Author: 0xjacobzhao

As AI becomes the fastest-growing technological wave globally, computing power is being viewed as the new "currency," and high-performance hardware like GPUs is gradually evolving into strategic assets. However, financing and liquidity for these assets have long been limited. At the same time, crypto finance urgently needs access to high-quality assets with real cash flows. The on-chain implementation of RWAs (Real-World Assets) is becoming a critical bridge between traditional finance and the crypto market. AI infrastructure assets, with their combination of high-value hardware and predictable cash flows, are widely considered the best entry point for non-standard RWAs. GPUs offer the most immediate potential for implementation, while robotics represents a longer-term exploration direction. Against this backdrop, GAIB's proposed RWAiFi (RWA + AI + DeFi) approach offers a novel solution for the on-chain financialization of AI infrastructure, driving the flywheel effect of "AI infrastructure (computing power and robotics) x RWA x DeFi."

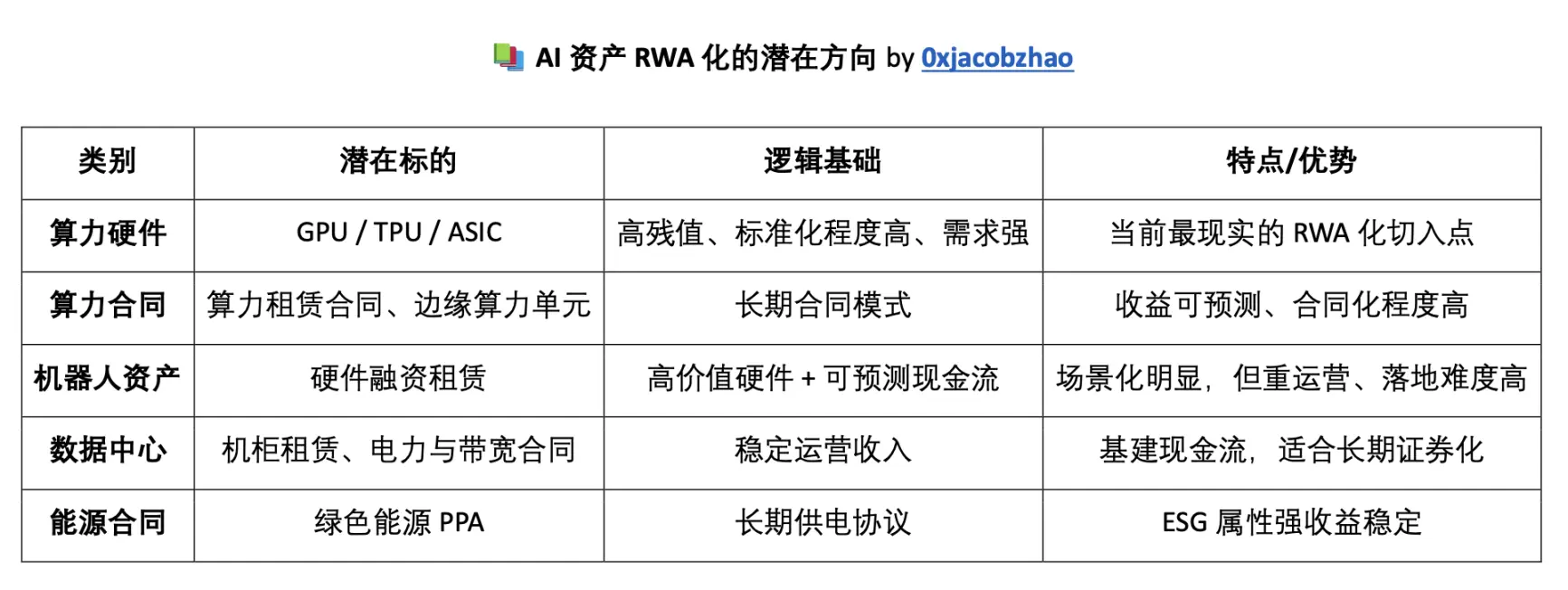

1. Outlook for the RWAization of AI Assets

In the discussion of RWA, the market generally believes that standard assets such as US Treasuries, US stocks, and gold will occupy a core position in the long term. These assets have deep liquidity, transparent valuations, and clear compliance paths, making them the natural carriers of the "risk-free rate" on the chain.

In contrast, the RWA transformation of non-standard assets faces greater uncertainty. While carbon credits, private lending, supply chain finance, real estate, and infrastructure possess substantial market scale, they are generally plagued by issues such as opaque valuations, difficulty in execution, lengthy cycles, and strong policy dependency. The real challenge lies not in tokenization itself, but in effectively regulating the execution of off-chain assets, particularly post-default disposal and recovery, which still rely heavily on due diligence, post-loan management, and liquidation.

Despite this, RWA still has positive significance: (1) The on-chain contracts and asset pool data are open and transparent, avoiding the "black box of the fund pool"; (2) The income structure is more diversified. In addition to interest, superimposed income can be achieved through Pendle PT/YT, token incentives and secondary market liquidity; (3) Investors usually hold securitized shares through the SPC structure rather than direct debt, which has a certain bankruptcy isolation effect.

Among AI computing power assets, GPUs and other computing hardware are widely considered the primary entry point for RWA due to their clear residual value, high standardization, and strong demand. Beyond the computing power layer, this can be further extended to computing power leases, whose contractual and predictable cash flow models make them suitable for securitization.

Following computing power assets, robotic hardware and service contracts also have the potential for RWA. Humanoid or specialized robots, as high-value equipment, can be mapped to the blockchain through financial leasing contracts; however, robotic assets are highly dependent on operations and maintenance, making their implementation significantly more difficult than GPUs.

Data center and energy contracts are also areas worth watching. Data center contracts, including cabinet leasing, power, and bandwidth contracts, offer relatively stable infrastructure cash flows. Energy contracts, exemplified by green energy PPAs, offer not only long-term returns but also ESG considerations, meeting the needs of institutional investors.

Generally speaking, the RWA transformation of AI assets can be categorized into several levels: in the short term, computing hardware like GPUs and computing power contracts will be at the core; in the medium term, this will expand to data center and energy contracts; and in the long term, robotics hardware and service contracts are expected to achieve breakthroughs in specific scenarios. While the common logic behind these strategies revolves around high-value hardware and predictable cash flow, the implementation paths differ.

2. The Priority Value of GPU Asset RWA

Among the many non-standard AI assets, GPU may be one of the more worthy areas for exploration:

- Standardization and clear residual values: Mainstream GPU models have clear market pricing and relatively clear residual values.

