summary

At the beginning of 2025, the global economy is still facing policy uncertainty. The US economy is performing strongly but is affected by the tightening financial environment and geopolitical risks. The Trump administration's policy adjustments have exacerbated market volatility, and investors are paying close attention to the long-term impact of trade, energy and immigration policies on inflation, employment and the stock market.

Cryptocurrency market trading activity declined in January, but the total market value increased by 10%. BTC's market share remained stable while ETH's slightly declined due to market sentiment and competition from Solana. BTC ETF had strong inflows of about $14.16 billion, pushing BTC prices to a new high. In contrast, ETH ETF had a small outflow of $369 million, and market sentiment was sluggish. The entire market's stablecoins continued to inflow $5.492 billion, of which USDC became the main driver of growth this month, with a circulation increase of about $4.3 billion.

BTC bulls are trying to break through the all-time high of $109,588, but short-term market sentiment is affected by the uncertainty of Trump's policies. ETH and SOL are facing key resistance levels, which may usher in an uptrend after a breakthrough, otherwise they may pull back to important support areas. Although Solana's price has reached a new high, there is still uncertainty about ETF approval in the short term, and the attitude of the SEC will become a key factor affecting the price trend of SOL.

In January, the Trumps launched their personal tokens TRUMP and MELANIA, which sparked heated discussions in the market and boosted the popularity of their family's crypto project WLFI. In addition, Trump officially signed an executive order on crypto after taking office, ushering in major adjustments to the US crypto regulatory framework.

1. Macro perspective

Macroeconomics

After entering January 2025, the global economic landscape is still affected by policy uncertainty. Recent market dynamics highlight the risks that may arise from aggressive US trade policies. Optimism about US economic growth remains high and its economic momentum remains strong. However, the increasingly tight financial environment in the United States and continued geopolitical and economic uncertainties remain important factors that need to be closely monitored.

Labor Market

The U.S. labor market continues to demonstrate remarkable resilience. 256,000 new jobs were created in December 2024, significantly exceeding economists' forecast of 156,000. This performance capped a strong end to the year, with an average of 186,000 new jobs created per month. In addition, the unemployment rate fell from 4.2% in November to 4.1% in December, showing a positive trend. Although economic growth is expected to slow slightly in the coming months, the strong labor market is expected to provide key support in the face of economic headwinds.

inflation

Inflationary pressures showed signs of easing in December. The consumer price index (CPI) rose 2.9% year-on-year, rising for the third consecutive month. The core CPI, which excludes the more volatile energy and food components, rose 3.2% year-on-year, slightly lower than the previous month and the 3.3% forecast by economists. Tightening financial conditions are expected to curb demand and bring inflation closer to sustainable growth levels. This process is expected to create favorable conditions for inflation to gradually move closer to the Fed's 2% target.

stock market

President Trump begins his second term with sweeping plans to expand oil production, restrict immigration, and impose tariffs. The "Trump trade" was volatile as investors assessed a series of executive orders signed by President Donald Trump within hours of his inauguration. Stocks broadly rose as Wall Street viewed Trump's comments and first-day actions on international trade as milder than expected. The 10-year Treasury yield was close to its recent peak of about 4.80%, reflecting the market's heightened focus on "sticky" inflation dynamics and potential tariff announcements from the administration.

Earnings Season

Major US banks beat high market expectations with three reporting fourth quarter earnings that doubled year-over-year. Analysts now expect S&P 500 earnings per share (EPS) to grow by about 12% in the fourth quarter of 2024. While macro signals are a bit mixed, the economy is showing strong momentum overall. GDP forecasts have been revised upward, monetary policy is gradually easing, and risk sentiment is positive. We see limited upside to our forecasts this quarter. Last week’s stellar bank results got the earnings season off to a good start.

Summarize

There remains a high degree of uncertainty about the economic development of the United States and the world. The policies of the administration under President Trump are a key source of this unpredictability, and the scope, timing, and intensity of policy implementation are important variables. In addition, ongoing geopolitical challenges, including the conflict in Ukraine and the changing dynamics in the Middle East, may have an impact on the broader global landscape.

