Author: Zhou, ChainCatcher

Since last year, Metaplanet, a Japanese listed company, has attracted significant attention for its Bitcoin asset strategy, with its stock price rising over 40-fold at one point. Public information indicates that the company currently holds 20,000 Bitcoins, ranking it the sixth-largest Bitcoin treasury in the world. However, despite Bitcoin's strength since April of this year, Metaplanet's stock price has retreated over 50% since peaking in June, increasingly demonstrating a decoupling from BTC.

Endogenous variables in the crypto market weaken

From an initial hotel company to now holding 20,000 bitcoins, Metaplanet has successfully implemented the "buy coins - raise shares - raise funds - buy more coins" model in less than two years.

In April 2024, as Bitcoin bottomed out and rebounded, the company initiated additional issuance and convertible bond financing, purchasing its first batch of BTC. Following the upward trend in the stock price, the company further increased its holdings through additional issuance by shareholders and low-interest loans. By early September 2025, the company held approximately 20,000 Bitcoins, with a crypto market capitalization exceeding $2 billion, ranking it the sixth-largest Bitcoin treasury company (after MicroStrategy, MARA, XXI, Bitcoin Standard Treasury Company, and Bullish).

In addition, the company has set its year-end target at 30,000 coins and will continue to purchase in September and October according to the established fundraising plan; President Simon Gerovich said at the special shareholders' meeting that he will strive to purchase a total of 210,000 BTC by 2027 (accounting for about 1% of the supply).

As of the close of trading on September 2nd (UTC+9), Metaplanet was trading at 832 yen, a 57% decline from its June high of 1,930 yen. Assuming a holding of 20,000 tokens and a BTC value of approximately $108,000–111,000 USD, the treasury's market capitalization is approximately $2.16–2.22 billion USD, corresponding to a "market capitalization/holding market capitalization" ratio of ≈ 1.8 (approximately the mNAV premium, excluding other assets/liabilities).

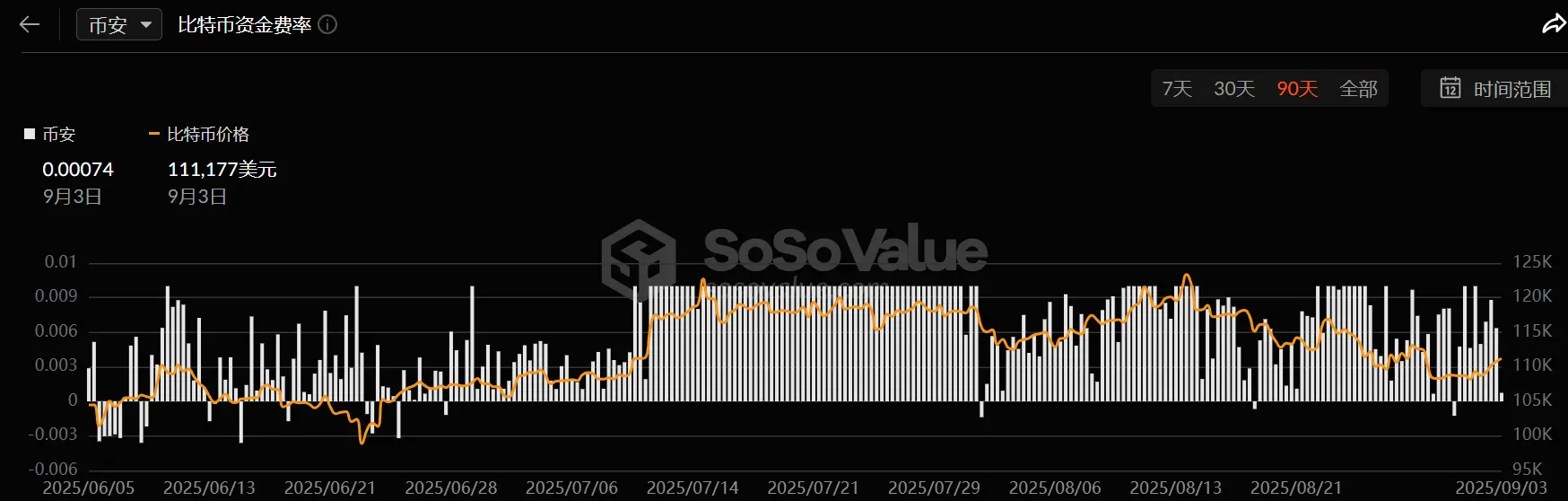

The divergence between stock prices and coin prices isn't solely due to noise from Metaplanet's individual stocks (as detailed in the article "From Misalignment to Collaborative Decline: The Crypto-Stock Linkage Reaches a Crossroads"). Nor can it be explained simply by "deteriorating fundamentals." The key lies in the weakening of crypto's intrinsic variables. According to SoSoValue, Bitcoin spot ETFs experienced a net outflow of approximately $751 million in August. Bitcoin funding rates have fallen from their mid-July highs to near zero, turning negative several times during this period. With marginal buying cooling and leverage momentum weakening, the threshold for re-coupling BTC treasury stocks with BTC has been raised.

PlayerUnknown's Battlegrounds or just drinking poison to quench thirst?

Metaplanet shareholders have reportedly approved an increase in authorized shares and the establishment of preferred stock terms, with a maximum issuance of approximately $3.8 billion. The proceeds will be primarily used to continue purchasing Bitcoin and expand treasury funds. Preferred stock is uncommon in the Japanese market; while fixed dividends and liquidation preferences provide financial certainty, they also imply immediate dilution and governance discounts. The market will assess the effectiveness of this "capital injection" based on whether it can translate into upward momentum.

What determines the success is not "whether it can be successfully issued", but what kind of crypto-β the funds encounter after entering the market.

According to the company's plan, the company aims to increase its Bitcoin holdings to 30,000 by the end of this year, which corresponds to three development paths in the future market:

1) Fast-Pace (β Recovery): If the Bitcoin spot ETF sees a significant return to net inflows, the company will be motivated to rapidly purchase nearly all of the newly added 10,000 Bitcoins in September and October, with the average price roughly within the current price range. This will result in a rapid increase in the amount of BTC on the books, with the mNAV premium temporarily stabilizing or even reversing. However, the trade-off is a higher average holding price, greater sensitivity to drawdowns, and the added "rigidity" of preferred stock dividends, which further amplifies the downward volatility.

2) Medium-Pace (β-Neutral): If Bitcoin prices fluctuate in the short term, the company is more likely to purchase in batches, increasing its holdings to 27,000-30,000 by year-end. This approach reduces the risk of buying at a high price, but dilution and preferential rights discounts will offset valuation flexibility. The stock price will likely trade close to mNAV, and the premium is unlikely to expand significantly.

3) Slow pace (weakening β): If net capital outflows continue, Bitcoin prices will find it difficult to maintain high levels, and the company's mNAV premium will continue to converge or even turn around. The expected dilution of preferred shares/additional issuances and rising financing costs, coupled with the collapse of market sentiment, will further amplify the momentum of stock price declines, shift the valuation center downward, or create pressure for passive deleveraging.

Conclusion

In short, while the treasury model has provided short-term growth momentum, its fragility is becoming increasingly apparent amidst market volatility and macroeconomic shifts. Having chosen to go all-in on Bitcoin, Metaplanet's future is no longer under its own control, instead placing its fate in the hands of the crypto market. As the crypto market increasingly diversifies its compliant purchasing methods, and as Metaplanet, as a follower of this path, shifts from a low-value market to a market consensus, it may find itself in an even more challenging position.

Click here to learn about ChainCatcher's current job openings