Author: oxStill

While all L2 blockchains are focused on TVL (Transactions Per Second), one project has quietly achieved a TPS of 100,000 transactions per second, even gaining the endorsement of Vitalik Buterin – this is MegaETH, a disruptor that claims to be building the "first real-time blockchain".

MegaETH's public offering is now in its final countdown. As of press time, it has been oversubscribed by 20 times, raising approximately $1 billion.

The market has already voted with real money, so what do professional analysts think?

0xResearch analysts Boccaccio & Marc Arjoon:

We believe that if you can secure an allocation higher than the minimum, this could be one of the best opportunities this year.

The auction will be conducted in the British auction format, starting at 9:00 AM Eastern Time on October 27 and lasting for 72 hours.

Unlike traditional token sales, this British auction format allows the market to determine a fair price through competitive bidding. The system operates by determining a liquidation price—the minimum price point at which the total bids fill the entire allocation of 500 million tokens.

All successful bidders, regardless of their individual bid amount, pay the same liquidation price. This means that even if someone bids as high as $0.0999 per token, they will only pay the final liquidation price if the final liquidation price is lower.

Bidders whose bids are below the liquidation price will receive a full refund, while bidders whose bids meet or exceed the liquidation price will receive an allocation. The auction format eliminates competition for gas fees and the advantage of first-come, first-served, creating a fairer allocation mechanism.

This sale offers 500 million MEGA tokens, representing 5% of the total supply of 10 billion tokens, and will be conducted entirely on the Ethereum mainnet, using USDT as the payment method.

The auction price range is from $0.0001 to $0.0999 per token, with a starting price of $0.0001 representing a fully diluted valuation (FDV) of $1 million and a maximum price of $0.0999 representing an FDV of $999 million.

Individual participants can bid a minimum of $2,650 and a maximum of $186,282, with a bid increment of $0.0001. The structure includes a mandatory one-year lock-up period for U.S. accredited investors, who are eligible for a 10% discount. Non-U.S. participants can choose the same lock-up period to enjoy the discount.

Following the auction, the allocation calculation period will run from October 30 to November 5, the refund and withdrawal period will be from November 5 to November 19, and the final allocation and redistribution will take place from November 19 to November 21.

