Source: Coin Metrics; Compiled by: Golden Finance

Key Points

Demand for Bitcoin Exposure: Continued inflows into spot Bitcoin ETFs and the performance of digital asset treasury tools like "Strategy" highlight investor demand for Bitcoin (BTC) exposure. While this may lead to a concentration of holdings among a small number of institutions, such products broaden investment channels for traditional investors.

Activity lags: Despite Bitcoin's record high price, its blocks haven't consistently reached full capacity. While this allows for lower-value transactions to be included in blocks, improving network accessibility, it also raises concerns about miner profitability. Limited transaction fee revenue undermines miners' incentive to maintain network security.

Bitcoin's use cases continue to expand: Wrapped BTC products and emerging native Bitcoin applications are creating new income opportunities for holders and driving network activity. However, transaction fees have remained subdued since August 2024, never exceeding $150. In the long term, fee revenue will need to play a greater role in maintaining miner motivation and network security.

1. Introduction

Bitcoin's price has surged, driven by the development of regulated Bitcoin investment vehicles and a wave of pro-cryptocurrency legislation. While investor security has improved, the sustainability of the underlying network has been overlooked. Without considering network activity, the long-term investment case for Bitcoin is incomplete.

In September 2024, our inaugural Bitcoin Asset Analysis Report highlighted Bitcoin's increasing scarcity, its advantages within Modern Portfolio Theory, and the rise of Bitcoin ETFs. With Bitcoin's price now exceeding $124,000, ETF inflows are on the rise. In this updated report, we delve deeper into the recent demand for Bitcoin exposure through ETFs and treasury firms, its impact on network activity, and emerging trends in the Bitcoin ecosystem for 2025 and beyond.

2. Factors driving Bitcoin’s attention

(1) US spot Bitcoin ETF continues to see inflows

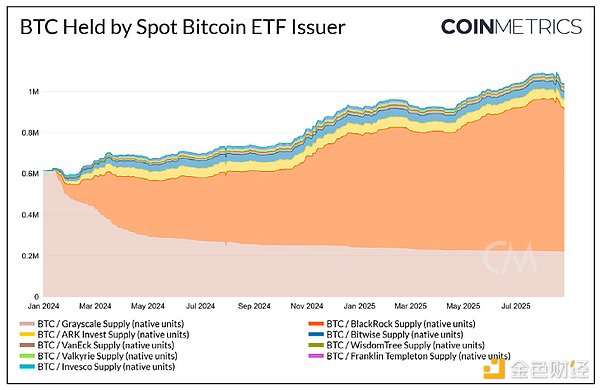

Since the approval of US spot Bitcoin ETFs in January 2024, market interest in them has fluctuated. Currently, the total amount of Bitcoin held by Bitcoin ETFs has exceeded 1 million, representing over 5% of the current Bitcoin supply. As Bitcoin prices hit record highs, institutional investors and traditional investment portfolios have refocused on ETFs, eager to increase their Bitcoin exposure.

The increase in Bitcoin ETF inflows can be explained by the following aspects:

1. Modern Portfolio Theory: This theory suggests that investing in Bitcoin can help improve risk-adjusted returns. Bitcoin's low correlation with gold and stocks can help diversify investment portfolios and hedge against market downside risks.

2. Simplify the custody process: Self-custody of Bitcoin requires a significant investment in mnemonic phrase management and multi-signature wallet security, while ETFs avoid these custody complexities.

3. Convenient access channels: Investors can participate in ETF investments through traditional brokerage platforms without having to access new cryptocurrency exchanges or conduct peer-to-peer transactions, which is in line with their existing investment habits.

2. The Rise of Strategy: Leveraged Bitcoin Investment Tools

Investors seeking greater Bitcoin exposure are starting to look at publicly traded companies focused on building Bitcoin treasuries, with Strategy (NASDAQ: MSTR) being a prime example.

