Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Federal Reserve Governor Christopher Waller once again called for a rate cut, saying he would support a 25 basis point cut in September and expecting further rate cuts within the next three to six months. He may support a larger rate cut if the non-farm payroll data indicates "significant weakness" in the US economy. In his speech to the Miami Economic Club, Waller mentioned that with core inflation approaching 2% and the labor market facing risks, the FOMC should lower the policy rate. With the release of the core PCE index tonight, economists expect PCE inflation to grow by 2.9% year-on-year in July, the highest level so far this year, with some economists even predicting that the growth rate may jump to 3%. In addition, it is worth noting that the US stock market will be closed for one day on September 1st for the US Labor Day .

In the AI sector, Cambricon 's stock price soared over 15% on August 28th, closing above Kweichow Moutai's 1,446.10 yuan . Although Cambricon's stock price fell today, it has risen over 110% since August. On the evening of the 28th, Cambricon issued an emergency announcement stating that it has no plans to release new products and that recent online information regarding the company's new products is misleading and false. Nvidia's second-quarter revenue of $46.7 billion exceeded market expectations of $46.2 billion, and its third-quarter revenue guidance of $54 billion also exceeded expectations. Several Wall Street investment banks, including Bank of America Securities, Morgan Stanley, Citigroup, and Goldman Sachs, maintained their buy ratings on Nvidia and raised their target price to a range of $210-235. They believe investors should ignore short-term uncertainties in the Chinese market and focus on the company's core growth strategy. After the release of its earnings report, Nvidia 's stock price briefly rose to within $0.01 of its all-time high, but ultimately fell.

In the Bitcoin market, currently trading at $111,000, it is testing the critical support range of $107,000 to $108,900. According to Glassnode data, if Bitcoin falls below this range, it could fall further to $93,000 to $95,000. With increasing pressure from short-term holders, $113,600 could become a resistance level for a rebound. Although Bitcoin's current retracement is approximately 11.4%, significantly lower than the 25% to 75% retracements of historical bear market cycles, there are no signs of widespread panic selling in the overall market. CryptoQuant analyst burakkesmeci noted that if Bitcoin closes above the $109,000 to $112,000 range this week, the upward trend is expected to strengthen. In the short term, $117,300 represents resistance, while $92,400 acts as support. Analyst Pentoshi has no clear preference for Bitcoin's future trajectory, believing that if the price fails to rise quickly, it could fall below last week's low and quickly drop to the $105,000 to $107,000 range. Murphy Market Observer noted that Bitcoin found support after hitting the short-term average cost of holdings at $108,000. This rebound may represent a price recovery after bottoming out, with short-term expectations potentially reaching near previous highs. However, a break above the key resistance level of $115,000 remains to be seen. Bitcoin Vector analysis suggests that the current price is attempting to break through $113,000, but has encountered resistance at $113,600. A break above this level would strengthen bullish expectations. Furthermore, Man of Bitcoin analysis suggests that Bitcoin needs to remain above $110,985 to continue its upward trend.

Regarding Ethereum, Man of Bitcoin stated that the price of ETH has reached the 100% Fibonacci extension level of wave c in wave-(2), and a small five-wave rising structure needs to be observed to confirm the price low. If the price falls below $4,317, the structure will be invalidated. Another analyst, Jelle, pointed out that the weekly chart of Ethereum shows an "expanded trumpet pattern" with a target price of $10,000, and the current key resistance level is $5,000. If it breaks through this level, it is expected to trigger the liquidation of about $5 billion in short positions, further driving the price up. However, if it fails to break through $5,000, it may fall back to $3,500 or the lower support level of $3,000. Technical analyst Jackis believes that ETH has broken through the 4.5-year institutional accumulation range and started a new structural expansion cycle. The bullish trend will remain strong in the next few years, but it may face volatility and pullback pressure in the short term. In addition, the prices of ETH and BTC remain highly correlated, and it is necessary to pay attention to the linkage performance of the two. Analysts believe that if ETH can continue to break through the 2021 historical high of US$4,880, it will confirm the continuation of the upward trend.

Regarding market dynamics, analyst Ran Neuner observed that the Solana price chart and Bitcoin price charts showed a rare "golden cross" pattern. Historically, similar patterns have driven SOL/USD price increases of over 1,000%. Currently, SOL is trading at approximately $217.78, with technical targets pointing to the $295-$300 range. Institutions such as Galaxy Digital and Jump Crypto plan to raise over $3 billion for the Solana Fund, further bolstering market demand. Furthermore, SOL has broken through its 50- and 200-week exponential moving averages, with technical indicators suggesting continued upward momentum. Meanwhile, the Pyth Network announced it had been selected by the US Department of Commerce for the verification and distribution of on-chain economic data. Following the announcement, the price of the Pyth-related token doubled within 24 hours, reaching a high of $0.25. Meanwhile, the closely related Wormhole token, W, surged 40%, reaching a high of $0.1053. Despite recent sluggish on-chain market conditions, projects within the Believe ecosystem are showing signs of recovery, with LAUNCHCOIN surging 53% within 24 hours. It is worth noting that the pre-market trading price of $ XPL on Hyperliquid and Binance was $1.06 and $0.79, respectively. The price on Hyperliquid was nearly 30% higher than that on Binance, possibly due to a large amount of funds going long on Hyperliquiquid. Among them, the whale "silentraven" manipulated the XPL price on the Hyperliquiquid platform to make a profit of $38.77 million, and still went long with 1x leverage, with a total position of $31 million.