- Active secondary market: With re-circulation, partial recovery can still be achieved in the event of default;

- Real productivity attributes: GPU is directly linked to the needs of the AI industry and has the ability to generate cash flow.

- High narrative fit: Combining the dual market hotspots of AI and DeFi, it is easy to attract investors' attention.

Because AI computing data centers are a nascent industry, traditional banks often struggle to understand their operating models and, therefore, are unable to provide loan support. Only large companies like CoreWeave and Crusoe can access financing from large private lenders like Apollo, while small and medium-sized enterprises are often excluded. Therefore, financing channels serving SMEs are urgently needed.

It's important to note that GPU RWAs don't eliminate credit risk. Well-qualified businesses can typically obtain financing at lower costs through banks and don't necessarily need to go on-chain. However, those who choose tokenized financing are often small and medium-sized enterprises, which carry a higher risk of default. This leads to a structural paradox in RWAs: high-quality assets don't require on-chain access, while riskier borrowers are more likely to participate.

Despite this, GPUs' high demand, recoverability, and clear residual value make their risk-return profile more advantageous than traditional financial leasing. The significance of RWAs isn't to eliminate risk, but rather to make it more transparent, priceable, and liquid. As a representative example of non-standard asset RWAs, GPUs possess both industrial value and potential for exploration. However, their success ultimately depends on off-chain qualification review and execution capabilities, not simply on-chain design.

3. Frontier Exploration of RWA-Based Robotic Assets

Beyond AI hardware, the robotics industry is also gradually entering the RWA landscape. The market is projected to exceed $185 billion by 2030, demonstrating enormous growth potential. With the advent of Industry 4.0, a new era of intelligent automation and human-robot collaboration is accelerating. Over the next few years, robots will be widely deployed in factories, logistics, retail, and even homes. Through structured on-chain financing mechanisms, the deployment and adoption of intelligent robots will be accelerated, while creating an investment opportunity for ordinary users to participate in this industrial revolution. Viable paths include:

- Robot hardware financing: Provides funds for production and deployment, with returns coming from leasing, sales, or operating income under the Robot-as-a-Service (RaaS) model; cash flow is mapped to the chain through SPC structure and insurance coverage to reduce default and disposal risks.

- Financialization of data streams: Embedded AI models require large-scale real-world data, which can provide funding for sensor deployment and distributed collection networks. Data usage rights or authorization income can be tokenized, giving investors channels to share in the future value of data.

- Production and supply chain financing: The robotics industry chain is long, involving components, production capacity, and logistics. Trade financing can free up working capital and map future cargo and cash flows onto the supply chain.

Compared to GPU assets, robotics assets are more dependent on operations and application deployment, and cash flow fluctuations are more affected by utilization, maintenance costs, and regulatory constraints. Therefore, it is recommended to adopt a transaction structure with shorter maturities, higher overcollateralization, and higher reserves to ensure stable returns and liquidity security.

4. GAIB Protocol: The Economic Layer of Off-Chain AI Assets and On-Chain DeFi

The RWA-ization of AI assets is moving from concept to reality. GPUs have become the most viable on-chain asset, and robotics financing represents a longer-term growth path. To truly empower these assets with financial attributes, the key lies in building an economic layer that can handle off-chain financing, generate income certificates, and connect to DeFi liquidity.

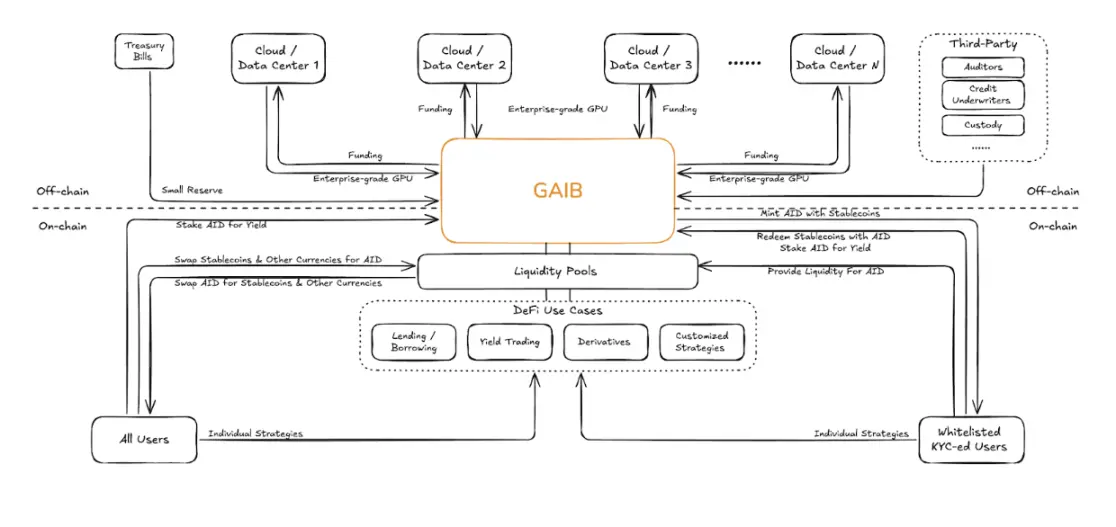

GAIB was born in this context. Rather than directly tokenizing AI hardware, it instead puts financing contracts collateralized by enterprise-grade GPUs or robots on-chain, building an economic bridge between off-chain cash flows and on-chain capital markets. Off-chain, enterprise-grade GPU clusters or robotic assets purchased and used by cloud service providers and data centers serve as collateral. On-chain, AIDs are used for stable pricing and liquidity management (non-interest-bearing, fully backed by T-Bills). sAIDs are used for revenue exposure and automatic accrual (underlying a financing portfolio + T-Bills).

GAIB's off-chain financing model

GAIB collaborates with global cloud service providers and data centers, using GPU clusters as collateral to design three types of financing agreements:

- Debt model: pays fixed interest (~10–20% annualized);

- Equity model: Share GPU or robot revenue (~60–80%+ annualized);

- Hybrid model: interest + income sharing.

GAIB's risk management mechanism is based on the overcollateralization and bankruptcy remoteness of physical GPUs. This ensures continued cash flow in the event of default through GPU liquidation or hosting in partner data centers. Due to the short payback period for enterprise-grade GPUs, overall maturities are significantly shorter than traditional debt products, with financing maturities typically ranging from 3–36 months. GAIB collaborates with third-party credit underwriters, auditors, and custodians to rigorously conduct due diligence and post-loan management, and uses government bond reserves as a supplemental liquidity guarantee.

