Author: Frank, PANews

Trillion-dollar trading volume, 60% perpetual contract market share, and an average of $400 million in daily on-chain settlements - Hyperliquid, a decentralized exchange that has been established for less than two years, is eroding the contract market of centralized exchanges with a series of disruptive data.

Whales are playing a "life-and-death gamble" with 50x leverage. Institutional funds are frantically buying orders with low fees, while retail investors continue to wait and see due to the lack of token categories. While Binance and Coinbase still dominate the industry, Hyperliquid has opened up a new battlefield for DEX counterattack with its extreme efficiency and risk coexistence model. However, the "slow" mechanism of the Dutch auction and the dilemma of the governance token HYPE being cut in half also make this subversion full of variables.

Trading volume exceeds one trillion, Hyperliquid becomes the "dark horse" of contracts

Since the airdrop detonated the market in 2024, Hyperliquid's contract trading volume has increased exponentially, completely breaking the industry curse of "decline after airdrop". On the contrary, in the recent market fluctuations, Hyperliquid has already established its position as a leading exchange.

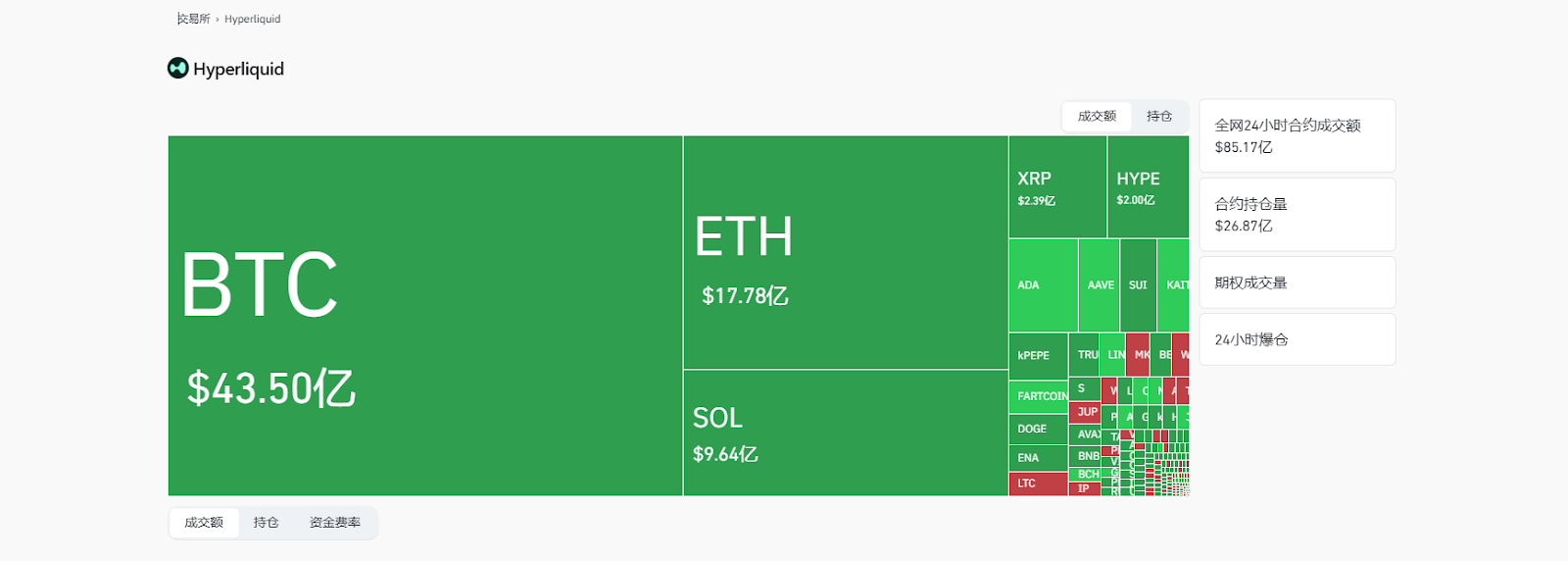

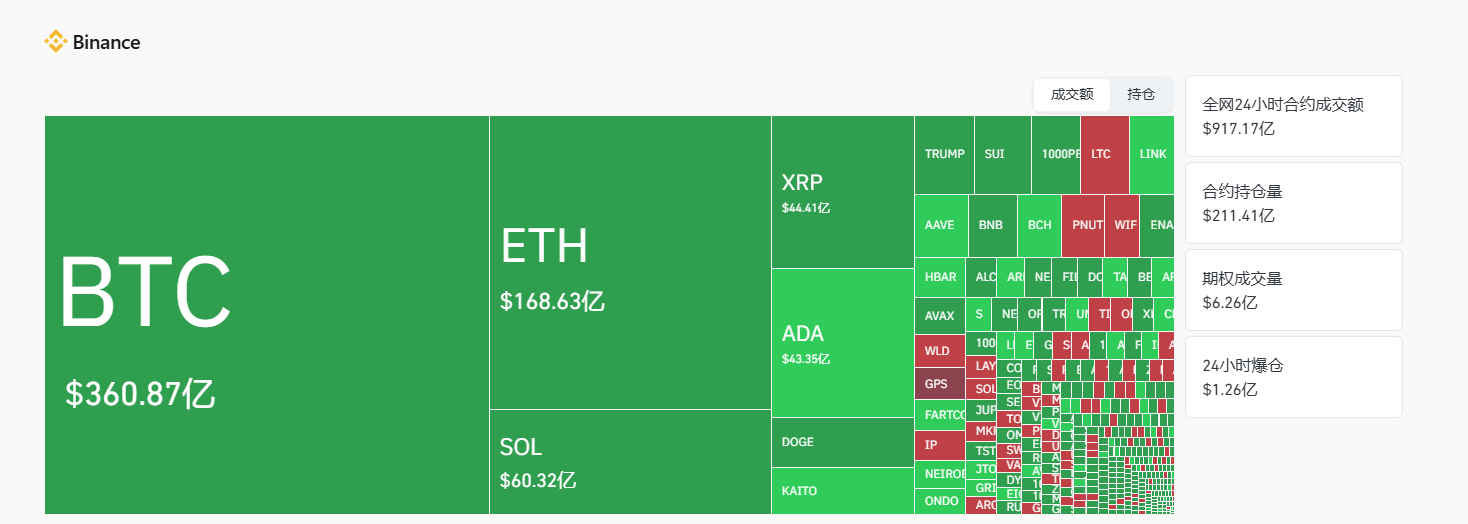

Data from March 5 showed that Hyperliquid's total trading volume exceeded $1 trillion for the first time. According to Coinglass data, Hyperliquid's contract trading volume on that day was about $8.5 billion, and Hyperliquid's contract trading volume ranked sixth among all exchanges, only lower than five centralized exchanges including Binance, OKX, Bitget, Bybit, and Gate.io. Binance's contract trading volume was about $91.7 billion. Although the gap is still obvious, Hyperliquid seems to have become a new force that Binance cannot underestimate.

According to data from hypurrscan, Hyperliquid's fee income is annualized to $746 million. In comparison, Coinbase's full-year trading revenue in 2024 is $4 billion.

