Author: Ponyo, Four Pillars

Compiled by: ODIG Invest

Decentralized exchanges (DEXs) are one of the most revolutionary innovations in the crypto market. They not only change people's understanding of "trading," but also redefine liquidity, trust, and the role of financial intermediaries.

As performance improves, Perpetual DEX (decentralized perpetual contract trading platform) is becoming an important part of the mainstream market.

Hyperliquid, a decentralized perpetual contract trading platform, has moved its orderbook model to the blockchain, a different approach from the traditional AMM (Automated Market Maker) model.

In most DEXs (such as Uniswap), prices are determined by liquidity pools and algorithms, and the matching mechanism is based on automatic pricing of the pool; the Orderbook model is closer to the experience of centralized exchanges (CEXs), where buyers and sellers complete transactions through placing orders and matching, which can present more accurate market depth and lower slippage.

Hyperliquid is also facing challenges in the perpetual DEX space. On the one hand, a new generation of perpetual DEXs—such as Aster, Lighter, and EdgeX—are rapidly emerging through high incentives, point mining, and airdrop strategies, grabbing trading volume and attention. On the other hand, market liquidity is highly dependent on incentive mechanisms, putting long-term community cohesion under scrutiny. While emerging competitors are rapidly rising through incentives, the true test lies in whether users will stick around once the subsidies end.

This article aims to outline Hyperliquid's current competitive landscape and challenges, analyzing liquidity dynamics, market giants' strategies, and market dynamics. It also explores how Hyperliquid maintains leadership and resilience amidst volatility and uncertainty. It serves as a reminder to investors that market success is never permanent; only by understanding probability and returning to fundamentals can we discern opportunities amidst turbulence.

Core Viewpoint

Hyperliquid is facing fierce competition from a new generation of perpetual contract DEXs - Aster, Lighter, EdgeX and others are emerging.

Liquidity is highly dependent on incentive mechanisms, and short-term funds and trading volume flow rapidly to new platforms, but Hyperliquid still maintains a lead in open interest and active users.

The perpetual DEX market is likely to consolidate, ultimately leaving a few winners. Leveraging its infrastructure, ecosystem, and HyperEVM, Hyperliquid is poised to remain a key player.

In the marketplace, success isn't guaranteed to last. Whenever a company demonstrates an attractive business model, competitors flock in—either by imitating it, attracting users with more lucrative incentives, or introducing their own innovations. This pattern recurs across industries: no advantage can remain unchallenged for long. This principle is as old as capitalism, and it's now playing out in the emerging field of perp DEXs.

Hyperliquid is under siege. Having successfully demonstrated the secure and efficient operation of its proprietary blockchain-based CLOB model (centralized order book), it quickly attracted users and liquidity, becoming a recognized industry leader. However, recent developments have reaffirmed that leadership inevitably invites challengers. A wave of new perpetual DEX projects (such as Aster, Lighter, EdgeX, Pacifica, and Avantis) have emerged, each employing a nearly identical core strategy: point-based mining, aggressive airdrop promises, and highly attractive incentives.

