Author: 0xjacobzhao

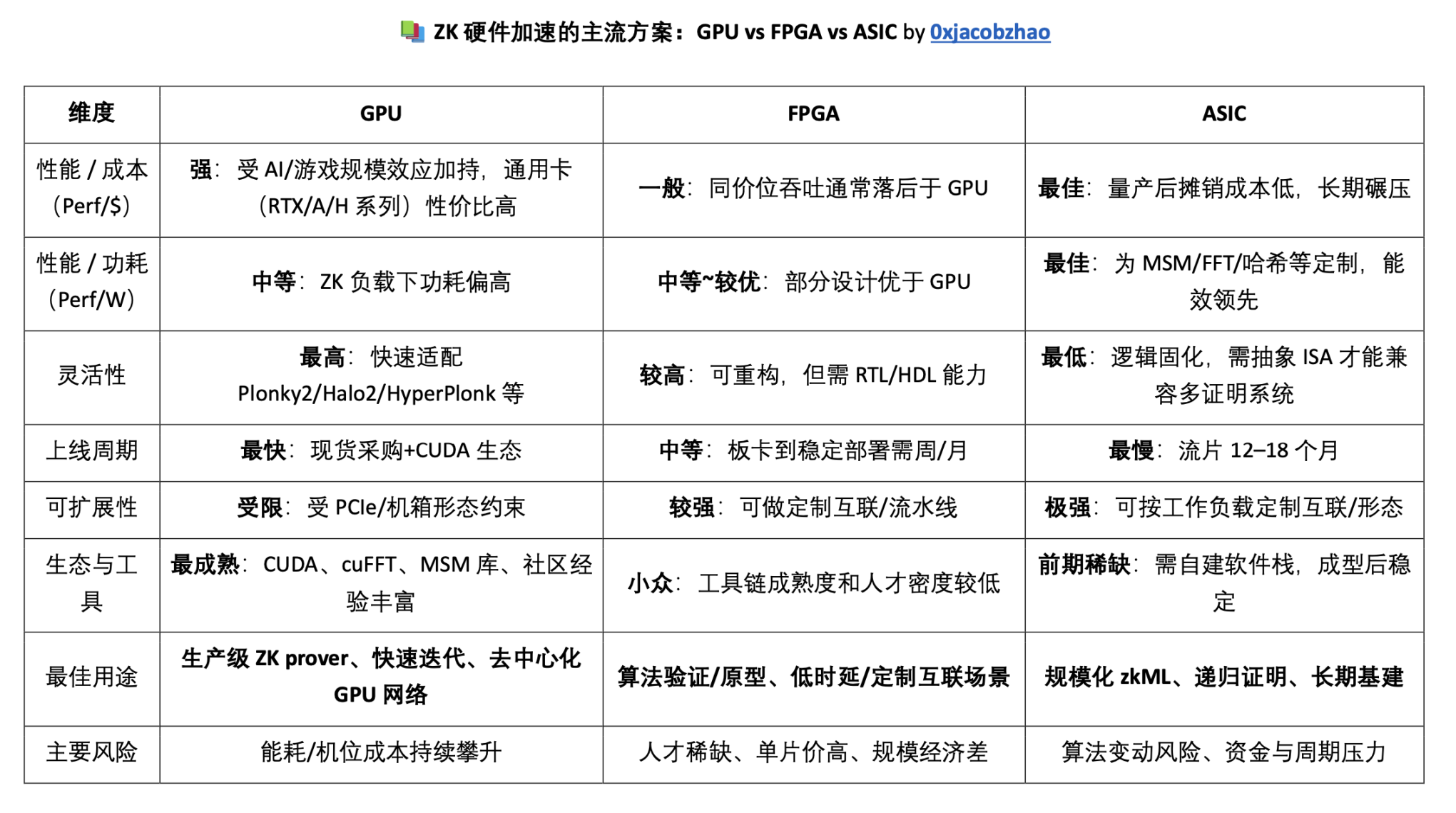

Zero-knowledge proofs (ZK), a next-generation encryption and scalability infrastructure, have demonstrated broad potential in emerging applications such as blockchain scaling, privacy-preserving computing, and zkML and cross-chain verification. However, the computationally intensive and high latency of the proof generation process present significant bottlenecks to its industrialization. ZK hardware acceleration is a key component of this emerging field. Within the ZK hardware acceleration pipeline, GPUs excel at versatility and iteration speed, ASICs pursue extreme energy efficiency and scalable performance, and FPGAs, an intermediate form factor, offer both flexible programmability and high energy efficiency. Together, these three form the hardware foundation for the implementation of zero-knowledge proofs.

1. ZK Hardware Acceleration Industry Landscape

GPUs, FPGAs, and ASICs constitute the three major mainstream solutions for hardware acceleration: GPUs are widely used in fields such as AI and ZK with their general parallel architecture and mature ecosystem; FPGAs rely on their reconfigurable features to be suitable for rapid algorithm iteration and low-latency scenarios; ASICs achieve extreme performance and energy efficiency through dedicated circuits and are the ultimate form of large-scale and long-term infrastructure.

- GPU (Graphics Processing Unit): A general-purpose parallel processor originally optimized for graphics rendering, now widely used in AI, ZK, and scientific computing.

- FPGA (Field Programmable Gate Array): A programmable hardware circuit that can be repeatedly configured at the logic gate level "like Lego", lying between general-purpose processing and specialized circuits.

- ASIC (Application-Specific Integrated Circuit): A dedicated chip customized for a specific task, burned once, with fixed functions, the highest performance and energy efficiency, but the least flexibility.

GPU Market Dominance: GPUs have become the core computing resource for AI and ZK. In the AI field, GPUs, leveraging their parallel architecture and mature ecosystem (CUDA, PyTorch, and TensorFlow), are virtually irreplaceable and have long been the mainstream choice for training and inference. In the ZK field, GPUs are currently the optimal solution due to their cost and availability. However, they are limited by storage and bandwidth for tasks such as large integer modular operations, MSM, and FFT/NTT, resulting in insufficient energy efficiency and economies of scale. Therefore, more specialized hardware solutions are still needed in the long term.

FPGAs offer a flexible solution: Paradigm bet on FPGAs in 2022, believing they hit the sweet spot between flexibility, efficiency, and cost. FPGAs offer advantages such as flexible programmability, short development cycles, and hardware reusability, making them suitable for tasks like ZK proof algorithm iteration, prototype verification, low-latency scenarios (such as high-frequency trading and 5G base stations), power-constrained edge computing, and high-security encryption. However, in terms of performance and economies of scale, FPGAs struggle to compete with GPUs and ASICs. Their strategic positioning is more like a "verification and iteration platform for unfinished algorithms," and they meet long-term, rigid requirements in a few niche industries.

The Final Form of ASICs: ASICs are already highly mature in cryptocurrency mining (such as Bitcoin SHA-256 and Litecoin/Dogecoin Scryp). By integrating algorithms into circuits, ASICs achieve orders of magnitude performance and energy efficiency advantages, becoming the sole dominant force in the mining industry. ASICs also show great potential in ZK proofs (such as Cysic) and AI inference (such as Google TPU and Cambricon). However, in ZK proofs, large-scale demand is still in the making due to the lack of complete standardization of algorithms and operators. Once standards are solidified, ASICs are expected to reshape ZK computing infrastructure, similar to mining ASICs, with performance and energy efficiency advantages 10–100 times greater, and low marginal costs after mass production. In the AI field, GPUs will continue to dominate training due to the frequent algorithm iterations and the heavy reliance on matrix parallelism. However, ASICs will continue to be irreplaceable for fixed tasks and large-scale inference.

In the evolution of ZK hardware acceleration, GPUs are currently the optimal solution, balancing cost, availability, and development efficiency, making them suitable for rapid rollout and iteration. FPGAs are more of a specialized tool, offering value in ultra-low latency, small-batch interconnection, and prototyping, but they struggle to compete with the economics of GPUs. In the long term, as the ZK standard stabilizes, ASICs will become the industry's dominant force, leveraging their superior performance, cost, and energy efficiency. The overall path forward is: short-term reliance on GPUs to capture market share and revenue, mid-term use of FPGAs for verification and interconnection optimization, and long-term bets on ASICs to build a competitive edge in computing power.

