monday showed that 10% of respondents had never purchased Bitcoin, and only 55% of newcomers included Bitcoin in their investment portfolio.

A recent survey by data aggregation platform Coingecko found that only 55% of new cryptocurrency users have chosen Bitcoin in their portfolio, which is seen by analysts as a sign of market maturity.

A Coingecko survey of 2,549 cryptocurrency participants showed that 10% of respondents had never even purchased Bitcoin.

“In other words, as other narratives and altcoin communities emerge and gain traction, Bitcoin becomes less likely to serve as an entry mechanism,” said Yuqian Lim, a research analyst at CoinGecko.

Only 55% of new cryptocurrency holders surveyed by Coingecko initially held Bitcoin.

Source: Coingecko

Altcoin Entry: Signs of a Healthy Market

Investors are starting to get started through other areas, such as DeFi or memecoins, Jonathon Miller, general manager of cryptocurrency exchange Kraken, told Cointelegraph in an interview.

He said: “This is a testament to the growth and maturity of the crypto ecosystem: Bitcoin is no longer the only dominant asset, while the process of acquiring cryptocurrencies is becoming increasingly smoother, making it easier for new onboarders to participate in emerging narratives.”

However, he also believes that users who initially shunned Bitcoin may return to it given growing geopolitical uncertainty, continued currency devaluation, and Bitcoin's reputation as the "soundest form of money."

“Over time, many participants who entered the crypto market attracted by the speculative trend will gradually realize the importance of Bitcoin and adjust their portfolios accordingly.”

The appeal of altcoins

Hank Huang, CEO of quantitative trading firm Kronos Research, told Cointelegraph that investors who bypass Bitcoin when first entering the market are often attracted to altcoins’ low unit costs and a stronger sense of community.

The CoinGecko survey found that 37% of respondents entered the crypto space through altcoins, rather than Bitcoin.

Source: Coingecko

Hank Huang said: "As cryptocurrency becomes more popular, more investors will bypass Bitcoin and turn their attention to altcoins with lower market capitalization and vibrant communities. This reflects that the market is maturing and diversification is driving participation."

“Market heat is shifting towards Sol, ETH, and memecoins, moving Bitcoin from being the default entry point to just one of many options in the crypto space.”

He further speculated that in the long term, the future of cryptocurrency will not rely solely on Bitcoin as it faces competition from new frameworks and its adoption is increasingly driven by a “diverse ecosystem where innovation, culture and community are as important as values.”

Users may worry about missing out

Tom Bruni, head of markets at investing social media platform Stocktwits, told Cointelegraph that a lack of understanding and frequent Bitcoin price increases may also be factors.

“While crypto natives believe the industry is still in its early stages, onlookers may feel they’ve missed out if they didn’t buy in when the price of Bitcoin was lower, as it once traded over $100,000,” he said.

“During the recent bull run, certain altcoins have significantly outperformed Bitcoin, prompting investors to seek out cryptocurrencies that are ‘cheaper’ than Bitcoin, which has driven people into the riskier altcoin and memecoin markets.”

In 2025, Bitcoin hit new all-time highs several times, the most recent being on August 14 when it broke through $124,000 for the first time.

Meanwhile, Bruni said Bitcoin’s market dominance may shrink as altcoins, stablecoins and other related blockchain technologies develop, but it will likely always be an “anchor” in many people’s portfolios.

He concluded: “Ultimately, performance drives allocation decisions. Therefore, as long as Bitcoin’s returns keep pace with the rest of the ecosystem, it’s unlikely that more people will shun it altogether.”

“Right now, Bitcoin is doing well, but if the market were to decline, it could be a catalyst for people to move into Bitcoin as a more stable and institutional cryptocurrency alternative.”

Zero Bitcoiners Won’t Last Long

Qin En Looi, managing partner at venture capital firm Onigiri Capital, told Cointelegraph in an interview that early adopters already own Bitcoin, while the majority of later users will enter the market only when Bitcoin is embedded in the traditional financial system and accessible through banks, wealth managers or retirement products.

“As this infrastructure matures, we may see the number of zero bitcoin holders decrease, but this process may be slower than many expect because it requires systematically building trust,” he said.

Ultimately, En Looi believes that Bitcoin’s role is evolving but will never disappear, as it serves as a benchmark for the entire crypto market, just as gold continues to serve as a reference point in traditional finance.

“Instead of a decline in correlation, we’re seeing a broadening of correlation, with stablecoins, tokenized assets, and application layer projects now taking center stage.”