Authors: 0xjacobzhao and ChatGPT 4o

In the current crypto industry, stablecoin payments and DeFi applications are among the few sectors with proven real demand and long-term value . Meanwhile, the flourishing Agent platform is gradually becoming a practical implementation of user interfaces in the AI industry , becoming a critical intermediary layer connecting AI capabilities with user needs.

In the field of the integration of Crypto and AI , especially in the direction of AI technology feeding back into Crypto applications, current exploration focuses on three typical scenarios:

- Conversational Interactive Agents : These mainly serve the purposes of chatting, companionship, and assistance. Although most of them are still shells of general large models, they are the first to be launched into the market and gain user attention due to their low development threshold, natural interactions, and token incentives.

- Information Integration Agents : These focus on the intelligent integration of online and on-chain information. While platforms like Kaito and AIXBT have achieved success in online, off-chain information search and integration, on-chain data integration remains exploratory and has yet to see significant success.

- Strategy Execution Agents : Focusing on stablecoin payments and DeFi strategy execution, these agents expand into two key areas: Agent Payment and DeFi Asset Intelligence. These agents are more deeply embedded in on-chain transaction and asset management logic, potentially breaking through the hype bottleneck and forming an intelligent execution infrastructure with financial efficiency and sustainable returns.

This article will focus on the integrated evolution path of DeFi and AI , sorting out its development stages from automation to intelligence, and analyzing the infrastructure, scenario space and key challenges of strategy execution agents.

Three Phases of DeFi Intelligence: Automation, Copilot, and the Transition to AgentFi