2. Hardware Perspective: Underlying Technical Barriers of ZK Acceleration

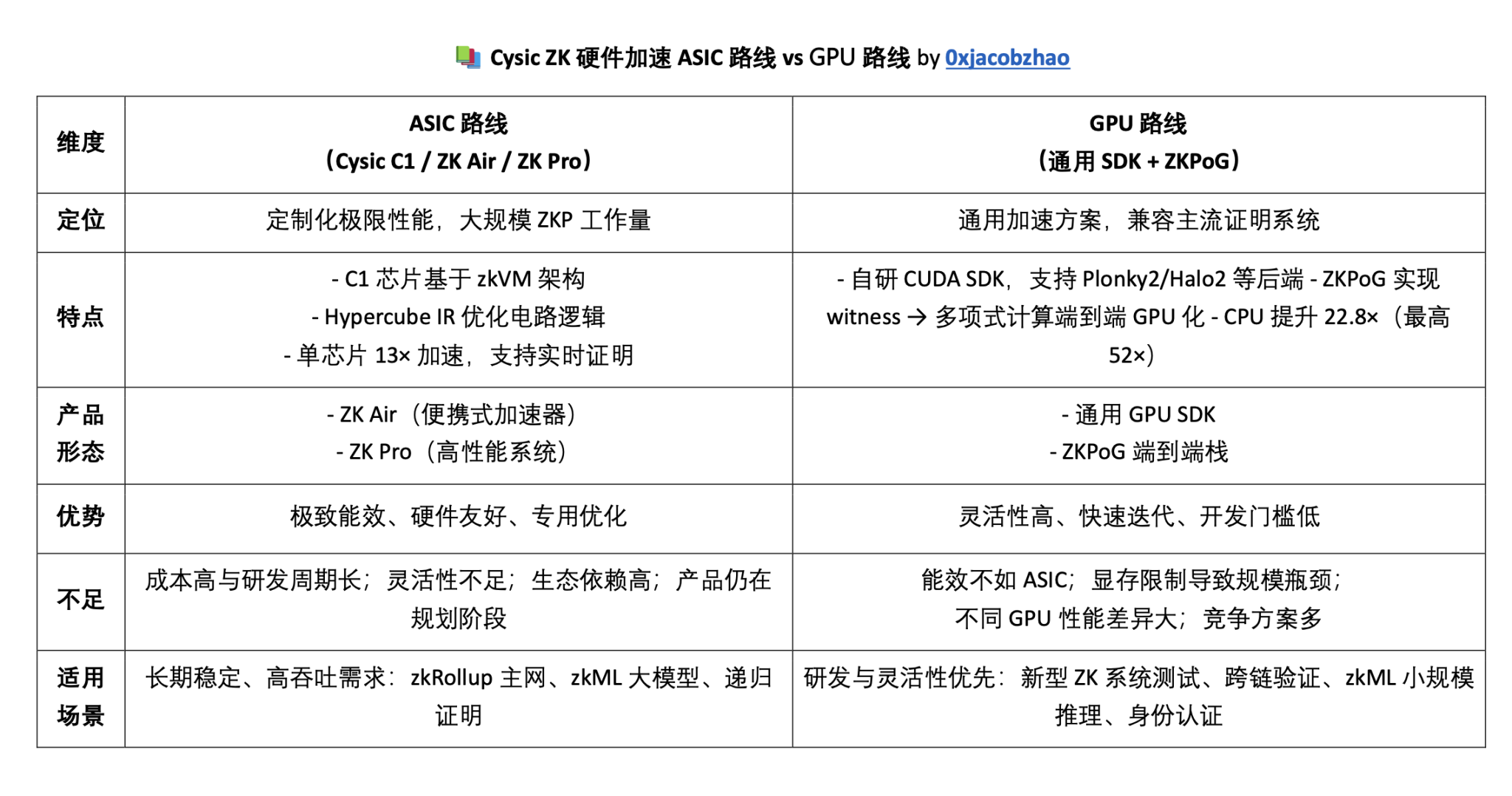

Cysic's core advantage lies in hardware acceleration for zero-knowledge proofs (ZK). In their representative paper, "ZK Hardware Acceleration: The Past, the Present, and the Future," the team argues that GPUs offer flexibility and cost-efficiency, while ASICs offer superior energy efficiency and extreme performance, but this requires a balance between development cost and programmability. Cysic is pursuing a dual-track approach of ASIC innovation and GPU acceleration, evolving from custom chips to a universal SDK to advance ZK from "verifiable" to "real-time usability."

1. ASIC route: Cysic C1 chip and dedicated equipment

Cysic's self-developed C1 chip is based on the zkVM architecture and has high bandwidth and flexible programmability. Based on this, Cysic plans to launch two hardware products: ZK Air (portable) and ZK Pro (high performance).

- ZK Air: A portable accelerator, similar in size to an iPad charger, plug-and-play, designed for lightweight verification and development.

- ZK Pro: A high-performance system that combines the C1 chip with a front-end acceleration module, targeting large-scale zkRollup, zkML, and other scenarios.

Cysic's research results directly support its ASIC strategy. The team proposed Hypercube IR as a dedicated ZK intermediate representation, abstracting proof circuits into a regularized parallel pattern, lowering the barrier to cross-hardware migration. Modular operations and memory access patterns are explicitly preserved in the circuit logic, facilitating hardware identification and optimization. In a Million Keccak/s experiment, Cysic's in-house developed C1 chip achieved approximately 1.31M Keccak proofs/second (approximately a 13x speedup), demonstrating the potential of dedicated hardware in energy efficiency and throughput. Hyperplonk hardware analysis revealed that MSM/MLE are more easily parallelized, while Sumcheck remains a bottleneck. Overall, Cysic is developing a comprehensive methodology in compilation abstraction, hardware verification, and protocol adaptation, laying the foundation for productization.

2. GPU Route: Universal SDK + ZKPoG End-to-End Stack

In the GPU direction, Cysic is also promoting the general acceleration SDK and the ZKPoG full-process optimization stack:

- Universal GPU SDK: Based on the self-developed CUDA framework, it is compatible with backends such as Plonky2, Halo2, Gnark, and Rapidsnark. Its performance exceeds that of open source solutions, supports multiple GPU models, and emphasizes compatibility and ease of use.

- ZKPoG (Zero-Knowledge Proof on GPU): This end-to-end GPU stack, developed in collaboration with Tsinghua University, optimizes the entire process from witness generation to polynomial computation for the first time. It achieves a speedup of up to 52x (average 22.8x) on consumer-grade GPUs and expands circuit size by 1.6x. It has been validated in applications such as SHA256, ECDSA, and MVM.

Cysic's core competitiveness lies in its hardware-software co-design. The team's proprietary ZK ASICs, GPU clusters, and portable mining rigs together form a full-stack computing power supply system, achieving deep collaboration from the chip layer to the protocol layer. By leveraging the complementary advantages of ASICs' extreme energy efficiency and scalability with GPUs' flexibility and rapid iteration, Cysic has established itself as a leading ZKP hardware supplier for high-intensity zero-knowledge proof (ZKP) scenarios. Building on this foundation, Cysic continues to advance the industry path of ZK hardware financialization (ComputeFi).