Trump's inauguration as the 47th president of the United States marked the beginning of a rapid policy shift. He reportedly prepared more than 100 executive orders, far exceeding the 17 orders signed by his predecessor, President Biden, on his first day. Although major macroeconomic legislation may take months to come, the initial policy landscape is expected to change rapidly.

2. Crypto Market Overview

Currency data analysis

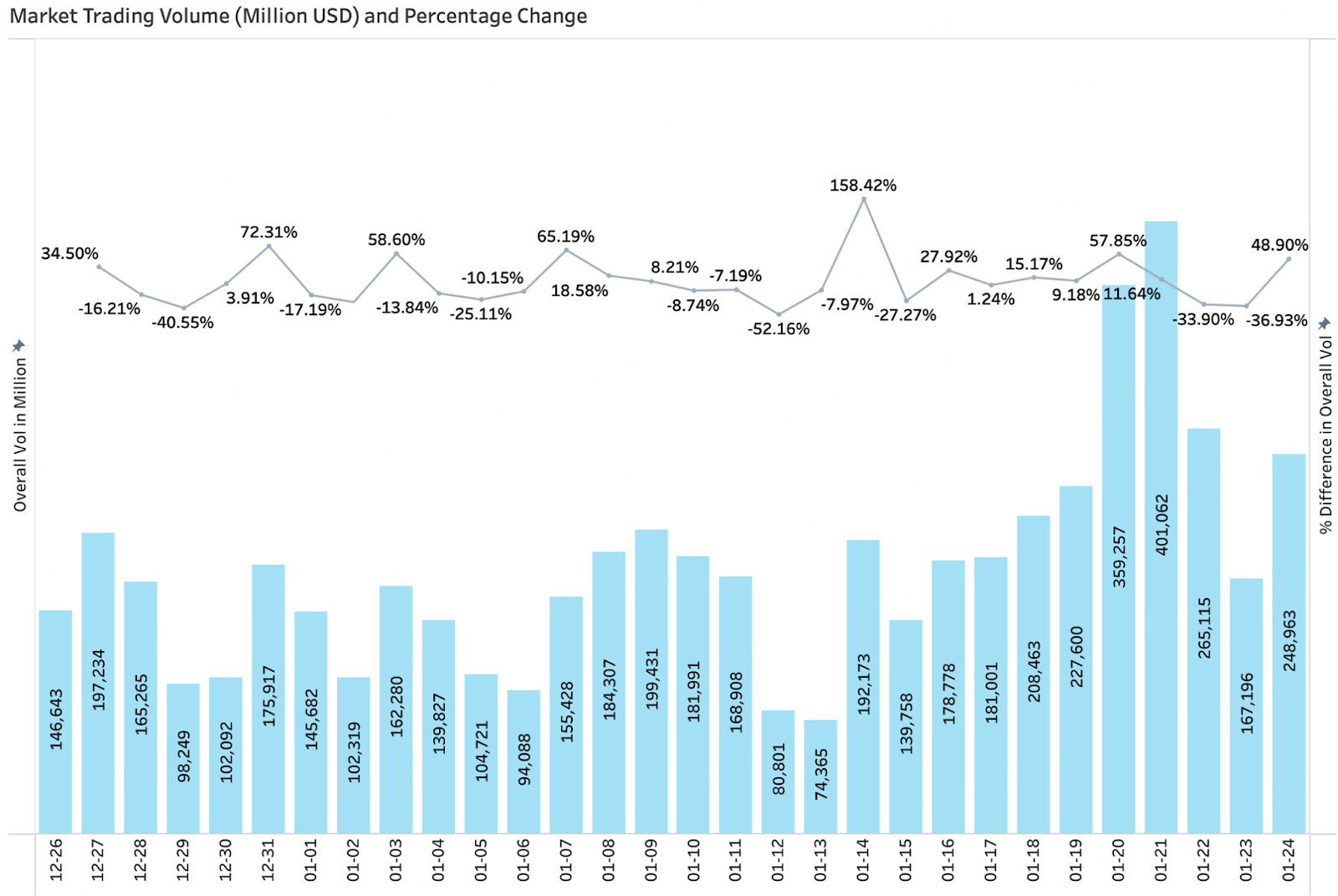

Trading volume & daily growth rate

According to CoinGecko data, as of January 24, the crypto market's trading activity has declined over the past month, with an average daily trading volume of $174.9 billion, down 40% from the previous cycle's daily average. On January 20, affected by Trump's inauguration, market trading activity rebounded.

