Original title: "SOL Guards' Crisis of Faith: Fundamentals Are Unbeatable, But Why Is the Price "Flat"?"

Original author: CryptoLeo, Odaily Planet Daily

Reference link: Grayscale report

As a loyal SOL guard, I have lost some confidence in SOL now.

Judging from token prices, this cycle may not be over yet. However, among the top tokens by market capitalization, BTC, ETH, BNB, and even XRP all hit all-time highs in the second half of 2025. However, SOL has not broken through its previous high since hitting $295 in January (even though there was a months-long Solana meme coin craze).

Why hasn't Solana's value risen yet? It could be due to the token's inflation mechanism, the shift in meme enthusiasm to other networks, or liquidity issues and the pessimism of whales. Another point worth noting is that Solana seems to always be a step behind others in catching up.

Some time ago, Grayscale released a Solana report titled "Solana: Crypto's Financial Bazaar." The report analyzed Solana's technical aspects, network ecology, total token supply and value, and other data indicators, which provided some confidence to the "SOL Guards." Odaily Planet Daily summarized the key points of the report as follows:

Solana Fundamentals: Technology, On-Chain Activity, and Transaction Volume

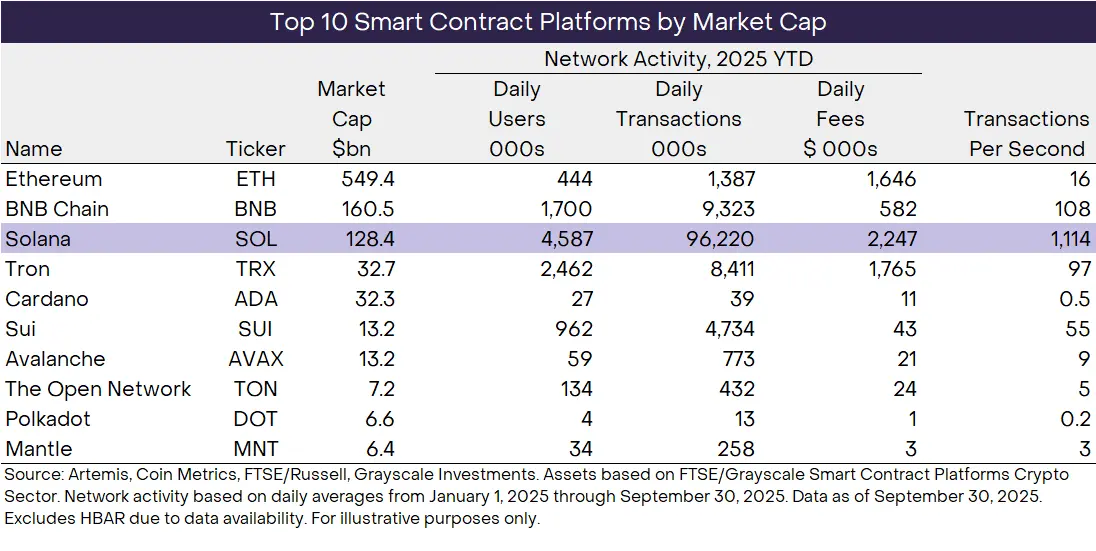

According to the report, Solana's depth and diversity of on-chain activity significantly outperform other networks, including Ethereum, BNB Chain, Tron, Cardano, and Sui. Leading in users, transaction volume, and transaction fees, the Solana network boasts more users and economic activity, which equates to a higher network value.

On-chain data and transaction volume

As shown in the figure below, SOL's market capitalization ranks third, but its daily active users, daily transaction volume, daily transaction fees, and transactions per second all rank first among similar blockchains.

Ecological applications and network income

The Solana network also hosts many industry-leading applications, such as:

1. Raydium DEX, a core component of Solana's DeFi infrastructure. Year-to-date, Solana DEX has surpassed $1.2 trillion in trading volume, exceeding any other blockchain ecosystem. Furthermore, Solana's leading DEX aggregator, Jupiter, is the largest aggregator by trading volume in the cryptocurrency industry.

2. pump.fun, a long-standing token issuance platform, has approximately 2 million monthly active users and daily revenue of approximately $1.2 million.

3. Helium is a DePIN project focused on mobile hotspots. Helium allows users to contribute network capacity, thereby building a nationwide network of mobile access points. These services are generally cheaper than centralized alternatives. Helium currently has 1.5 million daily active users, 112,000 hotspots, and partnerships with major telecom companies such as AT&T and Telefónica.