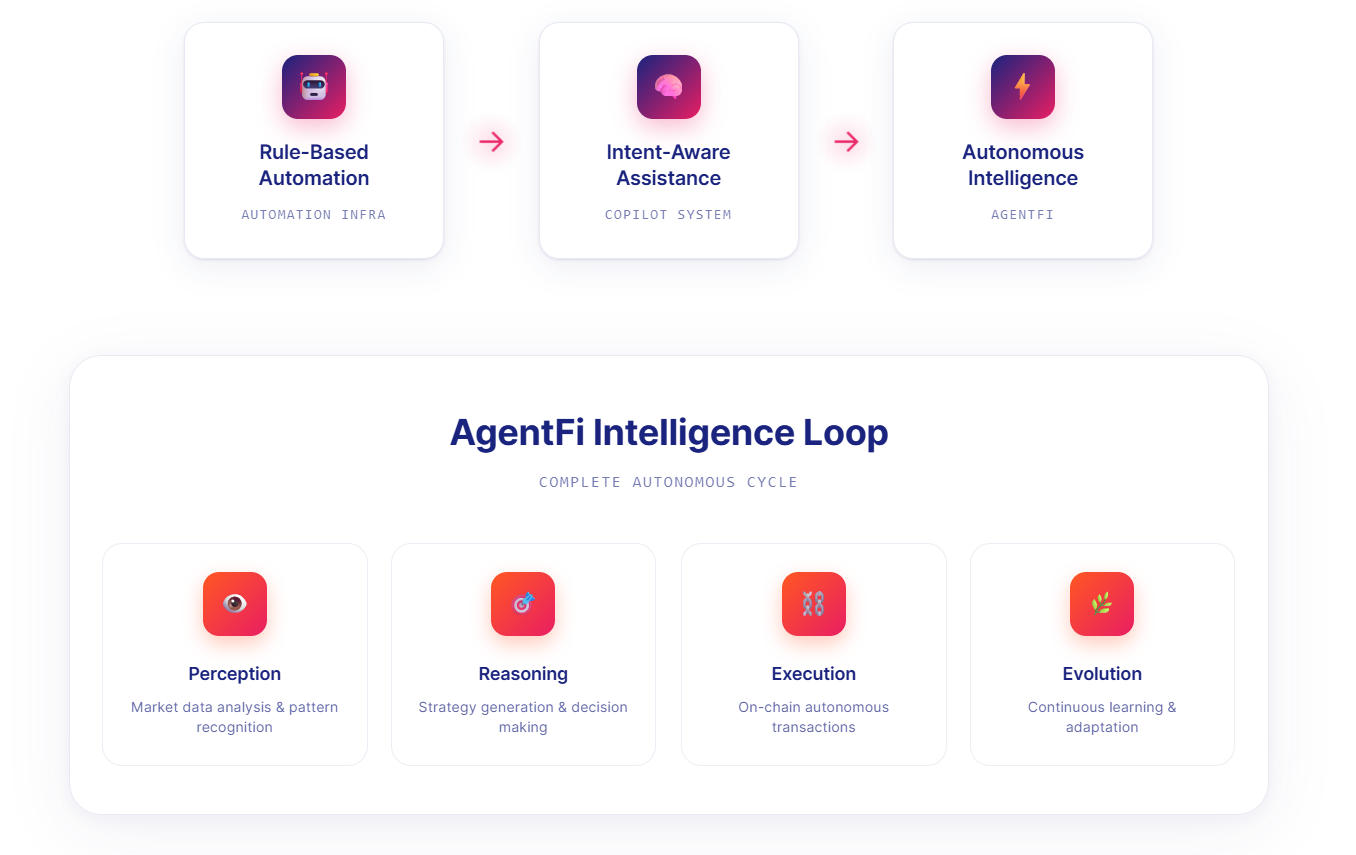

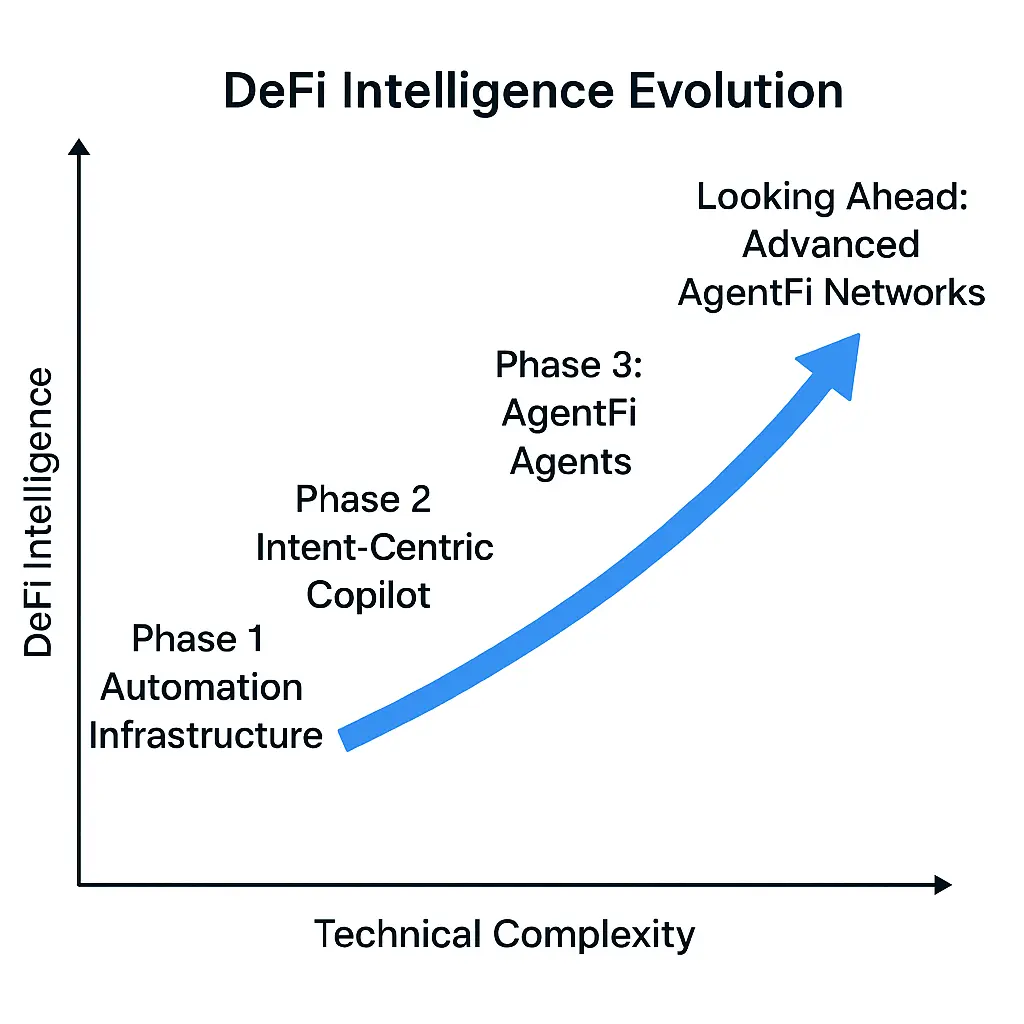

In the evolution of DeFi intelligence, we can divide system capabilities into three stages: Automation (automation tools) , Intent-Centric Copilot (intent-driven assistant) and AgentFi (on-chain intelligent agent) .

- Automation is more like a rule trigger: it executes fixed tasks based on preset conditions, such as arbitrage, rebalancing, take-profit and stop-loss, etc. It cannot generate strategies and cannot operate independently.

- Copilot introduces intent recognition and semantic parsing capabilities. Users input through natural language, and the system understands, decomposes and recommends execution paths, but user confirmation is still required in the end, and the execution chain is not closed.