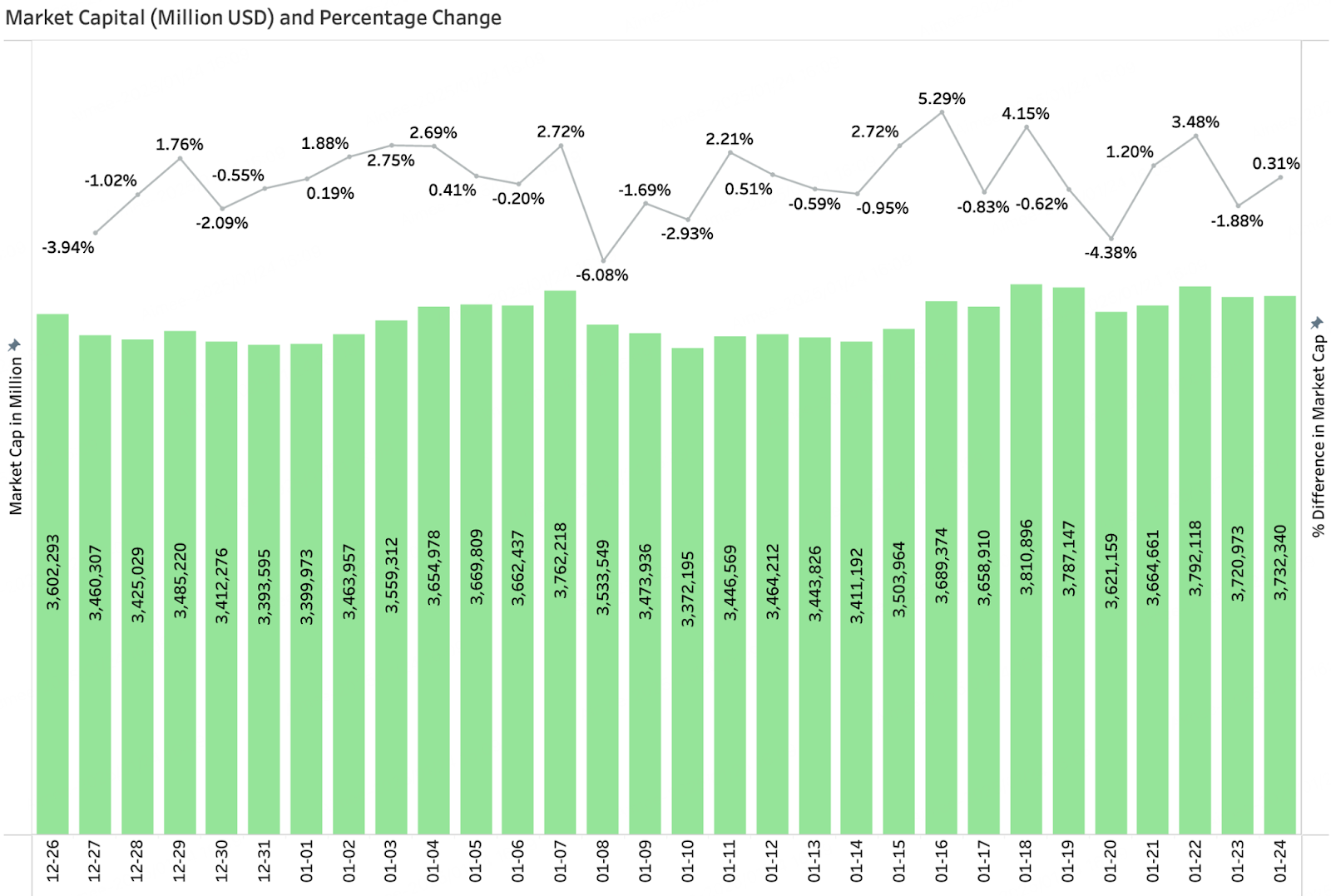

Total market value & daily growth

According to Coingecko data, as of January 24, the total market value of cryptocurrencies was $3.73 trillion, up 10% from the previous month. Among them, BTC accounted for 57.4% of the market and ETH accounted for 11.3%. Affected by factors such as weak prices, low market sentiment and strong competition from Solana, ETH's market share has declined slightly.

