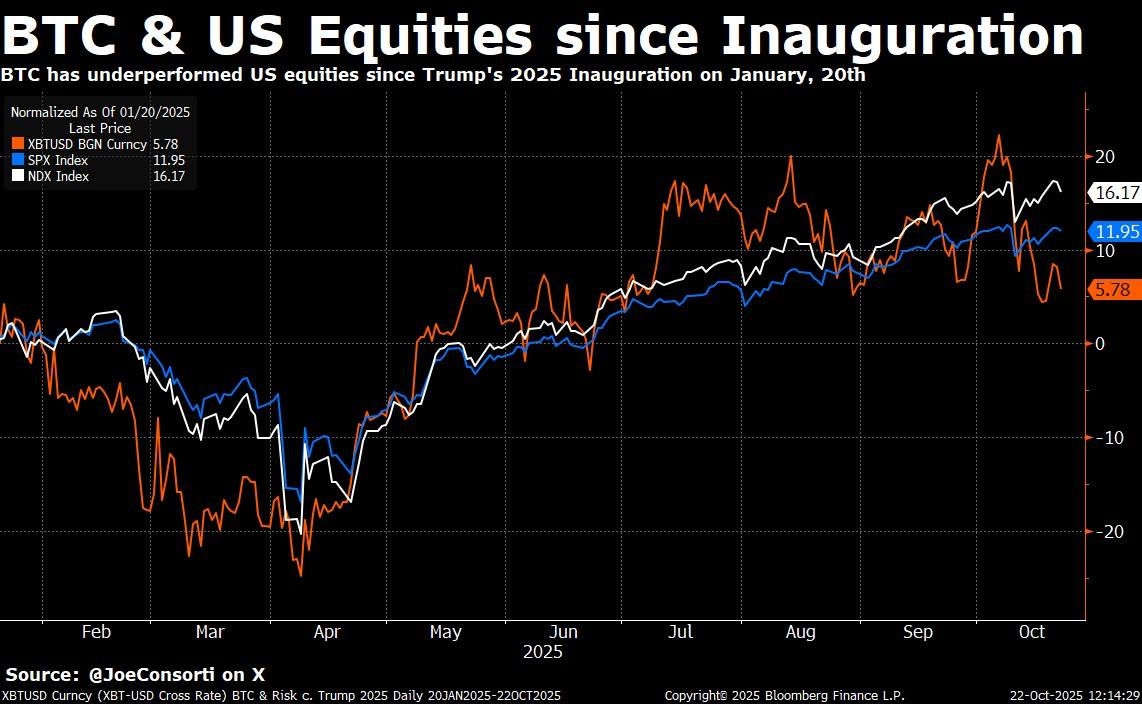

Bitcoin has underperformed nearly every major asset class this year. By the fourth quarter of 2025, it had significantly lagged behind gold, the Nasdaq, the S&P 500, the Hang Seng, and the Nikkei 225. Investors who bought Bitcoin around President Trump's inauguration in 2025, anticipating a positive market response from his endorsement, have so far earned a meager return of just over 5%.

This article will delve into Bitcoin's recent weakness, focusing on its key supply and demand dynamics. We will deconstruct Bitcoin's evolving price action by analyzing the behavior of long-term Bitcoin holders, changes in mining activity, and the flow of funds into ETFs.

Bitcoin’s “annus rut”

The chart above shows that Bitcoin has significantly underperformed the U.S. stock market since Trump took office in 2025. The Nasdaq and S&P 500 have outperformed Bitcoin by more than 100%, while Bitcoin's performance has been relatively flat.

If you bought Bitcoin on Inauguration Day (January 20, 2025), your return on investment would be only 5.78%. By comparison, major stock indices like the Nasdaq and S&P 500 significantly outperformed Bitcoin during the same period. Even gold, a traditional safe-haven asset, significantly outperformed Bitcoin.