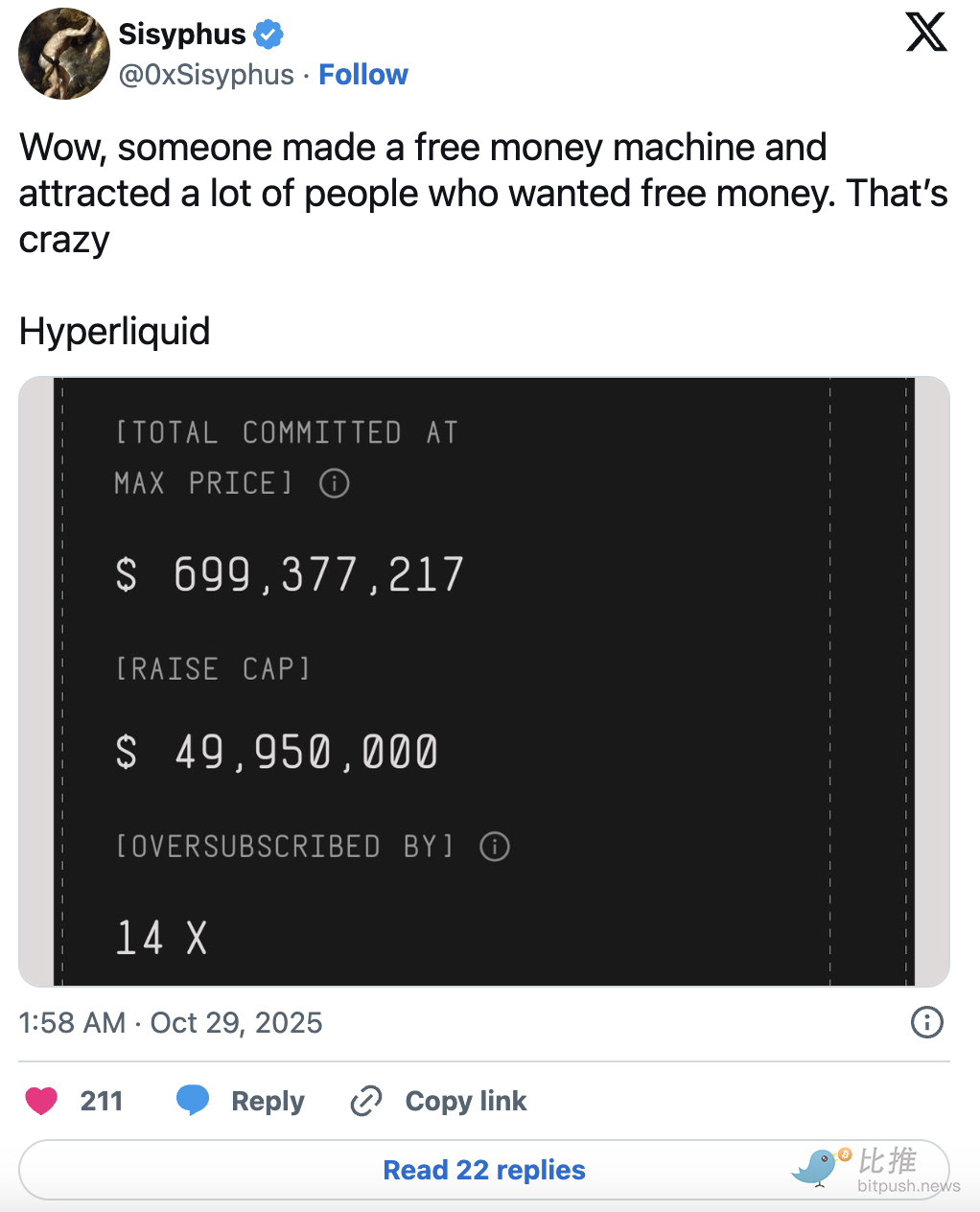

As expected, the MegaETH public sale has been very successful so far, oversubscribed by 14 times. With the final day approaching, this number is likely to only increase further, with most deposits/bids pouring in during the last few hours.

After all, if someone gives you a free money-making machine, the only right thing to do is to deposit as much money as possible into it.

Currently, MegaETH is trading on the premarket (on Hyperliquid) with an FDV valuation of $4.5 billion, allowing depositors to potentially earn 4.5x returns. The main issue is that any depositor may only earn 4.5x returns at the minimum bid amount ($2,650). The MegaETH team has publicly disclosed factors influencing allocation, primarily including past wallet interactions, social media influence, and some new "social credit" platforms (such as Ethos).

As with any free money-making machine, we've seen a lot of Sybil activity. If the minimum bid is $2,650 and you have 450 Echo/Sonar accounts, you can earn more and have a higher chance of making money than savvy crypto enthusiasts with good social connections and DeFi/on-chain credentials.

We've discussed MegaETH several times on the podcast and are generally optimistic about the chain. The team has taken a unique approach to ecosystem building (MegaMafia is now in its second phase, with the third coming soon) and focuses on unique applications—rather than forks of Uniswap, Aave, Morpho, or Compound (which seem to dominate most other chains).

Regardless of your opinion on MegaETH's valuation, we've learned two key lessons over the past few months:

1. Some chains are now explicitly focused on revenue, while others focus on other narratives (such as decentralization). It is currently unclear which will provide better returns (e.g., XRP vs. Hyperliquid, or ETH vs. SOL).

2. Many significant returns now come from private public markets (such as Echo, Sonar, etc.), pre-deposits, etc. The whitelist and Discord roles of 2021 (and the subsequent Sybil attack, buying and selling of whitelist and Discord roles) have now evolved into Sonar and Echo (and the subsequent Sybil attack, buying and selling of KYC-verified Sonar and Echo accounts).