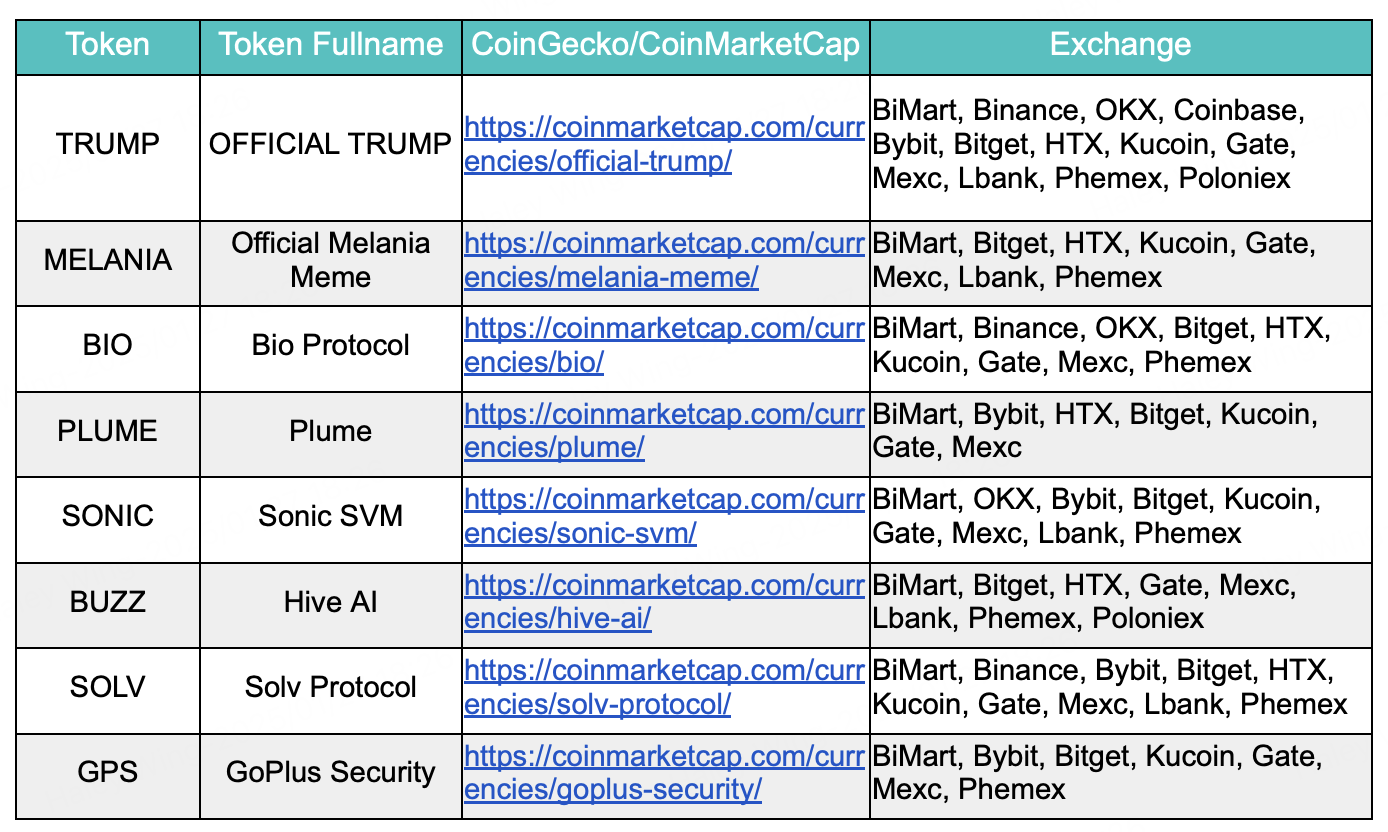

New popular tokens in January

Among the popular new tokens in January, TRUMP's market value soared rapidly after it was listed on DEX, reaching a maximum of $14.74 billion, setting a record for the fastest listing on an exchange. The next day, Trump's wife's token MELANIA was also launched, triggering a heated discussion in the market about the Trump family's "conspiracy to harvest", and also set off a wave of FOMO emotions of celebrity memes.

