Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market stands at a critical juncture. The next two weeks will see a flurry of employment reports, key inflation data, and the Federal Reserve's interest rate decision, all of which will set the tone. Historically, September is typically the worst-performing month for US stocks . However, the Cboe Volatility Index (VIX) is currently at unusually low levels, and the S&P 500 has avoided a significant correction for several consecutive days. This uncanny calm has some Wall Street analysts concerned. BitMine Chairman Tom Lee predicts a 5% to 10% market correction in the fall, followed by a year-end rebound. Ed Yardeni of Yardeni Research has questioned the likelihood of a September rate cut, arguing that persistent inflation risks could cause the Fed to maintain interest rates, resulting in a short-term market shock.

Notably, spot silver prices have broken through $40 per ounce for the first time since 2011 , with a year-to-date increase of over 40%. The USGS's proposal to include silver in its "critical minerals list" has been interpreted by Citigroup as a prelude to potential import tariffs of up to 50%. The bank maintains its bullish silver price forecast of $43 per ounce. Meanwhile, Goldman Sachs raised Cambricon's target price to 2,104 yuan within a week , citing strong earnings and growing AI chip shipments, citing its leadership in China's AI chip sector.

In the cryptocurrency market, Bitcoin is facing a critical test. Overall market sentiment is cautiously bearish. A report from Greeks.live notes that Bitcoin is weak, lacking strong support at the key $108,000 price level. The market attributes the current correction to "market fatigue" or potential manipulation, and is watching for potential volatility triggered by the non-farm payroll data on September 5th. Pessimism is primarily focused on concerns about key support levels. Analyst Ted believes Bitcoin may have formed a short-term top at $124,000 and plans to short it if the price rebounds to the $115,000-$120,000 range. Big Smokey and Altcoin Sherpa both believe there is a short-term risk of a drop to $105,000 or lower, citing selling by long-term whale wallets, stagnant inflows into spot ETFs, and weakness in traditional markets as key sources of pressure. Key short-term support lies at $104,000. A more pessimistic prediction is that trader Roman warns that a fall below the $98,000-$100,000 range could "officially confirm the end of the bull market." AlphaBTC also points out that a repeat of the bearish crossover signal on the daily chart could lead to a price retest of $92,000, or even a drop to as low as $80,000. However, there are also optimistic voices in the market. Michaël van de Poppe sees $102,000-$104,000 as an ideal entry range. CrypNuevo believes that the current market is more likely to deviate than a deep correction, predicting that large funds will take advantage of panic buying before interest rate adjustments. Even if the price may test $107,200 or pull back to $94,000 in the short term, he believes that the $117,000 CME gap will eventually be filled.

In contrast to Bitcoin's weakness, Ethereum has shown relative strength. Analyst Ted noted that despite Ethereum's recent outperformance, it may still face pressure to retest the key support level of $4,000 in the short term. On-chain data shows that a prominent Bitcoin whale is continuously converting its Bitcoin holdings into Ethereum, having recently sold over 837,000 ETH. Analyst Axel Bitblaze believes that insufficient liquidity is the primary issue in the current market, but with the Federal Reserve initiating rate cuts and ending quantitative tightening, liquidity is expected to return in October or November, driving a market rebound and paving the way for a new bull market in 2026.

Regarding market dynamics, the WLFI token will be the center of attention with its Time-Based General Evolution (TGE) event at 9:00 PM tonight , attracting interest in its ecosystem projects, Blockstreet (BLOCK) and Dolomite (DOLO). On-chain data indicates that well-known market maker Jump Crypto is suspected of acting as a market maker for WLFI. The project has received investments from several institutions, including DWF Labs ($25 million), Aqua One Fund ($100 million), and Nasdaq-listed ALT5 Sigma ($1.5 billion). Momentum 6 partners have also stated they hold a seven-figure position.

2. Key Data (as of 12:00 HKT, September 1)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin : $107,863 (+15.24% YTD), daily spot trading volume $30.48 billion

- Ethereum : $4,397.19 (+31.69% YTD), with a daily spot trading volume of $23.75 billion

- Fear of Corruption Index: 47 (Neutral)

