Written by Lei Jianping, Leidi.com

Figure Technology Solutions Inc. (stock code: "FIGR"), a blockchain-based lending company, was listed on the Nasdaq in the United States yesterday.

Since 2025, the U.S. stock market has experienced a significant recovery.

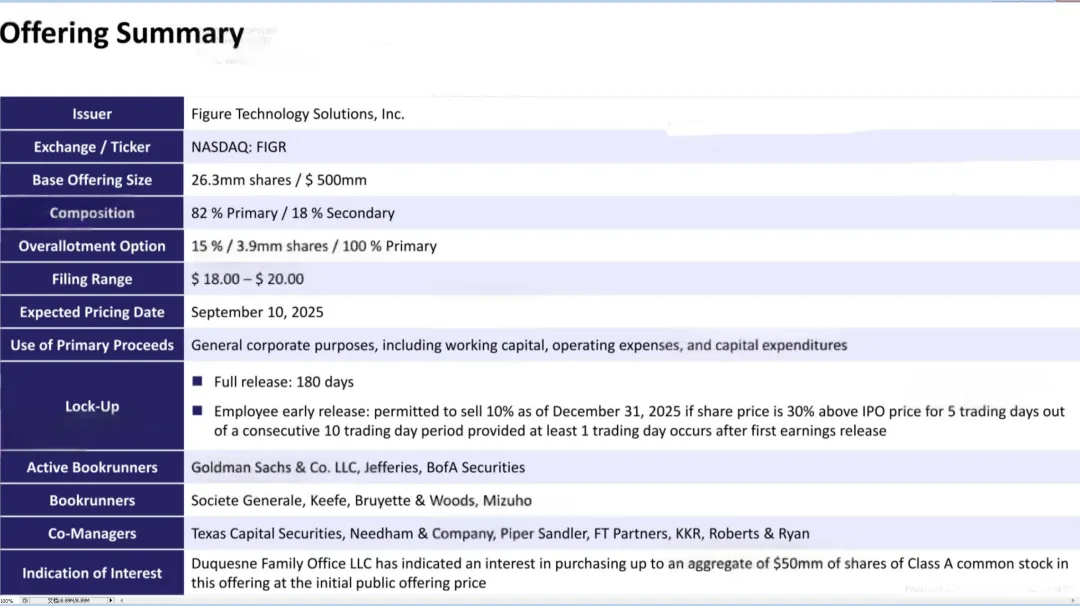

Before its listing, Figure raised its offering range from US$18 to US$20 to US$20 to US$20 to US$22, and its offering size from 26.32 million shares to 31.5 million shares.

Figure's final issue price was US$25, and the total amount of funds raised was US$788 million.

Figure's opening price was $36, up 44% from the issue price; its closing price was $31.11, up 24% from the issue price; based on the closing price, the company's market value was $6.6 billion.