- AgentFi represents a complete intelligent closed loop of “perception → reasoning/strategy generation → on-chain execution → evolution” and is an intelligent agent with the ability to autonomously execute and continuously evolve on-chain .

| Dimensions | Automated Infrastructure | Intent-Centric Copilot | AgentFi |

| Core Logic | Rule triggering + conditional execution | Intent recognition + operation guidance | Strategy closed loop + autonomous execution |

| Execution method | Trigger execution based on preset conditions (if-then) | Understand user instructions and assist in disassembly operations | Fully autonomous perception, judgment, and execution |

| User Interaction | No interaction required, passive triggering | The user expresses his intention through prompts, and the system assists in disassembly | No human interaction required, can collaborate with humans/agents |

| Intelligence level | Low, process automation | Interactive understanding | High, autonomous strategy generation and evolution |

| Strategic capabilities | None, execute the preset task | Limited, depends on user instructions | Strong, self-learning and optimized combination |

| Landing difficulty | Low, biased towards backend services | Medium, requires strong front-end interactive design | High, requiring deep collaboration between AI and execution infrastructure |

| On-chain execution | ✅ Perception ❌ Decision-making (fixed rule triggering) ✅ Support simple execution | ✅Perception ✅Decision-making ⚠️ User confirmation is required for execution | ✅Perception ✅Decision-making ✅ Complete closed-loop on-chain execution |

| Typical representatives | Gelato、Mimic | HeyElsa.ai , Bankr | Giza ARMA |

To determine whether a project truly belongs to AgentFi, you need to see if it meets at least three of the following five core criteria:

- Autonomous perception of on-chain status/market signals (not static input, but real-time monitoring)

- Ability to generate and combine strategies (not preset strategies, but the ability to self-formulate action plans based on context)

- Can autonomously perform operations on the chain (no user interaction required, can perform complex operations such as swap/lend/stake)

- Has persistent state and evolutionary capabilities (Agents have a lifecycle, can run for a long time, and self-adjust based on feedback)

- Possessing Agent-Native architecture (such as dedicated Agent SDK, managed execution environment, Agent middleware, etc.)

In other words, automated trading ≠ Copilot, and even less so AgentFi: automated trading is merely a “rule trigger.” While Copilot can understand user intent and provide operational recommendations, it still relies on human involvement. True AgentFi, on the other hand, is an “intelligent entity with perception, reasoning, and on-chain autonomous execution capabilities,” capable of completing strategy closure and continuous evolution without human intervention.

Analysis of intelligent adaptability of DeFi scenarios:

In the DeFi (decentralized finance) system, core application scenarios can be roughly divided into asset circulation and exchange and income-generating finance . We believe that there are significant differences in the adaptability of these two scenarios in terms of intelligent paths:

1. Asset circulation and exchange scenarios

Asset circulation and exchange scenarios are primarily based on atomic interactions, including Swap transactions, cross-chain bridges, and fiat currency deposits and withdrawals. Their essential characteristics are "intent-driven + single atomic interaction." The transaction process does not involve revenue strategies, state maintenance, or evolutionary logic. Most of them are suitable for the lightweight execution path of Intent-Centric Copilot and do not belong to AgentFi.

Due to its low engineering threshold and simple interaction, most DeFAI projects on the market are currently at this stage and do not constitute AgentFi's closed-loop intelligent entities. However, a few high-level complex swap strategies (such as cross-asset arbitrage, perpetual hedging LP, leveraged rebalancing, etc.) actually require the access of AI Agent capabilities and are currently in the early stages of exploration.

| Scene Category | Whether there is sustainable income | AgentFi Compatibility | Difficulty of project implementation | illustrate |

| Swap Transactions | ❌ No | ⚠️ Partial adaptation (Intent transactions only, not true AgentFi) | ✅ Easy to implement | Single atomic operations (such as currency swaps) do not accumulate policy state and are suitable for Copilot calls. |

| Cross-chain bridge | ❌ No | ❌ weak | ✅ Easy to implement | Cross-chain is an intermediary transmission that does not involve strategic planning and adjustment, and the marginal participation of AI is extremely low. |

| Fiat currency deposits and withdrawals | ❌ No | ❌ None | ❌ Uncontrollable | Highly dependent on CeFi channels and compliance processes, on-chain agents cannot initiate operations autonomously |

| Aggregation Optimization | ⚠️ Not necessarily | ⚠️ Partially compatible | ✅ Medium | Mainly based on automated tools, if it is possible to combine multi-platform quotes or profit maximization paths, it can be executed by lightweight agents, but it is difficult to evolve intelligent agents in the long term. |

| ✅ Swap trading combination | ✅ There is a possibility of profit | ✅ Immature | ❌ Difficult to implement | Such as cross-asset arbitrage, perpetual hedging LP, dynamic position allocation, etc., require the support of complex strategy engines. Currently, it is still in the prototype stage and no agent is available. |

2. Asset-Income Financial Scenarios

Asset-return financial scenarios, with their clear profit targets, complex strategy combinations, and dynamic state management requirements, are a natural fit for AgentFi's "closed-loop strategy + autonomous execution" model . Its core features are as follows:

- Quantifiable profit targets (APR/APY) make it easier for agents to build optimization functions;

- The strategy portfolio is vast , covering multiple assets, multiple maturities, multiple platforms, and multiple interaction processes;

- Operations require frequent management and real-time adjustments , and are suitable for execution and maintenance by on-chain agents.