On-chain mechanism

- Minting and Redemption: Through the contract, qualified users (whitelist + KYC) can mint AIDs with stablecoins, or redeem AIDs with stablecoins. Furthermore, non-KYC users can also obtain AIDs through secondary market transactions.

- Staking and Revenue: Users can stake AID as sAID, which automatically accumulates revenue and appreciates in value over time.

- Liquidity pool: GAIB will deploy AID liquidity pool in mainstream AMM, and users can exchange AID with stablecoins.

DeFi scenarios:

- Lending: AID can be connected to lending protocols to improve capital efficiency;

- Income trading: sAID can be split into PT/YT, supporting multiple risk-return strategies;

- Derivatives: AID and sAID serve as underlying income assets, supporting innovation in derivatives such as options and futures;

- Customized strategies: Connect to Vault and Yield Optimizer to achieve personalized asset allocation.

In short, GAIB's core logic is to transform off-chain real cash flows into on-chain composable assets through the financing and tokenization of GPUs, robotic assets, and government bond assets. This is then combined with AID/sAID and DeFi protocols to create a revenue, liquidity, and derivatives market. This design combines real-world asset support with on-chain financial innovation, building a scalable bridge between the AI economy and crypto finance.

5. Off-chain: GPU asset tokenization standards and risk management mechanisms

GAIB uses a Segregated Portfolio Company (SPC) structure to transform off-chain GPU financing agreements into tradable on-chain income certificates. Investors who deposit stablecoins receive an equivalent value in AI synthetic dollars (AID), which can be used to participate in the GAIB ecosystem. By staking and receiving sAID, investors can share in the profits from GAIB's GPU and robotics financing projects. As underlying repayments flow into the protocol, the value of sAID continues to grow. Investors can ultimately redeem their principal and earnings by burning tokens, achieving a one-to-one mapping between on-chain assets and real-world cash flow.

Tokenization standards and operation procedures:

GAIB requires assets to have a comprehensive collateral and guarantee mechanism. Financing agreements must include clauses such as monthly monitoring, overdue thresholds, and overcollateralization compliance. Underwriters are also required to have at least two years of lending experience and complete data disclosure. The process involves investors depositing stablecoins → a smart contract mints AID (non-interest-bearing, T-Bills reserve) → holders stake and receive sAID (yield-generating) → the pledged funds are used for GPU/robot financing agreements → SPC repayments flow into GAIB → the value of sAID increases over time → investors burn sAID to redeem principal and returns.

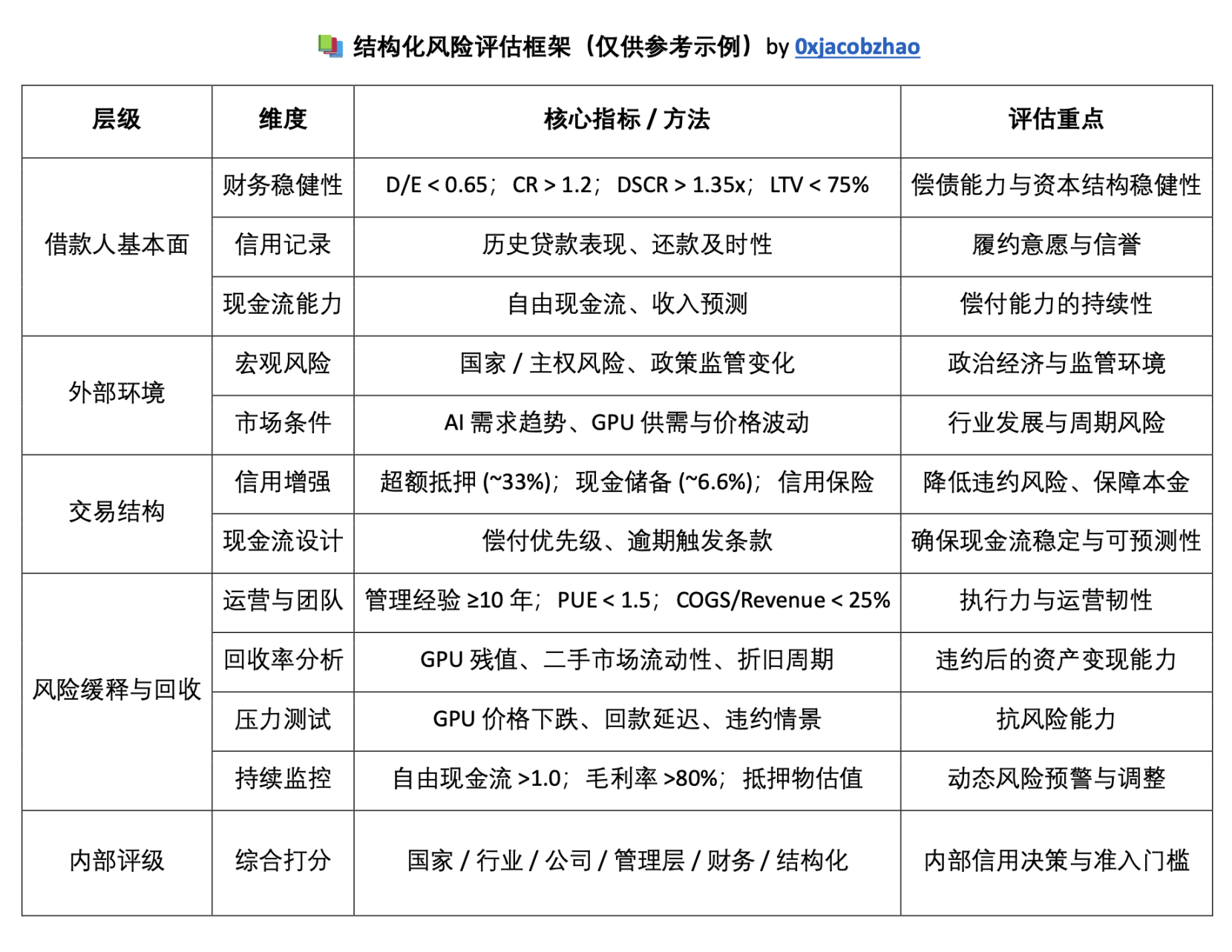

Risk management mechanism:

- Overcollateralization - Funding pool assets typically maintain an overcollateralization ratio of approximately 30%.