Former Messari executive Kunal G (@kunalgoel) posted:

MegaETH's scale is staggering, and every calculation it generates defies all intuitive expectations. While the market views it as just another ordinary L2, my models show that its actual opportunities far exceed imagination.

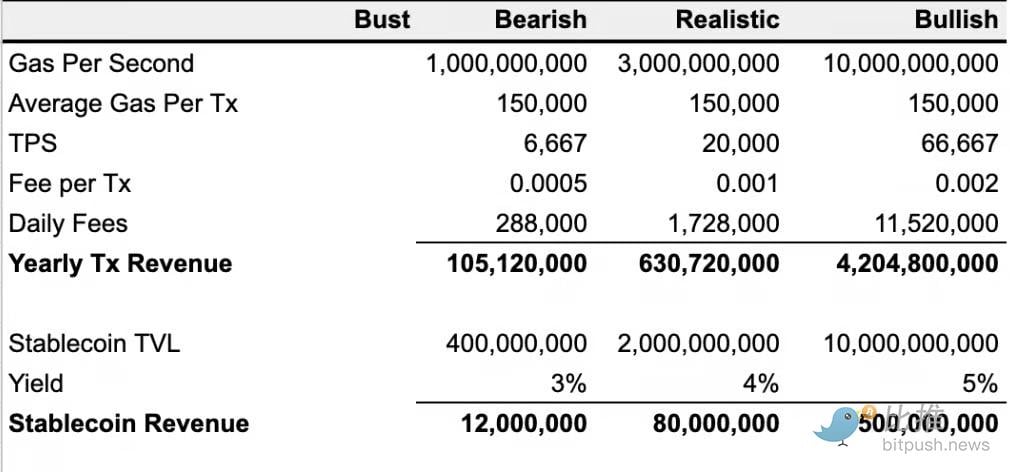

I constructed four scenario models:

Optimistic Scenario – MegaETH achieves advertised performance of 10 Gigagas per second, or 66,667 typical transactions per second.

Real-world scenario – The actual scale reached one-third of the expected size, i.e., 3 Gigagas per second, or 20,000 transactions per second.

Pessimistic Scenario – Only 10% of the advertised scale, 1 Gigagas per second, 6,667 transactions.

Failure Scenario – The project fails completely, and the final fully diluted valuation (FDV) is locked at $200 million.

Even in a pessimistic scenario, assuming a single transaction fee as low as $0.0005 (lower than most L1 and L2), MegaETH could generate $288,000 in revenue per day from transaction fees alone, with an annualized revenue exceeding $100 million.

Revenue potential increases dramatically with scale:

- In a real-world scenario, annual revenue reaches $600 million.

In an optimistic scenario, if transaction fees rise slightly to $0.001-$0.002, annual revenue would soar to $4.2 billion.

In addition, MegaETH's native stablecoin, MegaUSD, can generate additional income through protocol rewards. Depending on the total value locked (TVL) of the stablecoins, this portion could contribute 8-9 figure annual revenue.

The project also plans to internalize MEV revenue through sorter permissions and rack hosting services. The recently launched "staking access" model will have a similar positive impact by reducing the circulating supply and entrusted staking revenue.

The model conservatively deducts 50-70% of transaction revenue for infrastructure costs such as the Data Availability Layer (DA), sorter, proof, and oracles. Despite the extremely high operational requirements, costs scale in tandem with throughput, making the calculation logic clear.