- Average gas: BTC: 1 sat/vB, ETH: 0.274 Gwei

- Market share: BTC 58.05%, ETH 14%

- Upbit 24-hour trading volume rankings : XRP, ETH, BTC, SOL, POL

- 24-hour BTC long-short ratio : 49.88%/50.12%

- Sector gains and losses: GameFi fell 7.76%, AI fell 5.38%

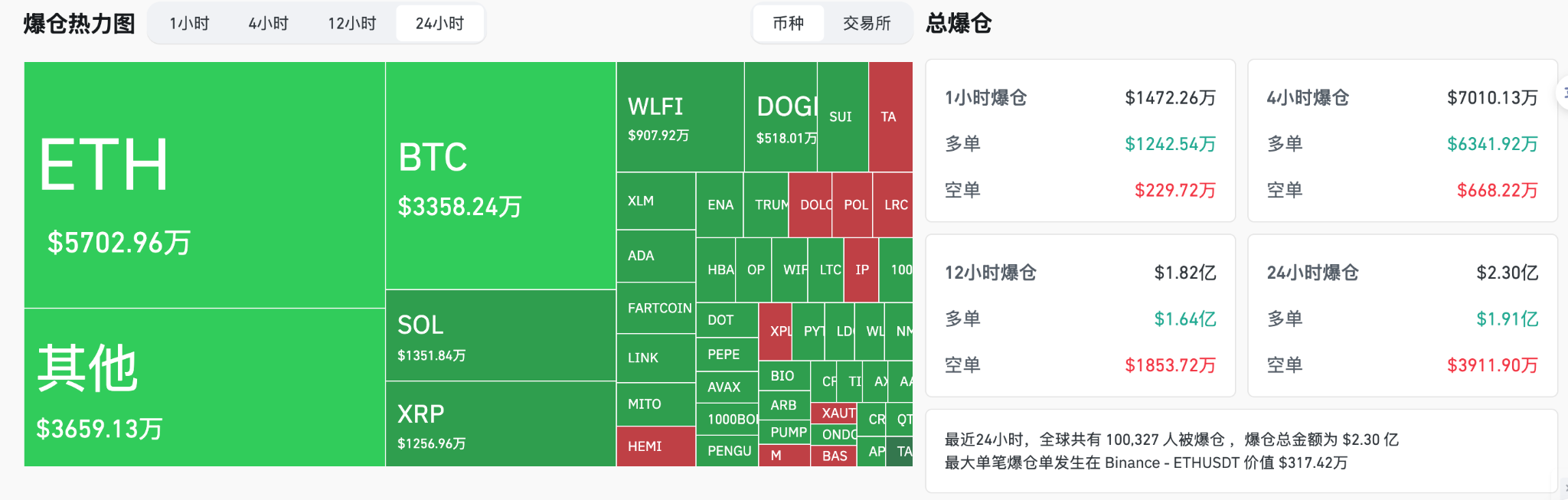

- 24-hour liquidation data : A total of 100,327 people were liquidated worldwide, with a total liquidation amount of US$230 million, including BTC liquidation of US$33.58 million, ETH liquidation of US$57.0296 million, and SOL liquidation of US$13.5184 million.

- BTC medium- and long-term trend channel : upper channel line ($112,577.10), lower channel line ($110,347.85)

- ETH medium- and long-term trend channel : upper line of the channel ($4477.41), lower line ($4388.75)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price is within the range or repeatedly passes through the cost range in the short term, it is in a bottoming or topping state.

3. ETF flows (as of August 29)

- Bitcoin ETF : -$127 million, first net outflow after 4 days of net inflow

- Ethereum ETF : -$165 million

4. Today's Outlook

- US stock markets will be closed on September 1

- WLFI will be launched on the Ethereum mainnet on September 1st, and early investors will unlock 20%

- Starknet will take a major step towards decentralized ordering on September 1st, with support for Bitcoin staking to follow in the coming weeks.

- Binance Wallet Launches Forest (FOREST) in the 36th TGE

- Binance Alpha to Launch Quack AI (Q) on September 2nd

- Trump's son Eric Trump will attend Metaplanet's special shareholders meeting on September 1

- Sui (SUI) will unlock approximately 44 million tokens at 8:00 am on September 1st, accounting for 1.25% of the current circulating supply and worth approximately $145 million.

- ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8:00 AM on September 1st, representing 4.55% of the current circulating supply and valued at approximately $8.4 million.

- Ethena (ENA) will unlock approximately 40.63 million tokens at 3:00 PM on September 2nd, representing 0.64% of the current circulating supply and valued at approximately $27.1 million.