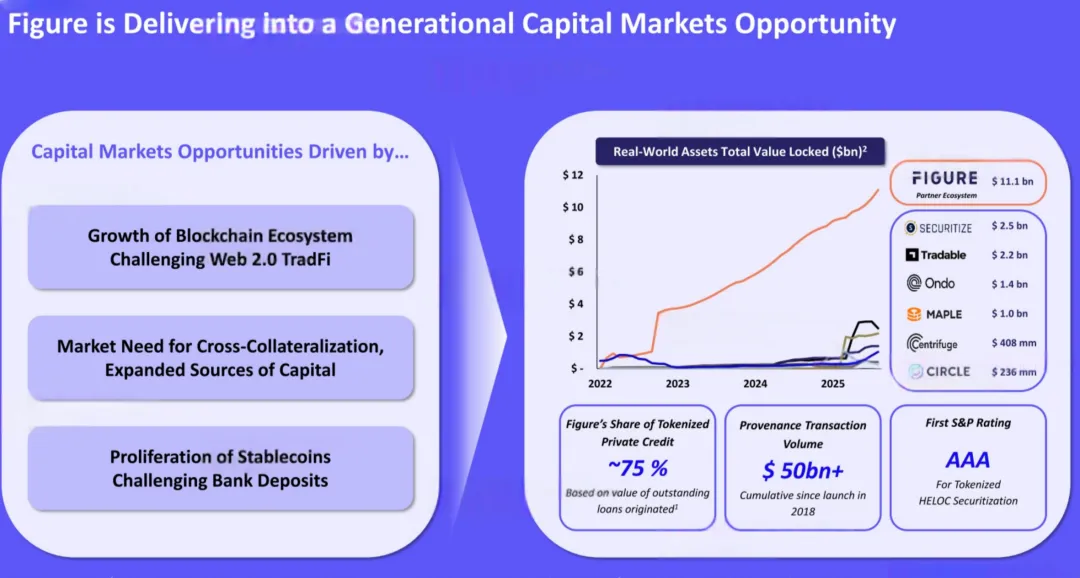

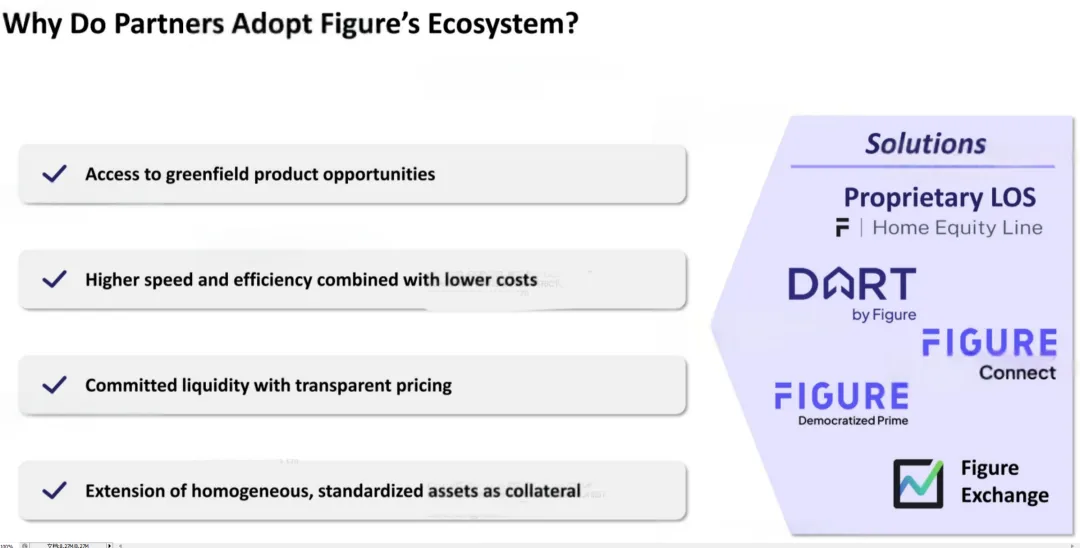

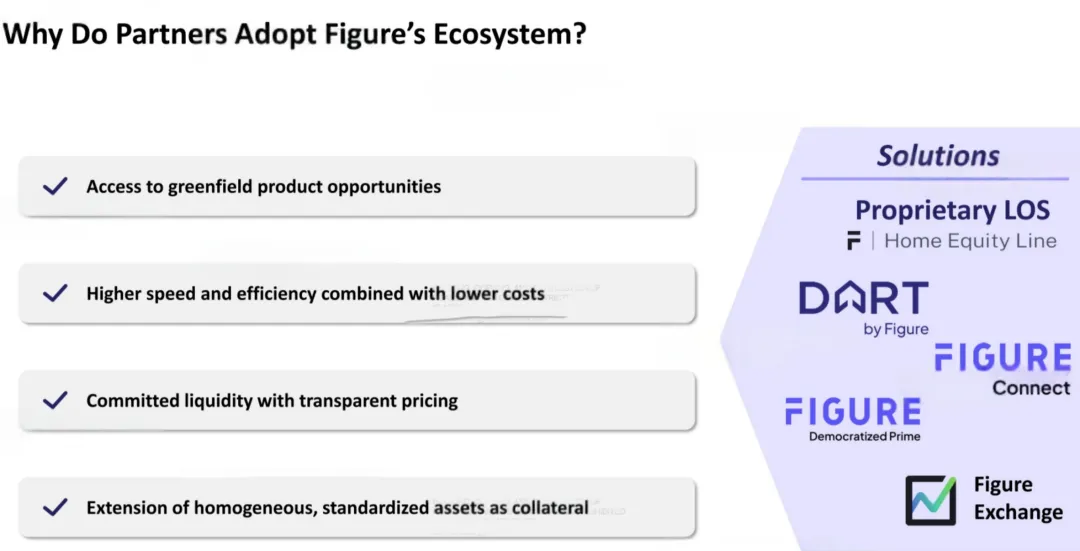

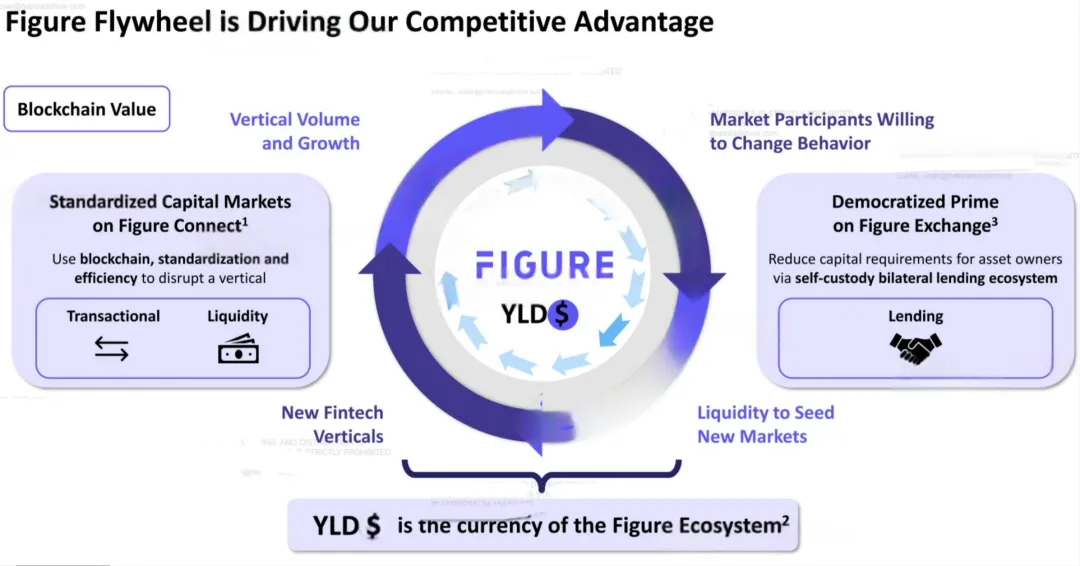

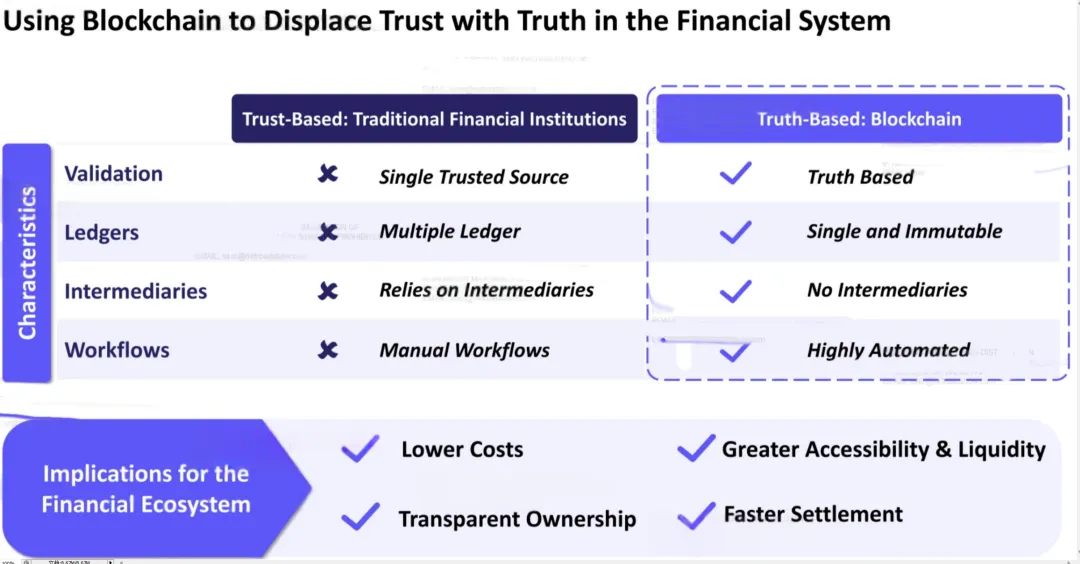

Figure co-founder Mike Cagney said his blockchain business is poised for significant opportunities. “If you think about the stock market, there are seven parties involved between the buyer and the seller in each transaction. Blockchain can reduce that to two.”

This marks another cryptocurrency company to go public, following Circle, the first stablecoin company, and Bullish, the first regulated exchange. Cryptocurrency exchange Gemini will be listed on the Nasdaq tonight.

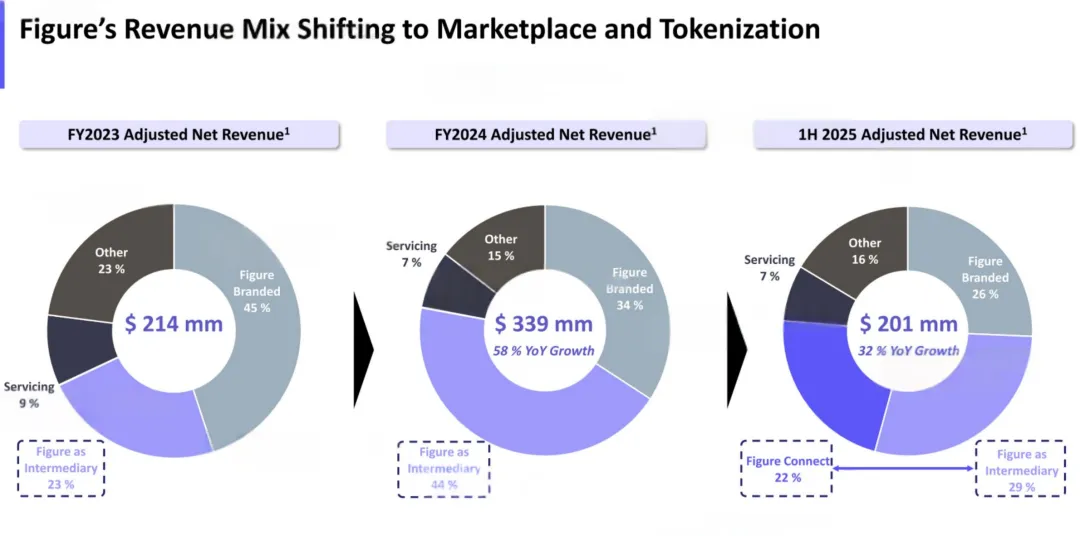

First-half revenue of US$341 million

Figure was founded in 2018 by Mike Cagney, co-founder of SoFi. Cagney was a member of the founding team of online lending platform SoFi and served as CEO until his departure in 2018. This background has given Figure a strong fintech foundation.

