Compiled by Tim, PANews

The rise of livestreaming has transformed content from a pastime into a highly leveraged market. Unlike traditional work models, where one hour of labor earns a fixed return, livestreaming multiplies the value of that hour by the number of viewers. A single hour of content can generate thousands of hours of viewer attention, a capital asset that can be monetized by advertisers, platforms, and creators. However, creator income distribution remains highly skewed.

On Twitch and YouTube, revenue primarily comes from subscription fees and advertising revenue. Due to their tiered revenue-sharing model, the average streamer retains only 50% of subscription revenue, while top creators can earn over 10 times that. New entrants like Kick disrupted this model by allowing streamers to retain 95% of subscription revenue, sparking a platform arms race between Kick and Twitch and generating multimillion-dollar contract deals.

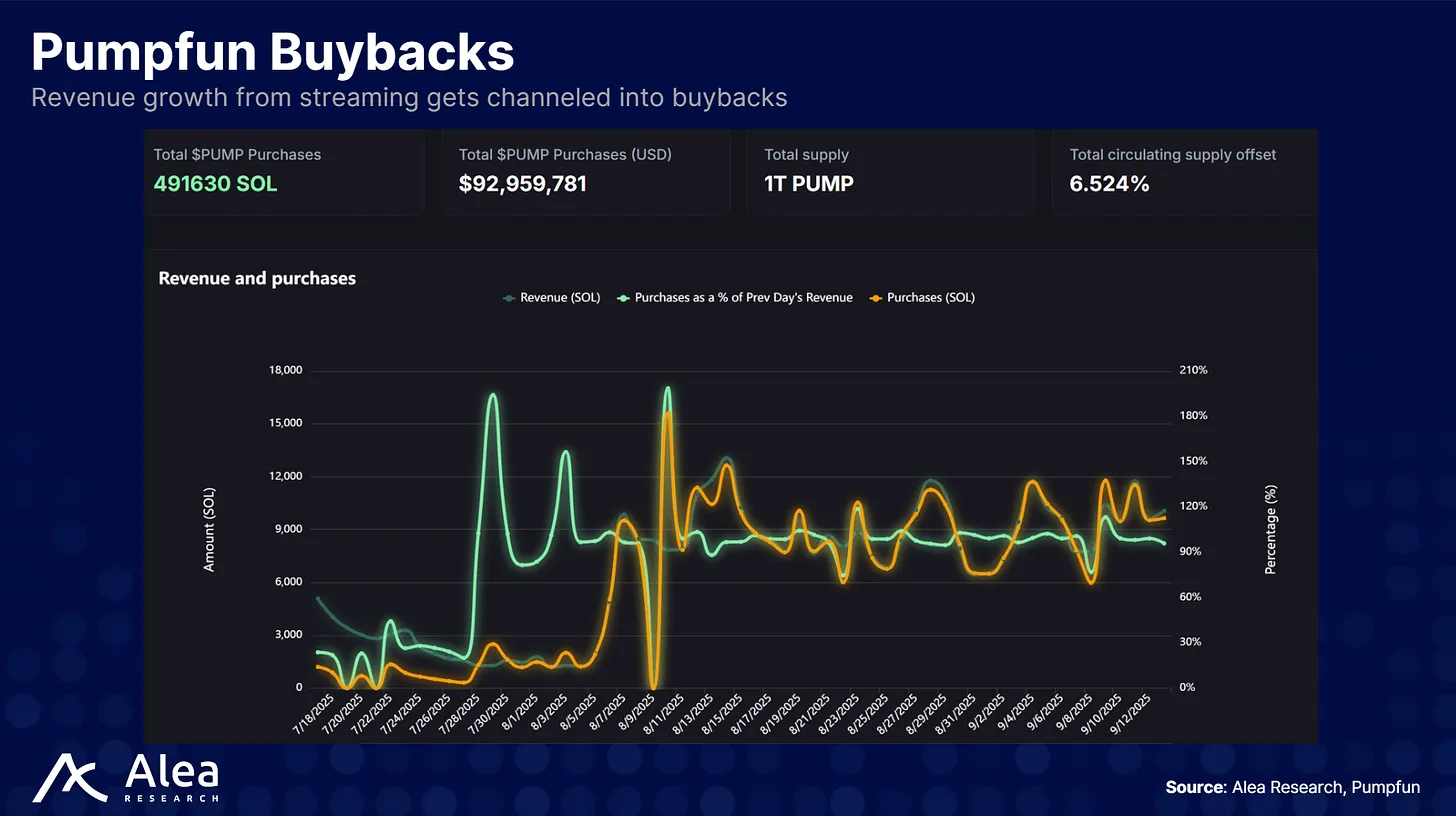

Entering this market is Pump.fun, a platform known for issuing meme tokens. In mid-2025, it quietly launched a live streaming feature and adopted a dynamic charging model that links the streamer's income to the performance of their tokens.

This issue will explore Pump.fun's creator capital market operating model, analyze its strategic significance in competing against Kick and Twitch, and clarify the value of live streaming tokenization.