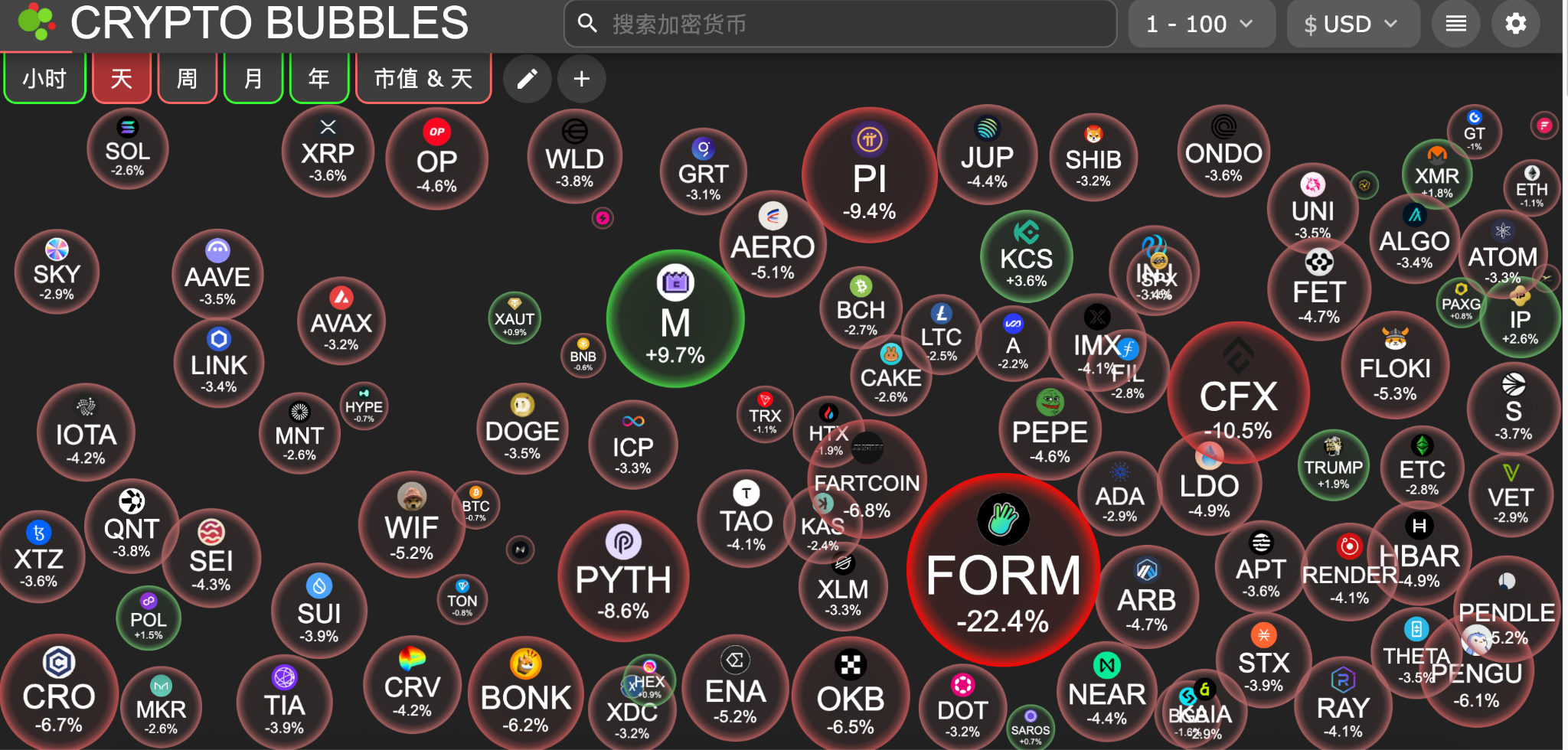

The biggest declines among the top 100 cryptocurrencies by market capitalization today: Four.meme fell 22.4%, Conflux fell 10.5%, Pi Network fell 9.4%, Pyth Network fell 8.6%, and Fartcoin fell 6.8%.

5. Hot News

- Data: SUI, ENA, IMX and other tokens will usher in large-scale unlocking, of which SUI unlocking value is about 145 million US dollars

- This week's preview: WLFI launches on Ethereum mainnet, unlocking 20% for early investors; September 5th non-farm payroll data may bring significant market volatility

- This week's macroeconomic outlook: Trump and the Federal Reserve's "power game" intensifies, and expectations of a 25 basis point rate cut are rekindled.

- A Bitcoin whale deposited another 1,000 BTC into HyperLiquid to exchange for ETH

- Binance to List World Liberty Financial (WLFI) and Add Seed Tags

- Solana's Alpenglow proposal passed, reducing block finality time to 150 milliseconds

- Trend Research deposited $4.72 million in ENS and $4.78 million in PENDLE to Binance

- ZhongAn Online: ZhongAn Technology plans to increase investment in ZhongAn International, which has entered into share purchase agreements with Cosmos, OKG, and others.

- Japanese nail salon operator Convano plans to raise $3 billion to support its Bitcoin treasury reserves

- Bonk.fun partners with WLFI to become the official launchpad for USD1 on Solana

- The Ethereum Community Foundation launches BETH, a proof-of-destruction token

- China Financial Leasing Group disclosed that it has invested in BlackRock and Hong Kong-listed Bitcoin and Ethereum ETFs

- Star investor Kevin O'Leary: BTC and crypto-related assets account for over 10% of his personal portfolio

- Japanese gaming giant Gumi plans to invest approximately $17 million in XRP

- International Commercial Settlement Holdings plans to raise HK$500 million, 90% of which will be used to explore cryptocurrency investment opportunities