1.Why is short selling not cost-effective?

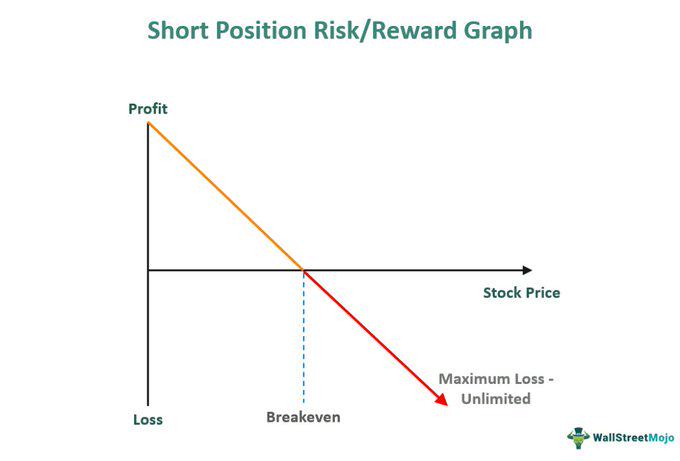

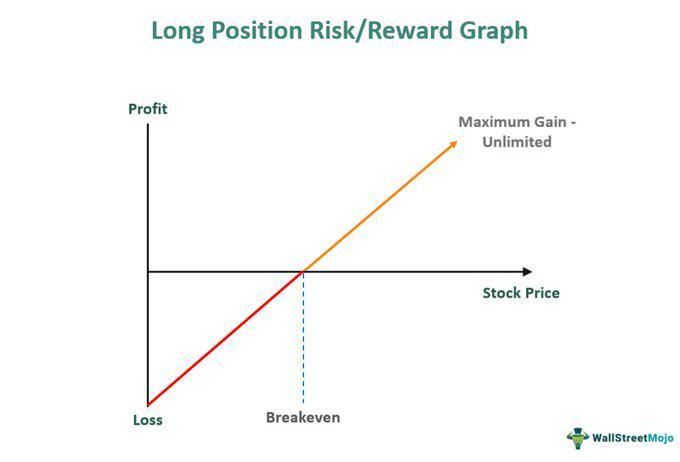

Theoretically, short selling can only earn you 100% at most, but you may lose a lot.

The maximum loss when going long is 1 times, but the profit may be infinite.

Although some people argue that since all altcoins in the cryptocurrency circle have strong gravity (team shipments), short selling is not as bad as imagined.

However, I still rarely go short (except for hedging), and the deeper reason is:

Short selling will make people become twisted and start to hate this industry (seeing the dark side will only deepen the hatred)

Once hatred takes over (it will definitely happen), and once faith is lost, one day one will definitely start to try empty promises, but the consequences, as you know, will be terrible.

What you need to know:

Humanity will always print money√

Bitcoin Eternal Bull Market√

--------Dividing line--------

2. How much profit doesthe $Luna short position make?

For 22 years, I have been criticizing the Luna scam on Twitter every day, to the point that there was a period of time when Luna's brainless fans chased me and insulted me every day, so I have a say.

$Luna crash, in essence:

Luna Bulls’ Fortune

↓Moved to↓

Luna short + CEX.

After all, it was once one of the top 10 projects in terms of market value, and there were many such wealth transfers, so the Air Force made a lot of money.

But you can't just watch the thief eat the meat and not watch the thief get beaten.

When Luna rose from 0.3 USD to 120 USD, countless short sellers’ money had already flowed into the long sellers’ pockets, so short selling was still not worth it.

It was one of the few times I opened a short position. I did not short Luna, but short $UST (Luna's stablecoin).

I still think this is a great decision. As UST is a stable currency, I started shorting it at around 0.9. Theoretically, I could lose less than 10% and earn 90% by profit.

However, this short-selling opportunity only occurs once every few years.

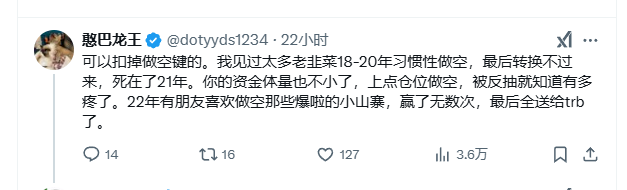

Moreover, every once in a while you will encounter stocks like $TRB , which will go through a nuclear explosion and pull up (no fundamentals, but $10→$550 in a few months). Even if you have a god-level margin, all your air force's ammunition will be cleared out in an instant.

Refer to what @dotyyds1234 said

So the conclusion is:

Don’t habitually go short (except for hedging)

Some money is better not to make

Bears would rather rest