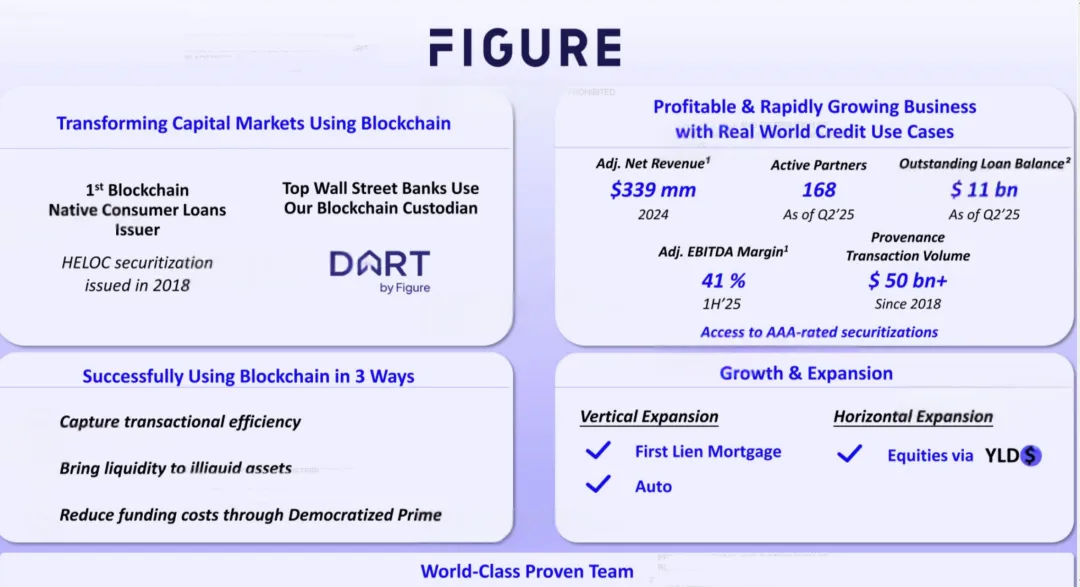

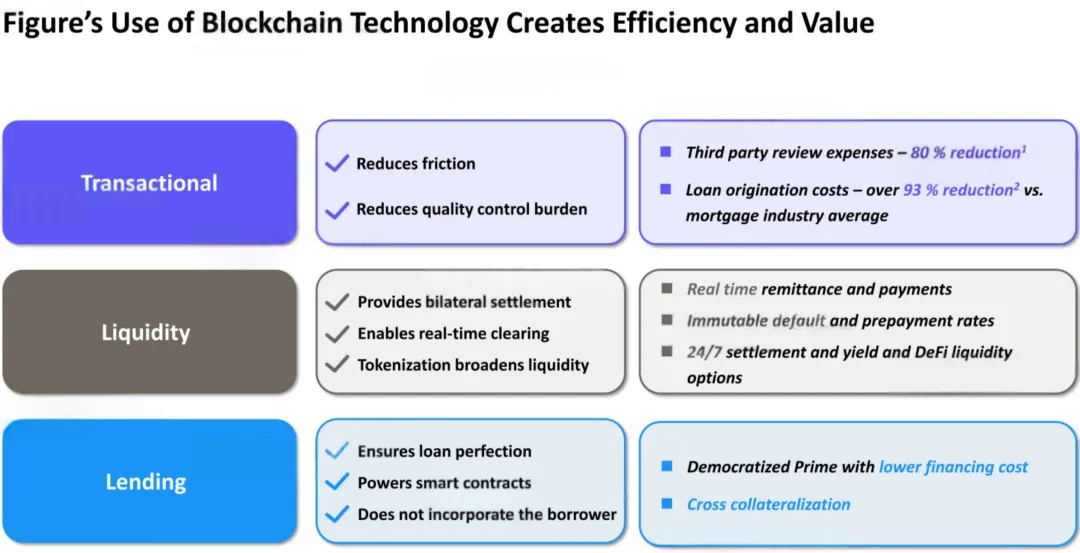

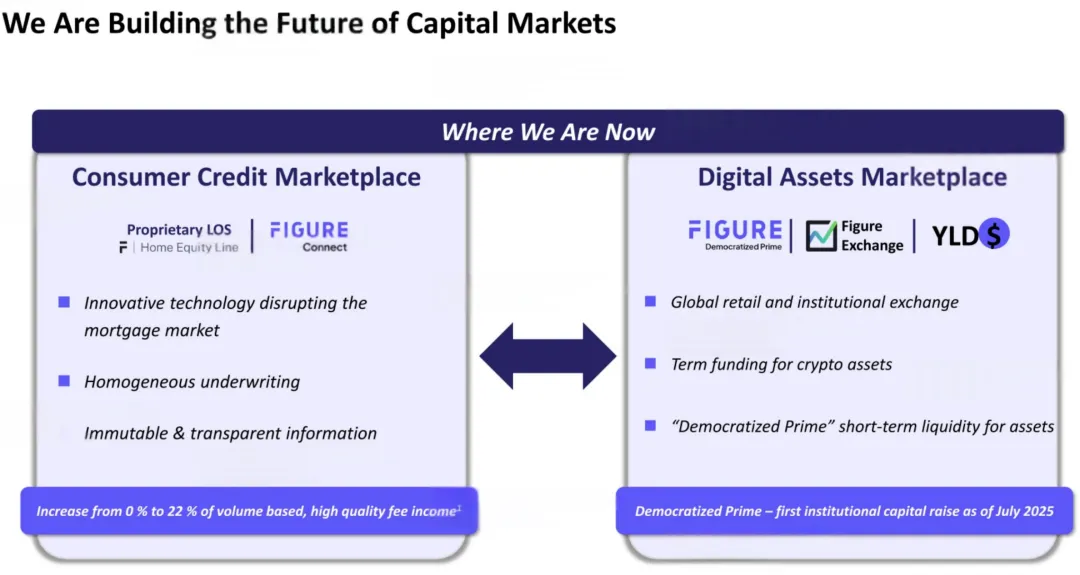

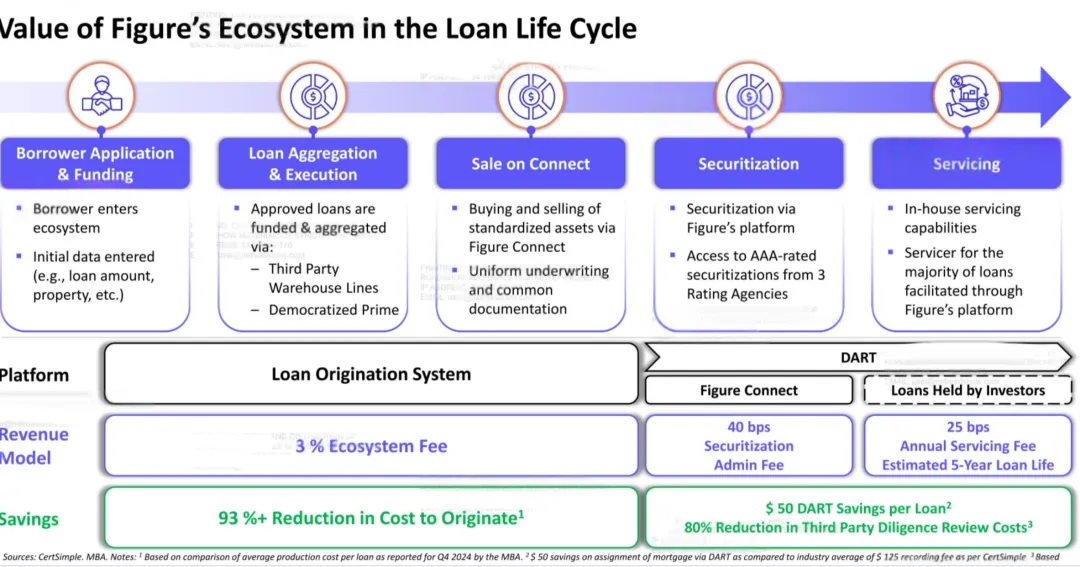

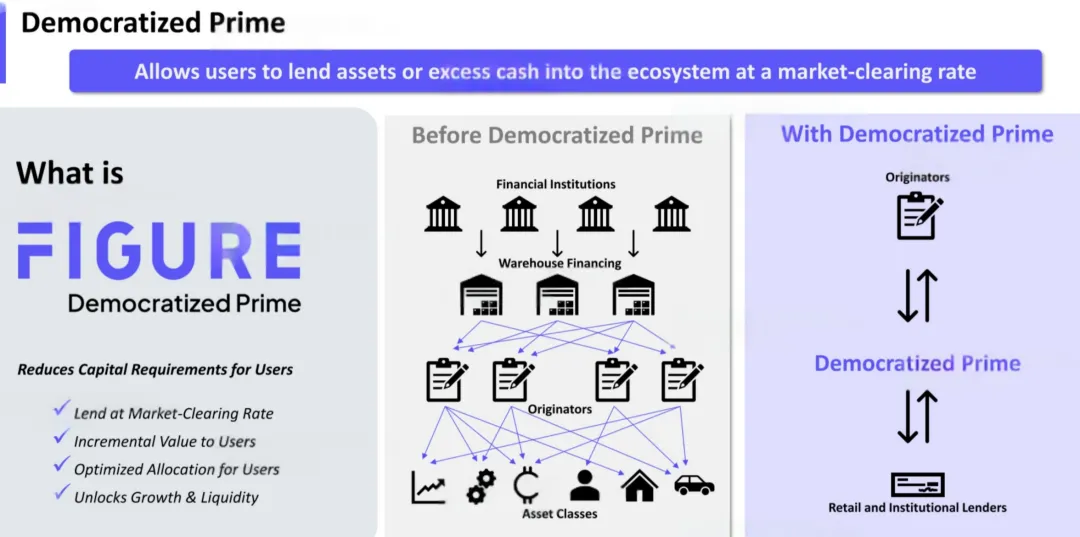

