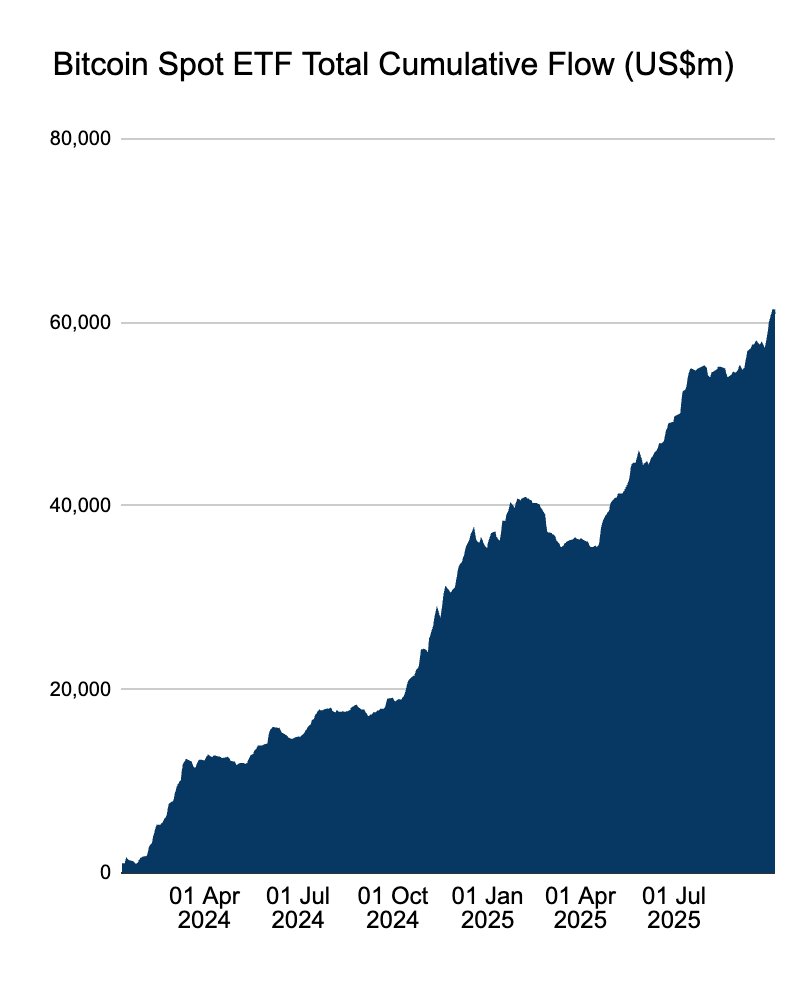

With spot Bitcoin ETFs injecting $5 billion to $10 billion into the market every quarter, institutional demand for Bitcoin is accelerating.

This wave of new money is tightening Bitcoin’s supply and strengthening its long-term bullish structure.

Bitwise Chief Technology Officer Hong Kim cited data from Farside Investors, saying that ETF inflows have become a stable force "as precise as clockwork," describing it as a "long-term trend that even a four-year cycle cannot stop," and predicted that "there will be another rise in 2026."

The continued influx of funds reflects a profound shift in how traditional finance interacts with Bitcoin. The flagship cryptocurrency, once dismissed as a speculative asset, is now being absorbed through regulated investment vehicles, providing predictable and consistent liquidity.

The assets under management of global crypto funds (including Bitcoin and Ethereum-themed products) have exceeded US$250 billion, indicating that institutions are incorporating digital assets into diversified investment portfolios.

The steady inflow of institutional capital not only pushes up prices but also reshapes the supply structure of Bitcoin.