The Current Situation: Kick vs. Twitch

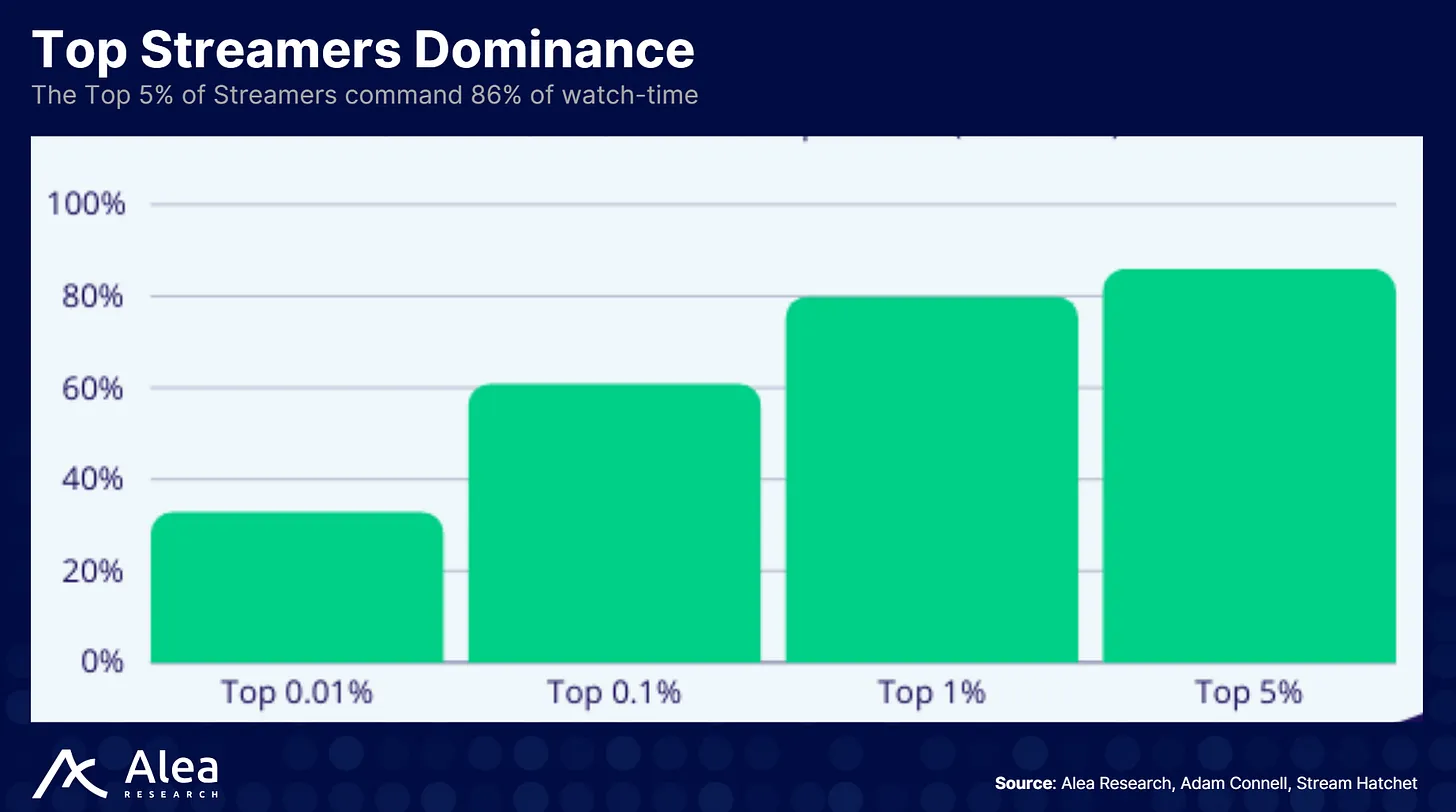

Twitch pioneered the live streaming industry, boasting an average of 1.5 billion hours of monthly viewing time. The platform employs a standard revenue-sharing model for most creators: a 50/50 split on subscription revenue, and a 55/45 split on advertising revenue from its ad incentive program. Top creators who reach the "Partner Plus Program" receive an even more generous 70/30 subscription split. This mechanism creates a Pareto dynamic, with top creators capturing 80% of viewing time and revenue, while smaller creators compete fiercely for the remaining 20%.

[Note: Pareto dynamics refers to the process of resource allocation or decision-making, whereby continuous adjustments and optimization are made to continuously approach or maintain a Pareto optimal state (a state where no party can further improve its own benefits without harming the interests of others).]

For example, Kai Cenat is the top-ranked streamer on Twitch, with active subscribers and revenue almost exceeding the combined total of the second to tenth top streamers.

Kick, founded in 2022 with support from the gambling platform Stake.com, challenged Twitch by promising to offer streamers a 95% share of subscription revenue and allowing them to broadcast content restricted by Twitch, such as gambling. Kick also signed high-paying contracts with top Twitch streamers to facilitate transfers, reportedly signing top Twitch streamer xQc to a two-year, $100 million non-exclusive contract and Amouranth for $30 million to $40 million.

During the period of these announcements, Kick added over a million new users. These moves demonstrate that live-streaming platforms are willing to spend heavily to attract attention, though revenue still comes from subscriptions, advertising, and tips from viewers.