- Cash reserves – Approximately 5–7% of funds are set aside in a separate reserve account for interest payments and default buffers.

- Credit Insurance - Partially transfer the GPU Provider's default risk by cooperating with compliant insurance institutions.

- Default Resolution – In the event of a default, GAIB and the underwriters may choose to liquidate the GPUs, transfer them to other operators, or place them in custody to continue generating cash flow. The SPC's bankruptcy remote structure ensures the independence of each asset pool, preventing any collateral damage.

In addition, the GAIB Credit Committee is responsible for developing tokenization standards, credit assessment frameworks, and underwriting entry thresholds. It also conducts due diligence and post-loan monitoring based on a structured risk analysis framework (covering borrower fundamentals, external environment, transaction structure, and recovery rates) to ensure the security, transparency, and sustainability of transactions.

6. On-chain: AID synthetic USD, sAID income mechanism and Alpha deposit plan

GAIB Dual Currency Model: AID Synthetic USD and sAID Liquidity Income Certificate

GAIB's AID (AI Synthetic Dollar) is a synthetic dollar backed by U.S. Treasury reserves. Its supply is tied to the protocol's capital dynamics: AID is minted when funds flow into the protocol and destroyed when revenue is distributed or redeemed, ensuring its scale aligns with the value of the underlying assets. AID itself serves only as a stable currency and circulation tool and does not directly generate revenue.

To earn returns, users must convert staked AID into sAID. As a tradable income token, sAID's value gradually appreciates with protocol-level real-world returns (GPU/robot financing returns, US Treasury bond interest, etc.). Returns are reflected in the sAID/AID exchange rate. Users automatically accrue returns simply by holding sAID, without requiring any additional action. Upon redemption, users can recover their initial principal and accumulated rewards after a cool-down period.

From a functional perspective, AID provides stability and composability, and can be used for trading, lending, and liquidity provision; while sAID carries income attributes, which can not only directly increase value, but also further enter the DeFi protocol and be split into principal and income tokens (PT/YT), meeting the needs of investors with different risk preferences.

Overall, AID and sAID form the core dual-currency structure of the GAIB economic layer: AID ensures stable circulation, while sAID captures real returns. This design maintains the usability of synthetic stablecoins while providing users with an income entry point linked to the AI infrastructure economy.

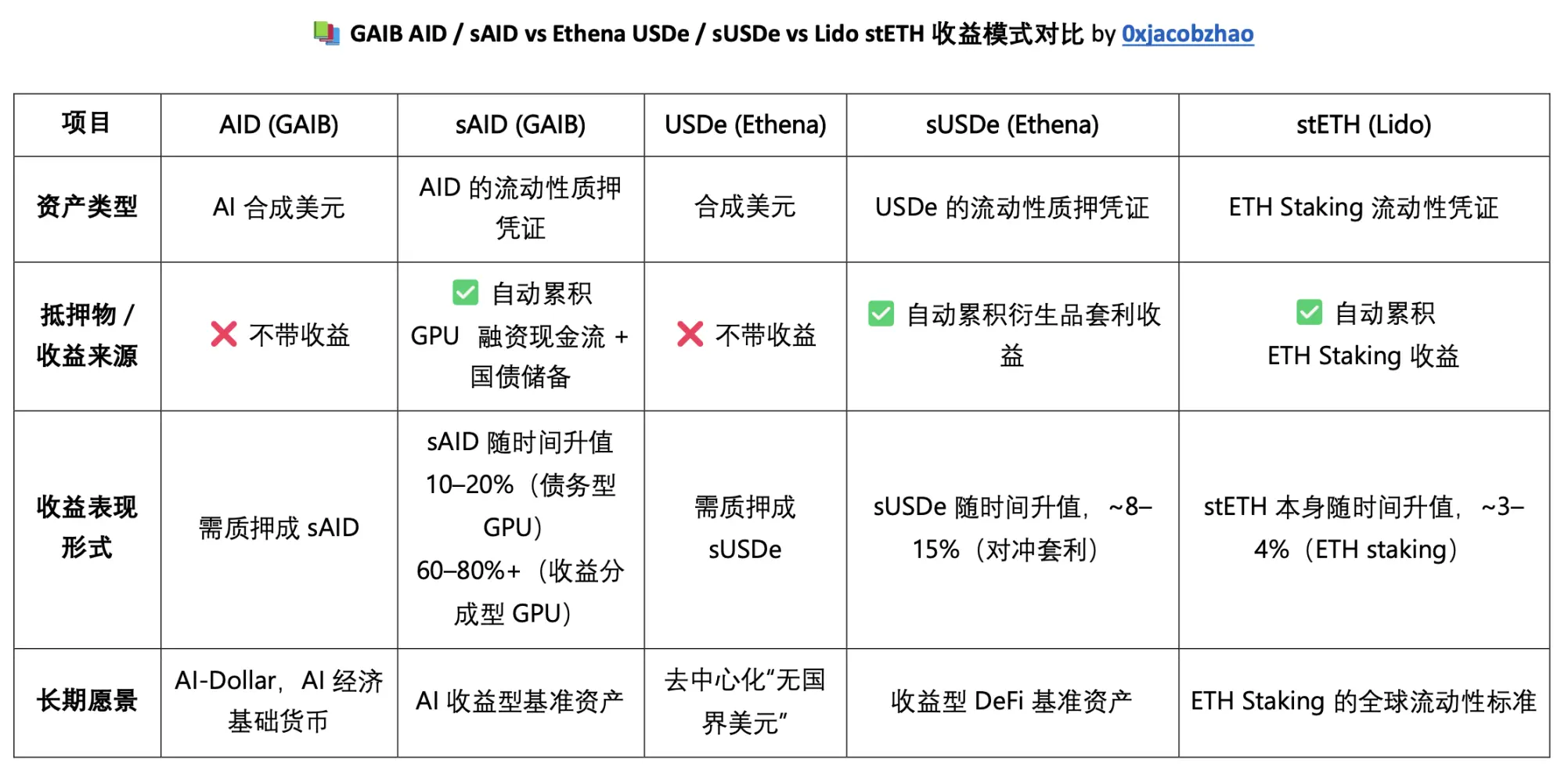

GAIB AID/sAID vs Ethena USDe/sUSDe vs Lido stETH Revenue Model Comparison

The relationship between AID and sAID can be compared to Ethena's USDe/sUSDe and Lido's ETH/stETH: the former, as a synthetic USD, does not generate income itself and only automatically accrues income after conversion to sTokens. The difference is that sAID's income comes from GPU financing contracts and US Treasury bonds, sUSDe's income comes from derivatives hedging, and stETH relies on ETH staking.