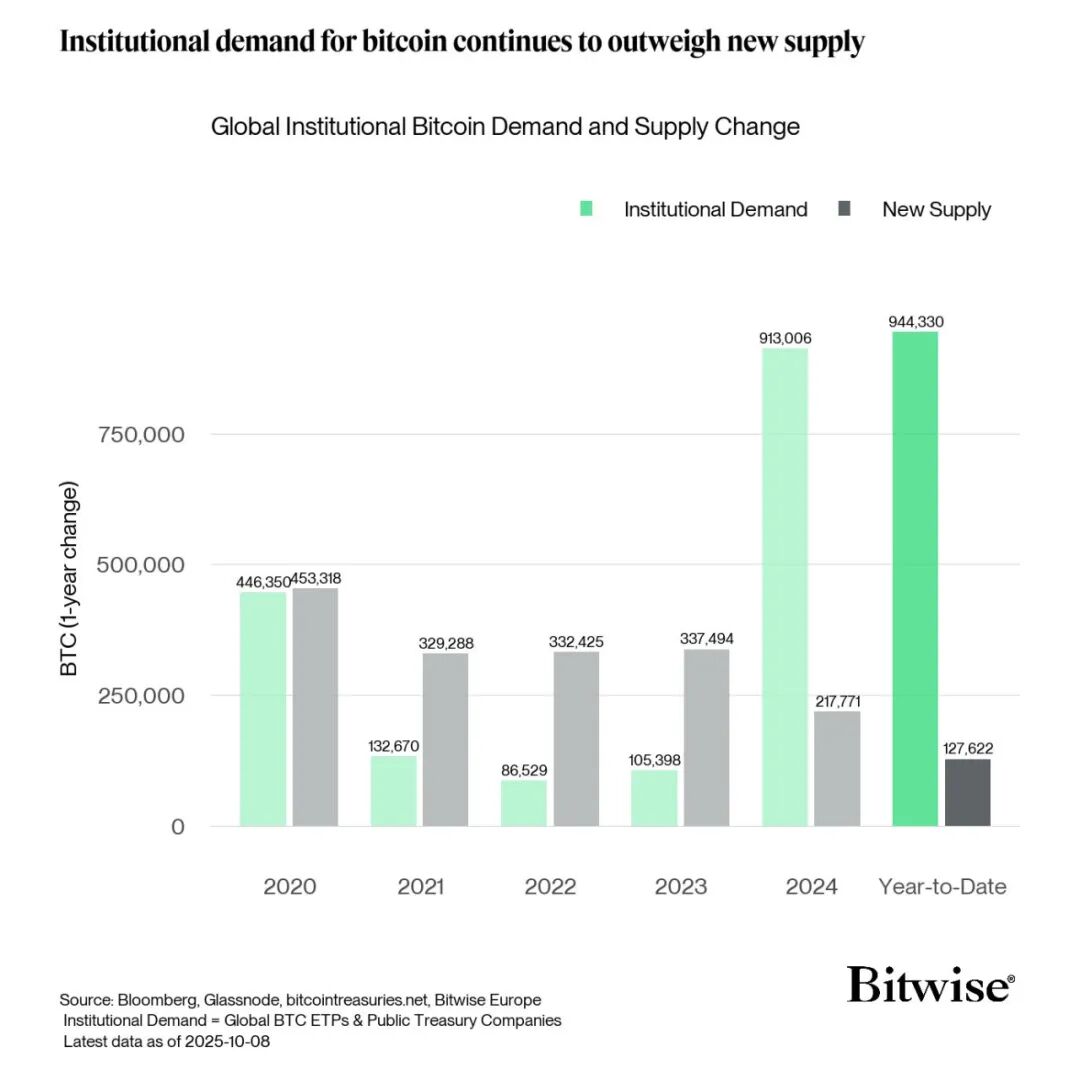

Andrei Dragos, head of European research at Bitwise, revealed that institutions had purchased a total of 944,330 bitcoins in 2025, exceeding the 913,006 bitcoins purchased in the whole of last year.

In comparison, miners have produced only 127,622 new coins this year, and institutional purchases are 7.4 times the new coin supply.

This imbalance stems from the eventual approval of a spot Bitcoin ETF by the SEC in 2024.

The approval triggered a structural shift: demand for regulated funds suddenly outstripped supply, reversing the sluggish institutional participation between 2020 and 2023 caused by policy uncertainty.

BlackRock's entry through the iShares Bitcoin Trust is symbolic, prompting other giants to follow suit.

As US policy signals warm up and Bitcoin's recognition as a treasury reserve asset increases, this trend will continue until 2025. Some government-backed companies have begun to directly include Bitcoin in their balance sheets, highlighting its growing institutional credibility.

With nearly three months left in the year and no sign of a slowdown in capital inflows, analysts expect Bitcoin's supply shortage to intensify.

The gap between issuance and demand shows that ETF-driven asset accumulation has changed market fundamentals, causing Bitcoin to gradually lose its speculative attributes and transform into a global financial instrument with sustained institutional demand.