1. Attention Value-Market Key Points

1. Market conditions

(1) Macro environment:

l Former Fed Vice Chairman Quarles: Trump's election will not affect the independence of the Fed and economic stability

Former Federal Reserve Vice Chairman Randall Quarles said that even if Donald Trump is re-elected as president, the independence of the Federal Reserve, the level of inflation and the labor market will not be threatened. He pointed out that there are misunderstandings about the independence of the Federal Reserve, emphasizing that the president can comment on the Fed's policies, but this does not mean that the Fed will lose its independence. Quarles, who served as Vice Chairman of Supervision during Trump's tenure, mentioned that tariffs themselves will not directly lead to inflation, but may prompt the Federal Reserve to lower interest rates. In addition, he expects a large number of illegal immigrants to be deported after Trump's election, but this will not have a significant impact on the labor market. Quarles' comments coincide with the release of a consumer price index report, which may show that potential inflation in the United States will only cool slightly at the end of 2024 against the backdrop of a strong job market and a solid economy, which may support the Federal Reserve to take a cautious approach to future interest rate cuts.

(2) Web3 field:

Fidelity Digital Assets Report: Ethereum has a clear long-term advantage, while Solana has an eye-catching short-term performance

Fidelity Digital Assets pointed out in its 2025 Outlook report that Ethereum has a clear advantage in the long term and also acknowledged Solana's rapid growth. The report emphasized that Ethereum's strong fundamentals, such as developer activity, TVL, and stablecoin supply, support its long-term prospects. Although Solana's revenue and TVL are growing faster, Fidelity believes that most of its revenue comes from Meme coin transactions, and this dependence is seen as a cyclical trend that performs well in bull markets but may weaken in bear markets. The report further pointed out that Solana's reliance on Meme coins has similarities with Ethereum's use of Uniswap, but Fidelity believes that Ethereum's fundamentals are less linked to speculation and are therefore more stable in the long run. Fidelity said that short-term price trends are often influenced by narratives and mentioned that both networks are planned to upgrade. Solana's Firedancer upgrade aims to significantly increase transaction speeds, while Ethereum's Prague/Electra (Pectra) upgrade focuses on enhancing functionality, scalability, and user security. However, Fidelity believes that the Pectra upgrade may not attract widespread interest from the community as it has no direct impact on ETH’s value proposition from an investment perspective.

2. Hot events

(1) Macro environment:

Italian bank Intesa Sanpaolo invests in Bitcoin for the first time, buying 11 coins worth about 1 million euros

Italy's largest banking group, Intesa Sanpaolo, has made its first investment in cryptocurrency, buying 11 bitcoins for a total value of about 1 million euros (about $1 million). The information was initially leaked on an online forum and then officially confirmed by the bank's press department. Although Intesa Sanpaolo confirmed the deal, it did not reveal the motivation for the investment or its future cryptocurrency strategy. The bank is relatively advanced in the field of blockchain and cryptocurrency, having partnered with Cassa Depositi e Prestiti SpA in July 2024 to pilot the issuance of $27.2 million in digital bonds on Polygon. The trend of large institutions investing in Bitcoin is becoming increasingly prominent, and software company MicroStrategy is a pioneer in this trend, having continued to buy Bitcoin for 10 consecutive weeks. Other institutions such as Metaplanet, the "Asian version of MicroStrategy," have also actively followed up, recently purchasing 237 bitcoins for $95,972.

(2) Web3 field:

Bitcoin price rebounds to $ 94,000 as Trump signs executive order supporting cryptocurrency

Bitcoin price rebounded to $94,000 following news that Donald Trump is set to sign pro-cryptocurrency executive orders on his first day in office. The orders could overturn key regulatory measures, including the SEC’s Accounting Bulletin 121 (SAB 121), which requires companies that hold customer cryptocurrencies to record those assets as liabilities on their balance sheets. According to The Washington Post, the orders are expected to address major challenges facing the cryptocurrency industry, such as banking restrictions and the controversial SAB 121. The bulletin has been criticized by the industry, and lawmakers have attempted to repeal it, but President Joe Biden vetoed the measure. The incoming Trump administration is expected to revisit the issue, as SAB 121 makes it more expensive and risky for banks to hold cryptocurrencies, making them less likely to offer crypto custody services to customers.

The cryptocurrency market rebounded strongly as the news broke, with Bitcoin falling to $89,000 but now climbing to $95,000; Ethereum also rebounded from below $3,000 to $3,100.

3. Hot topic narrative

l ANIME tokens will be launched soon: 50.5% will be allocated to the community Azuki and Animecoin join hands to create an open anime universe

According to official news, ANIME tokens will be launched on the Ethereum and Arbitrum platforms in January 2025, with 50.5% of the tokens allocated to the community. ANIME aims to promote the transformation of the anime ecosystem through cooperation with decentralized brands such as Azuki, making it a creative economy jointly owned by the community, aiming to provide participation opportunities for more than 1 billion anime fans. Community members participating in the token claim include Hyperliquid, Kaito and Arbitrum. Azuki also announced a partnership with the Animecoin Foundation to jointly promote the construction of an open anime universe. The Azuki community has demonstrated the unique value of Web3 for intellectual property incubation through decentralized brand building, the creation of more than 100 sub-communities, global events, and rich fan creations.

Influenced by this news, the Azuki series of NFTs generally rose, among which Azuki rose by 17.45% in a single day, Azuki Elementals rose by 20.25% in a single day, and Beanz rose by 22.86% in a single day.