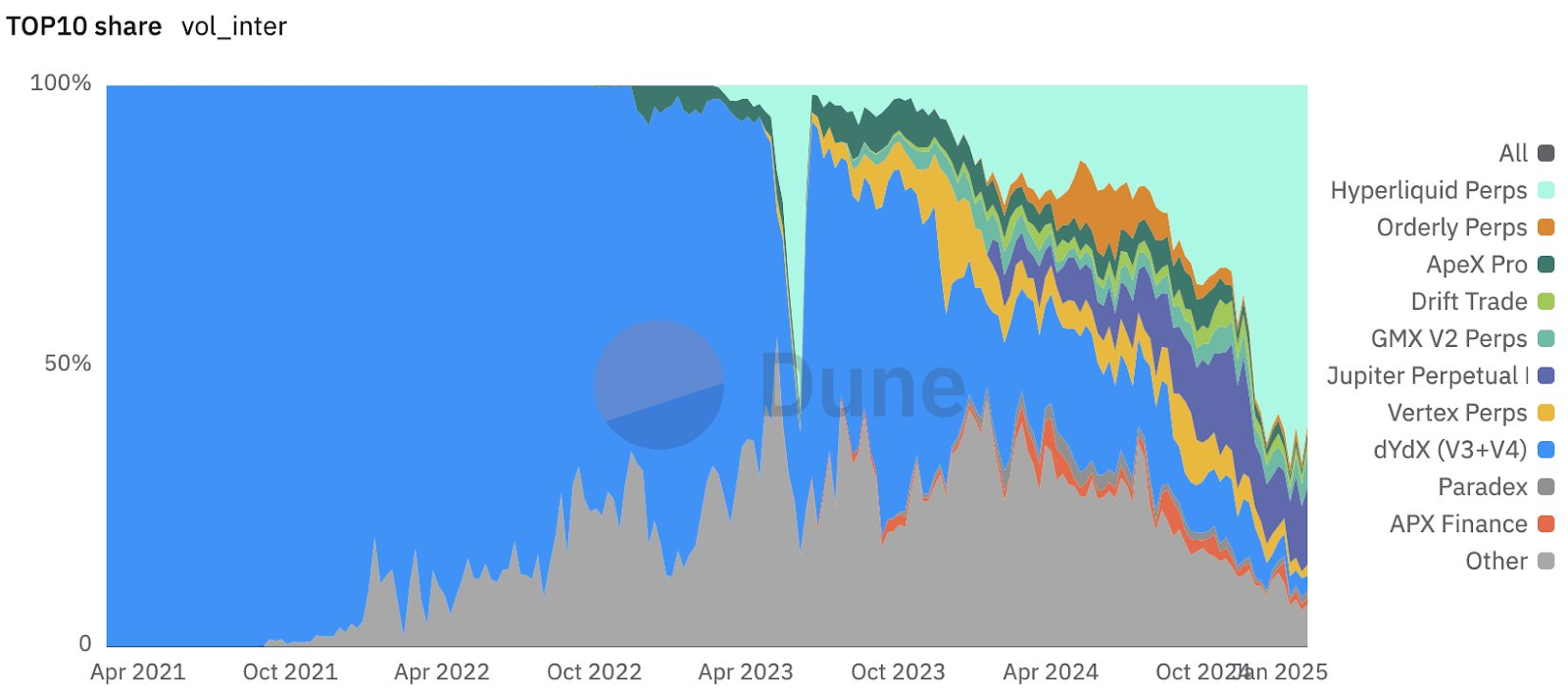

Among decentralized exchanges, Hyperliquid has become the dominant player in the perpetual contract market. According to data provided by analyst WarDaddyCapital on February 8, Hyperliquid's market share in perpetual contracts has reached 60.5%, while on November 1, 2024, its market share was only 33.2%, and in March 2023, its market share was less than 2%. This growth rate is unique among decentralized exchanges.

Trump's new casino under the giant whale deal

The rise of Hyperliquid is inseparable from institutions and high-net-worth traders. Especially recently, the frequent opening of orders by whales has triggered market discussions. Hyperliquid seems to have become a public place for whales to open orders, including cases of smart money that takes unconventional actions and shows off its strength.

On March 2, before Trump announced that five crypto assets including BTC, ETH, SOL, ADA, and XRP would be added to the strategic reserve of crypto assets, a whale held $6 million in assets and used 50 times leverage to go long on ETH and BTC. The opening price of ETH was $2,197 and the liquidation price was about $2,149. After the order was opened, the price of ETH fell to as low as $2,171, and it almost went bankrupt. Fortunately, a few minutes later, the market surged with the help of Trump's favorable news, and the user eventually made a profit of more than $6.8 million in a single day. Many people on social media believe that this extreme operation may have been done by insiders around Trump. However, this statement was later denied by Conor Grogan, director of Coinbase, who found that the funds came from phishing and the user was a user of the crypto gambling platform Roobet. This risky operation seems to be just a gambler's exciting way to play.