1. Competition is coming

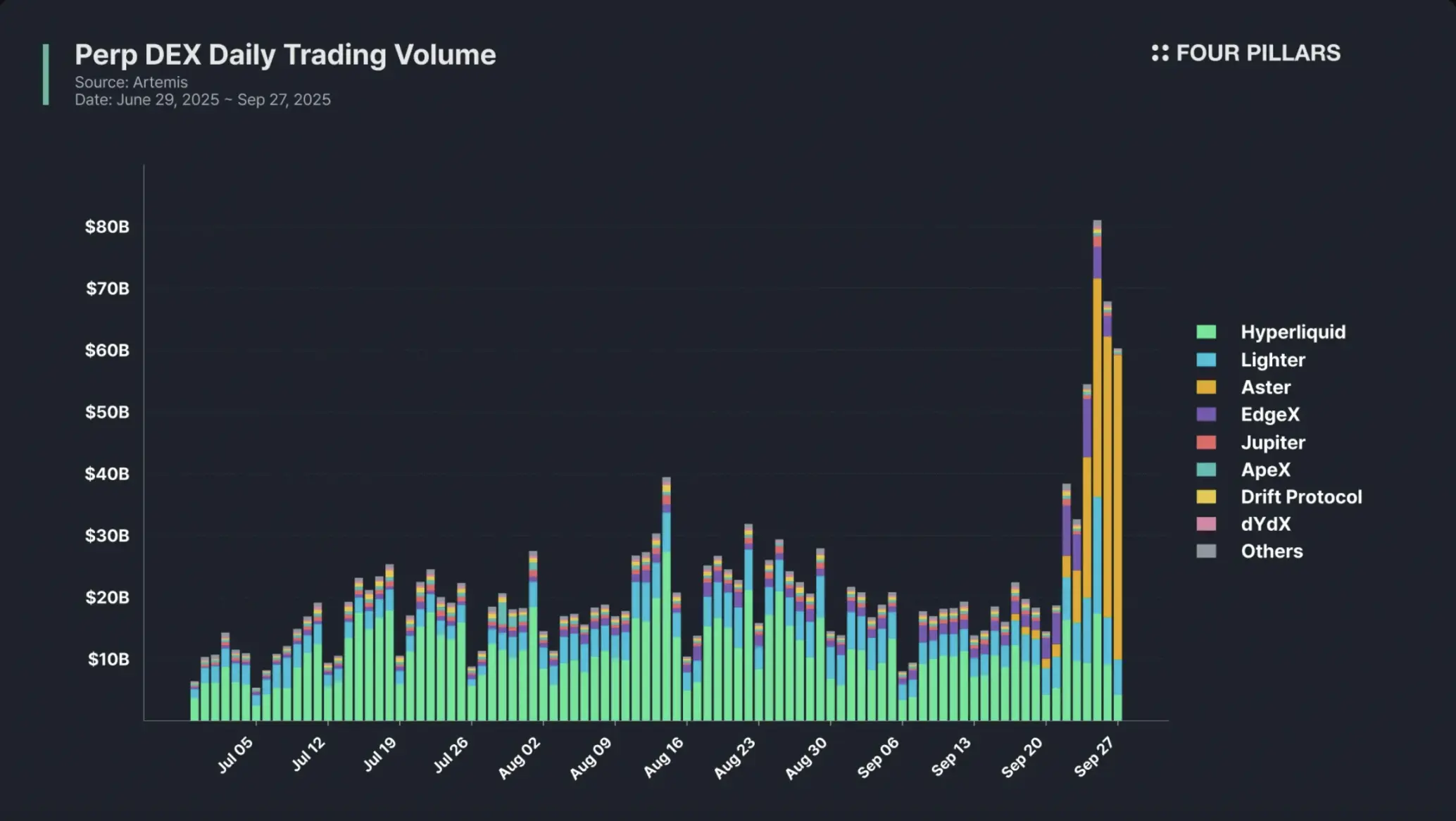

On a single day in late September, Aster and Lighter reached $42.8 billion and $5.7 billion in daily trading volume, respectively, surpassing Hyperliquid's approximately $4.6 billion. Other newcomers, such as EdgeX, followed closely behind, with a trading volume of $3.3 billion. To outside observers, this seemed to dethrone Hyperliquid. Just a few months ago, it controlled over 70% of the on-chain perpetual swap market; now, its ranking has fallen to second or even third place.

But context is important. In that same month alone, Hyperliquid still managed nearly $300 billion in trading volume, a scale that no new entrant has been able to approach for a long time. In terms of active users and open interest (a better indicator of investment than daily trading volume), Hyperliquid remains far ahead.

2. The Nature of Liquidity

Liquidity is inherently transferable. Traders seek not only optimal execution efficiency but also optimal incentive returns.

In the crypto market, token incentives often far exceed transaction fees, which makes funds exhibit "mercenary-like" characteristics - they will flow to the most profitable places at the moment.

But that doesn't mean all liquidity is created equal. Some liquidity is opportunistic, coming for yield and quickly leaving; other liquidity is more "sticky," driven by trust in the platform's infrastructure, reputation, and long-term value. For Hyperliquid, the key question is: how much of its liquidity is "mercenary" and how much is "durable"?

The conventional wisdom is that once incentives decrease, “Farmers” will leave the market, and established platforms will eventually regain their share.

But this also leads to a new thought: What will happen if "nomadic liquidity" (continuously circulating between platforms that have not issued tokens) becomes the new market norm?

In such an environment, platforms that have already issued coins may fall into a paradox - their original advantages may become a burden.

3. The role of giants

Hyperliquid faces challenges not only from emerging competitors but also from strategic rivals with deep resources – the most representative of which is Binance and its founder CZ.