AID Alpha: Liquidity launch and points incentive mechanism before GAIB mainnet

AID Alpha officially launched on May 12, 2025, as an Early Deposit Program (EDP) for liquidity before the AID mainnet launch. It aims to guide protocol funding through early deposits while providing participants with additional rewards and gamified incentives. All deposits will initially be held in U.S. Treasury bonds (T-Bills) for security, and will subsequently be gradually allocated to GPU financing transactions, forming a transition path from low risk to high return.

On the technical level, the AID Alpha smart contract follows the ERC-4626 standard. For every dollar of stablecoin or synthetic stablecoin a user deposits, they will receive an AIDα receipt token (such as AIDaUSDC, AIDaUSDT) on the corresponding chain, ensuring cross-chain consistency and composability.

During the Final Spice phase, GAIB opened access to a diverse range of stablecoins, including USDC, USDT, USR, CUSDO, and USD1, through the AIDα mechanism. After users deposit stablecoins, they receive a corresponding AIDα receipt token (such as AIDaUSDC or AIDaUSD1). This token serves as a proof of deposit and is automatically credited toward the Spice points system, enabling further participation in DeFi platforms like Pendle and Curve.

As of now, the total deposit size of AIDα has reached the upper limit of $80M. The details of the AIDα asset pool are as follows:

All AIDα deposits are subject to a lock-up period of no more than two months. After the campaign ends, users can choose to exchange AIDα for mainnet AID and stake it as sAID to enjoy ongoing returns, or they can redeem the original assets directly while retaining their accumulated Spice points. Spice is a points system launched by GAIB during the AID Alpha phase to measure early participation and allocate future governance rights. The rule is "1 USD = 1 Spice/day," with multiple multipliers (e.g., 10x for deposits, 20x for Pendle YT, 30x for Resolv USR) added, up to 30x, creating a dual incentive of "revenue + points." Furthermore, a referral mechanism further amplifies returns (20% for the first level, 10% for the second level). After the Final Spice period, points will be locked for governance and reward distribution during the mainnet launch.

GAIB has also issued 3,000 limited-edition Fremen Essence NFTs as exclusive tokens for early supporters. A reserved number will be reserved for the first 200 large depositors, with additional slots allocated through a whitelist and those with deposits exceeding $1,500. NFTs can be minted for free (only gas fees are required), and holders will receive exclusive rewards upon mainnet launch, priority product testing, and core community membership. Currently, the NFT is priced at approximately 0.1 ETH on the secondary market, with cumulative trading volume reaching 98 ETH.

7. GAIB On-chain Funds and Off-chain Asset Transparency

GAIB maintains high standards for asset and protocol transparency. Users can track its on-chain asset categories (USDC, USDT, USR, CUSDO, USD1), cross-chain distribution (Ethereum, Sei, Arbitrum, Base, etc.), TVL trends and details in real time through the official website, DefiLlama and Dune. At the same time, the official website also discloses the allocation ratio of off-chain underlying assets, the amount of active deals, expected returns and pipeline projects (Selected Pipeline).