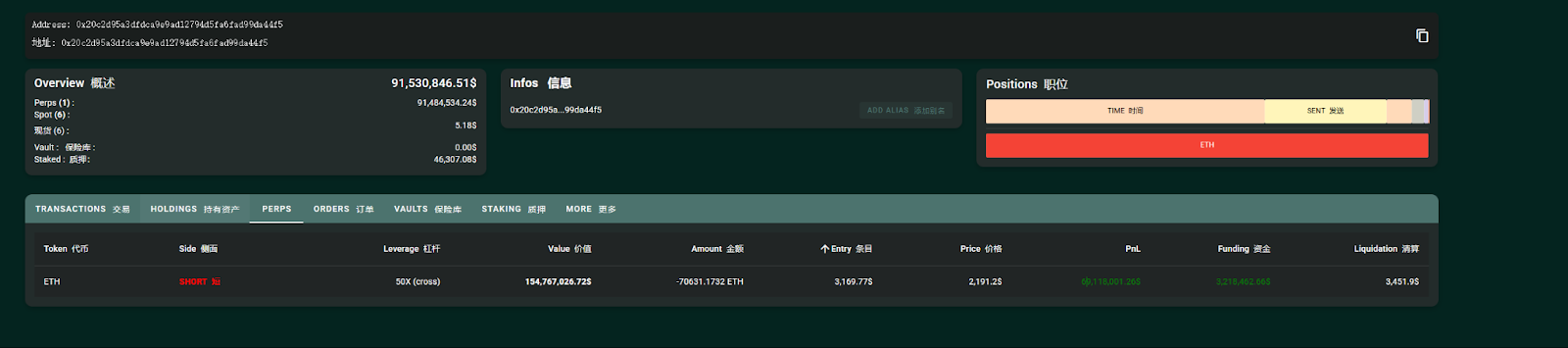

In addition to this extreme speculation, some whales have also gained huge profits from long-term holdings. According to on-chain analyst @ai_9684xtpa, a whale opened an Ethereum short position with 50x leverage in January, with an opening price of $3,169 and a maximum floating profit of over $78 million. As of March 5, the order is still held, and the current floating profit is still $69 million. The user has also become the user with the most profit on Hyperliquid. According to information provided by social media users, the address belongs to the new stablecoin protocol Resolv, which may be an order from its hedge fund.