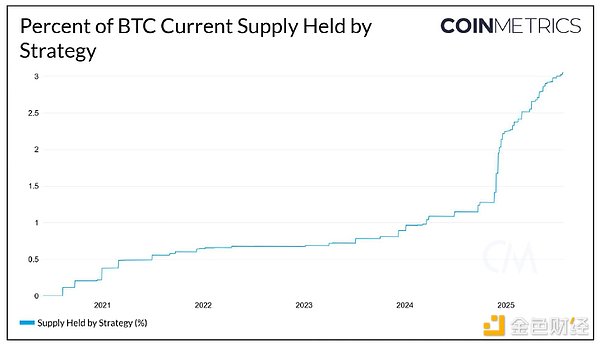

Compared to Bitcoin ETFs, Strategy shares exhibit greater volatility, offering investors higher potential returns. This is due to Strategy's model of increasing its Bitcoin holdings through recursive leverage: the volatility of its shares enables it to continually issue low-interest convertible bonds (which sophisticated investors can hedge against), and use the proceeds to purchase Bitcoin. Strategy's core objective is to increase the number of Bitcoins per outstanding common share (i.e., "BTC yield"). Investors anticipate that Strategy will continue to increase its Bitcoin holdings, which drives its stock price to a premium relative to the value of its underlying treasury.

Strategy currently holds over 628,000 Bitcoins, representing 3% of the current Bitcoin supply. For reference, this amount is only 100,000 less than the total Bitcoin held by BlackRock’s Bitcoin ETF for millions of investors.

Strategy currently holds over 628,000 Bitcoins, representing 3% of the current Bitcoin supply. For reference, this amount is only 100,000 less than the total Bitcoin held by BlackRock’s Bitcoin ETF for millions of investors.

Strategy uses the conceptual metric "BTC risk" to measure the probability that the value of the Bitcoin backing its issued bonds will fall to the bond's face value. If the Bitcoin price were to decline over a prolonged period, this risk, if realized, could weaken Strategy's ability to finance future Bitcoin purchases, potentially forcing it to repeatedly sell off its Bitcoin holdings to meet its debt obligations.

3. Is network activity correlated with Bitcoin demand?

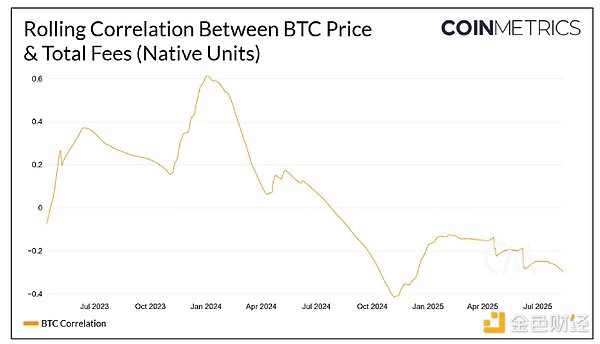

Just as company revenue determines stock price value, transaction fees are considered a key factor in determining token prices. Transaction fees not only reflect network usage but also serve as a core reward for miners to maintain network security.

Passive Bitcoin holdings reduce network activity and fee revenue, threatening network security. If miners fail to generate sufficient Bitcoin revenue from block rewards and transaction fees, they may cease operations to avoid losses, leading to the concentration of computing power in a small number of operators. By analyzing changes in fee activity, we can clearly determine whether it is driving Bitcoin prices higher.

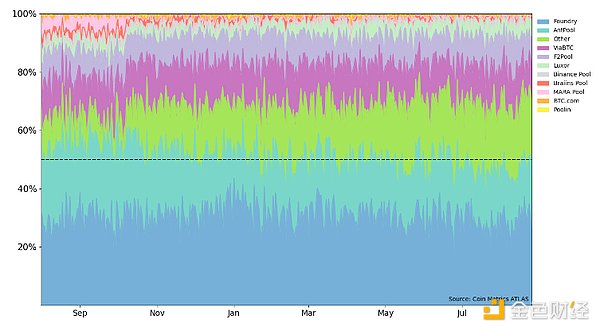

(1) Mining pools continue to dominate

Since the release of our first Bitcoin Asset Analysis Report, the top mining pools have maintained a stable control over total hashrate. US-based Foundry controls approximately 30% of the hashrate, followed closely by Chinese-based Antpool at 18%. To maximize profits, miners continue to compete for control of hashrate and network dominance. The current block generation difficulty is at an all-time high, indicating that mining pools are continuously investing in new mining machines to maintain their dominance in the network.