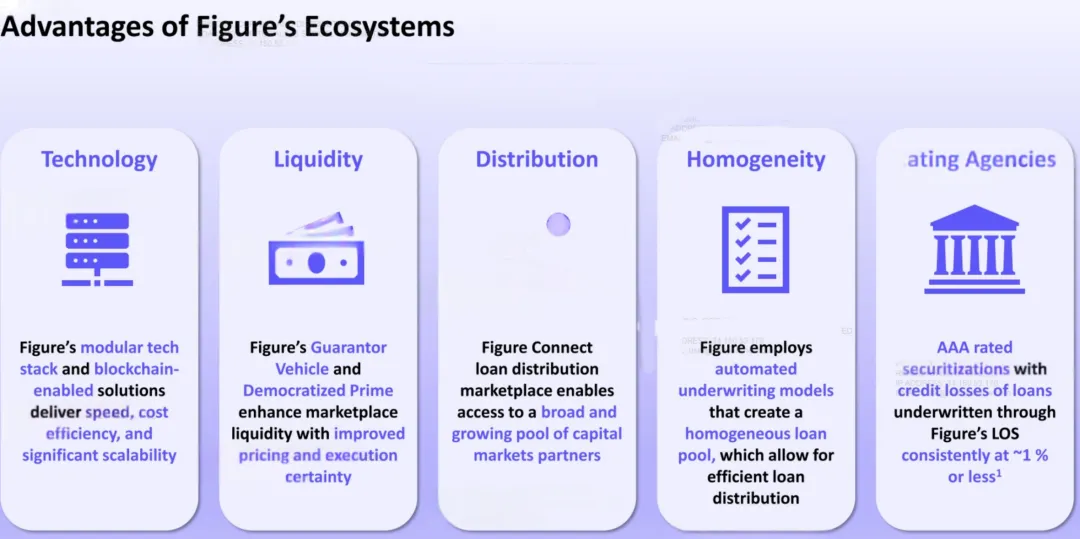

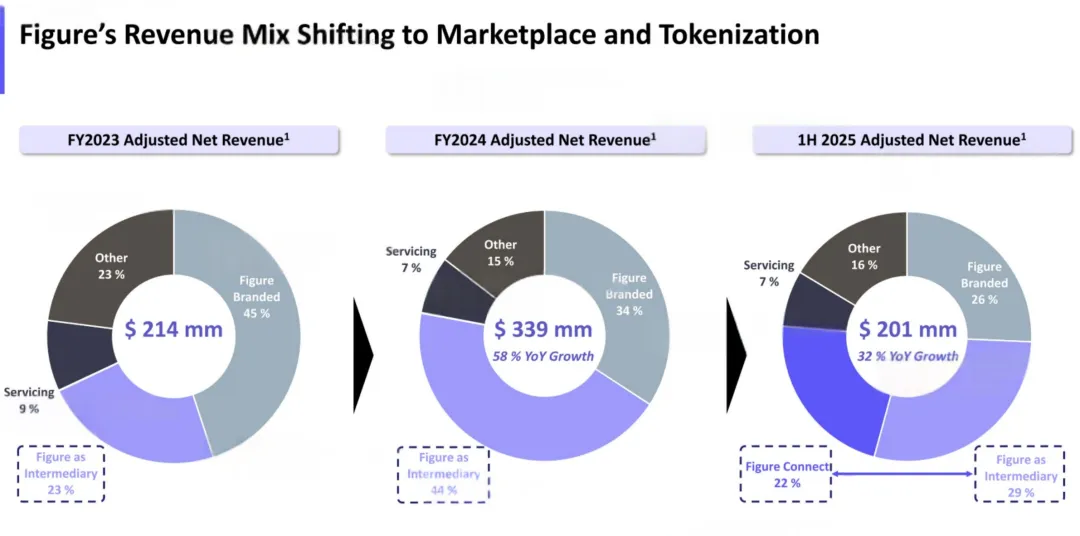

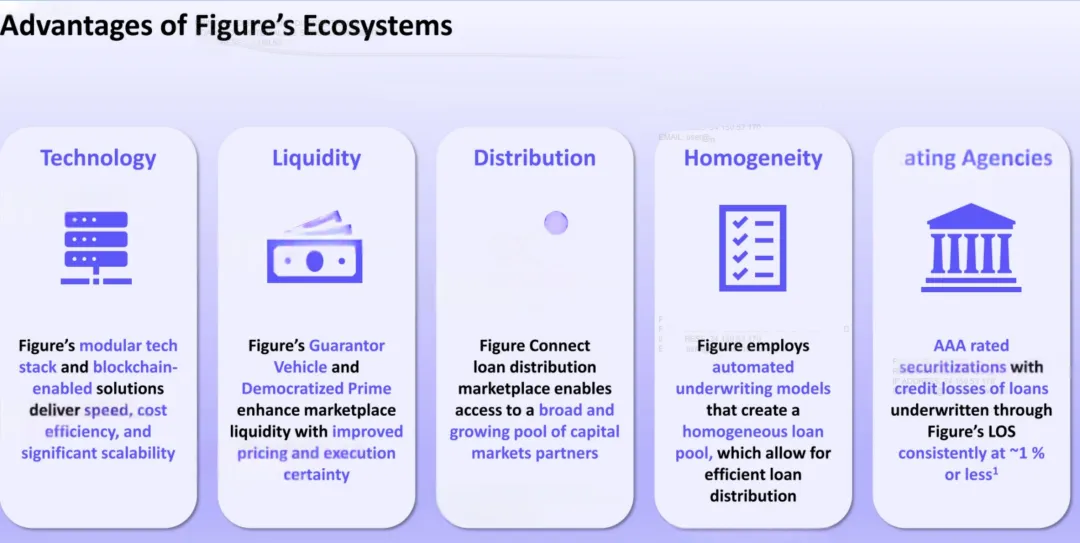

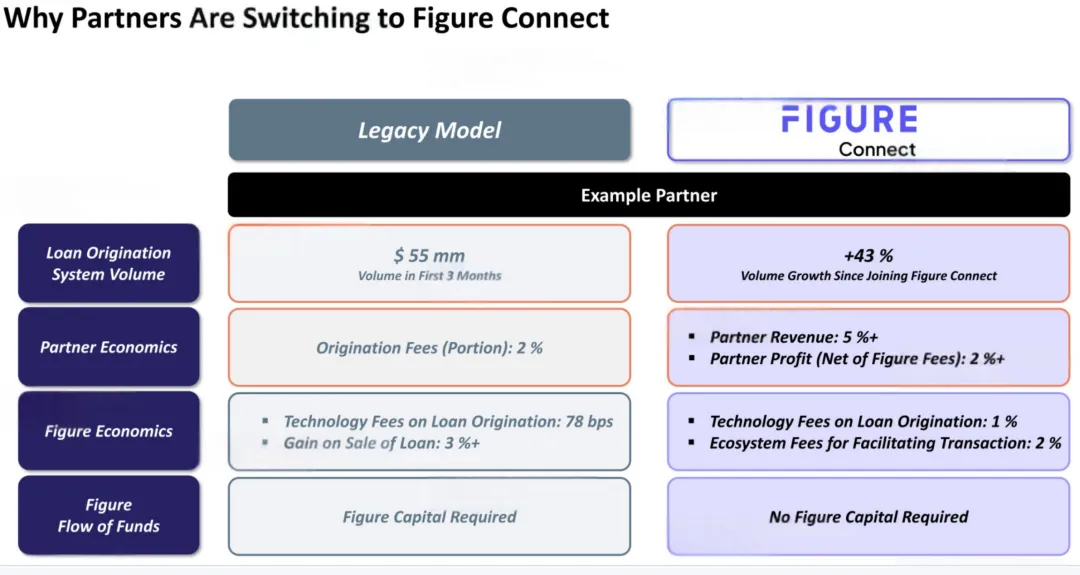

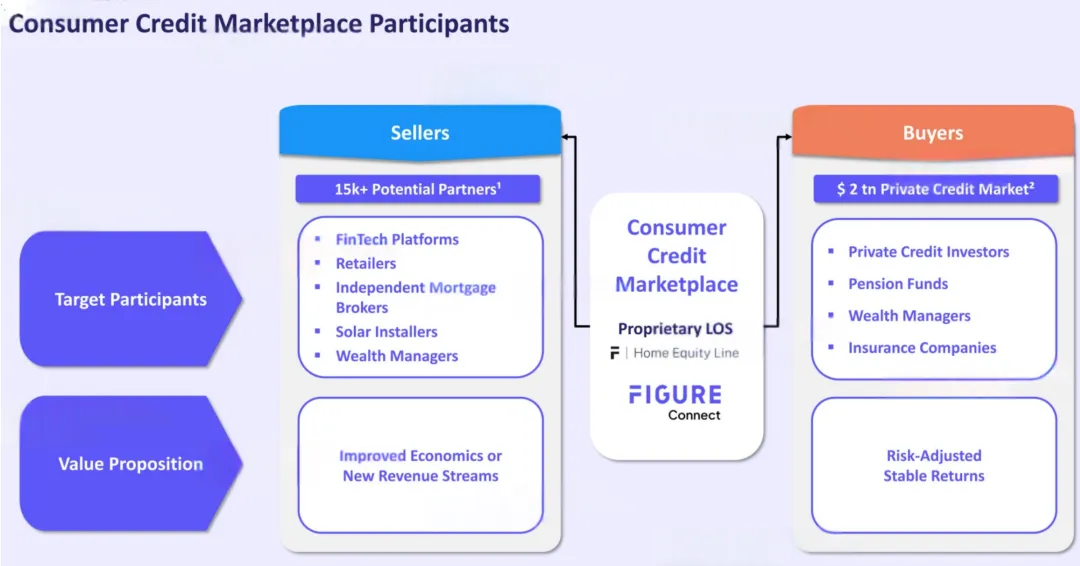

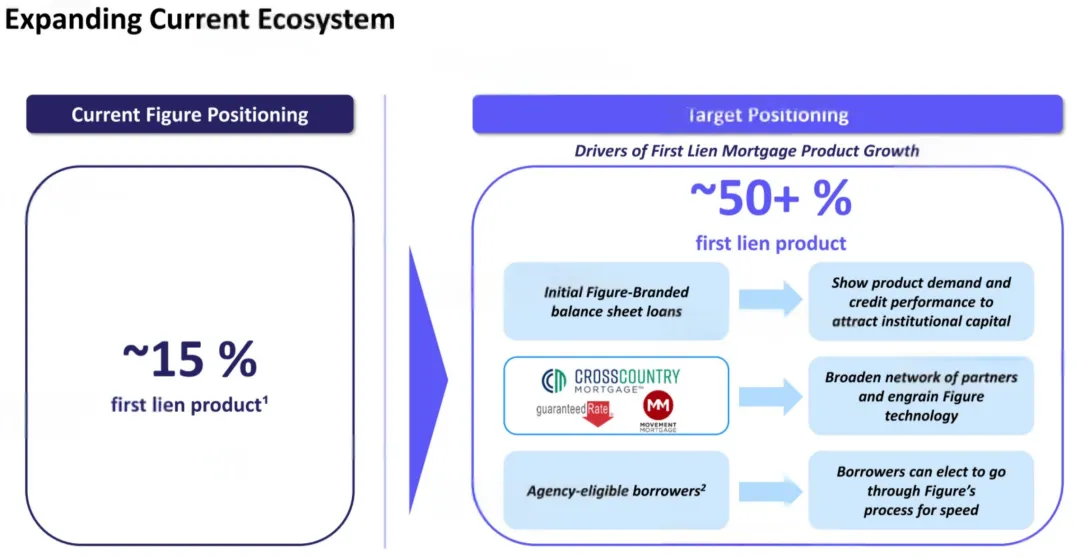