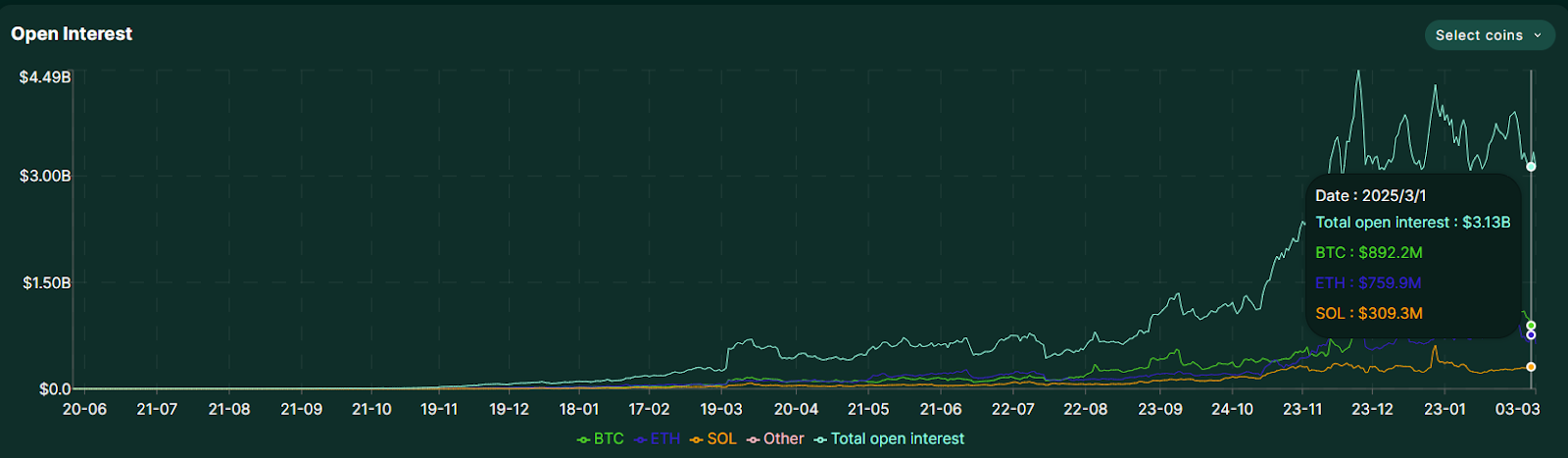

In addition, it is not uncommon to hear news about whales spending millions of dollars to open orders and build positions on Hyperliquid. From the data, the average transaction volume contributed by a single user of Hyperliquid is about 2.56 million US dollars, which also indirectly confirms the difference in its user structure. Under the recent market fluctuations, the enthusiasm of whales to open positions has increased. The number of open contracts on Hyperliquid has been at a high level. Since December 2024, it has always remained above the level of 3 billion US dollars.