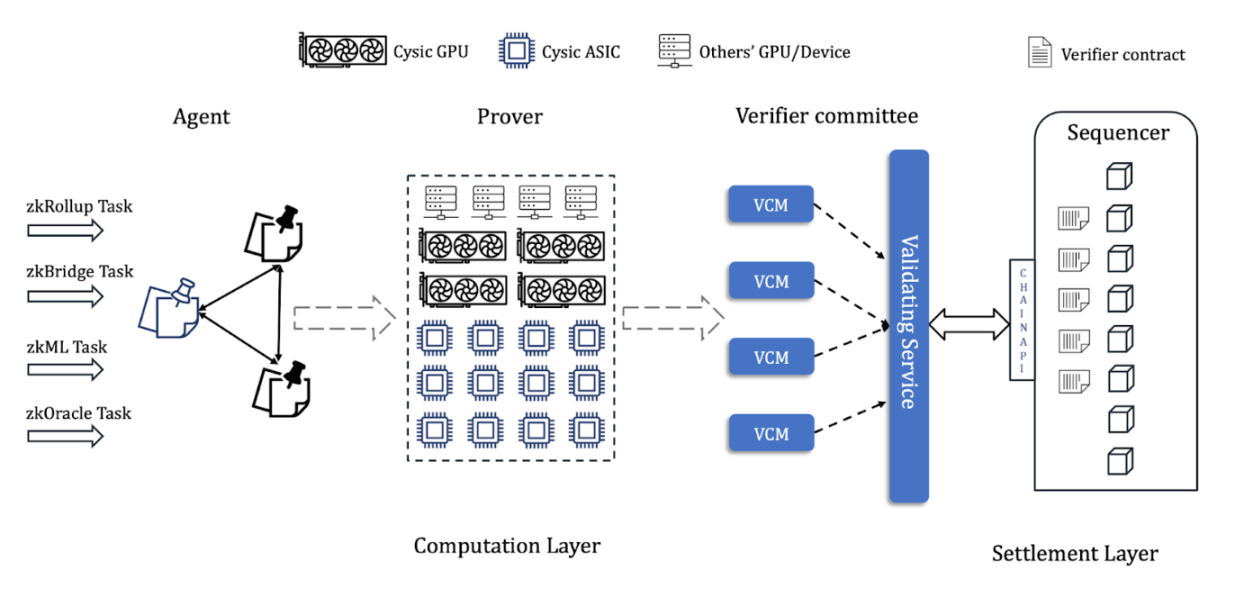

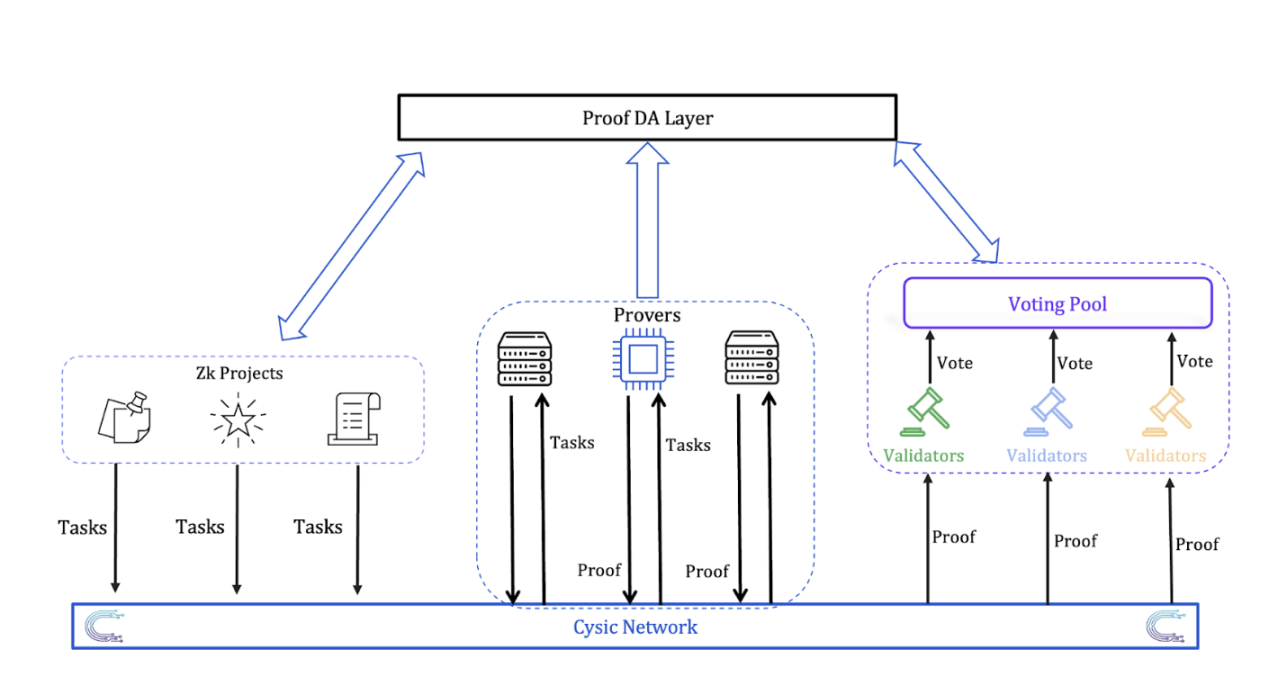

3. Protocol Perspective: Cysic Network: Universal Proof of Concept Consensus

The Cysic team released the "Cysic Network Whitepaper" on September 24, 2025. The project, centered around ComputeFi, financializes GPUs, ASICs, and mining rigs into programmable, verifiable, and tradable computing assets. Based on the Cosmos CDK, Proof-of-Compute (PoC), and the EVM execution layer, it builds a decentralized "task matching + multi-verification" marketplace, offering unified support for ZK proofs, AI reasoning, mining, and HPC. Leveraging its vertical integration capabilities of proprietary ZK ASICs, GPU clusters, and portable mining rigs, as well as its CYS/CGT dual-token mechanism, Cysic aims to unlock the liquidity of real computing power and complement the critical pillar of Web3 infrastructure: computing power.

Cysic Network adopts a bottom-up four-layer modular architecture to achieve flexible expansion and verifiable collaboration across fields:

- Hardware Layer: Consists of CPU, GPU, FPGA, ASIC mining machines and portable devices, forming the foundation of network computing power.

- Consensus Layer: Built on Cosmos CDK and using a modified CometBFT + Proof-of-Compute (PoC) consensus mechanism, it incorporates both token staking and computing power staking into verification weights, ensuring the unification of computational and economic security.

- Execution Layer: Responsible for core logic such as task scheduling, load routing, bridging, and voting, and implements multi-domain programmable computing through EVM-compatible smart contracts.

- Product Layer: Aiming at the final application scenario, it integrates the ZK proof market, AI reasoning framework, crypto mining and HPC modules, and can flexibly access new task types and verification methods.

As a ZK Proof Layer for all industries, Cysic provides high-performance, low-cost proof generation and verification services. The network improves efficiency through a decentralized Prover network and off-chain verification combined with an on-chain aggregation mechanism. Using a PoC model, Cysic combines computing power contributions with staking weights to build a computational governance system that combines security and incentives.

ZK Proof Layer: Decentralization and Hardware Acceleration

While zero-knowledge proofs can verify computations without leaking information, the generation process is time-consuming and costly. Cysic Network improves efficiency through decentralized Prover and GPU/ASIC acceleration, and reduces latency and costs on Ethereum verification through off-chain verification and aggregated on-chain verification. The process is as follows: ZK projects publish tasks through contracts → Prover generates decentralized proofs through competitive competition → Verifier performs multi-party verification → on-chain contract settlement. Overall, Cysic combines hardware acceleration with decentralized scheduling to create a scalable Proof Layer, providing underlying support for ZK Rollup, ZKML, and cross-chain applications.

