By Lacie Zhang, Researcher at Bitget Wallet

In the Solana ecosystem, renowned for its high speed and low costs, we're observing the rapid emergence of a new trend: the rapid rise of proprietary automated market makers (AMMs), a group of "invisible" giants with no official website or publicity. They are reshaping the trading landscape with more professionalism and efficiency, becoming a new engine driving on-chain capital flows. In this article, Bitget Wallet Research will guide you through this silent revolution, analyzing the logic behind the rise of proprietary AMMs and their impact on the industry.

Hidden Giant: The Operating Logic of Self-Operated AMM

Image source: Helius

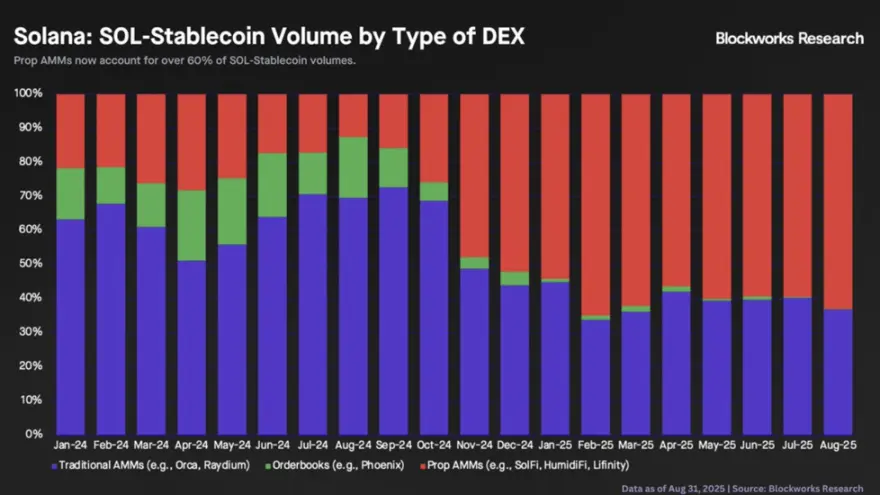

According to Blockworks, in August 2025 alone, proprietary AMMs processed approximately $47 billion in spot trading on Solana, representing 31% of the total DEX trading volume on the Solana chain. This trend is even more striking for highly liquid trading pairs like SOL-stablecoin. Since May 2025, proprietary AMMs have consistently accounted for over 60% of the SOL-stablecoin trading volume each month, and their share is even higher for trading between stablecoins.

Source: Blockworks Research

To understand this revolution, we must first clarify the definition of a proprietary AMM. Simply put, it's an on-chain market maker operated by a small team of professionals using their own funds, with no liquidity access available to ordinary users. This stands in stark contrast to traditional AMMs like Uniswap, which allow anyone to become a liquidity provider (LP) and earn fees, achieving "crowdsourced" liquidity. Proprietary AMMs, on the other hand, return market-making power to professional teams, prioritizing extreme efficiency and risk control. Their specific operating model features the following:

Invisible entrance: Most self-operated AMMs do not have a user-facing website entrance, and ordinary users cannot interact with them directly.

Algorithm confidentiality: Market-making algorithms and parameters are strictly confidential, and transparency is significantly lower than traditional AMMs.

Reliance on Aggregators: The way to obtain transaction orders is to directly connect to an aggregator (such as Jupiter), which will match the user's transaction request to the platform with the best quotation.

Comparison table of self-operated AMM and traditional AMM operating models

Note: A few self-operated AMMs (such as Lifinity) have opened user front-ends, but their liquidity is still mainly based on the team’s own funds, and transactions are still completed by routing to aggregators.

This business model is built on pure execution efficiency, not brand or community. Traditional DeFi projects must invest heavily in marketing and community building to attract users and liquidity. In contrast, self-operated AMMs convert all of their marketing budgets into offering users a slight price advantage during transactions, ultimately capturing a significant amount of trading volume. This also indirectly demonstrates that the DeFi market is maturing, with market participants becoming more like rational economic agents—following the principle of "best price wins"—rather than simply idealists who prioritize "decentralization."

Concept Analysis: Is it a "Dark Pool" or an "Active Market Maker"?

With the rise of proprietary AMMs, related terms like "Dark AMM" and "Proactive Market Maker (PMM)" have become increasingly common, making it crucial to clarify the differences between them. In reality, these three concepts are not mutually exclusive; rather, they differ in their definitions.