2. Key Data (as of 12:00 HKT, August 29)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin : $111,568 (+19.8% YTD), daily spot volume $34.188 billion

- Ethereum : $4,485.44 (+34.05% YTD), with a daily spot trading volume of $28.49 billion

- Fear of corruption index : 50 (neutral)

- Average gas : BTC: 1 sat/vB, ETH: 0.22 Gwei

- Market share : BTC 58.18%, ETH 14.19%

- Upbit 24-hour trading volume rankings : PYTH, CRO, SOL, XRP, TREE

- 24-hour BTC long-short ratio : 49.17%/50.83%

- Sector gainers and losers : PayFi fell 2.89%, RWA fell 1.67%

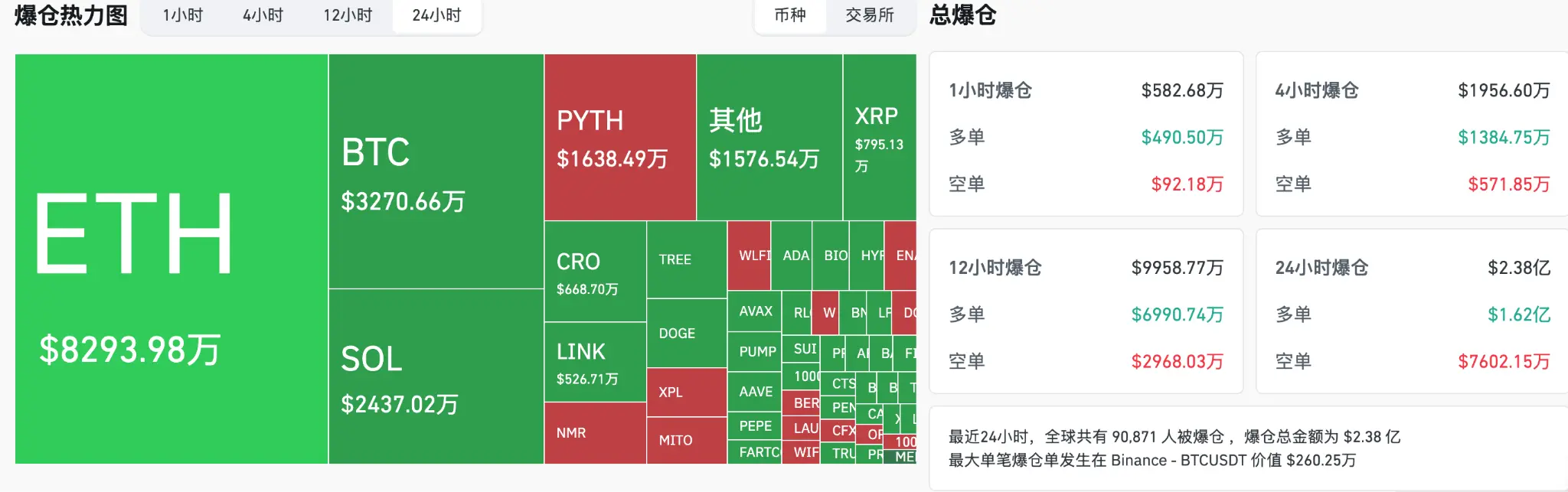

- 24-hour liquidation data : A total of 90,871 people were liquidated worldwide, with a total liquidation amount of US$238 million, including BTC liquidation of US$67.3982 million, ETH liquidation of US$97.20 million, and SOL liquidation of US$19.4186 million.

- BTC medium- and long-term trend channel : upper channel line ($114,815.70), lower channel line ($112,542.12)

- ETH medium- and long-term trend channel : upper line of the channel ($4514.96), lower line ($4425.56)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price is within the range or repeatedly passes through the cost range in the short term, it is in a bottoming or topping state.

3. ETF flows (as of August 28)

- Bitcoin ETF: +$179 million, 4 consecutive days of net inflows

- Ethereum ETF: +$39.1636 million, 6 consecutive days of net inflow

4. Today's Outlook

- Binance Alpha will list CeluvPlay (CELB) and Dexlab (XLAB) on August 29th.

- The U.S. stock market will be closed for one day on September 1st for Labor Day.

- US Core PCE Price Index Annual Rate in July: Previous value: 2.80%, forecast: 2.90% (August 29, 20:30)

- Final value of the University of Michigan Consumer Confidence Index for August: previous value 58.6, forecast value 58.6 (August 29, 22:30)

The biggest gains in the top 100 by market capitalization today: Pyth Network up 93.8%, Conflux up 8.4%, Four up 6.1%, Pump.fun up 6.1%, and Ethena up 5.7%.

5. Hot News

- Pyth Network Selected by the U.S. Department of Commerce for Validation and Distribution of On-Chain Economic Data

- Canadian firm Luxxfolio plans to raise $73 million to increase its Litecoin (LTC) holdings

- Whale "silentraven" currently holds $31 million in XPL long positions, with a floating profit of approximately $10 million.

- Guotai Junan International's share price surged over 20%, possibly due to the launch of its crypto trading service.

- Frax founder to serve as CTO of blockchain project Stable

- DeFi Development increased its holdings by approximately 410,000 SOL, bringing its total holdings to over 1.83 million SOL.

- The US government released the latest GDP data to Bitcoin, Ethereum, Solana, Tron, Stellar, Avalanche, Arbitrum, and Polygon.

- The number of initial jobless claims in the United States for the week ending August 23 was 229,000, while the expected number was 230,000.

- Strive Funds plans to purchase over $700 million in Bitcoin after its IPO

- Sandbox founder resigns and lays off 50% of staff, de-emphasizing Metaverse business and shifting to Web3 applications and Launchpad plans

- Linea will hold a TGE in September and launch native ETH earnings in October