- GAIB official website: https://aid.gaib.ai/transparency

- Defillama: https://defillama.com/protocol/tvl/gaib

- Dune: https://dune.com/gaibofficial

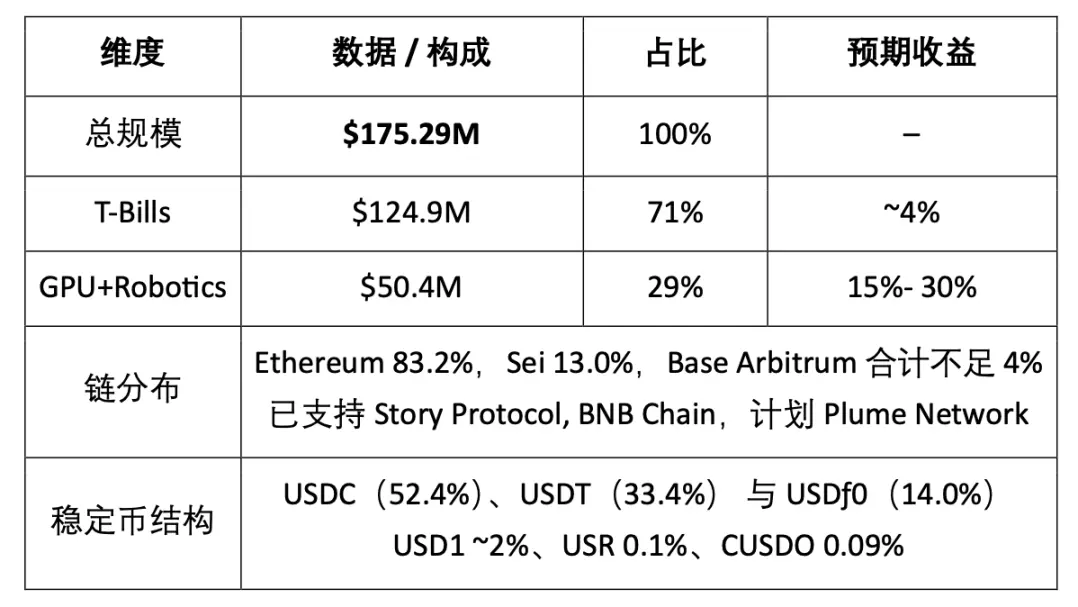

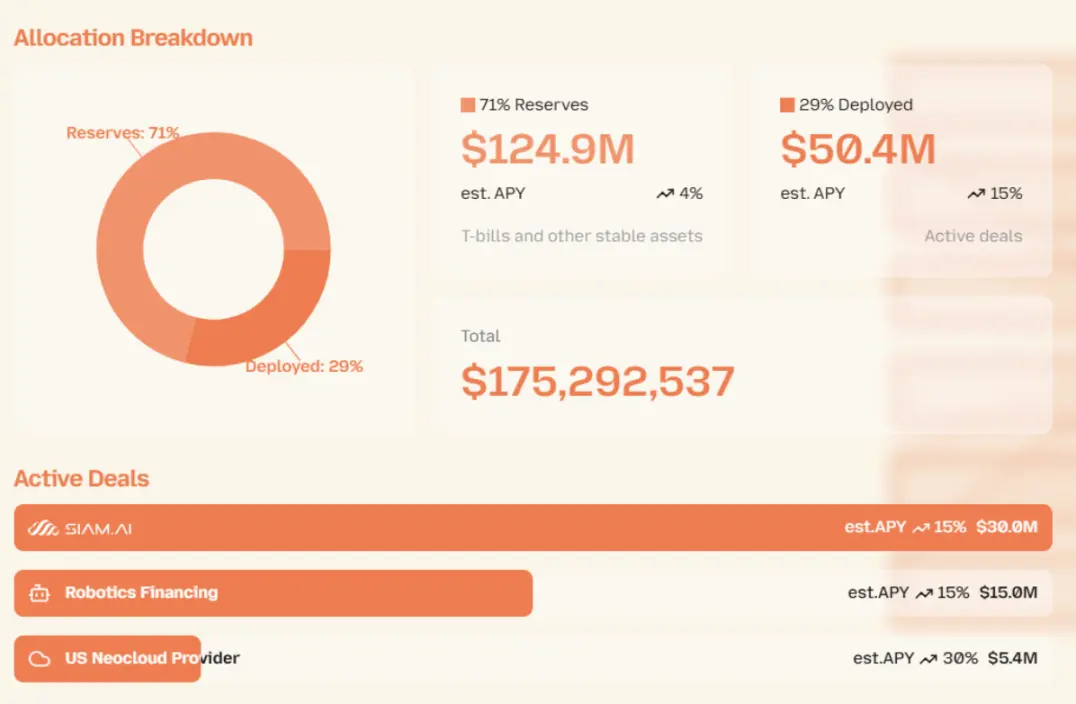

As of October 2025, GAIB's total assets under management are approximately $175.29M. Its "two-tier configuration" not only takes into account stability but also brings excess returns to AI Infra financing.

- Reserves account for 71%, approximately $124.9 million, primarily in U.S. Treasury bonds, with an expected annualized return of approximately 4%;

- Deployed assets account for 29%, approximately $50.4M, and are used for off-chain GPU and robot financing projects, with an average annualized return of approximately 15%.

Regarding on-chain funding distribution, according to the latest Dune data, Ethereum accounts for 83.2% of cross-chain funding, Sei accounts for 13.0%, and Base and Arbitrum together account for less than 4%. By asset structure, funding primarily comes from USDC (52.4%) and USDT (47.4%), with the remainder consisting of USD1 (~2%), USR (0.1%), and CUSDO (0.09%).

GAIB's off-chain asset allocation remains consistent with its investment projects and capital allocation, including Thailand's Siam.AI ($30M, 15% APY), two Robotics Financing projects (totaling $15M, 15% APY), and a US Neocloud Provider ($5.4M, 30% APY). GAIB has also established a project pipeline of approximately $725M, with a broader total project pipeline outlook of $2.5B+ over 1-2 years. These projects include GMI Cloud, Nvidia Cloud Partners in multiple regions ($200M and $300M in Asia, $60M in Europe, and $80M in the UAE), North American Neocloud Providers ($15M and $30M), and a robotics asset provider ($20M), laying a solid foundation for subsequent expansion and scaling.

8. Ecosystem: Computing Power, Robots, and DeFi

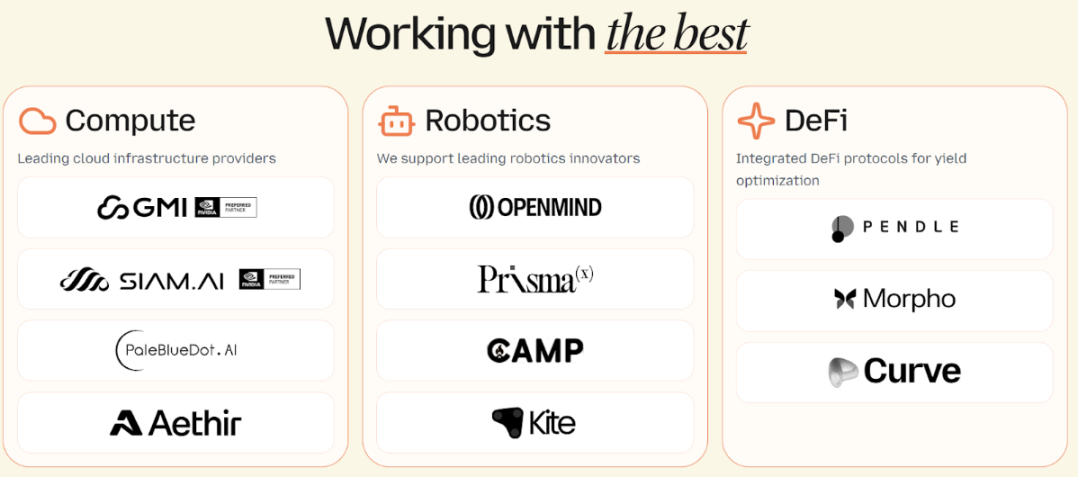

GAIB's ecosystem consists of three parts: GPU computing resources, robotics innovation enterprises, and DeFi protocol integration, aiming to form a complete closed loop of "real computing power assets → financialization → DeFi optimization".

GPU Computing Ecosystem Resources: On-chain Computing Assets

In the on-chain financing ecosystem of AI infrastructure, GAIB has cooperated with multiple computing power service providers, covering sovereign/enterprise-level clouds (GMI, Siam.AI) and decentralized networks (Aethir, PaleBlueDot.AI), which not only ensures the stability of computing power but also expands the narrative space of RWA.

- GMI Cloud: One of NVIDIA's six global Reference Platform Partners, it operates seven data centers across five countries and has raised approximately $95M in funding. It excels at low latency and its AI-native environment. Through its GAIB funding model, its GPU expansion boasts greater cross-regional flexibility.

- Siam.AI: Thailand's first sovereign-level NVIDIA Cloud Partner, delivering up to 35x performance improvements and 80% cost reductions in AI/ML and rendering scenarios. The company has completed a $30M GPU tokenization deal with GAIB, marking GAIB's first GPU RWA case and establishing its first-mover advantage in the Southeast Asian market.

- Aethir: A leading decentralized GPUaaS network with over 40,000 GPUs (including over 3,000 H100s). In early 2025, they completed the first GPU tokenization pilot on BNB Chain in collaboration with GAIB, raising $100,000 in funding in just 10 minutes. In the future, they will explore integrating AID/sAID with Aethir staking to generate dual benefits.