3. On-chain data analysis

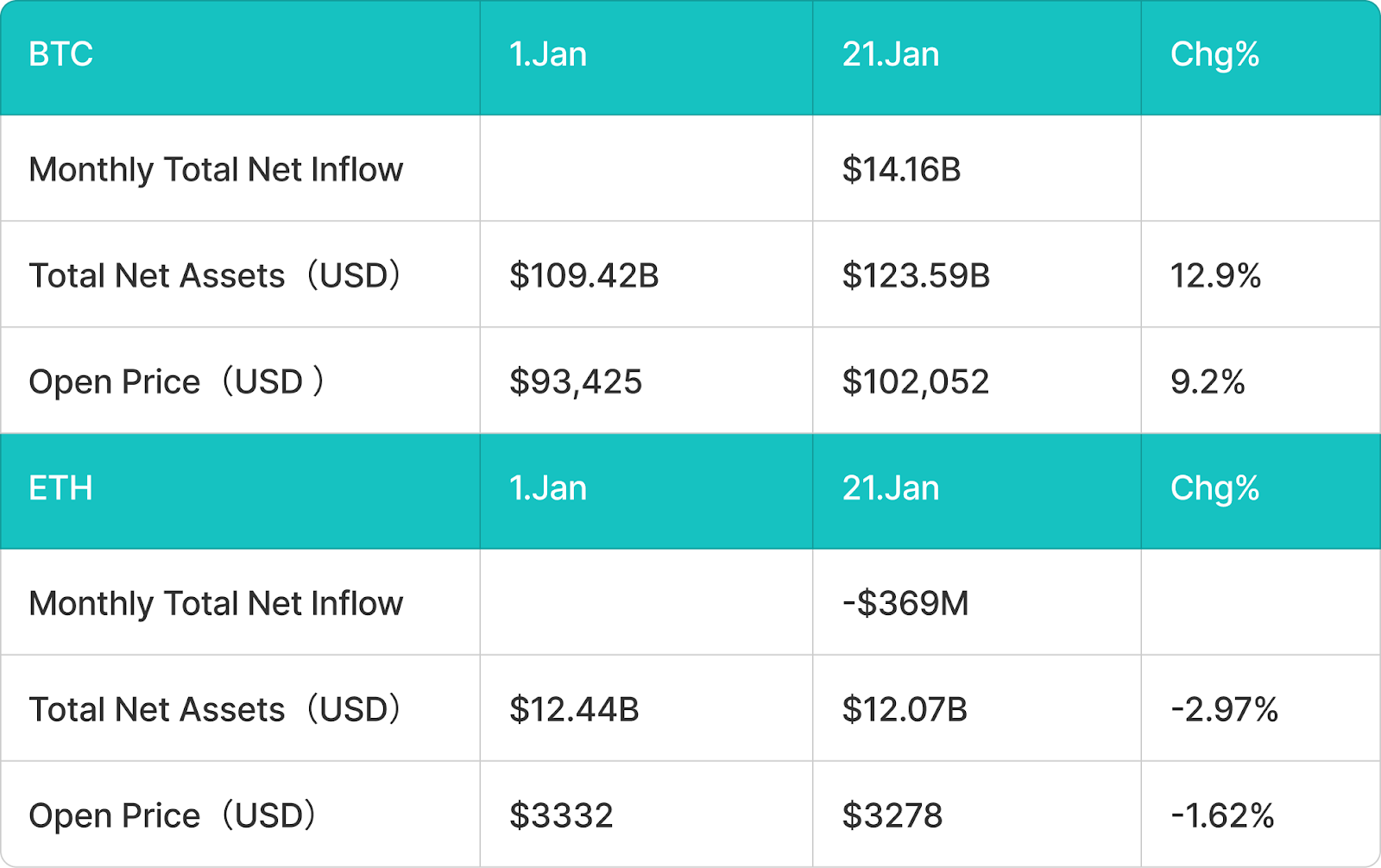

3.1 Analysis of BTC and ETH ETF inflows and outflows In January, BTC ETF inflows reached USD 14.16 billion

In mid-December, BTC prices were not significantly affected after a brief correction, and the stimulus effect of Trump's economic policies continued. On January 20, with Trump's official inauguration, BTC prices were once again strongly driven to achieve significant gains. In January, BTC ETF fund inflows continued to increase, with a total inflow of up to $14.16 billion, pushing BTC prices from $93,425 to $102,052, a year-on-year increase of 9.2%. In addition, on January 20, BTC prices further hit a record high of $108,228, showing the market's strong confidence in BTC in the current macroeconomic environment and the growth of safe-haven demand.

ETH ETF saw a small outflow of $369 million in January

Compared with BTC, ETH's market performance this month is still sluggish. ETH ETF funds have a small outflow of $369 million, a year-on-year decrease of 2.97%, and the price has dropped from $3,332 at the beginning of the month to $3,278, a drop of 1.62%. On December 17, when BTC hit a record high of $108,135, the price of ETH was $4,078. On January 20, when BTC hit a record high again, the price of ETH had fallen to $3,439, showing its continued downward trend. Even though Trump's inauguration caused market fluctuations, this good news failed to change the market's more cautious investment attitude towards the Ethereum ecosystem.

3.2 Analysis of Stablecoin Inflows and Outflows

Stablecoin inflows in January were approximately $5.492 billion, mainly from USDC, USDT, and DAI

The stablecoin market continued its strong growth momentum in January, which was particularly significant due to the stimulus effect of Trump's economic policies. Among them, USDC became the main driver of growth this month, with the circulation increasing by about US$4.3 billion, accounting for a significant share of the expansion of the stablecoin market. The positive impact of Trump's official inauguration this month prompted a large amount of US funds to flow into the crypto market.

4. Price analysis of mainstream currencies