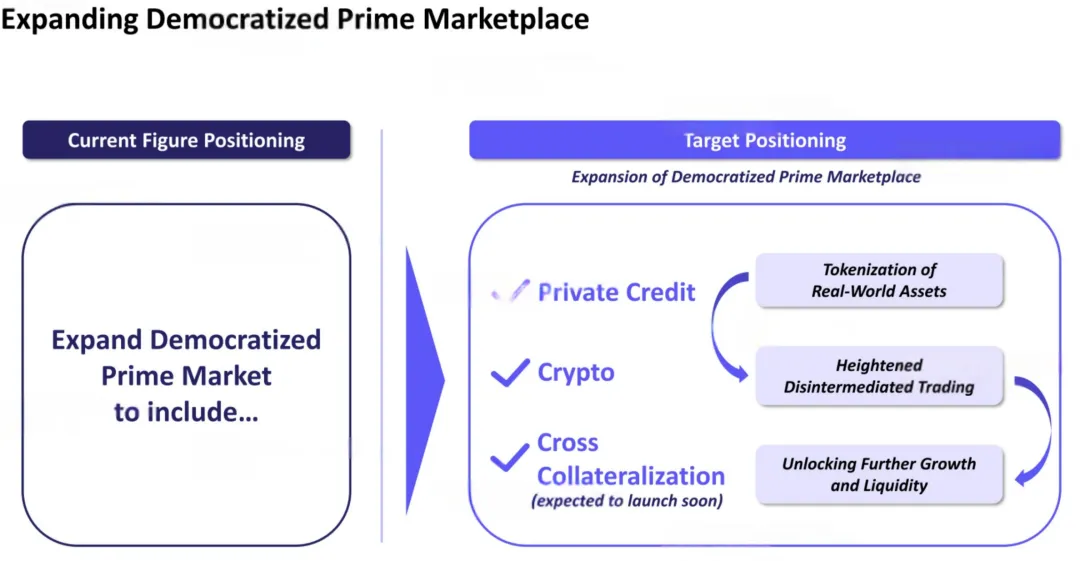

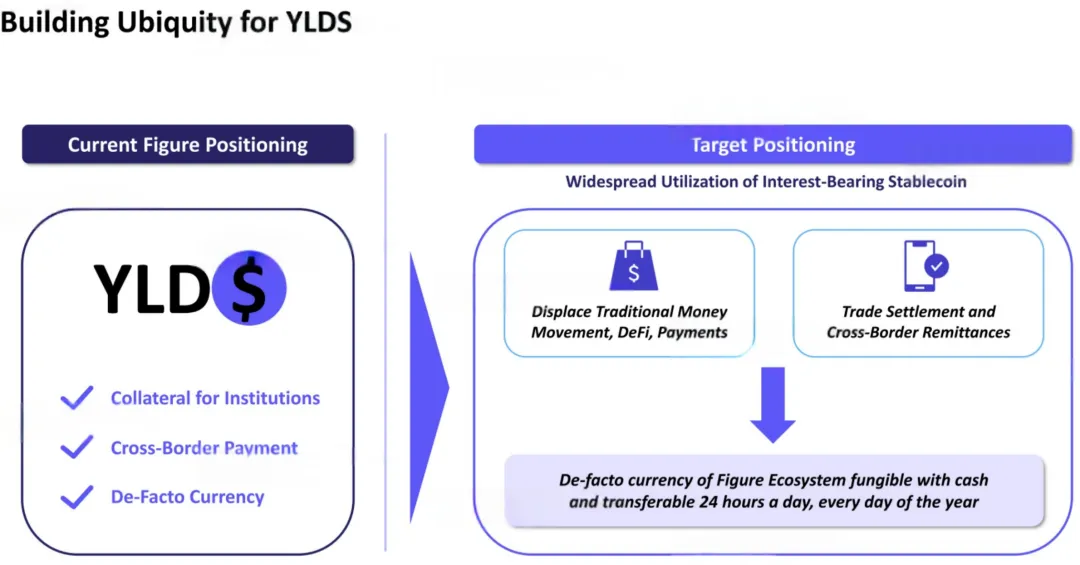

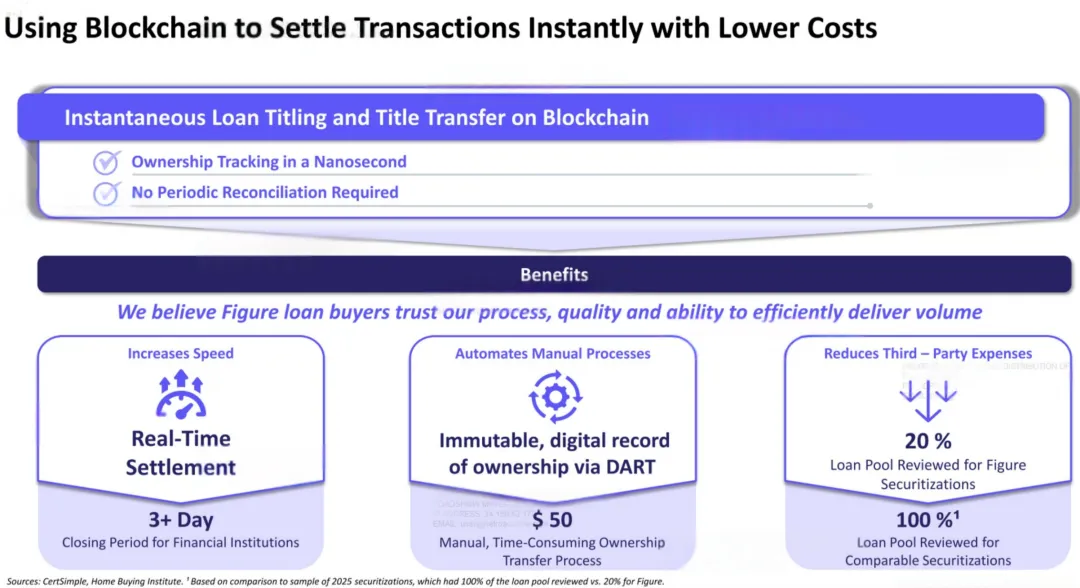

Figure's core business is developing blockchain technology to facilitate lending.