- Dark AMM: The core concept is information hiding. It describes a trading method that conceals order intent during the matching phase, aiming to reduce information leakage and price shocks.

- Proactive Market Makers: The core of Proactive Market Makers is active pricing. This refers to dynamically adjusting quotes through the use of oracles and proactive inventory management to achieve higher capital efficiency.

- Proprietary AMM: The core of the system lies in the ownership of funds and the operating entity. It defines a model in which the operating team uses its own funds to make markets.

Definition table of three AMM concepts

Once the definitions are clarified, it's easy to see that these three concepts aren't mutually exclusive, but rather describe different dimensions of the same financial entity. In fact, a typical proprietary AMM, in pursuit of ultimate efficiency and security, typically employs a "dark pool" trading model, and its pricing strategy (though not publicly disclosed) is likely proactive.

Therefore, while mainstream media sometimes use these terms interchangeably, the term "proprietary AMM" addresses the underlying logic and gets to the heart of the matter: who controls the funds and who bears the risk. Compared to the technical characteristics of "dark pool AMM" or "active market maker," "proprietary AMM" more accurately reveals the essence of this new force from the perspective of its business model and operating entity.

Efficiency Revolution: Why Solana Became the Ultimate Proving Ground

The rise of proprietary AMMs stems from their precise targeting of the core pain points of traditional AMMs. The passive design of traditional liquidity pools inevitably leads to high slippage when dealing with large transactions, and they are constantly plagued by impermanent loss and MEV attacks (such as sandwich attacks). Proprietary AMMs, however, address these challenges almost perfectly through the meticulous management of professional teams and proactive pricing strategies. They offer users narrower spreads, lower slippage, and more stable trading results. Especially for large-scale transactions, the experience is now close to that of top-tier centralized exchanges.

The realization of all this is inextricably linked to Solana's unique blockchain architecture. First, Solana's high throughput and extremely low transaction fees make this "active" model, which requires frequent quote updates, economically feasible. Second, the dominant position of aggregators (particularly Jupiter) in the Solana ecosystem creates a "one-stop distribution channel" for these market makers. Without having to build their own brands, websites, or user communities, they can focus all resources on their single core competency: execution and pricing. This extreme division of labor significantly simplifies their business model and reduces operating costs.

It can be said that the self-operated AMM is not simply a choice of Solana. It is itself a native market structure that coexists with Solana. It is a perfect example of the co-evolution between the high-performance architecture of the underlying public chain and the business model of the upper-level financial application.

The future: the wave of specialization and the specter of centralization

The rise of self-operated AMMs indicates that the on-chain market is developing in a more professional and polarized direction, and a clear "dual-track market" will gradually take shape.

- Mature asset markets: Highly liquid trading pairs such as SOL-stablecoin will increasingly be dominated by proprietary AMMs that can provide extreme spreads.

- Long-tail asset markets: For example, Meme coins, which have just been launched on the external market, will continue to rely on traditional permissionless AMMs such as Raydium for early price discovery and liquidity guidance.

This trend is a victory for efficiency and signals a profound professionalization of on-chain market making. The market structure is shifting from open crowdsourcing of liquidity to specialized market making by a small number of teams. This has significantly improved the efficiency and security of on-chain transaction execution, setting a new benchmark for the industry.

But on the other side of the coin is the resurfacing concern of the specter of centralization. While users enjoy improved execution quality, they also inadvertently make a trade-off and sacrifice: trading DeFi's core principles of transparency, permissionlessness, and decentralization for extreme efficiency. When the majority of order flow is directed to a small number of anonymous "black boxes," while transactions are still settled on-chain, the opacity of the process undoubtedly introduces new trust risks and undermines the auditability foundation on which DeFi is built.

From a broader perspective, the dominance of proprietary AMMs is reshaping and solidifying Solana's ecosystem positioning. It further reinforces Solana's image as the "Nasdaq of blockchains"—a platform tailored for high-performance, institutional-grade financial applications, prioritized by execution speed and capital efficiency. This gives Solana a differentiated advantage in the public blockchain race, making it the preferred platform for innovative protocols seeking to combine CEX-like performance with the core capabilities of DeFi.

Conclusion

The rapid rise of proprietary AMMs on Solana is no accident; it's a logical, even inevitable, evolution of the DeFi market in its pursuit of extreme capital efficiency. While it has sparked significant discussions about the future of decentralization, this proactive and efficient liquidity provision model has already taken the industry to new heights. Regardless of how the landscape ultimately evolves, this silent revolution has already written the prelude to the next chapter in on-chain finance.