| Ranking | Scene Category | Whether there is sustainable income | AgentFi Compatibility | Engineering difficulty | illustrate |

| 1 | Liquidity Mining | ✅ Yes | ✅✅✅ Very high | ❌ High | Strategies require frequent dynamic adjustments (such as reinvestment, migration, dual-pool strategies, etc.), which are most suitable for deploying AI strategy agents. |

| 2 | Borrowing | ✅ Yes | ✅✅✅ Very high | ✅ Low | Interest rate fluctuations and mortgage status are readable, making risk warnings and automatic position adjustments easy to implement. |

| 3 | Pendle (PT/YT income rights transaction) | ✅ Yes | ✅✅ High | ❌ High | The income period and structure are diverse, and the combination transaction is complex. The intelligent agent can optimize the buying and selling timing and income stability. |

| 4 | Funding Rate Arbitrage (Perp/CeFi/DeFi Hybrid) | ✅ Yes | ✅✅ High | ❌ Very High | Multi-market arbitrage has AI advantages, but the complexity of off-chain interaction and coordination is extremely high and is still in the exploratory stage. |

| 5 | Staking/Restaking/LRT Strategy Combination | ⚠️ Fixed Income | ⚠️ Conditional adaptation | ⚠️ Medium | Static staking is not suitable for Agents, but dynamic combination agents such as multiple LST+Lending+LP can intervene |

| 6 | RWA (Real World Assets) | ⚠️ Stable income | ❌ Low | ⚠️ Compliance is important | The stable revenue structure, high compliance threshold, and lack of interoperability between protocols mean that there is no room for AgentFi strategy implementation in the short term. |

Due to multiple factors such as the duration of income, volatility frequency, on-chain data complexity, difficulty in cross-protocol integration, and compliance restrictions, there are significant differences in the adaptability and engineering feasibility of different income scenarios in the AgentFi dimension. The priority recommendations are as follows:

High-priority business implementation direction:

- Lending/Borrowing : Interest rate fluctuations are easy to track with standardized execution logic, suitable for lightweight agents.

- Yield Farming : With frequent pool dynamics, a wide range of strategy combinations, and high yield volatility, AgentFi can significantly optimize annualized returns and interaction efficiency, but engineering implementation is challenging.

The following layout directions can be explored in the medium and long term:

- Pendle income rights trading : The time dimension and yield curve are clear, suitable for agents to manage maturity rotation and inter-pool arbitrage;

- Funding Rate Arbitrage : Theoretically, it offers considerable returns, but requires addressing cross-market execution and off-chain interaction challenges, posing a significant engineering challenge.

- LRT dynamic combination structure : Static staking is not suitable, you can try LRT + LP + Lending and other strategies for automatic adjustment.

- RWA multi-asset portfolio management : While implementation is difficult in the short term, Agents can assist with portfolio optimization and maturity strategies.

Introduction to DeFi intelligent scenarios:

1. Automation Infra: Rule Triggering and Conditional Execution

Gelato, one of the earliest infrastructure providers for DeFi automation, previously provided conditionally triggered task execution support for protocols like Aave and Reflexer. However, it has now transitioned to a Rollup as a Service provider. Currently, the primary focus of on-chain automation is shifting to DeFi asset management platforms (such as DeFi Saver and Instadapp). These platforms integrate standardized automated execution modules, including limit order settings, liquidation protection, automatic rebalancing, DCA, and grid strategies. Furthermore, we've seen some more complex DeFi automation tool platform projects:

Mimic.fi(https://www.mimic.fi/)

Mimic.fi is an on-chain automation platform serving DeFi developers and projects, supporting programmable automation tasks on chains like Arbitrum, Base, and Optimism. Its core approach is to automate cross-protocol operations through "if-then" rule triggers. Its architecture consists of three layers: Planning (task and trigger definition), Execution (intent broadcasting and execution bidding), and Security (triple verification and security controls). Currently, the product is in its early stages of deployment, using an SDK for integration.

AFI Protocol(https://www.afiprotocol.ai/)

AFI Protocol is an algorithmically driven agent execution network that supports 24/7 non-custodial automated operations, focusing on addressing decentralized execution, strategy barriers, and risk management issues in DeFi. Designed for institutions and advanced users, it offers programmable policies, permission management, SDK tools, and a yield-generating stablecoin, afiUSD, as its native asset. Currently in beta at Sonic Labs, it has not yet been publicly launched or made available to retail users.

2. Intent-Centric Copilot: Intent Expression and Execution Suggestions

The DeFAI concept, which was once a hot topic at the end of 2024, is largely based on the speculative hype surrounding meme tokens. Excluding some of the meme token-focused hype, the vast majority of projects fall into the intent-centric copilot category—that is, users express their intent through natural language, and the system responds with transaction suggestions or completes basic on-chain operations. Their core capabilities remain at the "intent recognition + copilot-style assisted execution" stage, lacking a complete closed-loop strategy and continuous optimization mechanism. Many products exhibit significant shortcomings in semantic understanding, cross-protocol calls, and feedback responses, resulting in generally poor user experience and limited functionality.