These applications represent only a small fraction of Solana's 500+ applications. Furthermore, as a blockchain with nearly every feature of other major networks, Solana ranks third in NFT trading, fifth in stablecoin trading volume, and seventh in tokenized assets. Other recent use cases include Pokémon collectible card trading and the on-chain issuance of tokenized stocks.

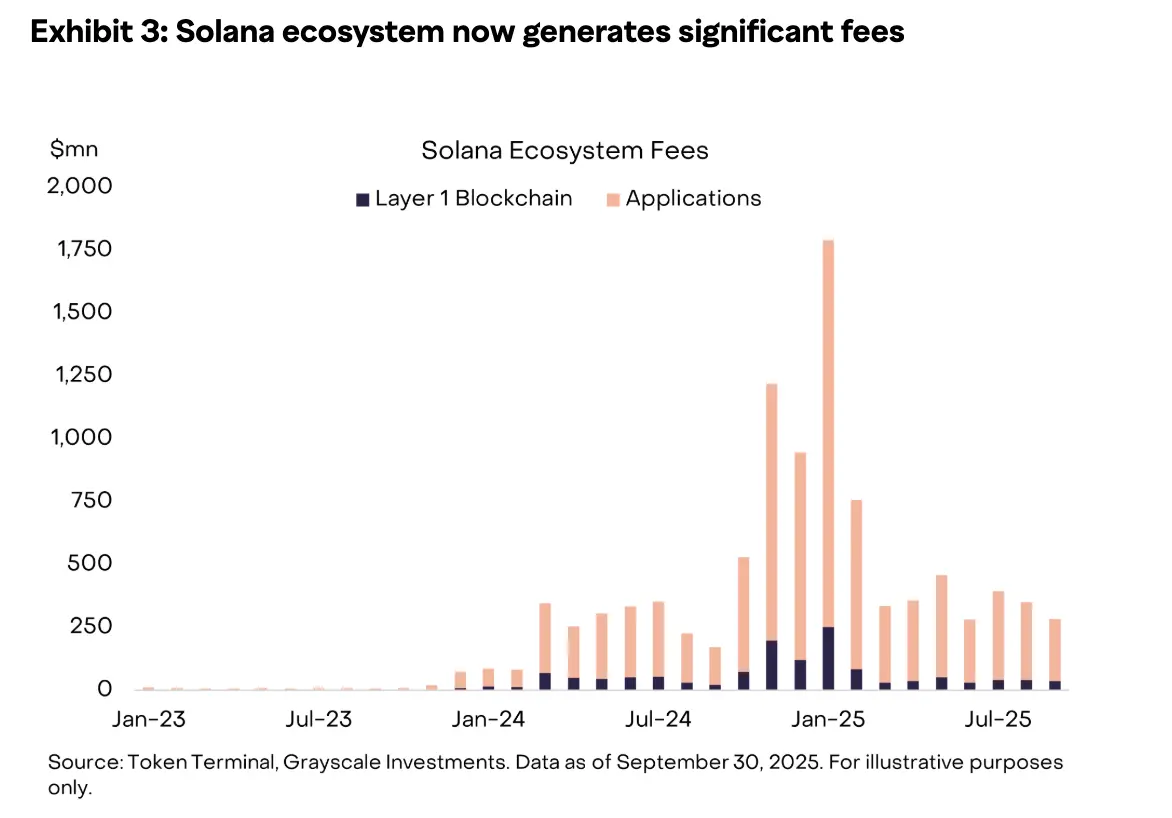

Measuring the Solana ecosystem requires considering both the economic activity of the blockchain itself and the applications it hosts. While these figures will fluctuate over time, the Solana ecosystem generates approximately $425 million in fees per month and over $5 billion in annual revenue. Grayscale believes fees are the most direct indicator of the aggregate demand for a blockchain and its applications, and these figures demonstrate significant demand for Solana.

