Whether it’s PAX Gold and Tether Gold, whose market capitalizations have hit record highs, or stock tokens that have been launched on major platforms, real-world assets (RWA) seem to be moving onto the chain at an unprecedented speed.

In particular, TradFi institutions have begun to place bets. From the growing gold token and US stock token markets, to the trillion-level predictions of financial giants such as BlackRock and Citi, to Nasdaq's entry into the market, RWA is not only the next important narrative of DeFi, but is also likely to become a historic shuttle for Crypto to connect to the real world.

For this reason, before discussing this trend, we should perhaps go back to the starting point and answer a fundamental question:

Why do Web3 and Crypto need RWA so urgently?

01. DeFi’s historical inevitability of breaking through the dimensional wall

Since Compound/Uniswap ignited the DeFi summer in 2020, the entire Crypto world has ushered in rapid development, and the types and volumes of on-chain assets have achieved rapid cold start and exponential expansion in the native asset cycle.

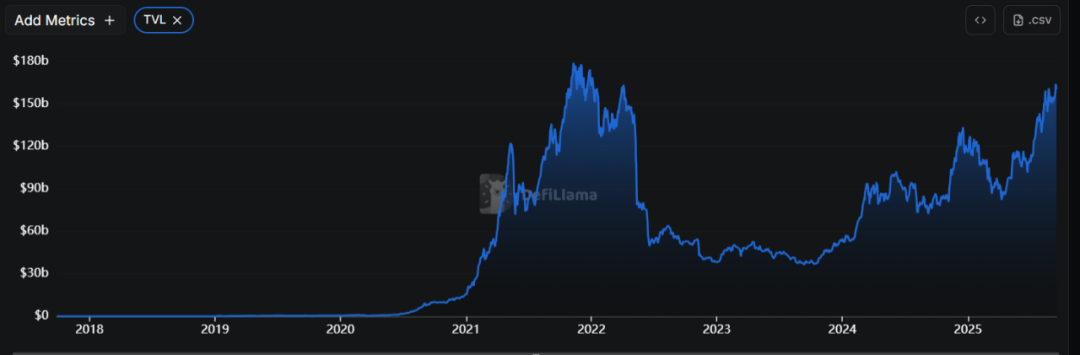

DeFiLlama statistics show that as of the time of writing, the total locked value (TVL) of DeFi across the entire network exceeded US$160 billion, close to the historical peak level of around US$178 billion in November 2022.

Source: DeFiLlama

Within this trillion-dollar empire, lending and staking protocols like Aave, MakerDAO, and Lido not only contribute a significant portion of funding but also serve as the critical infrastructure upon which countless DeFi protocols rely. It can be said that the vast majority of today's decentralized trading and derivatives protocols are built on the credit system of these underlying lending protocols.

In the early stages of DeFi development, the "internal circulation" between native assets was undoubtedly an ingenious design. It not only solved the seed funding needs of the ecosystem's cold start, but also greatly stimulated various borderless innovations in the crypto world to improve capital efficiency. However, the limitations of this "internal circulation" model are also becoming increasingly prominent:

- First, there is the homogeneity of assets. Collateral is highly concentrated in a few mainstream crypto assets, which leads to high systemic risk. Once the prices of core assets fluctuate sharply, it is very easy to trigger chain liquidations.

- Secondly, there is the limitation of growth ceiling. The scale of DeFi is always limited by the total market capitalization and volatility of the native crypto market, making it difficult to break through its own dimensional wall.

In other words, relying solely on the internal circulation of native assets, DeFi can no longer break through the ceiling. To introduce a more stable value anchor, DeFi must look outward and turn its attention to real-world assets.

It is against this backdrop that the RWA (Real World Assets) narrative emerged. RWA, short for "real world assets on-chain," aims to tokenize real-world assets like real estate, US Treasury bonds, consumer credit, US stocks, and art onto the blockchain, unlocking liquidity and improving transaction efficiency.

Objectively speaking, the current DeFi and Web3 markets still have a large gap compared to the size of traditional financial markets, but the emergence of RWA (Real World Assets) tokenization has brought new hope for Web3 to enter the next trillion-dollar market.

This is also the only way for DeFi to move from "internal circulation" to "external circulation" and from native prosperity to mainstream adoption.

02. Burning Oil: RWA Practice from Gold to US Stocks

Now that we have figured out the necessity of RWA, let’s take a look at the current market situation - the current RWA market is showing a booming trend, and the most mature and typical representative is tokenized gold.