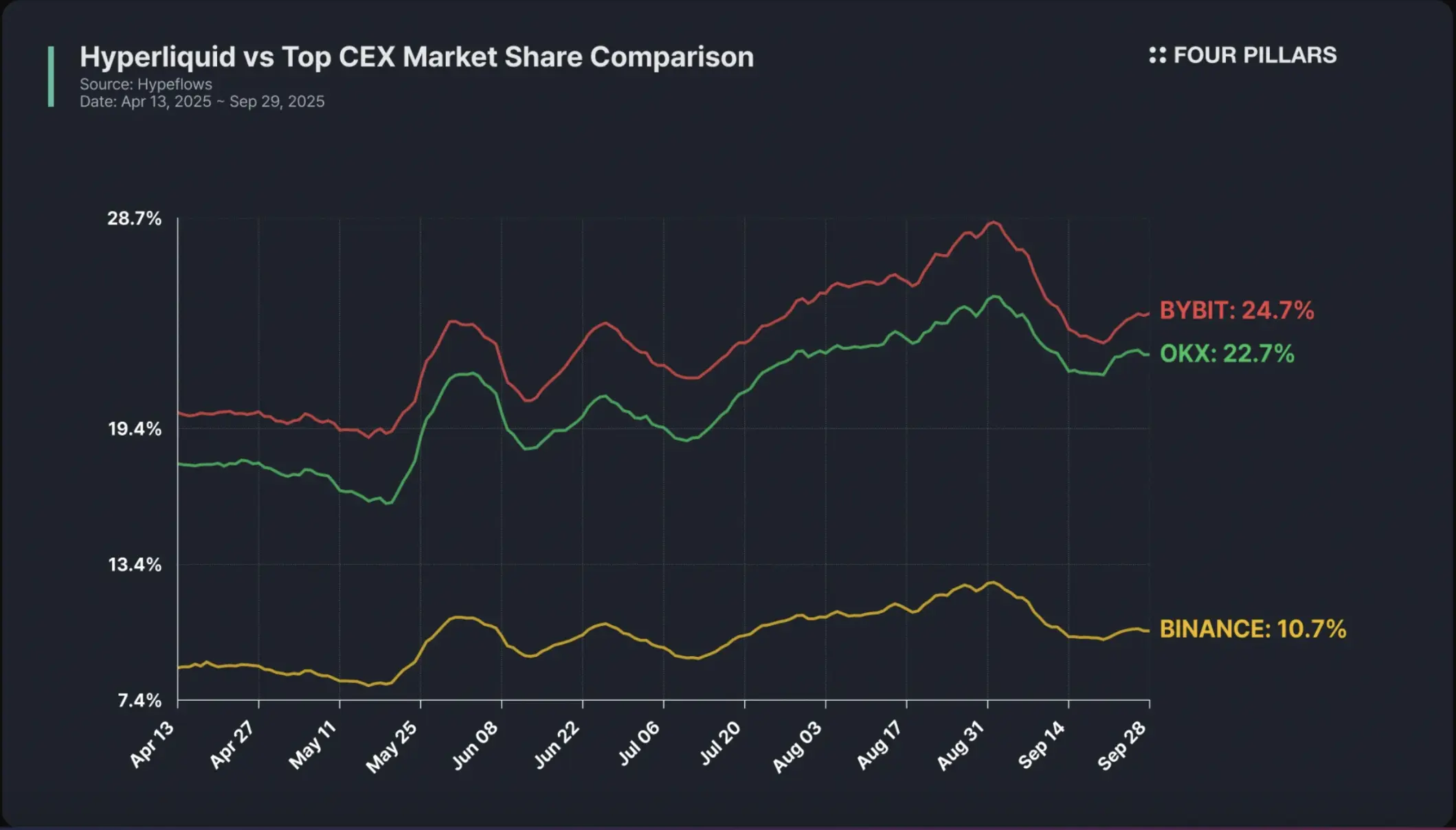

Binance is known for its aggressive competitive style. Many believe its tactics contributed to the collapse of FTX. With Hyperliquid's trading volume now consistently exceeding 10% of Binance's, it's no surprise that CZ took note.

His first action was to launch the $JELLYJELLY perpetual contract at the height of the incident. This move was seen by the market as an attempt to increase volatility and put pressure on Hyperliquid's liquidity pool (HLP) by increasing margin and liquidation risks.