Solana’s advantage: second only to Ethereum in terms of developer scale, and applicable to all users

Universal technological advantages

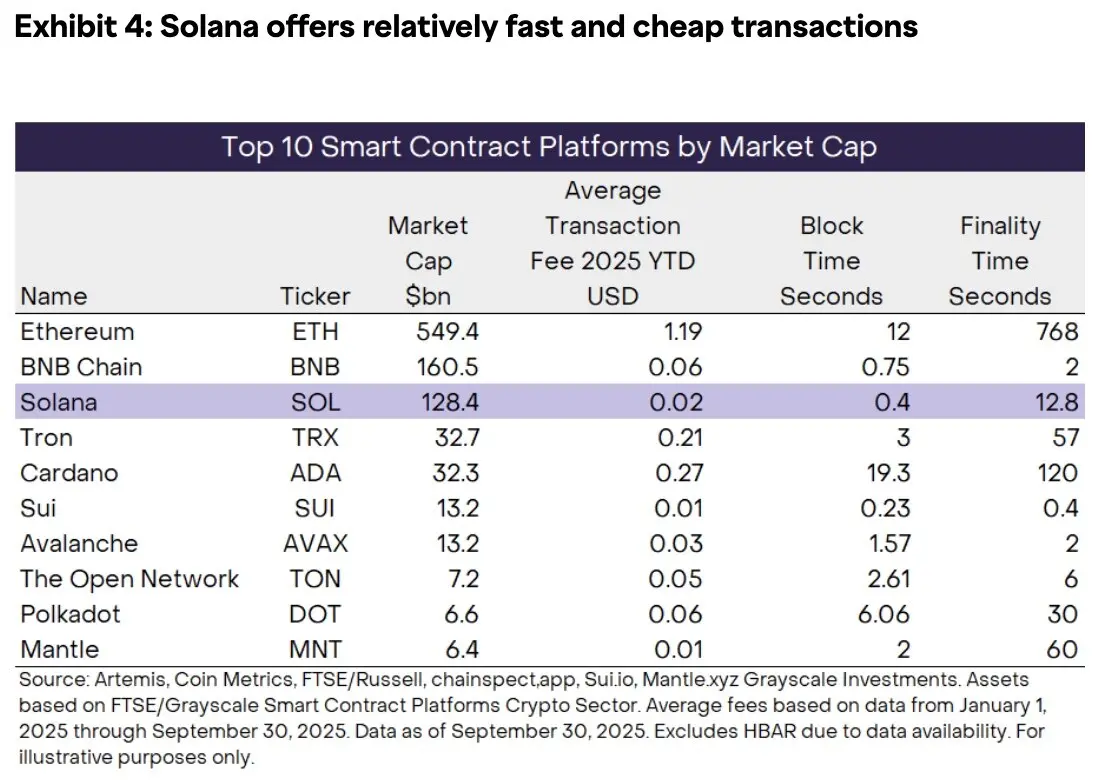

In addition to fundamental analysis, Grayscale also mentioned that the reason why SOL has good data is that it provides fast, cheap transactions and a seamless user experience. The network generates a new block every 400 milliseconds, and transactions can be finally confirmed in about 12-13 seconds. In addition to high throughput, transaction costs have also remained at a relatively low level:

Solana uses "local fee markets" technology, which limits fee competition to specific applications. So far this year, users have paid an average transaction fee of just $0.02. Partly due to this feature, the median daily transaction fee has been just $0.001 this year. Solana's transaction speed and cost-effectiveness are faster and cheaper than comparable blockchains. Solana's upcoming upgrade, Alpenglow, is expected to reduce final confirmation times to 100-150 milliseconds.

Solana's user experience is primarily due to its monolithic (single blockchain) design (rather than a layered design, which avoids the need to bridge assets between network components) and its wallet infrastructure, which is led by Phantom. Furthermore, Solana's network failure rate has been significantly lower than the industry average in recent years, which has also provided a foundation for user adoption.

Furthermore, Solana smart contracts do not rely on the Ethereum Virtual Machine (the system used by Ethereum and many other smart contract platforms, including BNB Chain, Polygon, and Avalanche). Instead, they utilize the unique architecture of the Solana Virtual Machine (SVM). Applications built on the SVM cannot be easily transferred to non-SVM blockchains, which leads to a stable user stickiness.

Second only to Ethereum in the number of developers

Currently, there are over 1,000 full-time developers working on applications for Solana and the SVM, and over the past two years, the number of developers dedicated to Solana has grown faster than any other smart contract platform (see chart below), second only to Ethereum. This human capital can contribute to Solana's continued innovation over time.

The long-term store of value of the SOL token (inflation, token performance, and competitor competition)

As we all know, due to the collapse of FTX, the price of the SOL token fell from a peak of nearly $260 in November 2021 to only $2 in December 2022. After the bankruptcy of FTX, many retail investors were uncertain about the future of Solana, although there were still a large number of SVM developers staying in Solana at that time.