Figure is leveraging artificial intelligence to optimize its business processes. The company uses OpenAI technology to assist in evaluating loan applications and has deployed a chatbot powered by Gemini, a subsidiary of Google's parent company, Alphabet, on its website.

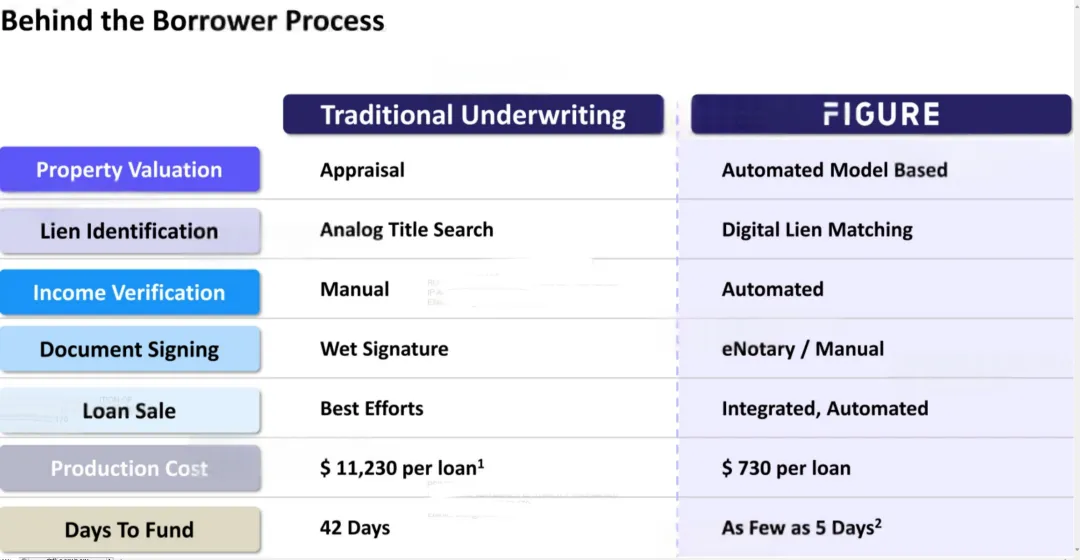

Figure's initial focus was on home equity loans (HELOCs). This is the most common financing method for US residents, but the traditional process is cumbersome, taking an average of over 40 days. Using its proprietary Provenance blockchain, Figure has shortened the approval process to approximately 10 days.

