Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

As Trump and Vance delivered dovish rhetoric on the US-China trade war, both US stock futures and the crypto market rebounded. This plunge is seen as a key turning point in the crypto market cycle, with deep deleveraging effectively releasing previously accumulated systemic risks. According to Glassnode data, crypto funding rates have fallen to their lowest level since the 2022 bear market. This marks one of the most significant leverage resets in the crypto market's history, demonstrating that excessive speculative activity has been systematically eliminated. Matrixport analysis indicates that this "capitulation sell-off" is of historic significance, completely reshaping the entire crypto market's position structure, virtually eliminating excessive leverage and benefiting only a very small number of traders. With volatility gradually receding, market signs suggest that new long positions are likely to be reestablished.

However, market uncertainty persists due to the ongoing US government shutdown. The federal government has initiated large-scale layoffs, and the Bureau of Labor Statistics has announced that it will postpone the release of the September CPI report until October 24th. The US government shutdown is currently reaching a critical juncture. Goldman Sachs' chief US political strategist, Alec Phillips, predicts that the shutdown is unlikely to extend beyond military payday on October 15th. Trump also stated that he has instructed Secretary of Defense Hegseth to "mobilize all available funds" to ensure that military payroll is paid on time during the shutdown. Meanwhile, there are many market events to watch this week. Federal Reserve Chairman Powell will deliver a speech early Wednesday morning Beijing time, expected to provide guidance on the economic and monetary policy outlook. Philadelphia Fed President Henry Paulson, a 2026 FOMC voting member, will also speak. The Federal Reserve will release its Beige Book on economic conditions. Federal Reserve Governor Waller will speak. The third-quarter earnings season for US stocks will also officially begin.

Bitcoin has returned to $115,000, with its market capitalization share rising back to over 59%. According to crypto analyst Mister Crypto, Bitcoin is retesting the golden cross, a bullish technical pattern that historically precedes gains and could trigger a significant rebound. Cathie Wood's ARK Invest's latest report states that Bitcoin's fundamentals remain solid, with network activity and profitability indicating strong demand and no signs of selling from long-term holders. Mid-sized investors are increasing their holdings, while selling pressure from large holders is easing, indicating a healthier market structure. Institutional adoption continues to accelerate, with trusts and spot ETFs collectively holding approximately 12.2% of the Bitcoin supply, demonstrating its deepening integration with traditional markets. Macroeconomic factors such as controlled inflation, weakening employment, and a shift in Federal Reserve policy may provide support for Bitcoin. ARK also cautions that 2025 may bring greater volatility, but the long-term outlook remains positive. On-chain data analyst Murphy noted that Bitcoin whales continue to increase their holdings, showing a clear trend of buying as prices dip. While the decline on October 11th was drastic, the psychological impact on major holders was far less than the two macroeconomic events of April this year and August last year, and the rate of capital outflow was also more moderate than in previous episodes. Furthermore, with the continued influx of large capital, the Bitcoin market has become more mature overall, and its response to unexpected events is no longer blind panic or a stampede. This is the beginning of a major bull-to-bear cycle, and the fundamentals of the bull market remain unchanged. The biggest market uncertainty currently lies with Trump, whose volatile policies could trigger short-term volatility.

Ethereum's rebound above $4,100 has seen many whales re-entering their positions. BitMine is suspected of buying 128,000 ETH, worth approximately $480 million, following the market crash. Furthermore, on-chain analyst Eye revealed that the whale who previously sold over $4.23 billion worth of BTC for ETH may be connected to Garrett Jin, a former exchange executive.

Most altcoins are undervalued, with the Altcoin Seasonal Index currently down to 41. DeFiance Capital researcher Kyle warned that this crash could be a cycle-ending event, and many altcoin projects may never recover from the failure. Crypto trader Eugene noted that the altcoin market is over for the foreseeable future. The scale of this wealth destruction, as well as the manner in which it was executed, will leave a lasting impression on participants. However, structural factors remain in the crypto market. Based on on-chain data, the popularity of BNB Chain remains undimmed, with the price of BNB rebounding sharply to previous highs. On-chain trading may once again become a market focus and a preferred destination for capital.

It's worth noting that institutions are believed to be the ones paying for the largest margin call in crypto history. Edward Chin, CEO of crypto hedge fund Parataxis, expressed his suspicion that he would hear about fund liquidations or market makers suffering heavy losses in the coming days or weeks, suggesting the market is poised for a new wave of bankruptcies.

2. Key Data (as of 13:00 HKT, October 10)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin: $114,745 (+22.90% YTD), daily spot trading volume $91.7 billion

- Ethereum: $4,135 (+23.63% YTD), with a daily spot trading volume of $55.8 billion

- Fear and Corruption Index: 38 (panic)

- Average gas: BTC: 1sat/vB, ETH: 0.131Gwei

- Market share: BTC 58.8%, ETH 12.8%

- Upbit 24-hour trading volume rankings: XRP, ETH, BTC, SOL, ZKC

- 24-hour BTC long-short ratio: 48.62%/51.38%

- Sector gains and losses: AI sector rose 22.07%, Layer2 sector rose 14.56%

- 24-hour liquidation data: A total of 181,455 people were liquidated worldwide, with a total liquidation amount of US$605 million, including US$121 million in BTC, US$218 million in ETH, and US$43.54 million in SOL.