HeyElsa (https://app.heyelsa.ai/)

HeyElsa is an AI copilot targeted at Web3 scenarios. Through natural language interaction, it empowers users to complete a variety of on-chain operations, including trading, cross-chain bridging, NFT purchases, stop-loss settings, and Zora token creation. As a versatile conversational crypto assistant, it caters to everyone from beginners to advanced traders (including highly active degen traders), and currently supports real-time interaction with over ten major blockchains. The platform currently boasts an average daily trading volume of $1 million, with daily active users ranging between 3,000 and 5,000. The system integrates yield optimization strategies and automated intent execution modules, establishing the foundational capability framework for AgentFi applications.

Bankr (https://bankr.bot/)

Bankr is an intent-based trading assistant that integrates AI, DeFi, and social scenarios. Users can issue commands through natural language on the X platform or a dedicated terminal to complete operations such as swaps, limit orders, cross-chain bridging, token issuance, and NFT minting. It supports Base, Solana, Polygon, and the Ethereum mainnet. Bankr has built a complete intent-to-compile-to-execute chain, emphasizing a minimalist trading experience and seamless operations within a social environment. It also activates the ecosystem through token incentives and revenue sharing mechanisms.

Griffin (https://griffain.com/)

Griffain is a multi-functional AI agent platform deployed on Solana. It supports natural language interaction with Griffain Copilot, enabling on-chain operations such as asset query, swaps, NFT transactions, and LP management. The platform features multiple built-in agent modules and encourages community participation in agent creation and sharing. Technically, it is built on the Anchor Framework, along with components such as Jupiter and TensorFlow, emphasizing mobile compatibility and front-end composability. Currently, it supports over 10 core agent modules, demonstrating strong execution capabilities and ecosystem integration.

Symphony (https://www.symphony.io/)

Symphony is an on-chain execution infrastructure for AI agents. It builds a full-stack system encompassing intent modeling, intelligent path discovery, RFQ execution, and account abstraction, aiming to become a core module of DeFi's intelligent execution layer. The platform has launched Sympson, a conversational assistant with market information and strategy recommendations, but on-chain execution is not yet available. Symphony provides the core components required by AgentFi and will support multi-agent collaborative execution and cross-chain operations in the future.

Hey Anon (https://heyanon.ai/)

HeyAnon is a DeFAI platform that combines intent interaction, on-chain execution, and intelligence analysis. It supports multi-chain deployment (Ethereum, Base, Solana, etc.) and cross-chain bridging (LayerZero, deBridge). Users can complete operations such as swaps, lending, and staking using natural language, and access on-chain sentiment and market dynamics analysis. Despite the high attention the project has received due to its founder, Sesta, it is still in the Copilot phase, with core strategies and execution intelligence yet to be fully implemented. Long-term development remains to be seen.

| Project Name | Core Positioning | Is there on-chain execution? | Brief Comment | score |

| HeyElsa | A conversational DeFi assistant for beginners or Degen | ⚠️ Limited (basic on-chain interactions) | The Intent→Agent→execution closed loop has been initially formed, with the strongest multi-chain support capabilities, friendly interaction, and clear positioning. | 4 |

| Bankr | Natural Language Trading Assistant + Social Embedding | ⚠️ Limited (Beta 0.5) | It can perform basic trading operations. The interface is simple but the closed loop has taken shape. The user social embedded experience is outstanding. | 3.5 |

| Griffain | Solana Multi-Agent Copilot Platform | ⚠️ Limited (basic functionality) | Supports multi-module calls, but strategy combination and intelligence are weak, and Solana limits its multi-chain adaptability | 3.0 |

| Symphony | Cross-chain execution infrastructure + account abstraction | ❌ None (dialogue suggestions only) | The architecture is solid and has the key modules required for AgentFi to execute, but it is not connected to actual user scenarios. | 2.0 |

| HeyAnon | Multi-chain DeFi Intention Assistant + Market Intelligence Analysis | ❌ None (text chat only) | The product remains at the question-and-answer level, has no actual on-chain capabilities, has not yet formed an execution closed loop, and has a certain degree of market gimmickry | 1.5 |

The above scoring system is primarily based on the product's current usability, user experience, and the feasibility of executing against the public roadmap, and is inherently subjective. Please note that this evaluation does not include code security checks and does not constitute investment advice. Please understand this.

3. AgentFi: Policy Closure and Autonomous Execution

We believe AgentFi represents a more advanced form of DeFi's intelligent evolution than Intent Copilot. Agents possess independent revenue strategies and on-chain automated execution capabilities, significantly improving users' strategy execution efficiency and capital utilization. By 2025, we are delighted to see a growing number of AgentFi projects already launched or in the planning stages, primarily focusing on lending and liquidity mining. Representative projects include Giza ARMA, Theoriq AlphaSwarm, Almanak, Brahma, and the Olas series.