4.1 Analysis of BTC price changes

BTC price has surpassed $106,000, but bulls are struggling to break the all-time high of $109,588. Short-term sentiment has taken a hit as U.S. President Donald Trump has not issued a specific executive order regarding strategic Bitcoin reserves.

On January 23, BTC rebounded from the 20-day exponential moving average ($100,831), which indicates a positive market sentiment. Buyers will once again try to push the price above the all-time high of $109,588. If successful, BTC/USDT is likely to accelerate upwards with a target of $126,706. On the downside, the 50-day simple moving average ($98,839) is a critical support. If this level fails, the price is likely to decline to the strong support of $90,000. Buyers are expected to defend the $90,000 to $85,000 support zone with all their might because a break below this zone could signal a deeper correction with a target of $73,777.

4.2 Analysis of ETH price changes

ETH rebounded from the neckline of the head and shoulders (H&S) pattern on Jan. 23, which shows that the bulls are trying to prevent the formation of a bearish pattern. ETH/USDT is likely to rise to the 50-day simple moving average ($3,503), which is an important resistance to watch out for in the short term. If the buyers push the price above the 50-day SMA, the pair could surge to $3,745. Conversely, if the price turns down from the 50-day SMA, it will suggest that the bears are still selling on rallies. This will increase the risk of a break below the neckline. If this happens, the price could plummet to $2,850.

4.3 Analysis of SOL price changes

Solana has broken the $260 resistance, which shows that the bulls are trying to establish their dominance. There is a minor resistance at $274, but this level is expected to be crossed. If the buyers push the price above $274, the SOL/USDT pair could surge to $295. Although this level might act as a strong resistance, if it is conquered, the next target would be $375. The 20-day exponential moving average ($228) is a critical support on the downside. If the price breaks down and closes below the 20-day EMA, it will suggest that the bulls have given up and the price could drop to the 50-day simple moving average ($211).