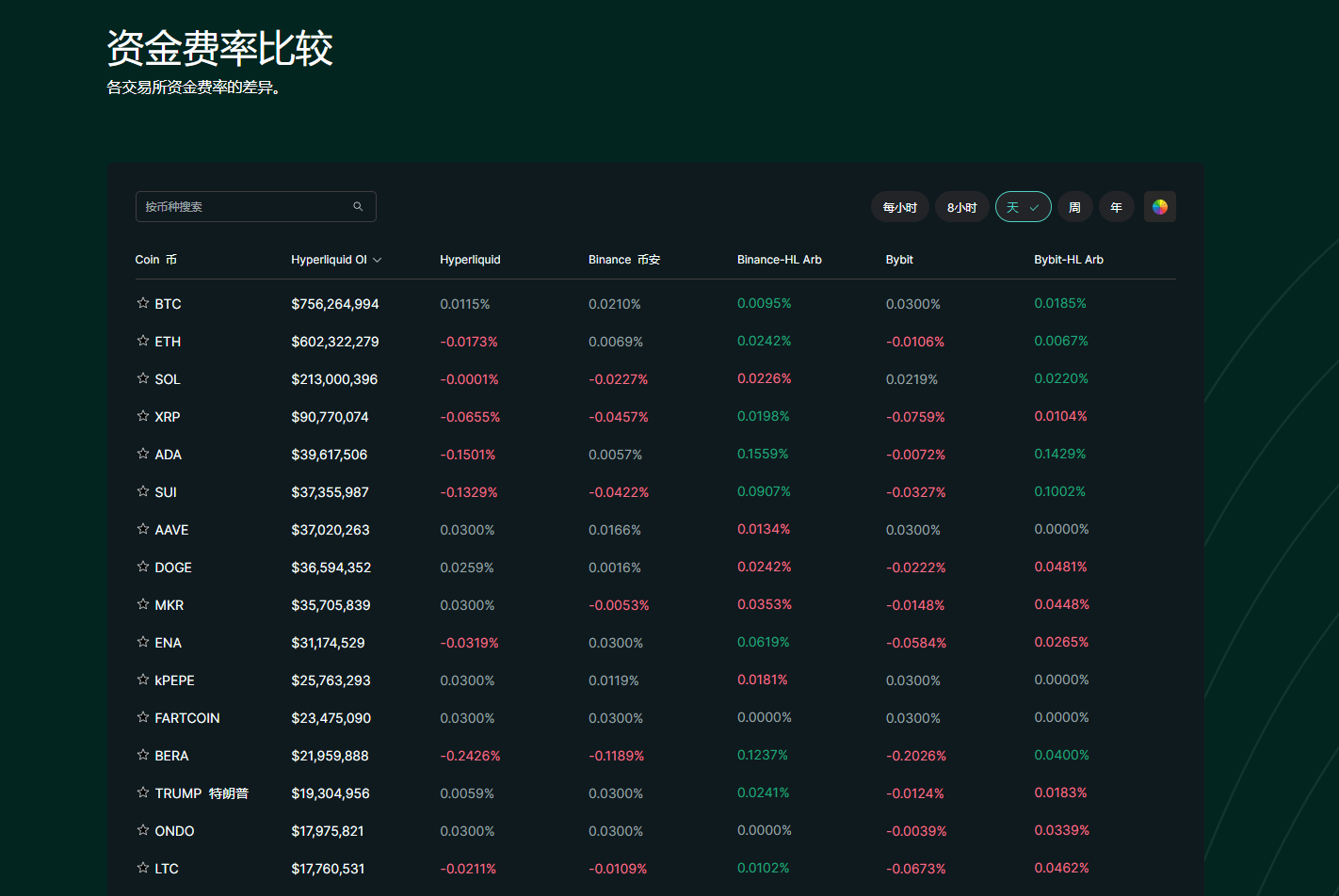

This phenomenon is closely related to Hyperliquid's low-fee strategy. Taking the data on March 5 as an example, the absolute value of Hyperliquid's funding rates for several mainstream tokens such as BTC, ETH, and SOL is much lower than that of Binance and Bybit. This is a relatively sensitive factor for users with large amounts of funds. Including transaction fees, Hyperliquid is also lower than most mainstream exchanges. In addition, on-chain contracts are more transparent and fair than centralized exchanges, which is also the reason why many large users choose them.

With the participation and activeness of whales, Hyperliquid seems to be becoming the largest on-chain clearing site. Since the end of February, Hyperliquid's daily clearing amount has basically remained above $400 million. Binance, OKX and other exchanges have not disclosed the full amount of liquidation data to Coinglass, so direct comparison is impossible. On March 6, Bybit, which released full data, had a contract clearing of only $80.61 million in the past 24 hours, far lower than Hyperliquid.

The dilemma of the Dutch auction: a homogenous ecosystem and a cold reception for retail investors

The transactions of whales have indeed brought a lot of attention to Hyperliquid, but it seems that attracting retail investors requires other logic. For example, launching more new tokens or creating more myths of wealth creation. As of March 5, Hyperliquid's cumulative user base was only 390,000, and the number of spot trading currencies was only 82, far lower than other mainstream exchanges. Therefore, the limited tradable assets seem to be the main reason why Hyperliquid has difficulty attracting more retail investors.

As a decentralized exchange, Hyperliquid's coin auction mechanism is very different from other exchanges. Hyperliquid uses the Dutch auction mechanism, which greatly reduces the cost of listing coins for project parties and can theoretically bring them more potential projects. On the other hand, there are also certain flaws. Some well-known projects have no motivation to initiate auctions, resulting in fewer spot trading pairs on Hyperliquid.