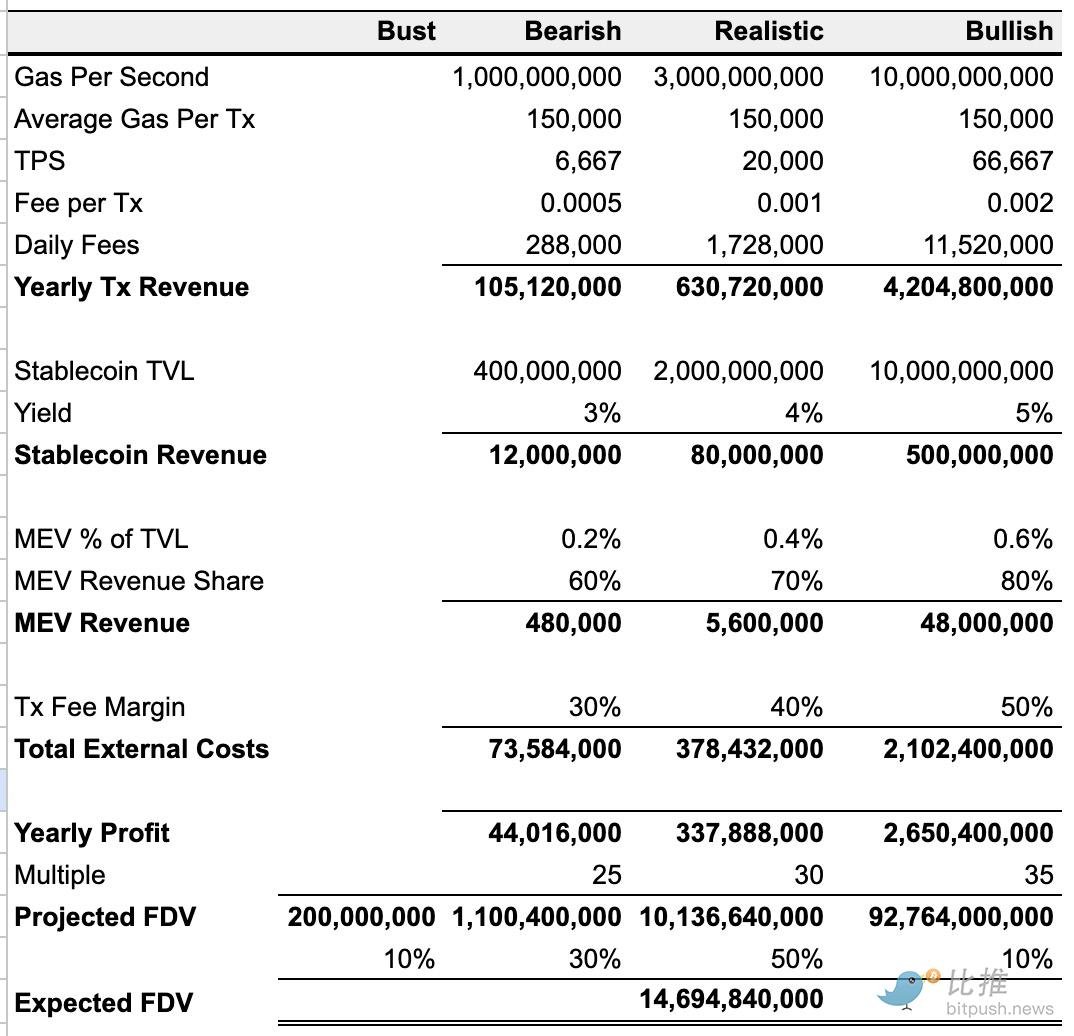

My baseline scenario predicts annual profits of over $300 million, which, based on a P/E ratio of 30, corresponds to an FDV of approximately $10 billion.

Taking into account the probabilities of all scenarios, the weighted expected FDV is as high as $14-15 billion—more than 3 times the current price of Hyperliquid perpetual contracts and more than 14 times the potential of the ICO price.

The main risks lie in the efficiency of the mainnet launch and the quality of ecosystem applications. The execution difficulty is particularly critical due to its unprecedented scale; if successful, they will be pioneering. Secondly, regarding ecosystem applications, there don't seem to be any major issues so far; the initial launch list includes both newcomers and established projects, resulting in a healthy lineup.