Giza ARMA (https://arma.xyz/)

ARMA is a smart proxy product launched by Giza, specifically designed to optimize cross-protocol returns on stablecoins. Deployed on the Base network, it supports multiple mainstream lending protocols, including Aave, Morpho, Compound, and Moonwell, and features core capabilities such as cross-protocol rebalancing, automatic compounding, and smart token swaps. ARMA's strategy system monitors stablecoin APRs, transaction costs, and yield differentials in real time, automatically adjusting capital allocation and achieving significantly higher returns than static holdings. Its architecture comprises smart accounts, session keys, core proxy logic, protocol access, risk management, and accounting modules, ensuring secure and efficient automated execution in a non-custodial model.

ARMA is now fully launched and is undergoing continuous iteration. With its modular architecture, security mechanisms, and good early operational data, ARMA has become one of the most practical Agent products in DeFi automated revenue management. It is one of the few AgentFi projects that combines both conceptual depth and product practicality.

Reference research report "A New Paradigm for Stablecoin Returns: From AgentFi to XenoFi" link: https://x.com/0xjacobzhao/status/1925226999699964158

Theoriq(https://www.theoriq.ai/)

Theoriq Alpha Protocol is a multi-agent collaboration protocol focused on DeFi scenarios. Its core product, Alpha Swarm, focuses on liquidity management, aiming to build a fully automated, closed-loop "perception-decision-execution" chain. Composed of three types of agents: Portal (on-chain signal perception), Knowledge (data analysis and strategy selection), and LP Assistant (strategy execution), it enables dynamic asset allocation and yield optimization without human intervention. The underlying Alpha Protocol provides agent registration, communication, parameter configuration, and development tool support, serving as the operational foundation for the entire Swarm collaborative system and considered the "agent operating system" of DeFi. Through AlphaStudio, users can browse, call, and combine various agents to build a modular, scalable network of automated trading strategies.

As one of the first projects on Kaito Capital Launchpad, Theoriq recently completed $84 million in community fundraising and is about to hold a TGE. Theoriq recently launched the AlphaSwarm Community Beta test network, and the mainnet version will be officially released soon.

Reference research report "Theoriq Research Report: The Evolution of AgentFi for Liquidity Mining Income" link: https://x.com/0xjacobzhao/status/1948545449016918511

Almanak (https://almanak.co/)

Almanak is an intelligent agent platform for DeFi strategy automation. It combines a non-custodial security architecture with a Python strategy engine to help traders and developers deploy sustainable on-chain strategies.

The platform's core components are Deployment (execution components), Strategy (strategy logic), Wallet (Safe+Zodiac security modules), and Vault (strategy assetization). They support yield optimization, cross-protocol interaction, liquidity provision, and automated trading. Compared to traditional DeFi tools, Almanak emphasizes AI-powered market perception and risk management. It already has 24/7 intelligent operation capabilities and plans to introduce multi-agent and AI decision-making systems, striving to build the next-generation AgentFi infrastructure.

Almanak's strategy system, a state machine program built in Python, serves as the "decision-making brain" of each Agent, automatically formulating and executing on-chain actions based on market data, wallet status, and user-defined conditions. The platform provides a complete Strategy Framework, supporting action bundles for on-chain trading, lending, and liquidity provision, eliminating the need to write underlying contract code. Cryptographic isolation, permission control, and monitoring mechanisms ensure the privacy and operational security of strategies. Users can write strategies using the SDK, and in the future, support will be added for natural language strategy creation, enabling a smooth transition from complex logic to a code-free experience.

Currently, the product has launched a USDC lending vault based on the Ethereum mainnet, while more complex trading strategies are in the testing phase and require whitelist access. Almanak will soon be joining cookie.fun's cSNAPS campaign for a community fundraising campaign, which is worth looking forward to.

Brahma (https://brahma.fi/)

Positioned as the "Orchestration Layer for Internet Finance," Brahma abstracts on-chain accounts, execution logic, and off-chain payment processes, enabling users and developers to efficiently and collaboratively manage both on-chain and real-world assets. Through Smart Accounts, continuously running on-chain Agents, and the Capital Orchestration Stack, Brahma provides users with an intelligent fund management experience that requires no backend operations or maintenance.

Representative Agents currently online:

- Felix Agent : Automatically optimizes feUSD bond interest rates to prevent liquidations and save interest.

- Surge & Purge Agent : Tracks volatility and executes automated trades;

- Morpho Agent : deploys and rebalances Morpho Treasury funds;

- ConsoleKit framework : supports the integration of any AI model and unifies execution strategies and asset management.

Olas (https://olas.network/)

The BabyDegen series of AgentFi products launched by Olas Network includes Modius Agent and Optimus Agent, both of which have been deployed on-chain, covering multi-chain ecosystems (Solana, Mode, Optimism, Base), and have complete on-chain interaction capabilities, strategy execution capabilities and autonomous asset management mechanisms.

- BabyDegen is an AI trading agent running on Solana, which realizes automatic buying and selling based on Coingecko data and community strategy library. It is currently integrated with Jupiter DEX and is in the Alpha testing phase.