The Essence of Live Streaming: Attention Economics and Pareto Dynamics

There's a common misconception that live streaming is a zero-sum game, where competition intensifies as more streamers join, tipping, and viewing time become diluted. In reality, attention follows a Pareto distribution, with a small number of viral creators capturing the vast majority of viewers, while the majority struggle to survive. When top streamers like Kai Cenat or IShowSpeed start live streaming, they actually expand their audience: millions of fans who might otherwise never use the new platform sign up specifically to watch.

This phenomenon explains why the Kick platform is willing to pay huge signing fees: introducing attention capital can promote the growth of the entire ecosystem rather than eroding the audience base of existing anchors.

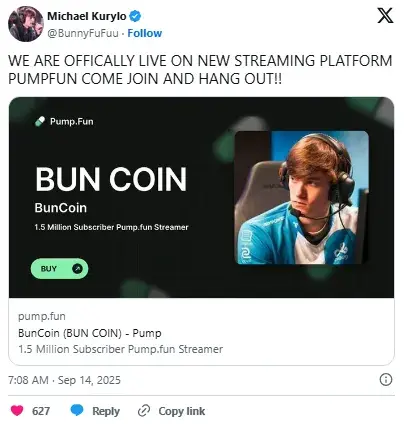

On the pumpfun platform, traditional Twitch streamers have begun to migrate (such as League of Legends streamer BunnyFuFuu):

The Pump.fun platform achieves this dynamic by leveraging fan spending power through tokens. Core viewers already have a monthly tipping budget, and purchasing streamer tokens simply converts this expenditure into a tradable asset. Holders actively promote the streamer (driving up the token price), and if a creator suddenly becomes popular, early supporters can share in the profits. In this way, streamer tokens transform tipping behavior into equity investment, deeply aligning fan interests with the creator's success while effectively mitigating the perceived "dilution" of popularity when new streamers become available.