- PaleBlueDot.AI: An emerging decentralized GPU cloud whose participation strengthens GAIB’s DePIN narrative.

Robot Ecosystem: On-chain Financing of Embodied Intelligence

GAIB has officially entered the embodied AI market and is extending its GPU tokenization model to the robotics industry, building a dual-engine "Compute + Robotics" ecosystem. Core to this initiative are SPV collateralization and cash flow distribution. Through AID/sAID, GAIB bundles robotics and GPU revenue, achieving on-chain financialization of hardware and operations. GAIB has already secured a total of $15 million in robotics financing, with an expected annualized return of approximately 15%. Partners include OpenMind, PrismaX, CAMP, Kite, and SiamAI Robotics, encompassing multi-dimensional innovations in hardware, data flow, and supply chain.

- PrismaX: Positioned as a "robot-as-miner," PrismaX connects operators, robots, and data users through a teleoperation platform, generating high-value motion and visual data at a price of approximately $30-50 per hour. PrismaX has already demonstrated early commercialization through a $99 per session payment model. GAIB provides financing to expand its robot fleet, while data sales proceeds flow back to investors through AID/sAID, forming a financialization path centered on data collection.

- OpenMind: OpenMind uses its FABRIC network and OM1 operating system to provide identity authentication, trusted data sharing, and multimodal integration, representing the industry's equivalent of TCP/IP. GAIB assetizes these tasks and data contracts on the blockchain, providing capital support. The two parties combine to achieve a complementary "technical credibility + financial assetization" approach, enabling robotics assets to move from the laboratory stage to bankable, iterative, and verifiable scale.

Overall, GAIB is collaborating with PrismaX's data network, OpenMind's control system, and CAMP's infrastructure deployment to gradually build a complete ecosystem covering the robot hardware, operations, and data value chain, accelerating the industrialization and financialization of embodied intelligence.

DeFi Ecosystem: Protocol Integration and Yield Optimization

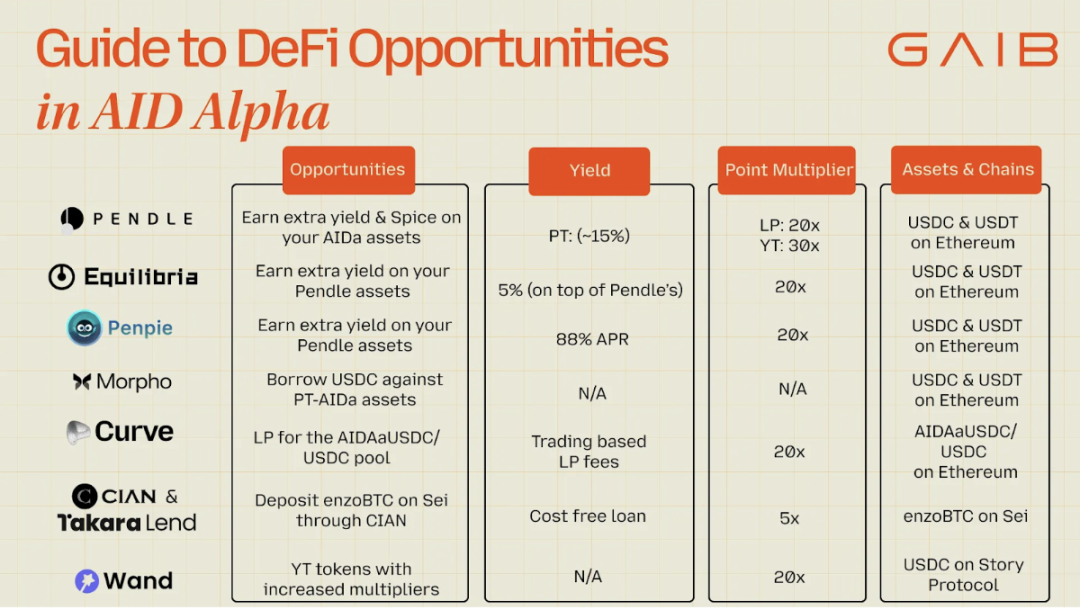

In the AID Alpha phase, GAIB deeply integrated AID/aAID assets with various DeFi protocols. Through revenue splitting, liquidity mining, mortgage lending, and revenue enhancement, it formed a cross-chain, diversified revenue optimization system, using Spice points as a unified incentive.

- Pendle: Users can split AIDaUSDC/USDT into PT (Principal Token) and YT (Yield Token). PT provides a fixed return of approximately 15%, while YT carries future returns and enjoys a 30x points bonus. LP liquidity providers can earn 20x points.

- Equilibria and Penpie: As Pendle's income enhancers, the former can increase the original income by an additional ~5%, and the latter can reach up to 88% APR. Both are superimposed with 20x points amplification.

- Morpho: Supports lending USDC using PT-AIDa as collateral, giving users the ability to access liquidity while maintaining their positions, and expanding into the mainstream Ethereum lending market.

- Curve: The AIDaUSDC/USDC liquidity pool can obtain transaction fee income and earn 20 times points at the same time, which is suitable for participants who prefer a conservative strategy.

- CIAN & Takara (Sei Chain): Users can pledge enzoBTC to Takara to borrow stablecoins, which will then be automatically injected into the GAIB strategy through the CIAN smart vault, realizing the combination of BTCfi and AI Yield, and enjoying a 5x points bonus.

- Wand (Story Protocol): On the Story chain, Wand provides a Pendle-like PT/YT split structure for AIDa assets. YT Tokens can earn 20 times the points, further strengthening the cross-chain composability of AI Yield.

Overall, GAIB's DeFi integration strategy covers public chains such as Ethereum, Arbitrum, Base, Sei and Story Protocol, BNB Chain and Plume Network. Through Pendle and its ecosystem enhancers (Equilibria, Penpie), lending market (Morpho), stablecoin DEX (Curve), BTCfi vault (CIAN + Takara), and the native AI narrative Wand protocol, it achieves full coverage from fixed income, leveraged income to cross-chain liquidity.

9. Team Background and Project Financing

The GAIB team brings together experts in AI, cloud computing, and DeFi. Core members have previously worked at institutions such as L2IV, Huobi, Goldman Sachs, Ava Labs, and Binance Labs. Graduates of Cornell University, the University of Pennsylvania, Nanyang Technological University, and the University of California, Los Angeles, these team members possess extensive experience in finance, engineering, and blockchain infrastructure. Together, they are building a solid foundation connecting real-world AI assets with on-chain financial innovation.