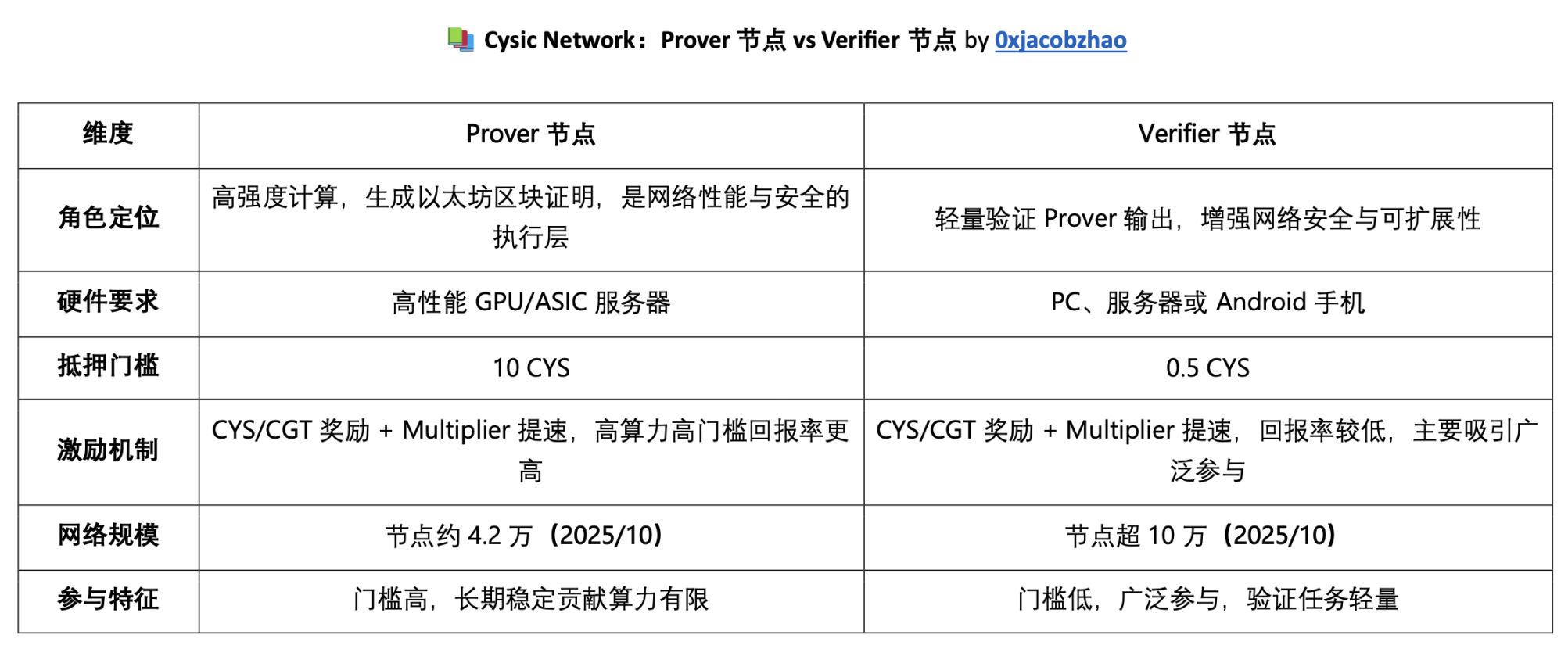

Node Role: Cysic Prover Mechanism

Cysic has introduced Prover nodes to its ZK network. Users can directly contribute computing power or purchase Digital Harvesters to perform proof tasks and earn rewards in CYS and CGT. Task acquisition can be accelerated by increasing the multiplier. Nodes must pledge 10 CYS as a security deposit; violations will result in the CYS token being withheld.

Currently, Prover's core mission is ETHProof Prover, focusing on block proofs on the Ethereum mainnet and aiming to promote the underlying ZK-based architecture and scalability. Overall, Prover undertakes high-intensity computational tasks and serves as the core execution layer for Cysic's network performance and security, providing computing power for subsequent trusted inference and AgentFi applications.

Node Role: Cysic Verifier Mechanism

Comparable to Prover, Verifier nodes are responsible for lightweight verification of proof results, improving network security and scalability. Users can run Verifier on a PC, server, or the official Android app, and use the Multiplier to improve task processing and reward efficiency.

Verifier offers a lower barrier to entry, requiring only a 0.5 CYS deposit. It's simple to operate and allows users to join and exit at any time. Overall, Verifier's low-cost, low-involvement model attracts more users, expands Cysic's reach on mobile devices and at the mass market, and enhances the network's decentralization and trusted verification capabilities.

As of October 15, 2025, the Cysic network has achieved significant scale: approximately 42,000 Prover nodes and over 100,000 Verifier nodes are operational, processing over 91,000 tasks and distributing approximately 700,000 $CYS/$CGT in rewards. It's important to note that despite this large number of nodes, activity and computing power contributions are unevenly distributed due to differences in access and hardware. The network has currently connected to three projects, and the ecosystem is still in its early stages. Whether it can further evolve into a stable computing network and ComputeFi infrastructure depends on further practical applications and collaboration.

IV. AI Perspective: Cysic AI: Cloud Services, AgentFi, and Trusted Reasoning

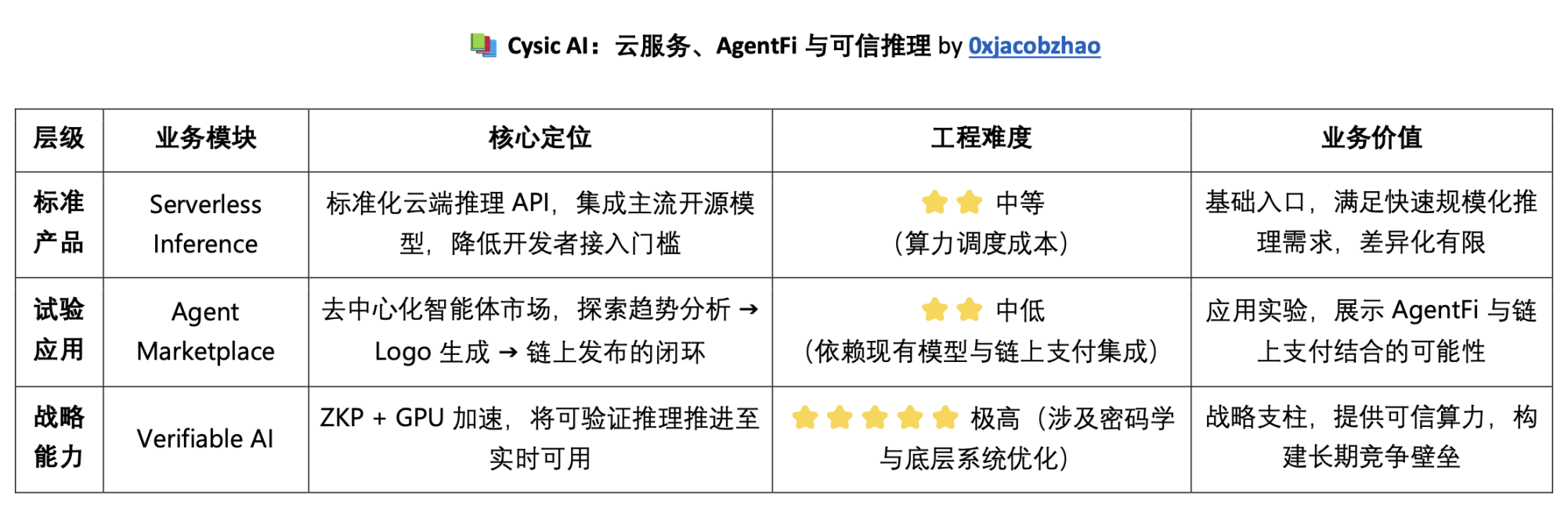

Cysic AI's business layout presents three layers of "product-application-strategy": the bottom-level Serverless Inference provides standardized reasoning APIs to lower the threshold for model calling; the middle-level Agent Marketplace explores the on-chain closed-loop application of AI Agent; the top-level Verifiable AI uses ZKP+GPU acceleration to support trusted reasoning, carrying the long-term vision of ComputeFi.

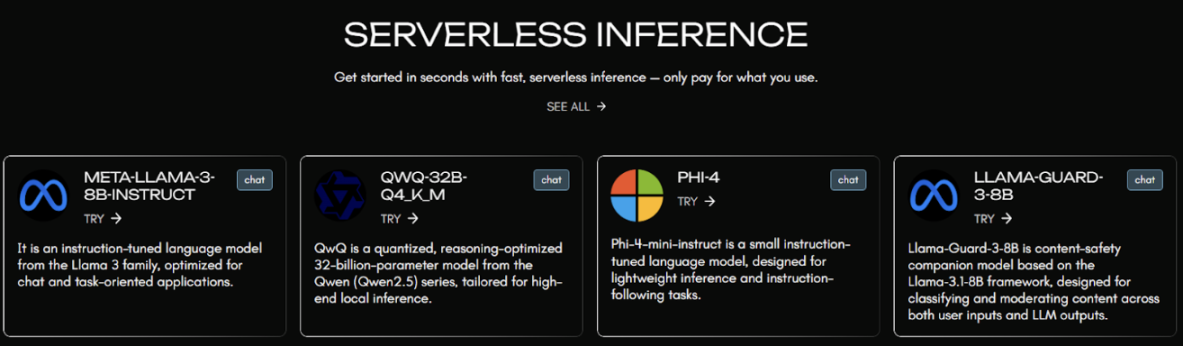

Standard product layer: Serverless Inference

Cysic AI has launched a ready-to-use, pay-as-you-go standard inference service. Users can quickly access a variety of mainstream models through APIs without having to build or maintain their own computing clusters, achieving low-threshold intelligent access. Currently supported models include Meta-Llama-3-8B-Instruct (task and dialogue optimization), QwQ-32B (inference enhancement), Phi-4 (lightweight instruction model), and Llama-Guard-3-8B (content security review), covering diverse needs such as general dialogue, logical reasoning, lightweight deployment, and compliance review. This service strikes a balance between cost and efficiency, meeting the needs of developers for rapid prototyping while also supporting large-scale inference for enterprise-level applications. It is a key component of Cysic's efforts to build a trusted AI infrastructure.