Entering the creator capital market

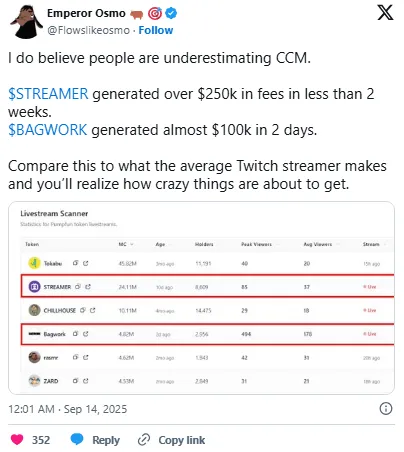

Pump.fun's transformation into livestreaming introduces a new economic model: streamer tokens. Instead of tipping or subscribing (or perhaps even simultaneously), viewers purchase tokens tied to a specific streamer. The value of these tokens fluctuates based on supply and demand, creating an investment mechanism that allows fans to speculate on a creator's popularity.

The anchor can earn transaction fees for each transaction. Under the Project Ascend plan, the maximum fee for small-cap tokens is 0.95%. The fee will naturally decrease as the token market value grows, and can be as low as 0.05%.

Pump.fun has now restored live streaming functionality for some users and strengthened content review to prohibit violent and animal abuse content, but its most critical innovation lies in directly linking fan engagement with creator income through a tokenized economic cycle.

Pump.fun’s tokenized live streaming model

Project Ascend adjusted Pump.fun's original fixed 0.05% creator fee to a floating mechanism: 0.95% for tokens with a market capitalization below $300,000, and only 0.05% for tokens over $20 million. This mechanism allows small creators to earn nearly 1% of each token transaction. According to Blockworks, this update helped Pump.fun regain market share, with total platform revenue exceeding $834 million, annualized revenue approaching $492 million, and driving daily buyback volume to over $68 million.

Pump.fun, which had suspended live streaming due to dangerous stunts, has now reopened its live streaming feature, currently available to 5% of its users, and has implemented stricter rules: violence, animal cruelty and hate speech are prohibited.

Viewers can freely buy and sell streamer tokens without permission, with no single entity controlling liquidity. Viewers' ability to go long or short on streamers' tokens not only increases market depth but also provides price signals about community sentiment. Tokens tied to creators' performance also incentivize them to maintain a consistent livestreaming frequency and community engagement.

Why choose Pump.fun instead of Twitch or Kick?

- Token Incentives: Unlike Twitch or Kick, fans don't receive financial rewards for tips or subscriptions; on Pump.fun, tips are converted into an asset. As the streamer's popularity grows, their tokens may appreciate in value, creating speculative upside for early supporters.

- Creators' income scales with their success: Streamers' income is no longer limited by fixed subscription fees. They can earn fees from token trading volume and benefit from network effects as more traders join. Pump.fun's dynamic fee model means that small creators can earn up to 19 times more per transaction than with the old fixed fee model.

- Community Ownership: Streamers and viewers share economic incentives. This could encourage more collaborative content, such as shared tasks or community decision-making about future streams.

Conclusion

Pump.fun believes that by tokenizing its fan base and allowing fans to share in revenue dividends, it can expand its reach and tipping scale. Whether Pump.fun can replicate the rapid growth of live streaming platform Kick in its early days depends on its ability to attract top streamers, maintain a strict content review mechanism, and expand its dynamic fee model.

But if the experiment succeeds, it could usher in a new paradigm for the creator economy, one that blends live streaming, trading, and speculation.