Bitcoin mining pool share chart (August 2024 to present)

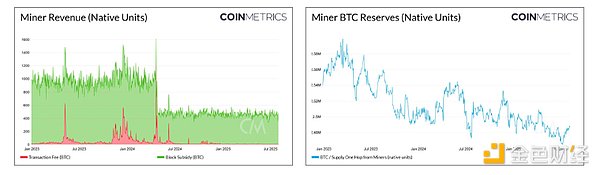

(2) Miners’ income is unsustainable

Despite mining pools controlling the network, individual miners' income is increasingly dependent on Bitcoin's price. Following Bitcoin's fourth halving in April 2024, transaction fees have continued to decline, currently accounting for less than 1% of miners' total revenue. Individual miners are reducing their holdings of Bitcoin, partly due to operational security concerns and partly due to the need to sell Bitcoin to cover operating costs.

Bitcoin is expected to undergo its fifth halving in 2028, when miners will only receive 1.5625 new bitcoins per block. This significant drop in revenue could cause some miners to exit the market due to the inability to maintain profitability. This withdrawal of miners would pose a threat to Bitcoin's decentralization and network security.

Against this backdrop, transaction fee revenue will become increasingly important in incentivizing miners to maintain network security and prevent the concentration of computing power. To offset the revenue shortfall caused by the reduction in Bitcoin block rewards, there are two ways: first, a surge in network activity driving up transaction fees, and second, the development of new applications creating additional demand for block space.

4. Activity lag problem

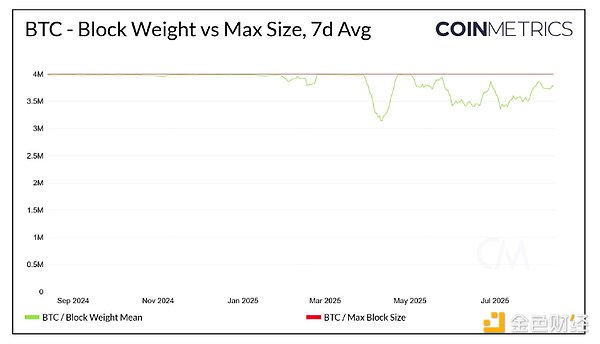

Since January 2025, the amount of available Bitcoin block space has increased significantly compared to the 2024 average. Block weight measures the size of transactions included in a block—complex transactions carry a higher weight and take up more block space than simpler ones. Currently, there is still ample space in the block to accommodate more transactions, provided there is demand.

Low demand for block space has kept fees low, allowing many fee-sensitive users to participate in network transactions. While low fees increase the inclusiveness of value transfer on a censorship-resistant network, there is little correlation between demand for Bitcoin assets and institutional investor demand for block space.

Bitcoin is increasingly being viewed as a "digital gold" and a store of value. Its appeal stems not from the fees generated by the network, but rather from its ability to hedge against inflationary pressures of fiat currencies and serve as an alternative means of storing or transferring value.