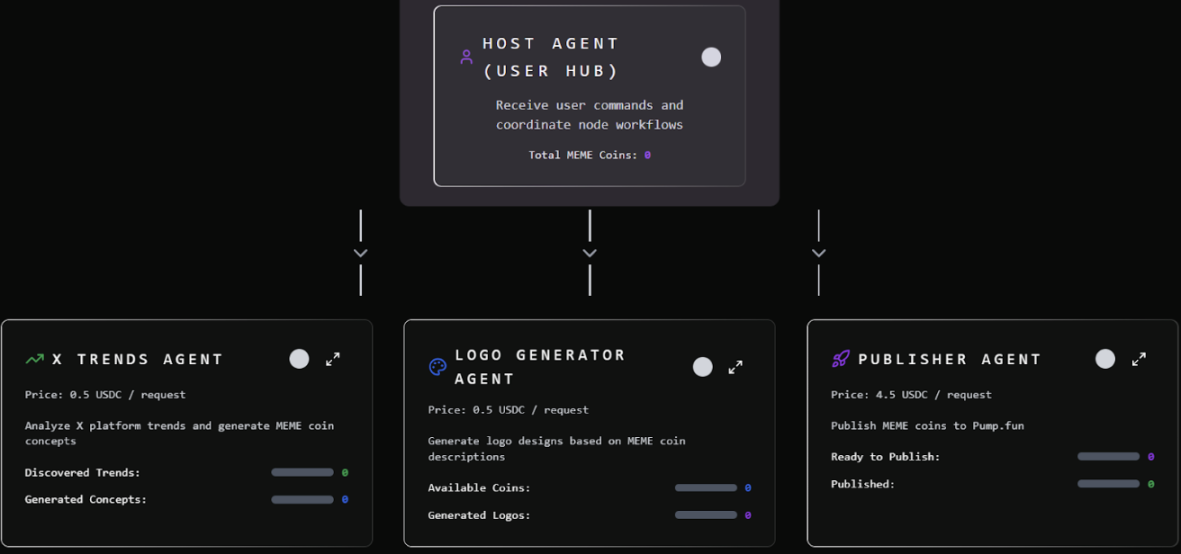

Application Experimentation Layer: Decentralized Agent Marketplace

Cysic AI's Agent Marketplace provides a decentralized platform for intelligent agent applications. Users simply connect to their Phantom wallet and complete authentication to access different AI agents and automatically pay using Solana USDC. The platform currently integrates three core agents:

- X Trends Agent: Analyzes X platform trends in real time and generates creative concepts that can be converted into MEME coins;

- Logo Generator Agent: quickly generate unique project logos based on descriptions;

- Publisher Agent: Deploy MEME Coin to the Solana network with one click (like Pump.fun).

The Agent Marketplace leverages the Agent Swarm Framework to improve collaborative efficiency, combining multiple autonomous agents into a task-collaborating group (Swarm) to achieve division of labor, parallelization, and fault tolerance. Economically, the Agent-to-Agent Protocol enables on-chain payments and automatic incentives, ensuring secure and transparent on-chain settlement, with users paying only for successful operations. Through this combination, Cysic has created a complete closed loop encompassing trend analysis → content generation → on-chain publishing, demonstrating the practical application of AI agents in on-chain financialization and the ComputeFi ecosystem.

Strategic Pillar: Hardware Acceleration for Trusted Inference (Verifiable AI)

The core challenge in AI reasoning is the trustworthiness of inference results. Verifiable AI uses zero-knowledge proofs (ZKPs) to provide mathematical guarantees for inference results, without leaking inputs or models. Traditional ZKML proof generation is too slow to meet real-time requirements. Cysic overcomes this bottleneck with GPU hardware acceleration and proposes three hardware acceleration innovations for Verifiable AI:

- First, in the parallelization of the Sumcheck protocol, the huge polynomial computing task is split into tens of thousands of CUDA threads for simultaneous execution, so that the proof generation speed can be increased almost linearly with the number of GPU cores.

- Secondly, by customizing the finite field arithmetic kernel and performing deep optimization on registers, shared memory, and warp-level parallel design, the memory bottleneck of traditional GPUs in modular operations is greatly alleviated, allowing the GPU to always maintain efficient operation.

- Finally, Cysic covers the full-link optimization of witness generation, proof generation, and verification in the end-to-end acceleration stack ZKPoG. It is compatible with mainstream backends such as Plonky2 and Halo2, and has achieved a measured performance of up to 52× that of the CPU, and achieved about 10 times acceleration on the CNN-4M model.

Through this comprehensive set of optimizations, Cysic has pushed verifiable reasoning from the stage of "theoretically feasible but too slow" to the stage of "real-time implementation", significantly reducing latency and costs, and making it possible for Verifiable AI to enter real-time application scenarios for the first time.

The Cysic platform is compatible with both PyTorch and TensorFlow. Developers simply encapsulate their models in a VerifiableModule to obtain inference results and corresponding cryptographic proofs without rewriting their code. The roadmap includes gradually expanding support for models such as CNN, Transformer, Llama, and DeepSeek, and releasing real-time demos for face recognition and object detection to verify usability. Furthermore, code, documentation, and examples will be openly available in the coming months to foster community collaboration.

Overall, Cysic AI's three-tiered approach forms a bottom-up evolutionary logic: Serverless Inference addresses usability, the Agent Marketplace demonstrates application, and Verifiable AI provides credibility and a competitive advantage. The first two are primarily transitional and experimental, but the true value and differentiation will be realized in the implementation of Verifiable AI. Its integration with ZK hardware and a decentralized computing network will be the key to Cysic's long-term advantage in the ComputeFi ecosystem.

5. Financial Perspective: NFT Computing Power Entry and ComputeFi Node

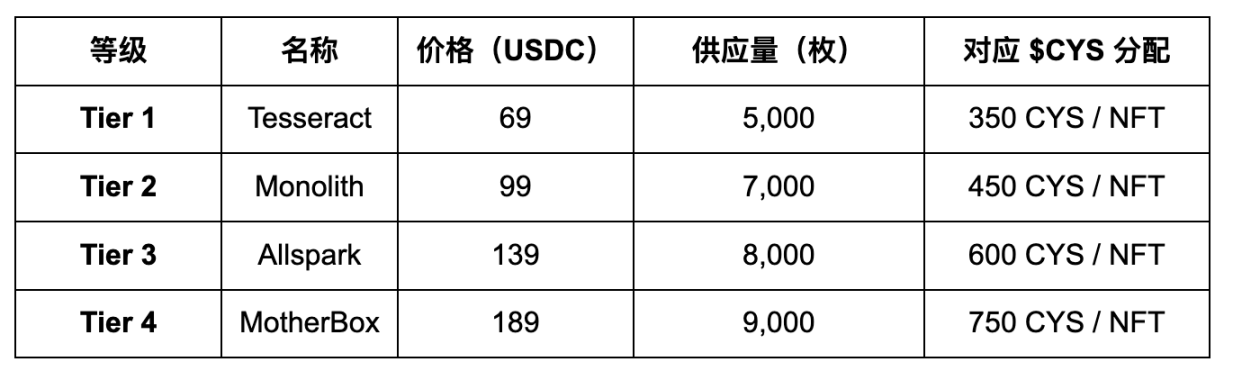

Cysic Network tokenizes high-performance computing assets like GPUs and ASICs through the "Digital Compute Cube" Node NFT, creating a ComputeFi portal for the general public. Each NFT acts as a verifiable license for the network node, simultaneously carrying revenue rights, governance rights, and participation rights: users can participate in ZK proving, AI reasoning, and mining tasks as agents or delegates without having to build their own hardware, and directly earn $CYS incentives.

The total supply of NFTs is 29,000, with a cumulative distribution of approximately 16.45 million CYS (1.65% of the total supply, within the 9% community allocation cap). The unlocking method is 50% instant TGE unlocking and 50% linear release over six months. In addition to the fixed allocation, NFT holders also enjoy additional benefits such as a multiplier boost (up to 1.2x), priority computing task rights, and governance weight. The public sale has now concluded, and users can trade on the OKX NFT Marketplace.

Unlike traditional cloud computing power leasing, Compute Cube is essentially an on-chain ownership confirmation of the underlying hardware infrastructure:

- Fixed Token income: Each NFT locks a certain proportion of $CYS distribution;

- Real-time computing power income: Nodes are connected to actual workloads (ZK proof, AI reasoning, crypto mining), and the income is directly distributed to the holder's wallet;

- Governance and priority: Holders have governance weight and priority in computing power scheduling and protocol upgrades;

- Positive cycle effect: more tasks → more rewards → more stake → stronger governance influence.