Another point is that each round of auction in this mechanism lasts 31 hours. Based on this calculation, a maximum of 282 projects can be launched through auction each year. At the same time, it is difficult for some tokens with strong timeliness to quickly seize the market through this auction mechanism.

Hyperliquid also tried to expand the variety of tokens on the chain by building products similar to Pump.fun and launched HFUN, but it seemed to have little effect, with the token with the highest market value being only $245,000.

Among the relatively thin token categories, Hyperliquid's own governance token HYPE has become the only exclusive product that can support the main beam. Taking the data on March 5 as an example, HYPE's trading volume was about 320 million US dollars, accounting for about 3.7% of the entire platform's trading volume. However, HYPE's recent trend has continued to create new lows as the market weakens. On March 4, it fell to a minimum of 15.3 US dollars, with a market value of approximately 5.59 billion US dollars, and the maximum decline from the high point was about 56.5%.

In addition, Hyperliquid also faces a lot of doubts in terms of decentralized governance. The "stand-alone mode" has always been the core doubt of Hyperliquid by those who are pessimistic about it. Of course, on the one hand, this doubt is that the token is only listed on its own exchange, and on the other hand, as a public chain, it still uses a permissioned validator access method, which does not seem to be "public". But on March 5, the Hyperliquid Foundation issued the latest announcement, announcing that after the next network upgrade, mainnet validators will no longer need permission to join. It can be regarded as a positive feedback to the doubts about the "stand-alone mode".

Overall, Hyperliquid seems to have taken a place in the whale contract market. But it still has a long way to go in terms of growth on the retail side. Perhaps as the network becomes more decentralized, new proposals to change the listing process and other operational ideas will allow this new exchange to go further.