5. Hot events of this month

5.1 Trump and his wife launch personal cryptocurrency, sparking heated discussions in the market

On January 18, former US President Trump officially launched his personal meme token "TRUMP", which aroused strong attention and enthusiasm in the market. It is reported that 80% of the supply of the token is controlled by Trump's affiliated companies CIC Digital LLC and Fight Fight Fight LLC, the latter of which will directly benefit from the income generated by token trading activities. According to Coingecko data, "TRUMP" began trading at an opening price of $0.1824, and the increase in just 12 hours exceeded 15,000%, soaring to about $30. Subsequently, the price of TRUMP climbed further, reaching a high of $75.35, with a cumulative increase of 41,200%, and a fully diluted valuation (FDV) of nearly $80 billion, becoming the most eye-catching phenomenon in the recent crypto market.

On January 20, Trump's wife Melania Trump also launched her own cryptocurrency "MELANIA". After the launch of this token, it quickly sparked heated discussions in the market. Its price once reached as high as $13, and its FDV exceeded $13 billion. However, this craze lasted only one day, and the price of MELANIA quickly fell back to $4.14, a drop of more than 215%. More significantly, the issuance of MELANIA caused market confidence to waver, causing a large number of investors to sell TRUMP, which directly led to a nearly 40% drop in the price of TRUMP. This token craze also had a significant impact on the technical level of blockchain. Due to the sudden surge in trading volume, Solana experienced a brief network congestion due to the surge in trading volume, which caused the price of USDT in its ecosystem to temporarily decouple, further exacerbating market turmoil.

Although the cryptocurrency launched by the Trumps has brought unprecedented traffic and attention to the industry, it is also accompanied by a lot of controversy. Their actions have been criticized for blurring the line between public office and commercial interests, and they have even been suspected of using their public positions for profit. This may not only damage their personal reputation, but also increase the regulatory pressure faced by the crypto industry.

5.2 Trump family crypto project World Liberty Financial (WLFI) has gained popularity and attracted new attention after the pre-sale ended

After Trump launched the "Meme" token on January 20, the attention to his family's crypto project World Liberty Financial (WLFI) quickly increased. Officials announced that the pre-sale of WLFI tokens has ended, with a total of 20 billion tokens issued at a price of $0.015 per token, raising a total of $300 million. It is worth noting that crypto investor Justin Sun spent 15 million USDT to purchase 1 billion WLFI tokens. After the first round of pre-sales, the WLFI team quickly announced that it would increase the supply by an additional 5% for the second round of pre-sales and increase the unit price of tokens to $0.05. This strategy further attracted widespread attention from the market, showing how popular the project is in the market.

In addition, to commemorate Trump's official becoming the 47th President of the United States, World Liberty Financial (WLFI) announced a series of major strategic asset purchase plans on the day of the inauguration, including: US$47 million in ETH, US$47 million in wBTC, US$4.7 million in Aave, US$4.7 million in LINK, US$4.7 million in TRX, and US$4.7 million in ENA.

Through personal tokens "TRUMP" and "MELANIA", as well as the family project WLFI, Trump and his family have set off an unprecedented craze in the crypto industry. However, the long-term impact of this series of initiatives remains to be seen, and the market is also paying attention to whether it will trigger stricter industry regulation and policy review in the future.

5.3 Trump takes office and officially signs the encryption executive order

On January 24, US President Trump officially signed the "Enhancing American Leadership in Digital Financial Technology" crypto executive order. This move not only demonstrates the US government's high attention to the digital asset industry, but also lays a clearer policy foundation for the future development of the industry. The core content of this executive order includes the following points:

Promoting the responsible development of digital assets and blockchain technology

Encourage various economic sectors to responsibly develop and apply digital assets, blockchain and related technologies to further promote technological innovation and economic integration.

Reversing restrictive policies

Some outdated policies have been cancelled, the most notable of which is the formal revocation of the SAB-121 policy. SAB-121 previously required companies holding crypto assets to include these assets in their balance sheets and disclose related risks. This requirement not only increased the cost of companies holding crypto assets, but also restricted their ability to provide cryptocurrency custody services. After the policy is revoked, the operating burden of related companies will be significantly reduced.