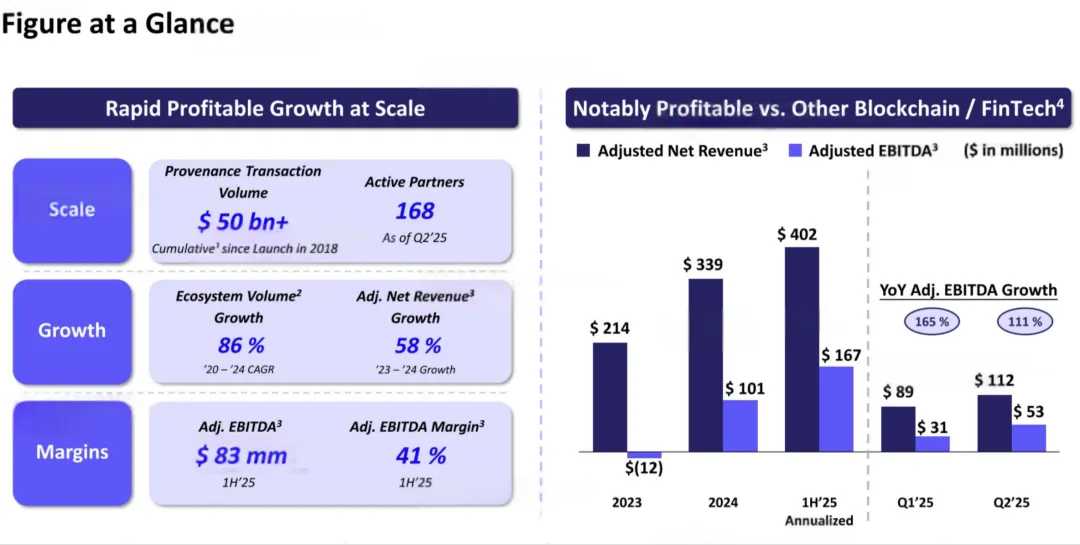

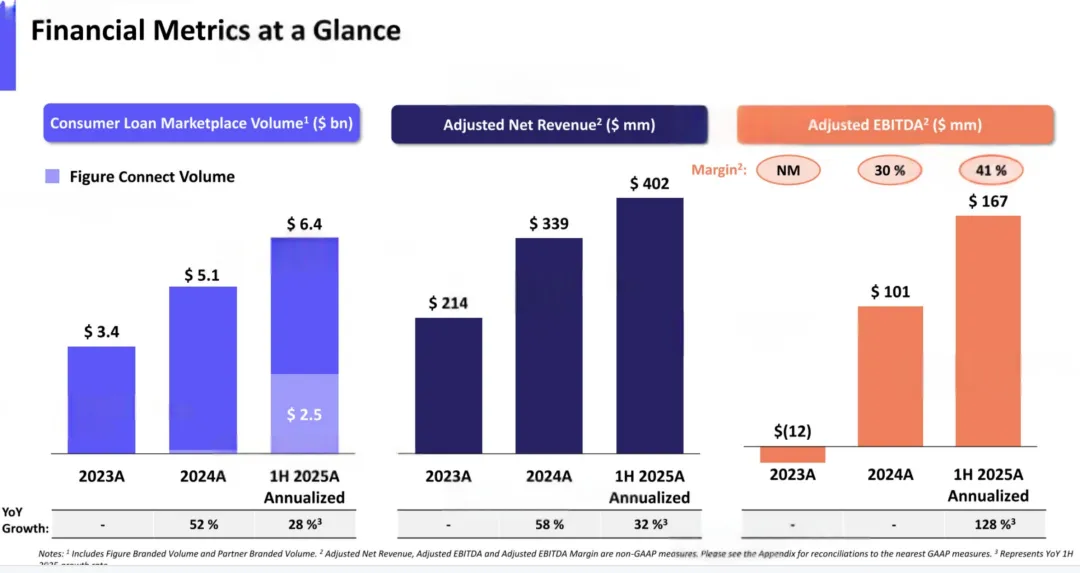

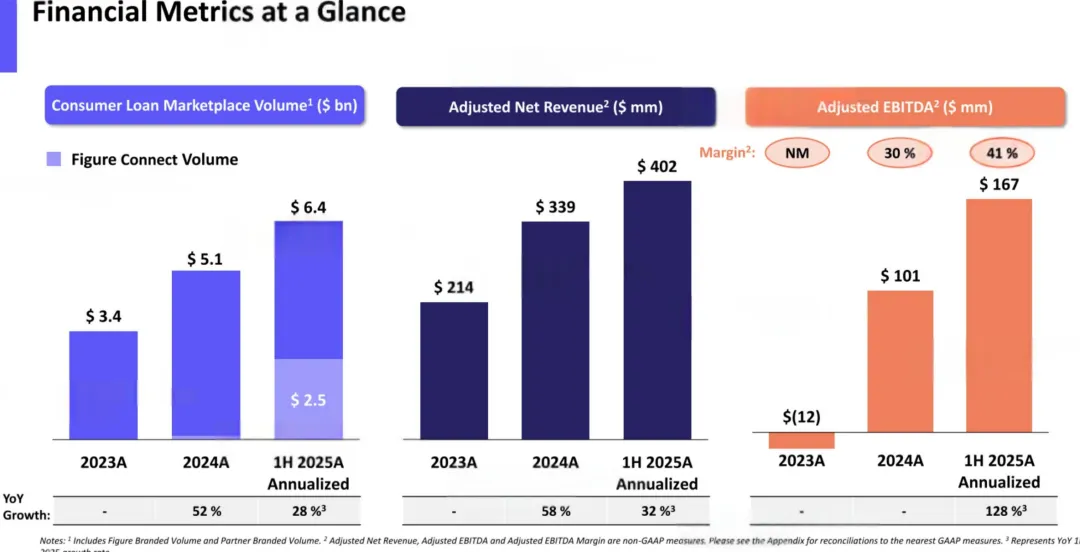

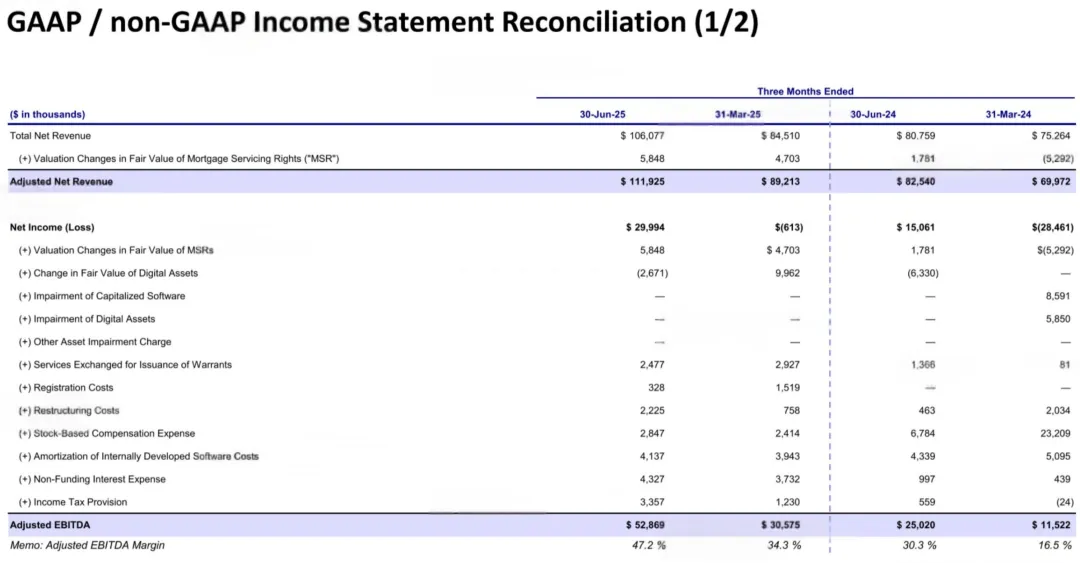

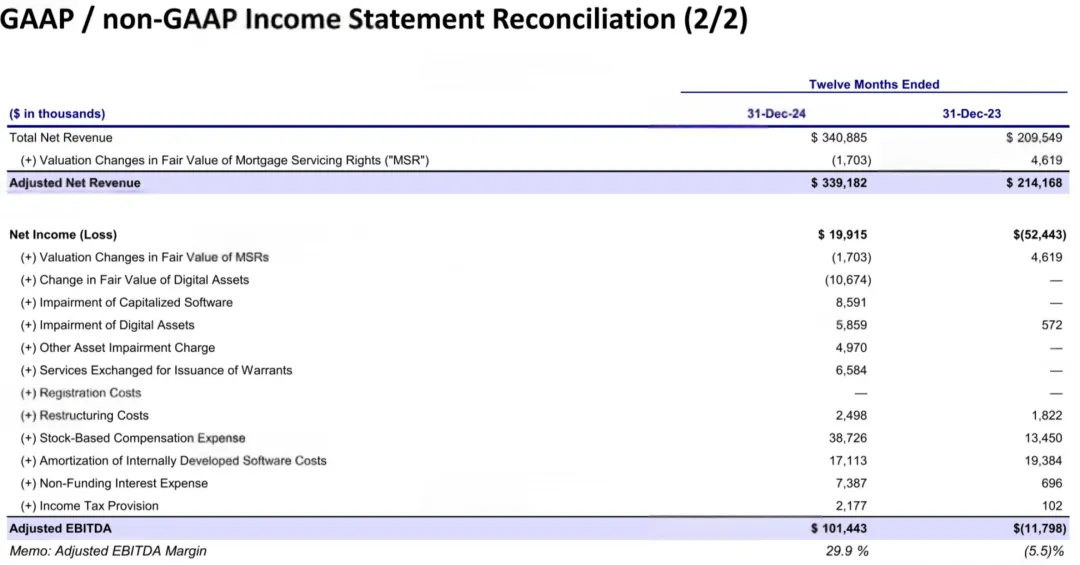

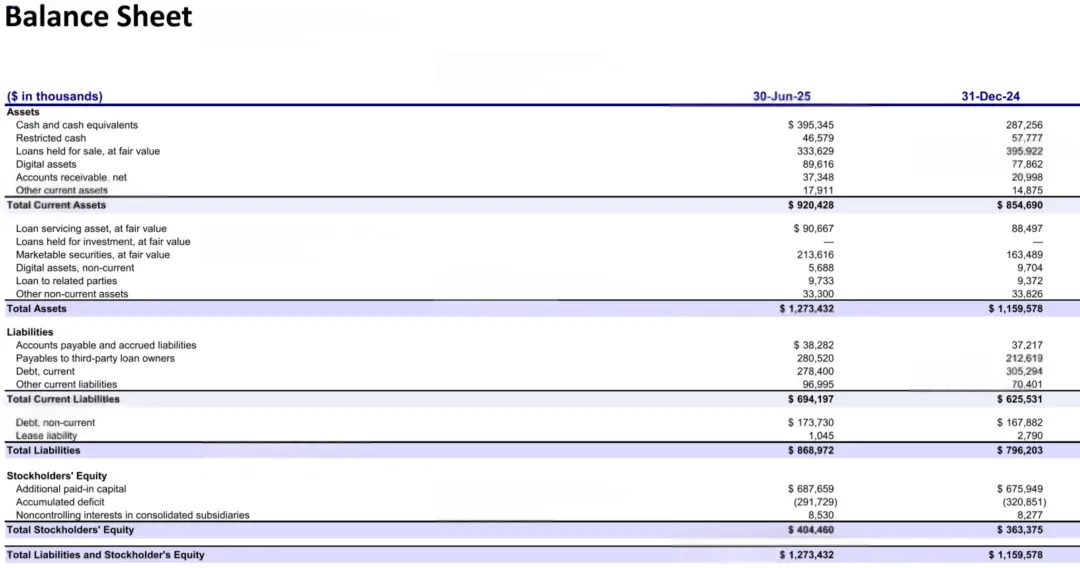

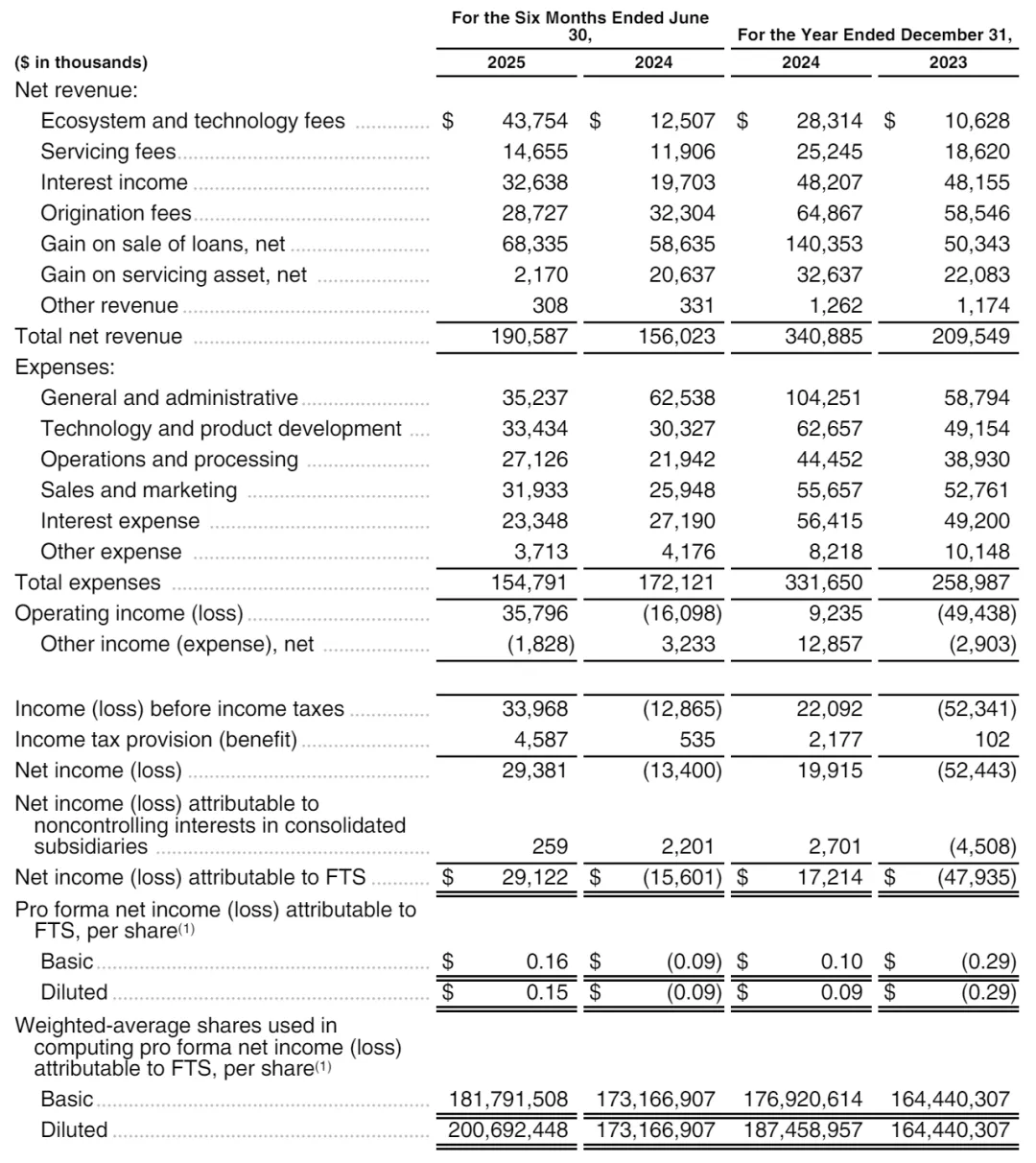

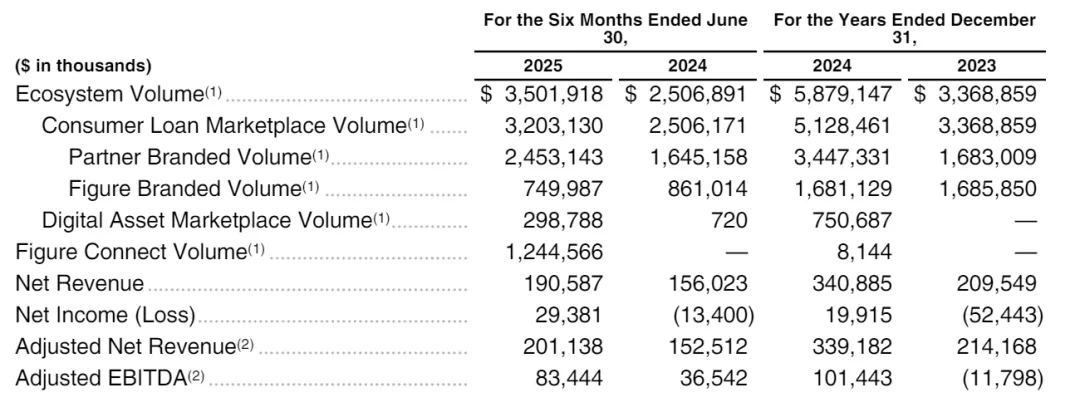

The prospectus shows that Figure's revenue in 2023 and 2024 will be US$210 million and US$341 million respectively; operating profit will be US$-49.44 million and US$9.24 million respectively; and net profit will be US$-52.44 million and US$19.92 million respectively.

Figure's revenue in the first half of 2025 was $191 million, up 22.4% from $156 million in the same period last year. Its main revenue came from proceeds from loan sales, with proceeds from lending reaching $68.34 million in the first half of 2025, compared to $58.64 million in the same period last year.

Figure's ecosystem and technology expenses in the first half of 2025 were US$43.75 million, compared with US$12.51 million in the same period last year; interest income was US$32.64 million, compared with US$19.70 million in the same period last year.