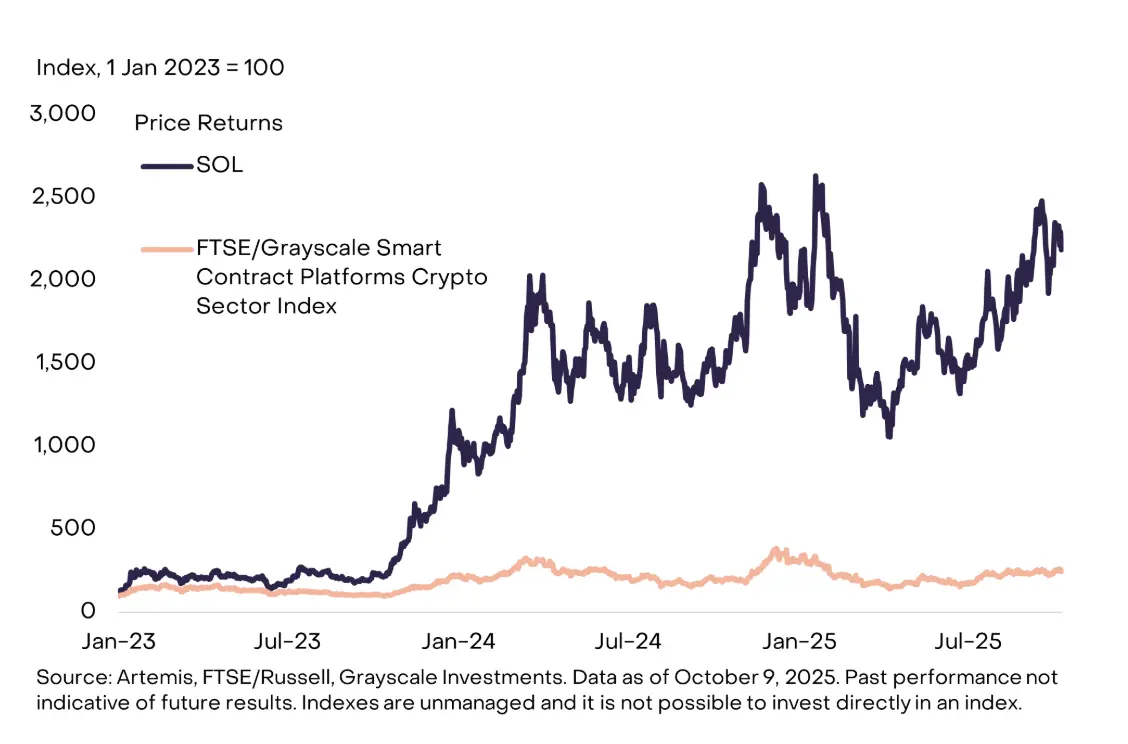

But starting at the end of 2023, the SOL token began to recover, significantly outperforming the FTSE/Grayscale Smart Contract Platform Cryptocurrency Industry Index.