Overall, Node NFTs transform decentralized GPUs and ASICs into tradable on-chain assets for the first time. This opens up a new market for computing power investment amidst the simultaneous surge in demand for AI and ZK. ComputeFi's cyclical effect (more tasks → more rewards → stronger governance) serves as a crucial bridge for Cysic to expand its computing network to the general public.

6. Consumer Scenario: Home ASIC Miners (Doge & Cysic)

Dogecoin, launched in 2013, utilizes Scrypt PoW and, since 2014, has merged mining with Litecoin (AuxPoW), enhancing network security through shared computing power. Its token mechanism features an unlimited supply with a fixed annual issuance of 5 billion DOGE, favoring community culture and payment properties. Among fully ASIC-enabled PoW coins, Dogecoin is the most popular after Bitcoin, with its meme culture and community influence fostering long-term ecosystem engagement.

On the hardware front, Scrypt ASICs have completely replaced GPUs and CPUs, with industrial-grade mining rigs like the Bitmain Antminer L7/L9 dominating the market. However, unlike Bitcoin, which has been completely farmed, Dogecoin still has room for home mining rigs. Lightweight products like the Goldshell MiniDoge, Fluminer L1, and ElphaPex DG Home 1 offer both cash flow and community-driven advantages.

For Cysic, entering the Dogecoin ASIC market holds three key implications: First, Scrypt ASICs are less difficult than ZK ASICs, allowing for rapid verification of mass production and delivery capabilities; second, the mining market offers a mature cash flow, providing stable revenue; and third, Dogecoin ASICs help build supply chain and brand experience, laying the foundation for future ZK/AI-specific chips. Overall, home ASIC mining rigs are a pragmatic approach for Cysic, providing transitional support for its long-term ZK/AI ASIC development.

Cysic Portable Dogecoin Miner: An Innovative Path to Home Use

Cysic officially released the DogeBox 1 during Token2049. This is a portable Scrypt ASIC miner for home and community users, positioned as a "verifiable home-grade computing power terminal":

- Portable and energy-saving: Pocket-sized, suitable for home and community users, lowering the threshold for participation;

- Plug and Play: Mobile App management, targeting the global retail market;

- Dual functionality: It can mine DOGE and verify DogeOS's ZK proof, achieving L1+L2 security.

- Incentive loop: DOGE mining + CYS subsidies, forming an economic closed loop of DOGE→CYS→DogeOS.

This product works in synergy with DogeOS (a zero-knowledge proof-based Layer-2 Rollup developed by the MyDoge team, led by Polychain Capital) and the MyDoge wallet, enabling Cysic miners to not only mine DOGE, but also participate in ZK verification, and establish an incentive loop through DOGE rewards + CYS subsidies, enhancing user stickiness and integrating into the DogeOS ecosystem.

Cysic's Dogecoin home mining machine is both a pragmatic cash flow source and a strategic foundation for long-term ZK/AI ASIC development. Through the hybrid model of "mining + ZK verification", it not only accumulates market and supply chain experience, but also introduces a new scalable, verifiable, and community-driven L1+L2 narrative to Dogecoin.

7. Cysic Ecosystem Layout and Core Progress

1. Collaboration with Succinct / Boundless Prover Network

Cysic has joined the Succinct Network as a multi-node Prover, leveraging a high-performance GPU cluster to handle real-time proofs for the SP1 zkVM. Cysic is collaborating closely with the team on GPU code optimization. Cysic has also joined the Boundless Mainnet Beta, providing hardware acceleration for its Proof Marketplace.

2. Early Collaboration Projects (Scroll)

In its early stages, Cysic provided Scroll with high-performance ZK computing, leveraging its GPU cluster to undertake large-scale proofing tasks, ensuring low latency and low costs, and generating over 10 million proofs. This collaboration not only validated Cysic's engineering capabilities but also laid the foundation for its subsequent exploration into hardware acceleration and computing power networks.

3. Home mining rigs debut on Token2049

Cysic released its first portable home ASIC miner, the DogeBox 1, on Token2049, officially entering the Dogecoin/Scrypt hashing power market. Positioned as a "palm-sized hashing power terminal," the DogeBox 1 boasts lightweight, low-power, and plug-and-play functionality. With a power consumption of only 55W and a hashing power of 125 MH/s, the DogeBox 1 measures just 100×100×35 mm. It supports Wi-Fi and Bluetooth connectivity, and produces noise levels below 35 dB, making it suitable for both home and community use.

In addition to DOGE/LTC mining, the device also supports DogeOS ZK verification, achieving L1+L2 dual-layer security, and building a triple incentive cycle of "DOGE → CYS → DogeOS" through DOGE mining + CYS subsidies.

4. Testnet is coming to an end, and the mainnet is coming soon

Cysic completed Phase III: Ignition on September 18, 2025, marking the official end of the testnet phase and the start of mainnet preparation. Following Phase I, which validated the hardware and token model, and Phase II, which expanded the Genesis Node fleet, this phase fully verified the computing network's user engagement, incentive mechanisms, and assetization logic.

Cysic has integrated zero-knowledge projects such as Succinct, Aleo, Scroll, and Boundless during its testnet phase. According to its official website, the testnet saw over 55,000 wallet addresses, 8 million transactions, and over 100,000 reserved high-end GPUs. Phase III: The Ignition testnet attracted 1.36 million registered users, processed approximately 13 million transactions, and formed a network of over 260,000 nodes comprised of approximately 223,000 Verifiers and 41,800 Provers. Regarding incentives, Cysic distributed approximately 1.46 million tokens (733,000 $CYS + 733,000 $CGT) and 4.6 million FIRE, with over 48,000 users participating in staking, demonstrating the sustainability of its incentive mechanism and computing power network.

Furthermore, the ecosystem map on Cysic's official website shows extensive connections with core projects in ZK and AI, demonstrating its broad compatibility and openness as a provider of underlying computing power and hardware acceleration. These ecosystem connections provide a strong external interface and collaborative foundation for future expansion in ZK, AI, and ComputeFi.

- zkEVM and L2: zkSync, Scroll, Manta, Nil, Kakarot

- zkVM/Prover Network: Succinct, Risc0, Nexus, Axiom

- zk Coprocessor: Herodotus, Axiom

- Infrastructure/cross-chain: zkCloud, ZKM, Polyhedra, Brevis

- Identity and Privacy: zkPass, Human.tech

- Oracles: Chainlink, Blocksense

- AI Ecosystem: Talus, Modulus Labs, Gensyn, Aspecta, Inference Labs

8. Cysic Token Economic Model Design

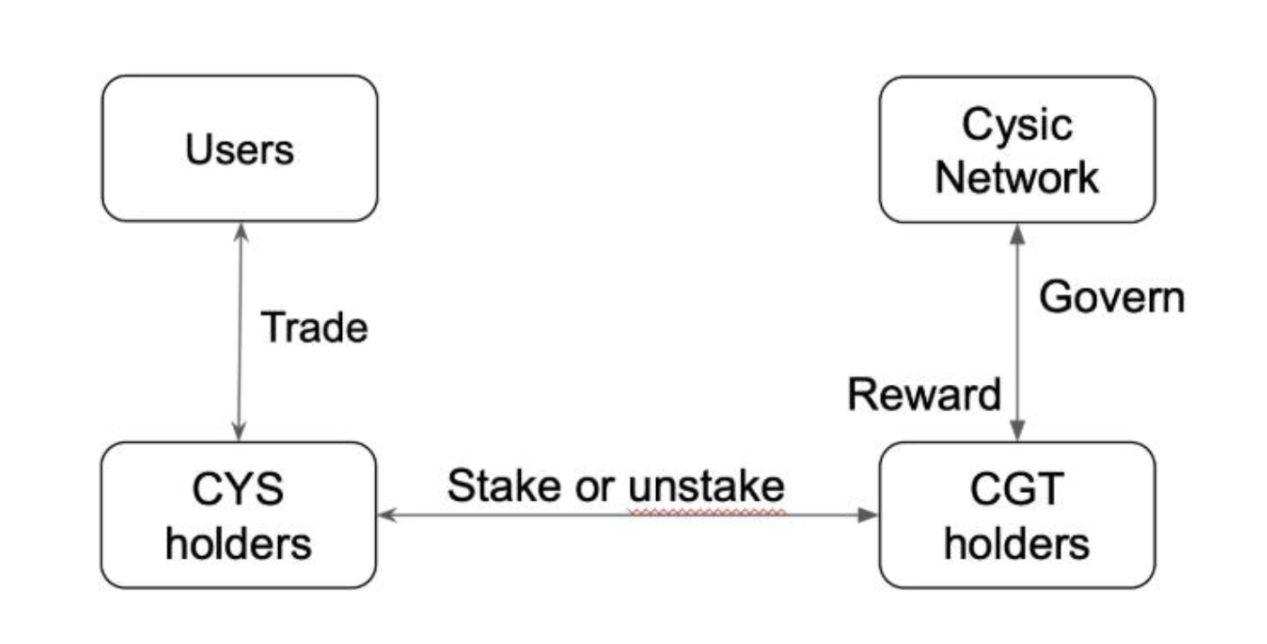

Cysic Network adopts a dual-token system: the network token $CYS and the governance token $CGT.