Where is the selling pressure? Long-term holders and miners

$100,000: The psychological stop-loss point for veteran players

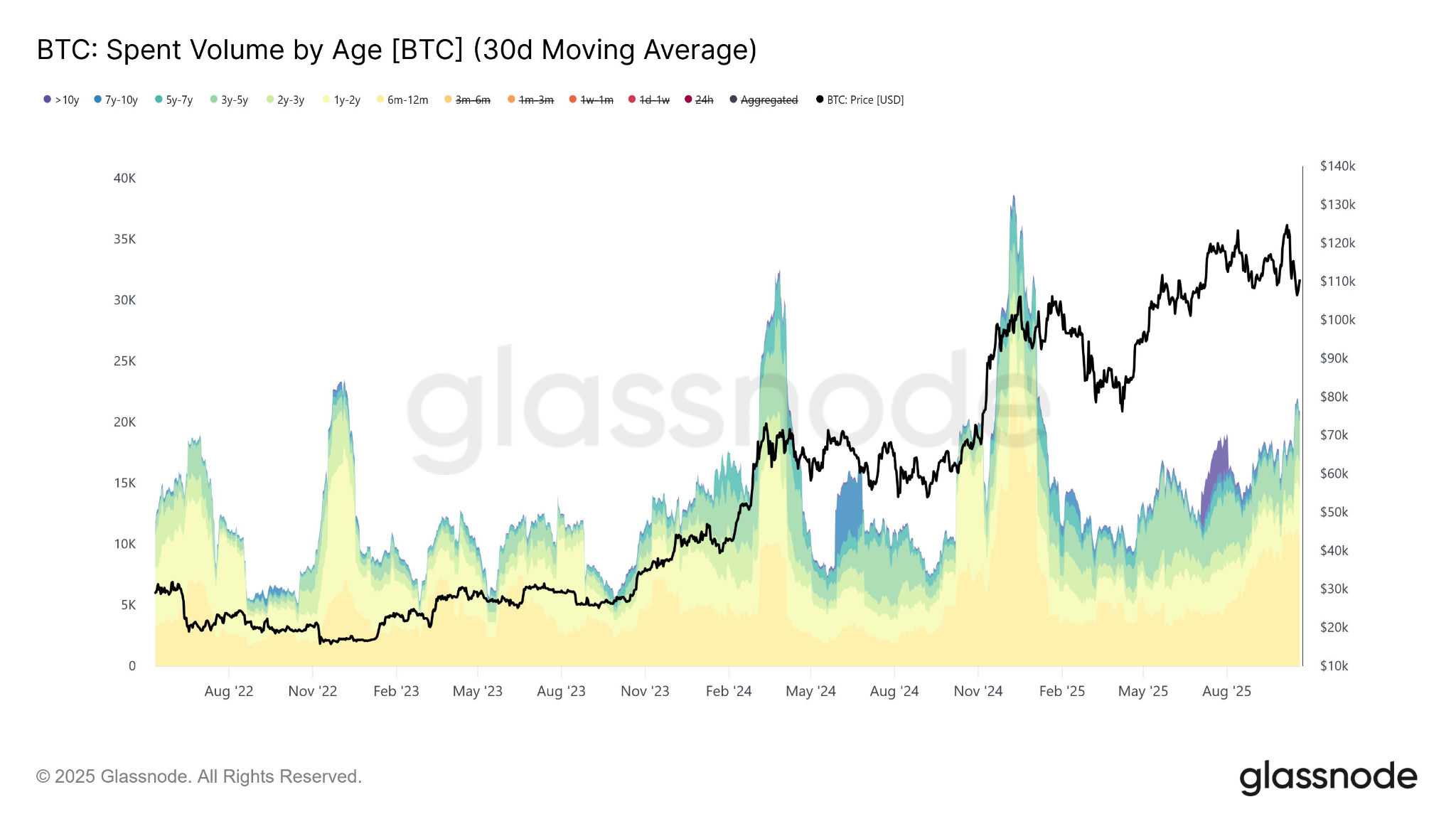

Bitcoin price has been hovering near the psychological level of $100,000. As the price stagnates at this level, long-term holders appear to be de-risking.

Whenever BTC > $100,000, selling by “old players” increases

The chart above (shown in purple and blue) shows an increase in "spent volume" among long-term holders, suggesting that more Bitcoin "veterans" are selling after years of holding. The chart reveals a significant increase in trading activity for older coins when BTC prices were above $100,000, reinforcing the view that early Bitcoin holders are selling their positions at current prices.