- BTC medium- and long-term trend channel: upper channel line ($118,440), lower channel line ($116,095)

- ETH medium- and long-term trend channel: upper line of the channel ($4281), lower line ($4196)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price is within the range or repeatedly passes through the cost range in the short term, it is in a bottoming or topping state.

3. ETF flows (as of October 10)

- Bitcoin ETF: -$4.5 million

- Ethereum ETF: -$175 million

4. Today's Outlook

- Portal to Bitcoin launched on the mainnet today

- CME Group plans to launch SOL and XRP futures options on October 13

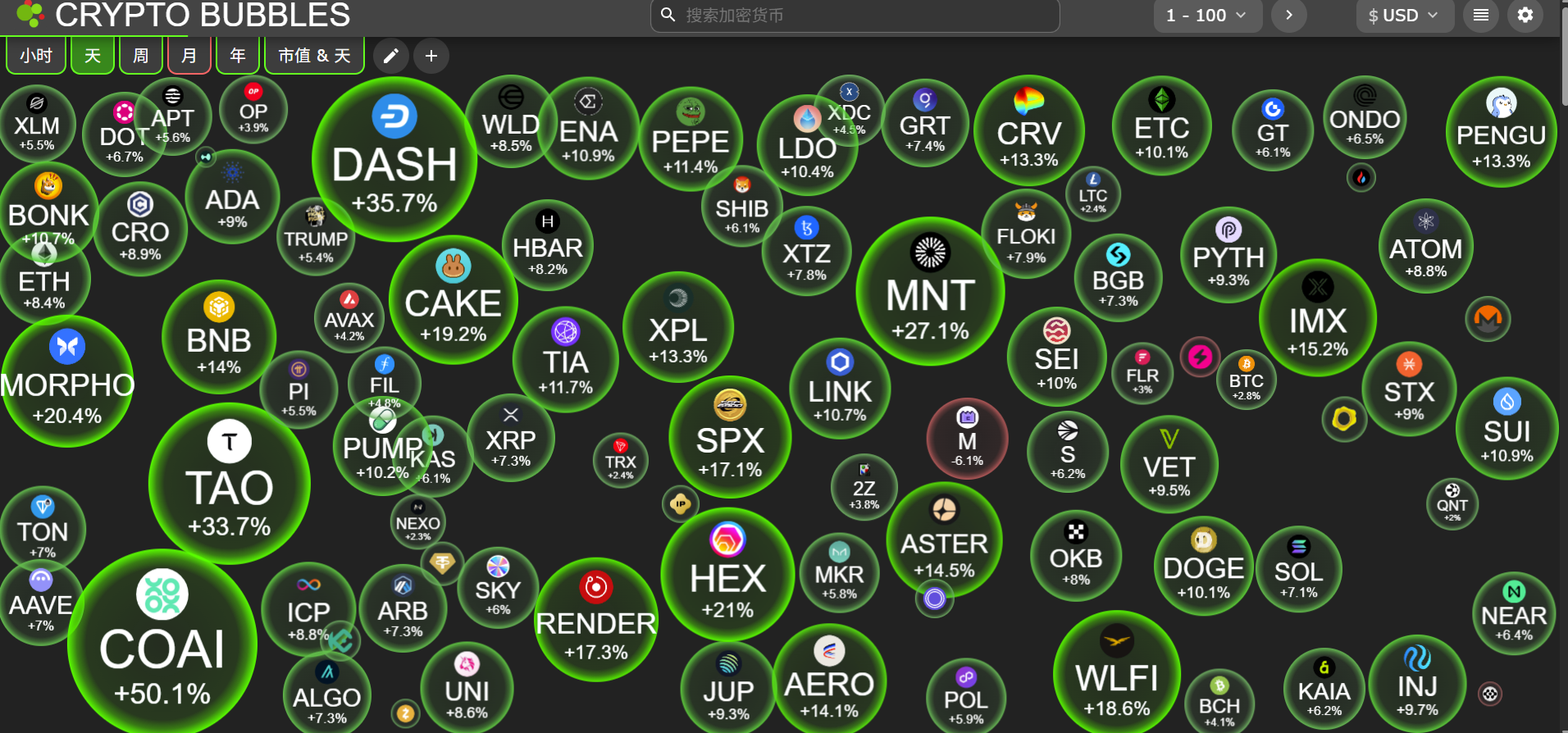

The largest increases in the top 100 cryptocurrencies by market capitalization today: COAI up 53.8%, DASH up 35.7%, TAO up 33.7%, MNT up 27.1%, and HEX up 21%.

5. Hot News

- Binance: $283 million in compensation paid for de-pegging of wealth management products; total compensation is still being calculated and processed

- Forbes: Trump is one of the largest Bitcoin investors in the United States, holding about $870 million in Bitcoin

- Microsoft Defender vulnerability could bypass authentication and upload malicious files

- The total stablecoin supply has risen to an all-time high of $301.5 billion

- The USST line launched by STBL, a stablecoin project under Tether Lianchuang, continues to decouple

- Circle: No plans to issue a Hong Kong-denominated stablecoin, but open to cooperation on Hong Kong dollar stablecoins

- Garrett Jin, a major investor, claims he has "nothing to do with the Trump family" and that the transactions involved are "not insider information."

- Crypto funding rates have fallen to their lowest point since the 2022 crash

- Base Lianchuang: A certain CEX's listing fee is as high as 9% of the total token supply, calling for permissionless on-chain listings