CZ subsequently further supported Aster, the decentralized exchange behind BNB Chain, in which he had invested. However, Aster's success may have been a secondary objective. A more plausible hypothesis is that CZ's true intention was to disrupt Hyperliquid's growth momentum, forcing market capital and attention to be dispersed among multiple competitors. Even if Aster couldn't reach Hyperliquid's scale, as long as it could serve as a distraction, his strategic goal would have been achieved.

From Binance's perspective, this strategy is highly rational: a decentralized competitive landscape prevents any one on-chain competitor from accumulating too much power. "Divide and conquer" has always been a classic tactic in commercial warfare.

4. Face your fears

The precept of the Bene Gesserit Order is: "I must not fear. Fear is the soul-killer. Fear is the little death that brings utter destruction."

The market often confirms this wisdom - the damage caused by fear is often deeper than the fundamentals.

Today, Hyperliquid's greatest risk may not be a specific competitor, but rather a growing perception that loyalty no longer pays off. If traders begin to believe they must constantly chase the next airdrop, Hyperliquid's long-term community cohesion will weaken. In this situation, the real enemy isn't competitors, but FOMO (fear of missing out).

It’s more important than ever for investors to distinguish short-term disturbances from long-term erosion. The wise approach is not to deny fear, but to acknowledge it, let it flow naturally, and then return to fundamentals.

5. Emerging Markets

That being said, it’s also worth remembering that this market is still young. Perpetual swap decentralized exchanges (Perp DEXs) today are likely similar to centralized exchanges (CEXs) from late 2010 to early 2020, when Binance, Huobi, Gate.io, BitMEX, Bybit, and OKX were still vying for market dominance.

Over time, we’re likely to see a similar consolidation pattern among decentralized exchanges, with a handful emerging as giants. The current incentive war isn’t the end of the industry, but simply part of its growing pains.

DEXs are entering a period of competition of their own.

6. Probability, not certainty

The battle for liquidity is far from over. Hyperliquid faces stiff competition from both opportunistic rivals and entrenched giants. However, several factors suggest the odds remain in its favor:

Superior Infrastructure and Development Ecosystem: Hyperliquid is a complete L1 chain, boasting a leading CLOB engine and a strong developer community built on the HyperEVM. This foundation is difficult for competitors operating solely as standalone DEXs to replicate.

Trendsetting Initiatives: From HIP-3 to its native stablecoin, Hyperliquid has consistently set the pace. The USDH token auction was one of the most hotly contested events in crypto, attracting all major players, with the native market ultimately prevailing. 50% of USDH revenue is allocated for buybacks and AF, making Hyperliquid unique in the L1 ecosystem, allowing it to both earn stablecoin returns and collect protocol fees on multiple fronts through HIP-3.

Stickier liquidity: Despite daily volume fluctuations, Hyperliquid maintains a dominant position in terms of open interest and active users, demonstrating that a loyal core group of traders remain engaged with the platform.

Season 3 Points Plan (Speculative): An update to the points page indicates that a new season (Season 3) is imminent. Hyperliquid's incentive allocation has always been a strength, with 38.8% of the $HYPE token supply reserved for community rewards, currently valued at approximately $5.8 billion. No competitor can match this incentive pool.

HyperEVM TGE: The upcoming launch of HyperEVM tokens (such as UNIT, Kinetiq, Felix, etc.) will return liquidity to the ecosystem and deepen the role of $HYPE. This evolution from a pure DEX to a broader L1 platform may bring significant revaluation opportunities.

As with all investments, we're talking about probabilities, not certainties. The hope for Hyperliquid is that when today's turmoil subsides, it will emerge stronger and smarter as a market leader.

···································

As the article emphasizes, market success is not sustainable. Even industry leaders like Hyperliquid face challenges from innovative competitors.

Investors need to understand that any platform is susceptible to disruption. The key is to assess the probability and timing; and to prioritize fundamentals such as technical strength, user engagement, and profitability, which are more important than short-term trading volume. This competition among perpetual swap trading platforms essentially reflects the entire cryptocurrency industry's shift from "unbridled growth" to "refined operations." While Hyperliquid faces challenges, its technological expertise and user base remain key advantages.

For investors, the key lies in understanding competitive dynamics and identifying opportunities amidst change, rather than relying on single judgments. Ultimately, as has been the case with the internet industry, only platforms that truly create value for users and possess sustainable business models will emerge victorious amidst fierce competition.