We speculate that as other asset classes (particularly AI) have surged this year, many tech-focused "old players" appear to be rotating out of Bitcoin to diversify and capture new opportunities. This shift has created persistent upward selling pressure, capping every rally this year.

Tracking Bitcoin Whales

This selling pressure has led to a frustrating market environment, keeping Bitcoin stuck in a volatile market this year rather than a meaningful breakout. To trigger a potential rally, Bitcoin would likely need to first break below the $100,000 support level to effectively flush out these sellers.

One of the most significant wallets driving this activity can be tracked on Arkham Intelligence. In October alone, this wallet deposited over $600 million worth of Bitcoin to various exchanges, a key indicator for monitoring whether market pressures are easing. You can explore this wallet here .

Bitcoin miners: From "network guardians" to "AI data centers"

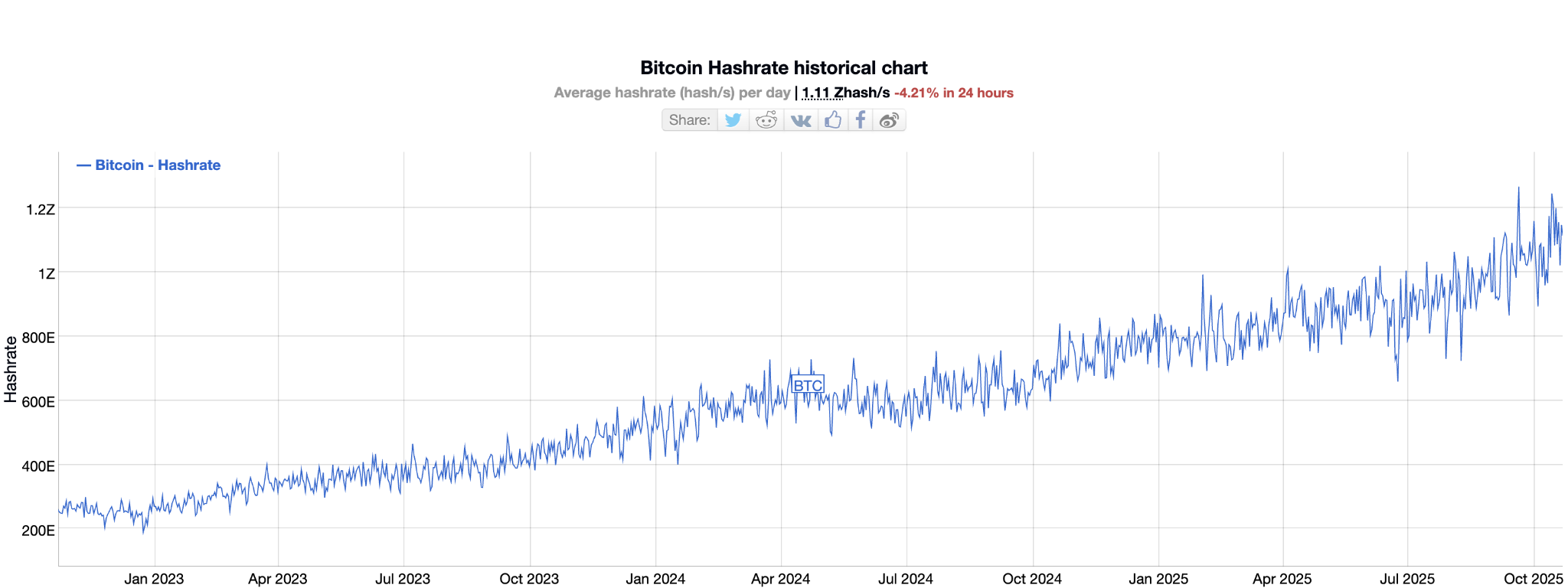

As Bitcoin miners migrate part of their operations from Bitcoin mining to AI-powered high-performance data centers (HPC), Bitcoin's security may face new risks. The shift of miners to AI could weaken Bitcoin's decentralized network and lead to a decline in hash rate in the long term.