Kony Kwong, co-founder and CEO of GAIB, brings experience across traditional finance and crypto venture capital. He previously served as an investor at L2 Iterative Ventures and oversaw fund management and mergers and acquisitions at Huobi M&A. Earlier in his career, he worked at institutions such as CMB International, Goldman Sachs, and CITIC Securities. He graduated with First Class Honors in International Business and Finance from the University of Hong Kong and received a Master's degree in Computer Science from the University of Pennsylvania. Believing that AI infrastructure lacked financialization ("-fi"), he founded GAIB to transform real computing power assets like GPUs and robots into investable on-chain products.

Jun Liu is the co-founder and CTO of GAIB. With a background in both academic research and industry practice, he specializes in blockchain security, cryptoeconomics, and DeFi infrastructure. He previously served as Vice President at Sora Ventures and as a Technical Manager at Ava Labs, supporting the BD team and overseeing smart contract audits. He also led technical due diligence at Blizzard Fund. He holds a dual degree in Computer Science and Electrical Engineering from National Taiwan University and pursued a PhD in Computer Science at Cornell University, where he participated in IC3 blockchain research. His expertise lies in building secure and scalable decentralized financial architectures.

Alex Yeh is a co-founder and advisor of GAIB and founder and CEO of GMI Cloud. GMI Cloud is one of the world's leading AI-native cloud computing service providers and has been selected as one of six NVIDIA Reference Platform Partners. Alex has a background in semiconductors and AI cloud computing, having managed the Realtek family office and previously held positions at CDIB and IVC. At GAIB, he is primarily responsible for industry partnerships, integrating GMI's GPU infrastructure and customer network into the agreement and promoting the financialization of AI infrastructure assets.

In December 2024, GAIB completed a $5 million pre-seed funding round led by Hack VC, Faction, and Hashed, with participation from renowned institutions such as The Spartan Group, L2IV, CMCC Global, Animoca Brands, IVC, MH Ventures, Presto Labs, J17, IDG Blockchain, 280 Capital, Aethir, and NEAR Foundation, as well as numerous angel investors from the industry and crypto sectors. Subsequently, in July 2025, GAIB secured another $10 million in strategic investment, led by Amber Group and joined by several Asian investors. This funding will be primarily used to tokenize GPU assets, further enhance GAIB's infrastructure, expand its GPU financial products, deepen strategic collaborations with the AI and crypto ecosystems, and strengthen institutional participation in on-chain AI infrastructure.

10. Summary: Business Logic and Potential Risks

Business Logic: GAIB's core positioning is RWAiFi, which transforms AI infrastructure assets (GPUs, robots, etc.) into composable financial products through on-chain methods, forming a closed loop of "real assets → cash flow securitization → DeFi optimization." Its business logic is based on three points:

- On the asset side, GPUs and robots offer the combination of high-value hardware and predictable cash flow, meeting the fundamental requirements of RWA. GPUs, due to their standardization, clear residual value, and strong demand, are currently the most practical entry point. Robots represent a longer-term exploration direction, leveraging teleoperation, data collection, and RaaS models to gradually bring cash flow onto the blockchain.

- Funding: Through its dual-layer structure of AID (stable settlement, non-interest-bearing, T-Bills reserve) and sAID (income-generating fund token, underlying a financing portfolio + T-Bills), GAIB achieves a separation between stable circulation and yield capture. It also unlocks returns and liquidity through DeFi integrations such as PT/YT, lending, and LP liquidity.

- Ecosystem: Cooperate with sovereign-level GPU clouds such as GMI and Siam.AI, decentralized networks such as Aethir, and robotics companies such as PrismaX and OpenMind to establish an industrial network across hardware, data, and services, and promote the development of the "Compute + Robotics" dual engine.

In addition, GAIB uses the SPC (Segregated Portfolio Company) structure to convert off-chain financing agreements into on-chain income certificates. The core mechanisms include:

- Financing model: Debt (10–20% APY), revenue sharing (60–80%+), hybrid structure, short term (3–36 months), fast payback period.

- Credit and risk control: Security is ensured through overcollateralization (approximately 30%), cash reserves (5-7%), credit insurance, and default resolution (GPU liquidation/custodial operations); and an internal credit rating system is established in conjunction with third-party underwriting and due diligence.

- On-chain mechanism: AID minting/redemption and sAID income accumulation, combined with protocols such as Pendle, Morpho, Curve, CIAN, Wand, etc., to achieve cross-chain, multi-dimensional income optimization.

- Transparency: The official website, DefiLlama, and Dune provide real-time asset and fund flow tracking to ensure a clear correspondence between off-chain financing and on-chain assets.

Potential risks: GAIB and its related products (AID, sAID, AID Alpha, GPU Tokenization, etc.) are designed to enhance revenue visibility through on-chain transparency, but underlying risks still exist. Investors should fully assess their risk tolerance and participate with caution.

- Market and liquidity risks: GPU financing returns and digital asset prices are subject to market fluctuations, and returns are not guaranteed. The product has a lock-up period, and if the market environment deteriorates, investors may face the risk of insufficient liquidity or discounted exit.

- Credit and execution risk: GPU and robotics financing often involves small and medium-sized enterprises, which have a relatively higher probability of default. Asset recovery is highly dependent on off-chain execution. If the handling is not smooth, it will directly affect investors' repayments.

- Technical and security risks: Smart contract vulnerabilities, hacker attacks, oracle manipulation, or loss of private keys may all result in asset losses. Deep integration with third-party DeFi protocols (such as Pendle, Curve, etc.) can increase TVL growth, but also introduces security and liquidity risks of external protocols.

- Asset characteristics and operational risks: GPUs are standardized and have a residual value market, while robotic assets are highly non-standardized and their operations rely on utilization and maintenance. During cross-regional expansion, robotic assets are particularly vulnerable to regulatory differences and policy uncertainty.

- Compliance and Regulatory Risks: The computing power assets invested in by GAIB belong to new markets and asset classes, and are not covered by traditional financial licenses. This may raise regional regulatory issues, including restrictions on its business operations, asset issuance, and use.

- Disclaimer: This article was created with the assistance of the AI tool ChatGPT-5. While the author has made every effort to proofread and ensure the accuracy of the information, some omissions are inevitable and we apologize for any inaccuracies. It is important to note that divergences between project fundamentals and secondary market price performance are common in the cryptoasset market. This article is intended solely for information aggregation and academic/research exchange and does not constitute investment advice or a recommendation to buy or sell any token.