5. Bitcoin Use Case Development in 2025

(1) Emerging Packaged Bitcoin Alternatives

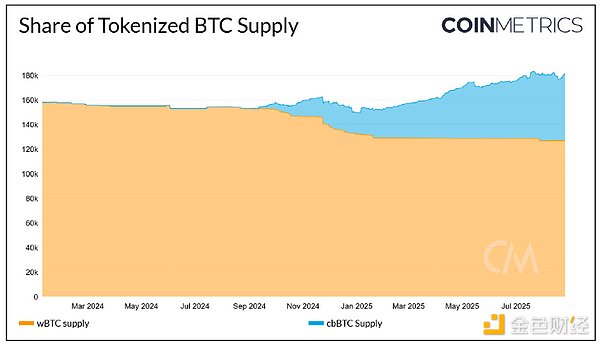

Coinbase's cbBTC saw a significant increase in supply amidst BitGo's custody adjustments for wrapped Bitcoin (wBTC). Users are locking up their Bitcoin to acquire tokens like cbBTC and wBTC, representing the underlying asset, thereby exploring opportunities for yield on other networks.

While BitGo previously held a significant share of the tokenized Bitcoin market, concerns arose regarding its reserve management following its announcement in August 2024 of a partnership with BitGo Singapore Ltd. and BiTGlobal to adjust its custody model. As a result, the supply of Bitcoin held in BitGo custody stagnated, with the wBTC supply stabilizing at approximately 127,000, down from the total supply of 153,000 last year.

Meanwhile, the supply of cbBTC has grown to over 52,000 since its launch in August 2024. While BitGo still holds the majority of Bitcoin for its users, Coinbase is steadily gaining market share.

(2) Native Bitcoin Applications Continue to Evolve

Developers are actively developing applications that reduce the need for custodians and cross-chain bridges when earning returns on Bitcoin. Holders can interact with these applications using native Bitcoin without having to hold tokenized Bitcoin.

The Babylon Genesis Chain provides security for external Proof-of-Stake (PoS) networks by incentivizing miners to stake Bitcoin to operators. Verifying the state of the PoS network with the Bitcoin network not only enhances the security of the PoS chain but also generates additional transaction fee income for Bitcoin miners. Bitcoin stakers retain ownership of their Bitcoin while also earning rewards from the PoS network, which relies on the operator's assistance in verifying the network's state.

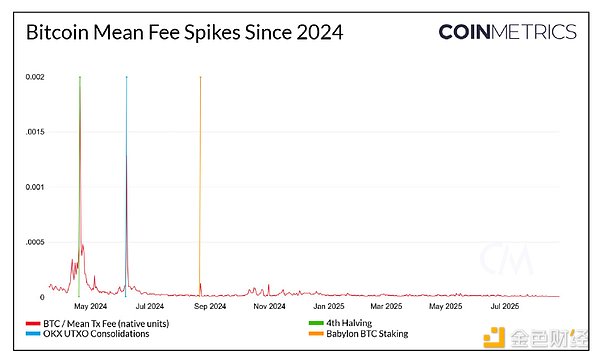

On August 22, 2024, when the Babylon staking business was first opened for deposits, the demand for block space increased significantly, and network fees once exceeded US$150, setting a new high for single-block fees since the integration of OKX unspent transaction outputs (UTXO) in June 2024. This phenomenon fully reflects the market's expectations for the Babylon staking business.

Since the Babylon staking program triggered a fee increase, Bitcoin transaction fees have never peaked above $150. Unless new factors emerge that prompt users to rush to include their transactions in the next block, the proportion of transaction fees in miners' revenue will remain low. The instability of transaction fee income has forced miners to rely more on newly issued Bitcoin block rewards to maintain operations.

VI. Outlook

Increased demand for Bitcoin through ETFs and digital asset treasuries (DATs) has been a primary reason for Bitcoin’s recent strong performance. However, this demand has not translated into increased network activity.

The continued slump in transaction fee revenue has cast a shadow over the future health of the Bitcoin network. As the number of newly minted Bitcoins decreases, transaction fees will become increasingly important in incentivizing miners to maintain network security. If miners are forced to exit the network due to chronic losses, Bitcoin's decentralization and censorship resistance will be at risk, and its core value proposition will be lost.

The emergence of more native Bitcoin applications is expected to return transaction fee revenue to miners, rather than diverting related activities to other blockchains. If Bitcoin is to live up to its high valuation, network activity and miner incentives must be improved as soon as possible.