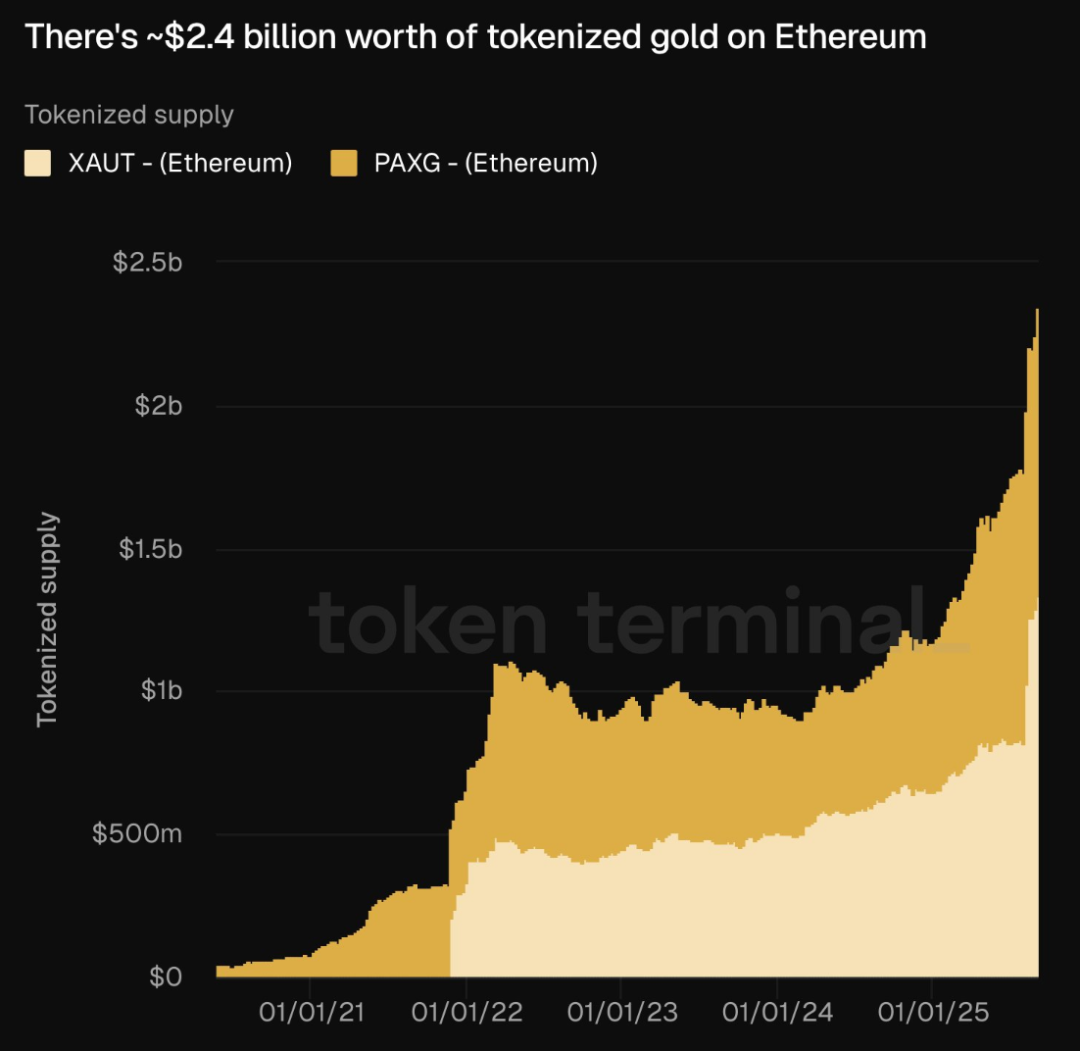

According to Token Terminal data, there is currently about $2.4 billion worth of tokenized gold (including XAUT and PAXG) on Ethereum. So far this year, the supply of tokenized gold has increased by about 100%, which not only reflects users' demand for on-chain safe-haven assets, but also proves the feasibility of the RWA model.

Source: Token Terminal

What is more noteworthy is that traditional financial authorities have also begun to accelerate the layout of RWA tokenization.

According to the Financial Times, the World Gold Council (WGC) is actively seeking to launch an officially recognized digital form of gold. "We are trying to establish a standardized digital layer for gold so that various financial products used in other markets can be applied to the gold market in the future." This move may completely change London's $900 billion physical gold market.

Of course, objectively speaking, compared with the gold ETF market of up to US$231 billion, or even the total market value of physical gold estimated at US$27.4 trillion, tokenized gold is indeed just getting started, but precisely because of this, its future growth potential is immeasurable.

Furthermore, tokenizing mainstream financial assets like U.S. Treasury bonds and stocks is becoming a hot topic in the RWA space. Leading projects, such as Ondo Finance, have successfully brought the returns of short-term U.S. Treasury bonds onto the blockchain, providing crypto users with a compliant and stable source of income.

Tokenized U.S. stocks have become a hot commodity recently, providing global users with a 24/7 accessibility channel to participate in the value growth of the world's top companies. From Ondo Finance to Robinhood to MyStonks, more and more institutions are moving popular stocks such as Apple and Tesla onto the chain, injecting a richer range of asset types into the DeFi ecosystem.

Currently, mainstream Web3 wallets have also begun to integrate tokenized RWA assets such as US stocks and gold. Taking imToken as an example, it now supports holding and managing stock tokens provided by Ondo Finance, such as Apple (AAPL) and Tesla (TSLA). The value of the tokens is anchored to their underlying assets and is co-managed by top financial institutions such as JP Morgan to ensure the compliance and security of the assets.