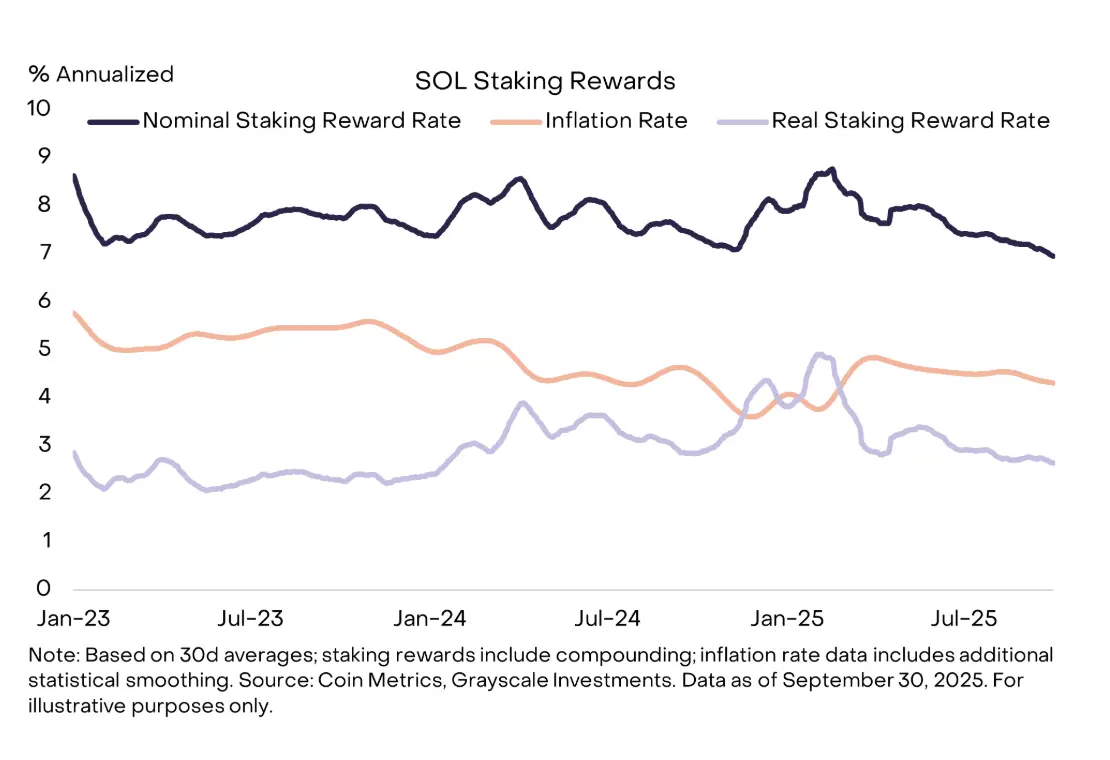

Currently, the supply of SOL tokens is growing at a rate of approximately 4% to 4.5% per year, which, all else being equal, could be considered a dilution of value for token holders. Depending on network conditions, SOL stakers can earn a nominal return of approximately 7%, but after adjusting for inflation, their "real" return is approximately 2.5% to 3%. Currently, approximately two-thirds of the outstanding SOL tokens are staked.

Grayscale states that SOL provides utility within the Solana network and may earn additional corresponding financial returns, but its value is tied to network size. Like other smart contract platform tokens, the investment thesis for the SOL token centers on the potential growth of the Solana network. Like other assets, the SOL token price doesn't always move in tandem with changes in network fundamentals. However, if the Solana network grows over time—acquiring more users, processing more transactions, and earning more fees—investors can expect the SOL price to increase.

Grayscale believes that Solana's vision is to be a "fast, low-cost blockchain open to everyone." However, its specific design leaves room for competitors to seize or retain market share in certain use cases.

For example, other blockchains sometimes offer faster and/or cheaper transactions by operating more centralized networks (e.g., using only a small number of active network nodes). Users may favor this convenience, even though centralization may introduce risks. Other blockchains may compete with Solana by keeping their networks permissioned (i.e., allowing only approved users and/or approved activities).

On the other hand, the Solana token may be less suitable as a long-term "store of value" monetary asset than Bitcoin or Ethereum. This partly reflects Solana's higher nominal supply inflation: scarcity is a key characteristic of any long-term store of value. But a more important factor may be the network's resilience to third-party interference. For a digital asset to serve as a long-term store of value, users need to be confident that they will be able to transact in virtually all future circumstances. One way to support this outcome is to keep node requirements low, so that the network remains highly decentralized and easily replicable. Solana's efficiency comes at the cost of relatively high hardware and bandwidth requirements, resulting in many network nodes running in data centers. In theory, this could become a source of centralization over time and a vector for third-party interference with the network.

Of course, these are complex and unresolved issues, and investor perceptions of crypto assets as a long-term store of value may change over time.

Conclusion

Finally, Grayscale believes that the three most important metrics for measuring on-chain activity are users, transaction volume, and transaction fees, and that Solana is currently the leading network in terms of on-chain activity. While the Solana network faces many formidable competitors, the depth and diversity of Solana's on-chain economy provide a solid foundation for SOL's valuation, a prerequisite for its further growth.

Solana boasts robust network performance, a massive user base, leading transaction volume and fees, and has experienced a resurgence, dominating the meme craze. Furthermore, Solana is backed by a massive SOL treasury. Aside from its inflation mechanism, SOL appears to have no significant blemishes that could significantly impact its value. Despite being a "cool protagonist" in a thriller, it's yet to reach new highs. At the time of this article, the SOL token price had fallen back to $185, leaving the SOL defenders practically helpless.