- Modius Agent is designed for the Mode network and focuses on USDC and ETH portfolio management. It has integrated Balancer, Sturdy, and Velodrome, and supports 24/7 automatic execution of strategies after users set their preferences.

- Optimus Agent is compatible with the three main networks of Mode, Optimism, and Base, and integrates more protocols such as Uniswap and Velodrome, providing a flexible multi-chain strategy combination. It is suitable for intermediate and advanced users to build an automated asset management system.

Axal(https://www.getaxal.com/)

Axal's core product, Autopilot Yield, provides a one-stop, non-custodial, and verifiable yield management experience. It integrates mainstream protocols such as Aave, Morpho, Kamino, Pendle, Hyperliquid, and takes on-chain strategy execution + risk control as its core design concept, enabling ordinary users to easily enter the complex on-chain yield network.

- The Conservative Strategy focuses on low-risk, mainstream, stable-return scenarios, primarily deploying funds in proven platforms like Aave and Morpho, offering an annualized return of approximately 5–7%. This strategy achieves steady growth through TVL monitoring, stop-loss mechanisms, and top-tier strategy screening, making it suitable for users seeking financial security and long-term returns.

- Balanced strategies offer medium risk with higher return potential (10–20% APY), utilizing wrapped stablecoins (e.g., feUSD, USDxL), liquidity provision, and arbitrage neutral positions. These strategies offer a more diverse range of returns, while Axal's automated monitoring and dynamic adjustments control exposure.

- Aggressive strategies are designed for users who prefer high risk and high returns. These strategies include high-leverage LPs, cross-platform tandems, market making in illiquid assets, and volatility capture, with theoretical annualized returns exceeding 50%. Axal's intelligent agent can configure stop-loss, automatic exit, and redeployment logic at the strategy level, providing users with a last-ditch protection in high-risk environments.

Fungi.ag (https://fungi.ag/)

Fungi.ag is a fully automated AI agent designed specifically for optimizing USDC yields. It automatically allocates funds across multiple lending protocols, including Aave, Morpho, Moonwell, and Fluid, achieving optimal capital allocation based on factors such as yield, fees, and risk. Users can enable the agent to automatically execute strategies in non-custodial mode by simply authorizing a session key, eliminating manual intervention. Currently, Fungi supports the Base chain, with plans to expand to Arbitrum and Optimism. Fungi also opens the Hypha custom strategy scripting interface to support community development of strategies such as DCA and arbitrage, and collaborates with social platforms through DAOs to build a co-economy.

ZyFAI (https://www.zyf.ai/)

ZyFAI is a DeFi smart assistant platform deployed on the Base and Sonic networks. It combines an on-chain interactive interface with AI-assisted modules to help users manage their assets intelligently under different risk preferences. Its core strategies are divided into three categories:

- Safe Strategy : Designed for conservative users, it focuses on audited and verified mainstream protocols such as Aave, Morpho, Compound, Moonwell, Spark, etc., focusing on USDC's unilateral deposits and stable income opportunities, and emphasizing asset security and long-term reliability.

- Yieldor Strategy : For users with high risk appetite, it requires holding 20,000 ZFI tokens to unlock. It covers high-yield protocols including Pendle, YieldFi, Harvest Finance, and Wasabi, and supports complex strategies such as DEX LP, profit splitting, and leveraged Vault. In the future, it will also be expanded to structured products such as Looping and Delta-neutral.

- Airdrop Strategy : A future strategy still under development, aimed at obtaining more airdrop incentives.

| Project Name | Core Positioning | Is there on-chain execution? | Brief Comment | score |

| Giza ARMA | Stablecoin Yield Optimization Agent | ✅ Complete | With comprehensive functions, good security mechanisms, and good measured benefits, it is currently AgentFi's representative product. | 4.5 |

| Theoriq | DeFi Intelligent Execution System | ⚠️ AlphaSwarm whitelist testing is in progress, temporarily non-Agent automatic execution | The architecture is complete, the team is solid, the technology is high, and the execution on the chain is not yet open. | 4 |

| Almanak | Quantitative Strategy Automation Platform | ⚠️USDC lending is now available and is currently undergoing whitelist testing. | The policy is highly customizable and has excellent security design, but the product is not yet open and the testing threshold is high. | 4 |

| Brahma | Multi-strategy execution smart account platform | ✅TWAP/DCA and Morpho Agent are online, others are under development | Multiple functional agents have been deployed, emphasizing ConsoleKit modular integration, user-friendly experience, and strong strategic capabilities. | 4 |

| Olas | Multi-chain DeFi portfolio management agent | ✅ Multi-chain operation (Mode, Base, etc.) requires the installation of the Pearl system | The three agents, BabyDegen/Modius/Optimus, have clear functions, closed-loop strategy execution, and strong autonomy. | 4 |

| Axal | Multi-strategy risk-return agent | ⚠️ Need to apply for whitelist | Provides three strategies: Conservative / Balanced / Aggressive. The product is not yet online. | 3.5 |

| Fungi.ag | Stablecoin lending yield optimization | ✅ Support Base and launch Open Beta version | Functions are similar to ARMA, but the technology and ecosystem are weaker, and it is currently more of a follower. | 3.5 |

| ZyFAI | AI-assisted asset management platform | ✅ Base + Sonic | The strategies are clearly divided (Safe/Yieldor) and the operation path is friendly, but the portfolio management AI is often weak. | 3 |