Whether it is the popular gold token or the stock token that is ready to go, RWA is no longer a fringe experiment, but a mainstream narrative that has moved from behind the scenes to the front stage.

03. RWA, Crypto’s historic shuttle

From a data perspective alone, the RWA narrative is definitely the clearest Alpha direction for "Blockchain+" in the next 10 years.

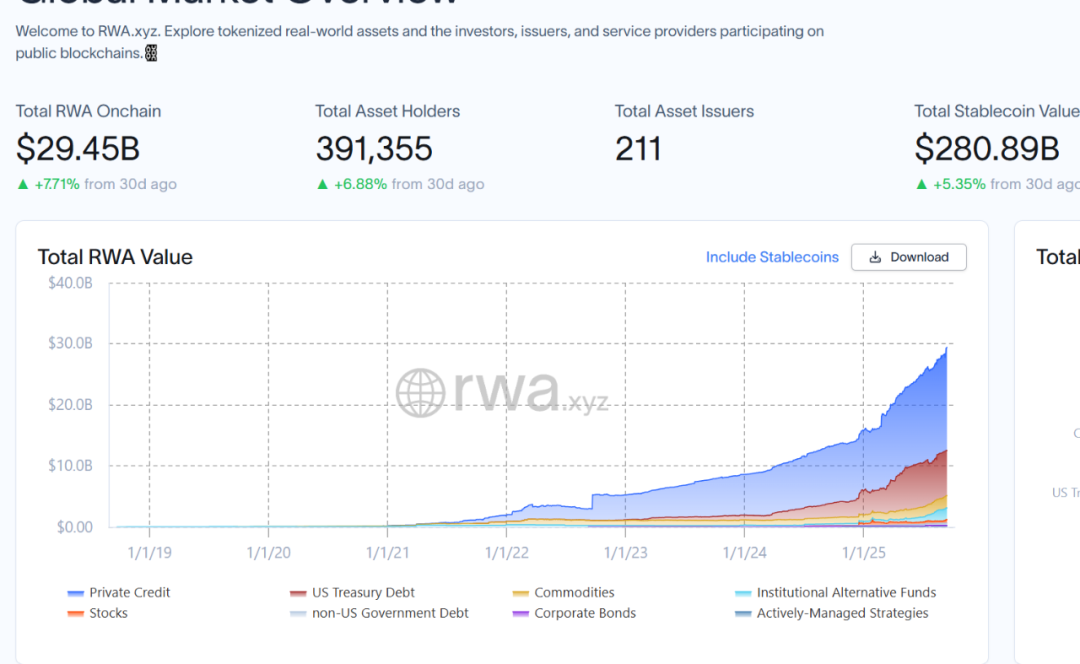

Statistics from the RWA research platform rwa.xyz show that the current total RWA market size is nearly US$30 billion, and BlackRock expects the market value of tokenized assets to reach US$10 trillion by 2030.

In other words, the potential growth space of RWA narrative may be more than 300 times in the next 7 years.

These numbers are not groundless. They are based on a simple fact: the total value of the world's real-world assets (real estate, stocks, bonds, credit, etc.) is as high as hundreds of trillions of dollars. Even if only a tiny portion of them are tokenized, it will bring an unprecedented flood of value to the blockchain world.

Source: rwa.xyz

In this transformation of capital flows, Ethereum is undoubtedly the core battlefield - from technological maturity, asset security, to the completeness of the DeFi protocol ecosystem, it is far ahead of other public chains. For this reason, Ethereum co-founder Joseph Lubin even bluntly stated: RWA will be one of the biggest engines driving the growth of the Ethereum ecosystem in the next decade.

It can be said that from the tokenization of US Treasury bonds (such as Ondo Finance) to on-chain financing of private credit (such as Centrifuge), various RWA projects are blossoming in many places.

The true significance of RWA goes far beyond simply putting assets on the chain. It marks a financial paradigm shift that is taking shape and may reshape the underlying structure of both DeFi and traditional finance:

- For DeFi: RWA introduces high-quality collateral that is stable, low-correlated, and has a continuous cash flow. This not only fundamentally addresses the systemic risks of DeFi's "internal circulation," but also brings unprecedented asset diversity and market depth.

- For traditional finance: RWA can "activate" assets with extremely poor liquidity, such as real estate and private equity, and achieve the division and efficient circulation of ownership through tokenization, greatly improving capital efficiency and creating new markets;

- For the entire ecosystem: Ethereum, as the absolute main battlefield of this revolution, is evolving into a "global unified settlement layer";

Essentially, RWA represents an "incremental capital narrative" that not only provides DeFi with more stable, low-correlated, high-quality collateral, but also marks the first real handshake between the blockchain world and the real financial system.

In the next decade, RWA may become a decisive turning point for Crypto to move towards the real economy and achieve mainstream adoption.