- $CYS (Network Token): The native transferable asset used to pay transaction fees, node staking, block rewards, and network incentives, ensuring network activity and economic security. $CYS also serves as the primary incentive for compute providers and validators. Users can stake $CYS to gain governance weight and participate in resource allocation and governance decisions within the Computing Pool.

- $CGT (Governance Token): A non-transferable asset, it can only be obtained by staking $CYS at a 1:1 ratio and participates in Computing Governance (CG) with a longer unstaking period. $CGT reflects computing power contribution and long-term participation. Computing providers are required to reserve a certain amount of $CGT as an entry deposit to prevent malicious behavior.

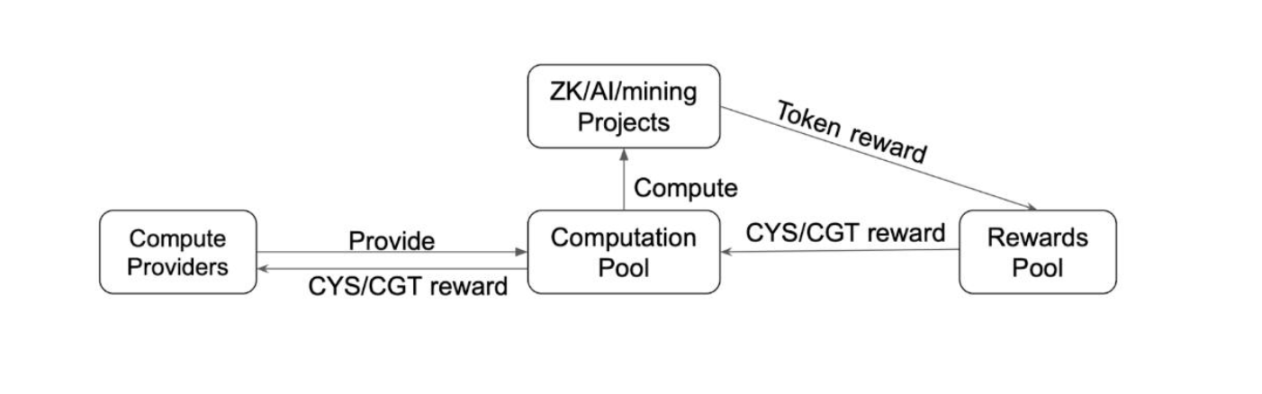

During network operation, computing providers connect their computing power to the Cysic Network to provide services for tasks such as ZK, AI, and crypto mining. Their revenue comes from block rewards, external project incentives, and computing power governance allocation. The scheduling of computing power and the distribution of rewards are dynamically adjusted based on multiple factors, with external project incentives (such as ZK, AI, and mining rewards) playing a key role.

9. Team Background and Project Financing

Cysic's co-founder and CEO is Xiong (Leo) Fan, formerly an Assistant Professor in the Department of Computer Science at Rutgers University. Prior to that, he was a researcher at Algorand and a postdoctoral researcher at the University of Maryland, where he received his Ph.D. from Cornell University. Leo Fan's research has long focused on cryptography and its intersection with formal verification and hardware acceleration. He has published numerous papers in top international conferences and journals, including IEEE S&P, ACM CCS, POPL, Eurocrypt, and Asiacrypt, covering areas such as homomorphic encryption, lattice cryptography, functional cryptography, and protocol verification. He has participated in numerous academic and industry projects, possessing both theoretical research and system implementation experience, and has served on the program committee of international cryptography conferences.

According to public information on LinkedIn, the Cysic team is comprised of members with backgrounds in hardware acceleration, cryptography research, and blockchain applications. Core members possess industry experience in chip design and system optimization, as well as academic training from top universities in Europe, America, and Asia. The team complements each other's expertise in hardware R&D, zero-knowledge proof optimization, and operational development.

In terms of financing, in May 2024, Cysic announced the completion of a US$12 million Pre-A round of financing, jointly led by HashKey Capital and OKX Ventures. Participants included Polychain, IDG, Matrix Partners, SNZ, ABCDE, Bit Digital, Coinswitch, Web3.com Ventures, as well as well-known angels such as Celestia/Arbitrum/Avax early investor George Lambeth and Eternis co-founder Ken Li.