AgentFi's Realistic Path and Advanced Vision

Lending and yield farming are undoubtedly AgentFi's most valuable and short-term readily implementable business scenarios. They are already mature in the DeFi world and are naturally suitable for the introduction of AI due to the following common characteristics:

- The strategy space is vast and many dimensions can be optimized

In addition to pursuing the highest returns, lending can also involve strategies such as interest rate arbitrage, leveraged recycling, debt refinancing, and liquidation protection;

Liquidity mining covers a rich range of strategy arrangements, including APR tracking, LP rebalancing, reinvestment compounding, and strategy combination.

- Highly dynamic, suitable for real-time perception and response of intelligent agents: interest rate changes, TVL fluctuations, changes in reward structure, new pool launches, new protocols, etc., will affect the optimal strategy path and require dynamic adjustment.

- There is an opportunity cost in the execution window, and the value of automation is significant: if funds are not allocated in the optimal pool, it will drag down returns and require automatic migration.

It's important to note that lending agents, due to their stable data structures and relatively simple strategies, have high feasibility. For example, lending AgentFi projects like Giza's Arma have officially launched. However, liquidity mining management, which requires real-time response to price fluctuations, volatility changes, and accumulated fees, places extremely high demands on the agent's data perception, strategy judgment, and on-chain execution. LP agents must not only accurately predict market conditions but also dynamically adjust positions and redistribute profits on-chain. This presents a relatively high level of engineering complexity, a challenge that projects like Theoriq are currently tackling.

In addition to lending and liquidity mining, we have some ideas about the mid- to long-term explorable layout directions based on AgentFi's adaptability:

Pendle income rights trading: The time dimension and income curve are clear, suitable for agents to manage maturity rotation and inter-pool arbitrage

Funding Rate Arbitrage: Theoretically, the returns are considerable, but the engineering challenges of cross-market and cross-chain interactions are difficult to solve.

Staking and Restaking: Not naturally suitable for AgentFi, but LRT dynamic combination has certain possibilities

RWA Assets: US debt agreements are not ideal scenarios, and multi-asset portfolio management structures are worth exploring

Swap transaction combination, upgraded from Intent infrastructure to AgentFi strategy engine

DeFi Intelligent Evolution Roadmap: From Automated Tools to Intelligent Networks

In summary, we have witnessed the evolution of DeFi intelligence from automation tools to intention assistants to intelligent agents.

The first phase, "Automation Infrastructure," features automation of basic on-chain operations through rule-based triggering and conditional execution. For example, these systems trigger trades or rebalancing tasks based on pre-set conditions like time and price. These systems are typically based on underlying execution frameworks, exemplified by projects like Gelato and Mimic.

The second phase, " Intent-Centric Copilot ," emphasizes expressing user intent and generating action suggestions. Systems at this stage move beyond simply understanding "what to do" to understanding "what the user wants" and then recommending the best execution path. Representative projects such as Bankr and HeyElsa primarily lower the barrier to entry for DeFi users by improving intent recognition and interactive user experience.

The third phase, the "AgentFi Intelligent Agent," marks the formation of a closed-loop strategy and autonomous on-chain execution. Agents can automatically perform perception, decision-making, and execution based on real-time market conditions, user preferences, and strategy logic, truly enabling 24/7, non-custodial, on-chain fund management. Furthermore, AgentFi autonomously manages user funds without requiring user authorization for each action. This mechanism has sparked significant discussions about security and trust , becoming a core concern in AgentFi's design. Representative projects include Giza ARMA, Theoriq AlphaSwarm, Almanak, and Brahma, all of which have demonstrated substantial capabilities in strategy deployment, security architecture, and product modules, and are the backbone of the current DeFi intelligent agent movement.

We look forward to the emergence of "AgentFi Advanced Intelligent Agents" in the future, which will not only achieve autonomous execution but also cover complex cross-protocol and cross-asset business scenarios. This is our vision for the future of DeFi intelligent advanced forms:

- Pendle income rights trading: In the future, intelligent entities will fully take over maturity rotation and strategy orchestration, maximizing capital efficiency.

- Funding Rate Arbitrage: Cross-chain arbitrage agents are expected to accurately capture every opportunity in the funding rate difference.

- Swap strategy combination: Swap is a key node in the multi-strategy profit path of the intelligent agent, achieving a leap in the value of the combination.

- Staking and Restaking: The intelligent agent will continuously optimize the staking combination strategy to dynamically balance returns and risks.

- RWA Asset Management: When the on-chain world welcomes diversified physical assets, intelligent entities allocate assets with global stable returns.