2. Attention Value-Hot Projects

1. Project Introduction

l $AICC | AI | @aicceleratedao

- Project launched jointly by team members from Coinbase, Google, ai16z and other major players.

- Aiccelerate positions itself as a DAO that focuses on both investment and development. It focuses on promoting decentralized, open-source AI development and supporting high-potential projects in different ecosystems.

- The team is already hard at work developing the first AI agent and will share more information in the coming weeks.

- Arc has been invited to provide consulting services for Aiccelerate DAO, and the team has transferred 100% of AICC tokens directly to Arc Treasury. At the same time, the team plans to use 30% of AICC tokens to create AICC/ARC liquidity pairs, which will generate fees and return to Arc Treasury, which will be used to fund ecosystem programs and incentivize developer contributions. The remaining 70% of AICC tokens have been locked in a custody contract, with Arc Treasury as the beneficiary, and will be redeemed in a linear manner next year.

3. Attention Value-Sector Rotation

1. Hot topics

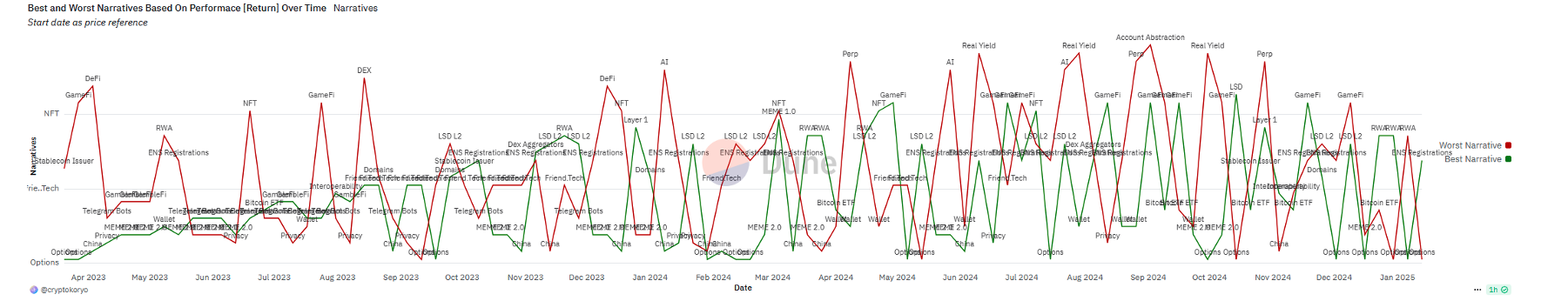

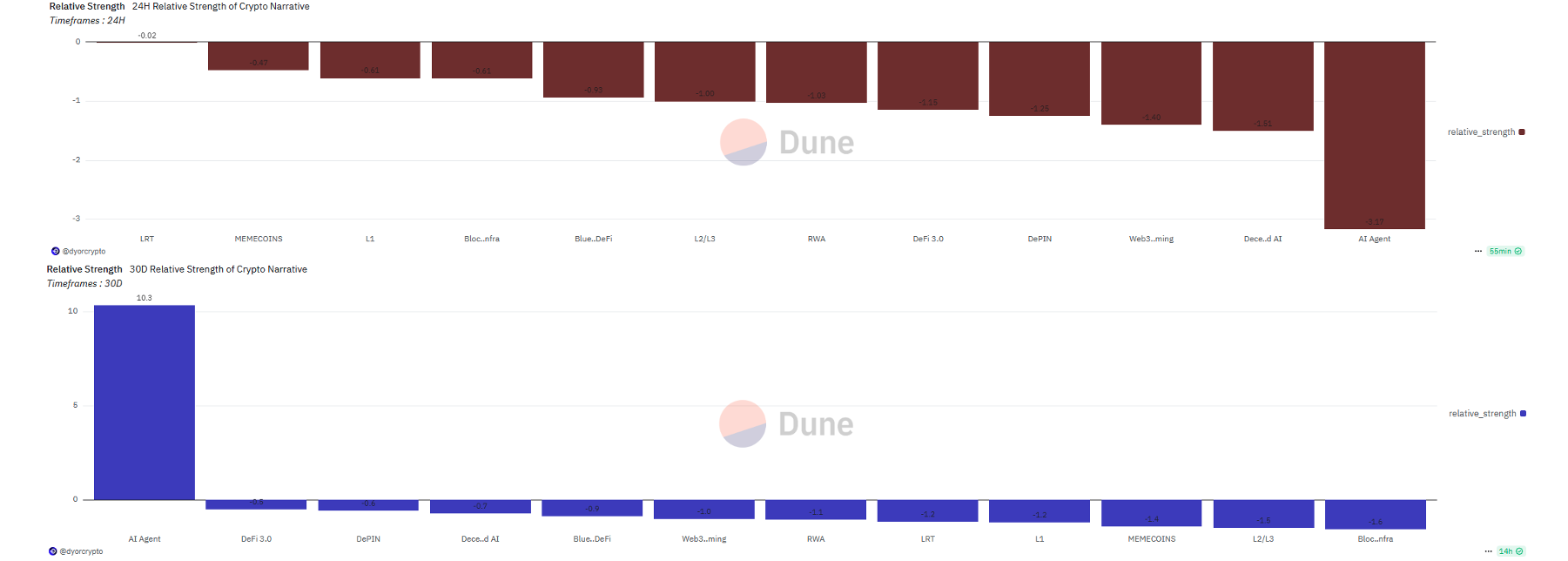

Source: Dune, Dot Labs

Source: Dune, Dot Labs

2. Inside the plate