- Core Scientific ($CORZ): Signed a 12-year HPC hosting agreement with CoreWeave, converting 100 megawatts (MW) of existing infrastructure and paving the way for a broader merger vote at the end of the month.

- Iris Energy ($IREN): has expanded its AI cloud to over 23,000 NVIDIA GPUs and achieved "preferred partner" status with NVIDIA.

- TeraWulf ($WULF): Secured a 10-year contract for over 200 megawatts (MW) of AI hosting valued at up to $8.7 billion.

- Bitdeer ($BTDR): One of the most aggressive players, it plans to convert part of its Tydal mine in Norway (175 MW) and its Clarington facility in Ohio (570 MW capacity) into AI data centers by the end of 2026, aiming to achieve more than 200 MW of AI IT load.

- CleanSpark ($CLSK) / Riot Platforms ($RIOT): Even traditional pure-play mining companies like CleanSpark and Riot Platforms are hiring “Chief Data Center Officers” and designing new campuses around “dual-use computers.”

The impact of a weakened Bitcoin network: unmanifested risks

Source: BitInfoCharts

The decline in hash rate caused by miners no longer securing the Bitcoin network could make the network less secure. A less secure Bitcoin network would be less attractive to institutional investors, which could lead to reduced demand and ultimately lower prices.

Miners, once crucial to Bitcoin's infrastructure, are now shifting their focus to more profitable ventures in artificial intelligence and cloud services. This migration is raising concerns about Bitcoin's future as a store of value and decentralized asset.

Demand-side dynamics: ETF inflows and government seizures

ETFs: The biggest demand driver

This chart shows the correlation between Bitcoin ETF inflows and price movements. When ETF inflows are strong, Bitcoin prices rise; however, a lack of inflows since mid-July has led to stagnant Bitcoin prices, highlighting the important role of ETFs in driving demand.

Bitcoin ETF inflows are highly positively correlated with Bitcoin prices in 2025. It shows that earlier this year, Bitcoin ETF inflows significantly drove price increases – however, starting on July 10, inflows stagnated, and Bitcoin’s price stagnated along with them.

Limited Growth in ETF Inflows While institutional capital flowing into Bitcoin ETFs is seen as a strong indicator of Bitcoin's maturity as an asset class, the lack of sustained inflows suggests that institutional interest may have peaked.

The US government seizure and its impact on Bitcoin’s viability

Source: https://www.justice.gov/opa/pr/chairman-prince-group-indicted-operating-cambodian-forced-labor-scam-compounds-engaged

One of Bitcoin's core narratives is its ability to resist government control. However, recent events are challenging this premise. The US government recently seized billions of dollars worth of Bitcoin through law enforcement actions. While Bitcoin's inherent security remains unquestioned, this action has sparked market concerns about its censorship-resistant nature. When an asset is vulnerable to government seizure, its value as a hedge against government control diminishes. This perceived increased ability of government censorship may also be contributing to the loss of confidence and the resulting sell-off among some established investors.

Risk-off Shift: The Quiet Rise of Privacy Coins

With the increasing transparency of the Bitcoin blockchain (which makes it easy to monitor) and government intervention, some investors seeking true anonymity are turning to privacy coins like Zcash.

The ZEC/BTC exchange rate chart shows that privacy coins like Zcash (ZEC) may benefit from Bitcoin's viability being questioned.

Conclusion: Bitcoin is at a crossroads

In summary, Bitcoin’s weak performance in 2025 is the result of the combined effects of supply and demand:

- Supply side (selling pressure): Long-term holders took profits at the $100,000 mark, while miners were attracted by the higher profits of AI and transformed, bringing potential network security risks.

- Demand side (buying): ETF inflows have stagnated since mid-July, while government regulations and seizures have shaken some investors' confidence in their decentralized value.

Outlook: The key question is whether Bitcoin can resume its upward trend or enter a prolonged period of sideways trading due to continued supply pressure. Investors should closely monitor the following two key signals to determine whether the market is shifting:

- Whales stopped depositing Bitcoin into exchanges.

- Bitcoin ETFs are seeing renewed growth in their net asset value (NAV) and inflows.