Author: 0xBrooker

BTC daily trend

BTC opened at $119,309.37 this week and closed at $117,488.60, with a low of $116,859.32 and a high of $124,533.00, a drop of 1.53%, an amplitude of 6.43%, and increased trading volume.

This week, the US released its July CPI and PPI data. While the CPI was largely in line with expectations, the PPI significantly exceeded expectations, reinforcing expectations that inflation would remain sticky or even rise. Federal Reserve Board members began to temper expectations for a significant September rate cut. The market had previously fully priced in a 25 basis point rate cut in September, with some 50 basis point pricing in. However, this week's significantly better-than-expected PPI data heightened inflation concerns, prompting the market to quickly remove the 50 basis point price.

Influenced by this expectation, the US dollar index rebounded somewhat, but still fell during the week. US stocks and Bitcoin, which had been rising due to the sharp interest rate cut, fell slightly due to the data, but still recorded gains during the week.

Currently, a 25 basis point interest rate cut in September remains highly likely, with both US stocks and Bitcoin (BTC) trending upwards. Regarding the market outlook, EMC Labs believes a cautious optimism is warranted, with close attention being paid to economic and employment data, particularly those related to inflation. Poor data could lead to further market volatility.

Policy, macro-financial and economic data

In last week's weekly report, we mentioned that "it is necessary to be vigilant that the three interest rate cuts priced in by the market will still face challenges, such as whether the CPI will rebound sharply due to the impact of tariffs. This major uncertainty will still make the market's optimistic pricing seem too high."

The US CPI and PPI data released this week did have a certain impact on the market.

The PCI data released on Tuesday showed that the seasonally adjusted CPI annual rate was 2.7% at the end of July, lower than the expected 2.8%. However, the seasonally adjusted core CPI annual rate was 3.1%, higher than the expected 2.00%, indicating that inflation remains sticky but relatively mild. This data reinforced market expectations of a significant interest rate cut, pushing the Nasdaq and Bitcoin to record highs.

However, the PPI data released on Thursday showed that the monthly rate in July was 0.9%, significantly higher than the expected 0.2%, and the annual rate reached 3.3%, also significantly higher than the expected 2.5%. The PPI data will most likely be transmitted to the CPI data in the future, making it possible for inflation data to rise in the following months.

The PPI data, which exceeded expectations, pushed the US stock market downward, causing BTC, which had just hit a record high and returned to an upward trend, to fall sharply on Thursday. It also pushed Altcoins, which were on the rise after the start of Altseason, to fall sharply.

The US dollar index, as well as long- and short-term Treasury bonds, saw some volatility. FedWatch data showed that traders quickly sold off their September 50 basis point pricing on Thursday, with the probability of a 25 basis point rate cut in September now exceeding 90%.

Based on the expectation of restarting the interest rate cut cycle, the Nasdaq, which had previously surged in the U.S. stock market, slowed down its gains, while the Dow Jones and Russell 2000 indices rebounded, with gains exceeding those of the S&P 500.

Judging by the data, the market still predicts the start of a rate cut cycle in September, but has lowered its expectations for the magnitude of the cut. Based on this assessment, the upward trend in the US stock and crypto markets remains relatively intact, and cautious optimism can be maintained going forward.

Crypto Markets: Inflows, Outflows, and Sell-offs

After fluctuating around $120,000 for four weeks, BTC attempted a breakthrough this week, reaching a high of $124,533. However, it plummeted back below $120,000 amid market volatility caused by PPI data.

However, the increased risk appetite driven by expectations of interest rate cuts has led to a continued influx of funds into the crypto market.

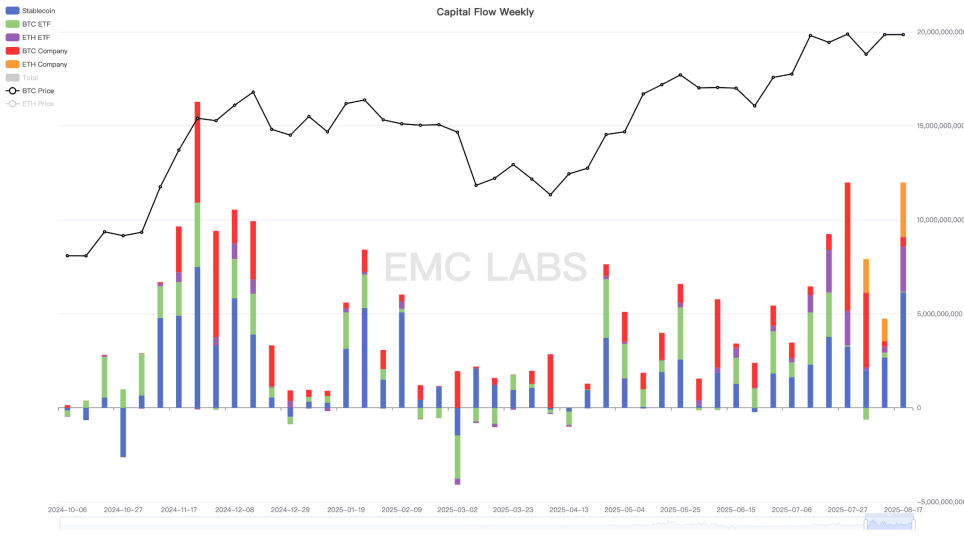

According to eMerge Engine statistics, the crypto market saw inflows of more than $19.8 billion throughout the week, including $6.145 billion in stablecoins, $38 million in BTC Spot ETF channels, $2.394 billion in ETH Spot ETFs, $509 million in corporate purchases of BTC, and $2.394 billion in corporate purchases of ETH.

Capital inflows are strong, and BTC's adjustment is due to a shift in capital, with the scale of capital inflows into the ETH market far exceeding that of BTC.

Crypto Market Capital Inflow and Outflow Statistics (Weekly)

While BTC adjusted this week, ETH continued its upward trend, rising by over 5.22%. Meanwhile, Ethereum ecosystem projects also saw significant gains.

In terms of BTC selling, it still continues the rising period characteristics of large rises and sells. Compared with the vigorous capital inflow, the selling pressure is not great.

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.75, which is in an upward phase.