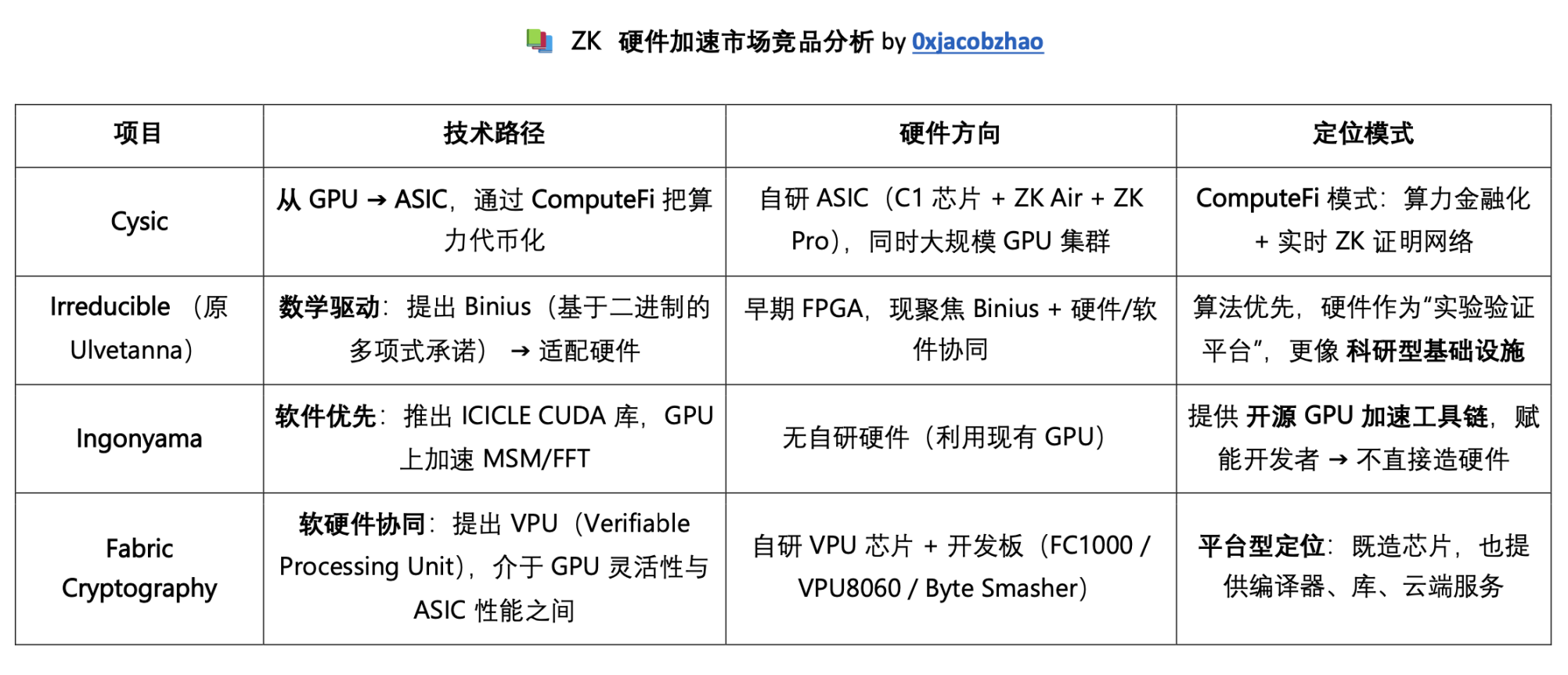

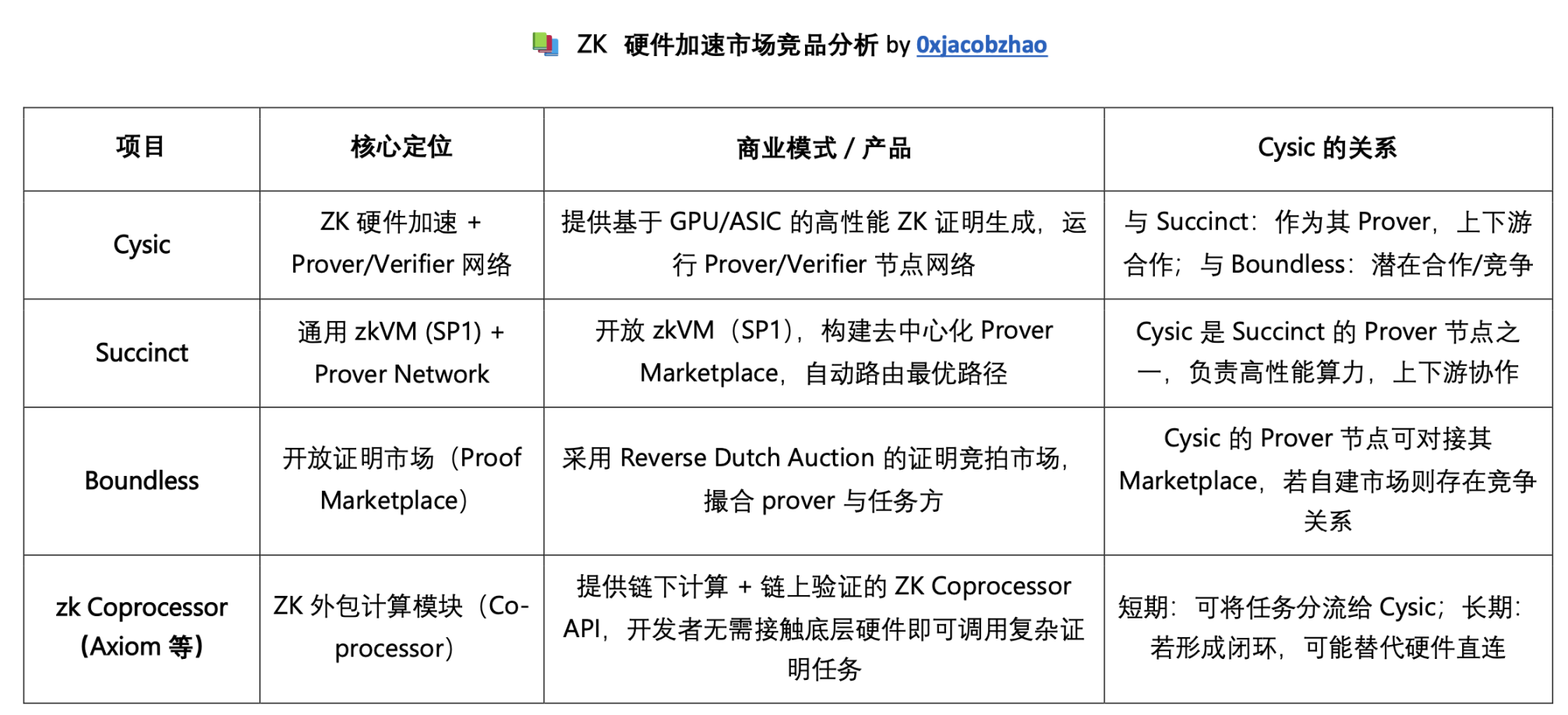

10. ZK Hardware Acceleration Market Competitive Analysis

1. Direct competitor (hardware-accelerated)

In the hardware-accelerated Prover and ComputeFi tracks, Cysic's core competitors include Ingonyama, Irreducible (formerly Ulvetanna), Fabric Cryptography, and Supernational, all of which focus on "hardware and networks that accelerate ZK Proving."

- Cysic: Full stack (GPU+ASIC+network), focusing on the ComputeFi narrative, with advantages in the assetization and financialization of computing power. However, the ComputeFi model still requires market education, and hardware mass production also has certain challenges.

- Irreducible: Combining academia and engineering, exploring new algebraic structures (Binius) and zkASIC, with strong theoretical innovation, but the pace of its commercialization may be constrained by the economies of scale of FPGA.

- Ingonyama: ICICLE SDK is open source and friendly, and has become the de facto standard for GPU ZK acceleration. It has a high ecological adoption rate, but there is a lack of self-developed hardware.

- Fabric: Positioned as a "software and hardware integration" path, it attempts to create a general-purpose encryption computing chip (VPU). Its business model is similar to "CUDA + NVIDIA", seeking a broader encryption computing market.

2. Indirect Competitors (ZK Marketplace / Prover Network / ZK Coprocessor)

In the ZK Marketplace, Prover Network and zk Coprocessor tracks, Cysic currently plays more of the role of an upstream computing power provider, while projects such as Succinct, Boundless, Risc0, Axiom, etc. are entering the same customer group (L2, zkRollup, ZKML) through zkVM, task scheduling and open market matching.

In the short term, Cysic's collaboration with these projects will primarily be collaborative: Succinct will be responsible for task routing, while Cysic will provide high-performance Prover nodes. The zk Coprocessor may offload some tasks to Cysic. However, in the long term, if Boundless and Succinct's marketplace model (auction vs. routing) continues to grow, while Cysic develops its own marketplace, direct conflict will inevitably arise among the three parties at the customer access level. Similarly, if the zk Coprocessor forms a closed loop, it could become a customer access point, replacing direct hardware connections. This risks relegating Cysic to a mere "foundry."

11. Summary: Business Logic, Engineering Implementation, and Potential Risks Business Logic

Cysic, with ComputeFi at its core, seeks to bridge the gap between computing power, from hardware production and network scheduling to financialized assets. In the short term, it aims to leverage GPU clusters to meet existing ZK Prover demand and generate revenue. In the medium term, it aims to enter the mature cash flow market through Dogecoin home ASIC mining rigs, verify mass production capabilities, and leverage community culture to open up access to consumer-grade hardware. Its long-term goal is to develop its own dedicated ZK/AI ASICs, integrate them with Node NFTs and Compute Cube, and capitalize and marketize computing power, building an infrastructure-based moat.

Engineering Implementation

At the hardware level, Cysic has completed GPU-accelerated Prover/Verifier optimizations (MSM and FFT parallelization) and announced ASIC development results (1.3M Keccak/s prototype). At the network level, they are building a verification chain based on the Cosmos SDK, supporting Prover node accounting and task distribution, and tokenizing computing power using Compute Cube/Node NFTs. Regarding AI, they have launched the Verifiable AI framework, which achieves trusted reasoning through GPU parallel optimization of Sumcheck and finite field operations. However, this framework offers limited differentiation compared to similar products in the industry.

Potential risks

- Market education and demand uncertainty: The ComputeFi model is still a new concept, and whether customers are willing to invest in computing power in the form of NFTs/tokens still needs market verification.

- Insufficient demand for ZK business: The ZK Prover industry is still in its early stages. Currently, GPUs can meet most of the demand, making it difficult to support large-scale shipments of ASICs, and its revenue contribution is limited.

- ASIC engineering and mass production risks: The certification system has not yet been fully standardized. ASIC R&D requires 12-18 months. This, combined with high tape-out costs and uncertainty in mass production yields, may impact commercialization progress.

- Doge home mining machine production capacity bottleneck: the overall market capacity of the home scene is limited, and electricity prices and community-driven factors lead to more "interest-based" consumption, making it difficult to generate stable and large-scale income.

- Insufficient differentiation in AI services: Although Cysic's Verifiable AI demonstrates GPU parallel optimization, its cloud-based inference services have limited differentiation. The Agent Marketplace has a low threshold, and the overall barriers are still not prominent.

- Competitive landscape dynamics: In the long term, it may conflict with zkMarketplace or zkCoprocessor projects such as Succinct and Boundless at the customer entry level, and be passively relegated to the role of "upstream OEM".

Disclaimer: This article was created with the assistance of the AI tool ChatGPT-5. While the author has made every effort to proofread and ensure the accuracy of the information, some omissions are inevitable and we apologize for any inaccuracies. It is important to note that divergences between project fundamentals and secondary market price performance are common in the cryptoasset market. This article is intended solely for information aggregation and academic/research exchange and does not constitute investment advice or a recommendation to buy or sell any token.