Figure's net profit in the first half of 2025 was US$29.38 million, compared with a net loss of US$13.4 million in the same period last year; adjusted EBITDA was US$83.44 million, compared with US$36.54 million in the same period last year.

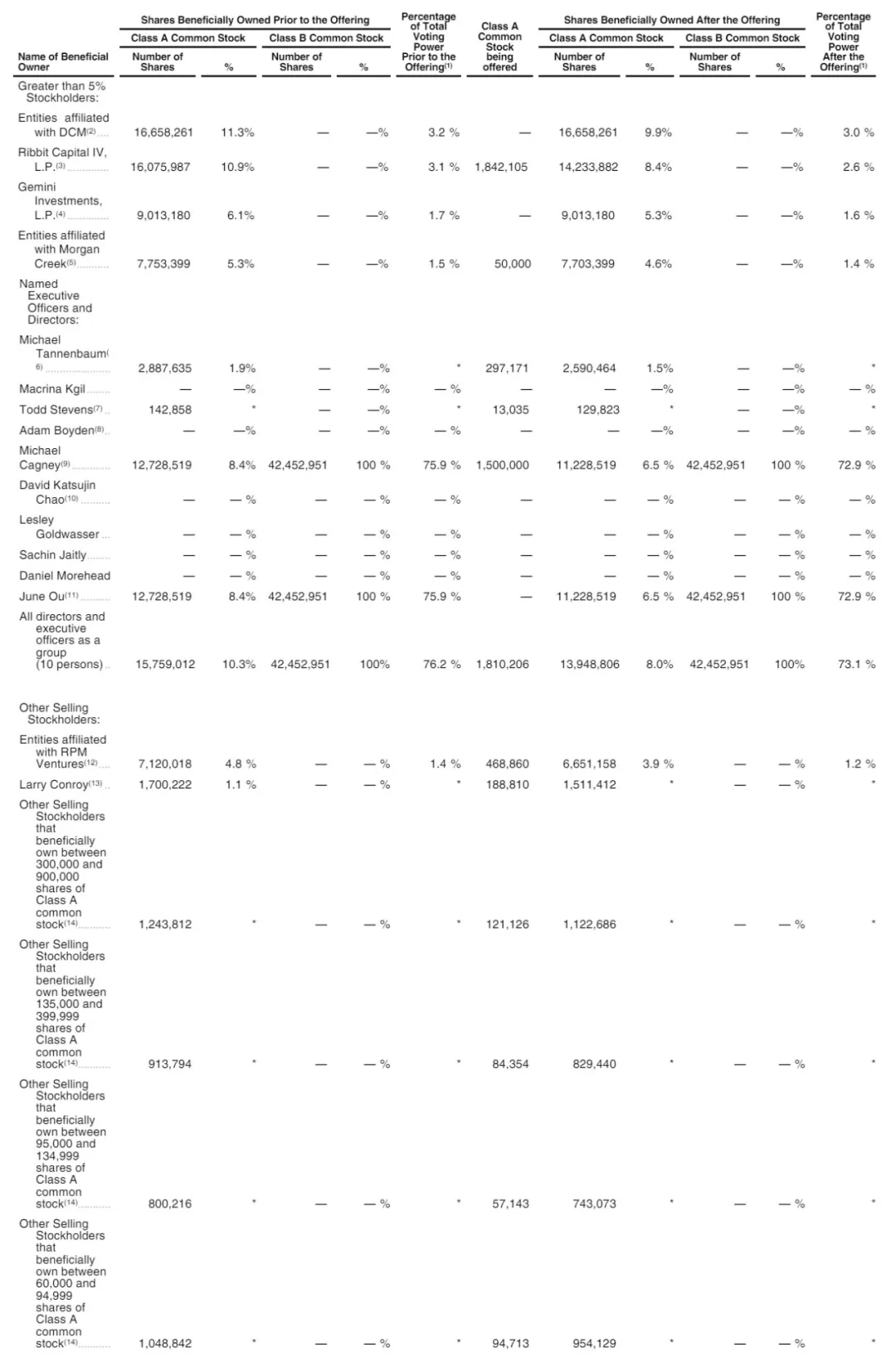

DCM and Ribbit Capital are shareholders

Before the IPO, DCM held 11.3% of Class A shares and 3.2% of voting rights; Ribbit Capital held 10.9% of Class A shares and 3.1% of voting rights;

Gemini Investments holds 6.1% of Class A shares and has 1.7% of voting rights; Morgan Creek holds 5.3% of Class A shares and has 1.5% of voting rights.

Michael Cagney holds 8.4% of Class A shares and 100% of Class B shares, with 75.9% of the voting rights; RPM holds 4.8% of Class A shares and 1.4% of the voting rights; Larry Conroy holds 1.1% of Class A shares.

After the IPO, DCM holds 9.9% of Class A shares and has 3% of voting rights; Ribbit Capital holds 8.4% of Class A shares and has 2.6% of voting rights;

Gemini Investments holds 5.3% of Class A shares and has 1.6% of voting rights; Morgan Creek holds 4.6% of Class A shares and has 1.4% of voting rights.

Michael Cagney holds 6.5% of Class A shares and 100% of Class B shares, with 72.9% of the voting rights; RPM holds 3.9% of Class A shares and 1.2% of the voting rights.

Figure Roadshow PPT