Establishment of the Presidential Task Force on Digital Asset Markets

The executive order requires the establishment of a special working group to promote the development of a federal regulatory framework within 180 days to regulate the issuance and operation of digital assets in the United States. In addition, the working group will evaluate the feasibility of establishing a national digital asset reserve and propose relevant standards.

Explicitly prohibit the issuance and promotion of CBDC

The development, issuance, or promotion of central bank digital currencies (CBDCs) is explicitly prohibited, and federal agencies are prohibited from taking any related actions within or outside the United States to ensure the decentralized nature of the financial system and market freedom.

The signing of this executive order fulfills most of Trump's promises to the crypto market during his campaign, and also demonstrates his high attention and support for the digital financial industry. A clear regulatory framework and policy orientation will provide a more stable development environment for the digital asset industry and attract more capital and innovative forces to enter the US market.

5.4 AI Agent track rebounded strongly after drastic fluctuations in January, and DeFAI became a new growth hotspot

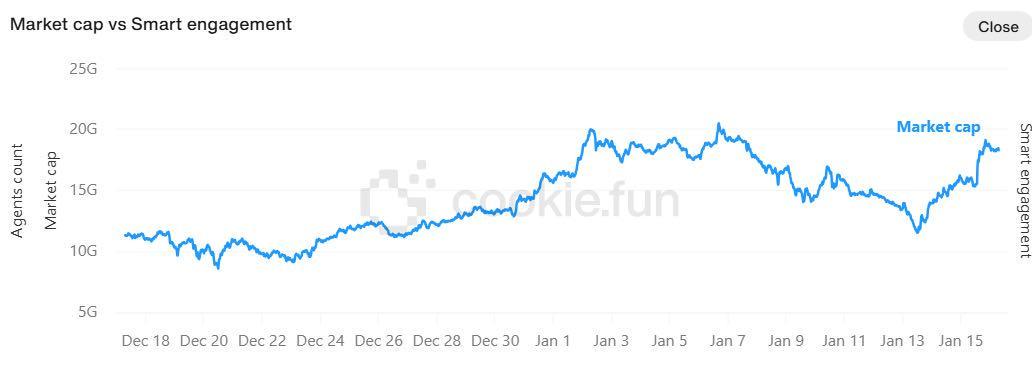

In January, the AI Agent track experienced significant market fluctuations, and mainstream tokens generally experienced a sharp correction. Core tokens in the Base ecosystem and Solana ecosystem, such as VIRTUAL, ai16z, and GAME, fell by 20%-50% in 7 days. Despite this, the market showed strong resilience after a deep correction. According to Cookie.fun data, the total market value of the AI Agent market fell from US$16.13 billion in early January to a low of US$11.57 billion, followed by a significant rebound in the middle of the month. This wave of correction not only provided the AI Agent track with an opportunity to breathe and adjust, but the rapid rebound also verified the sustainability of its long-term narrative. As one of the core hotspots in the Web3 field in 2025, the AI Agent track is ushering in new growth opportunities. Against this background, DeFAI (AI+DeFi) has gradually become an important breakthrough direction for the AI Agent ecosystem, especially in the fields of autonomous DeFi agents and market analysis and forecasting, attracting widespread attention. On January 13, the price of Bitcoin fell sharply to below $90,000, but the next day DeFAI-related tokens rose against the trend by 38.73%, among which GRIFT, BUZZ and ANON saw particularly significant increases.

6. Outlook for next month

6.1 Changes and impacts of encryption policies after Trump’s inauguration

After Trump takes office, with the official signing of the crypto executive order, the change of leadership of regulatory agencies such as the SEC, and the establishment of the Digital Asset Committee, the regulatory framework of cryptocurrencies in the United States will undergo major adjustments. The following are the core changes worth paying attention to:

Construction and promotion of the regulatory framework for crypto assets

The crypto executive order signed by Trump requires the development of a federal digital asset regulatory framework within 180 days, focusing on stablecoins, crypto asset issuance and trading market structure. This framework will directly affect market access, compliance costs and operating models, and may become an important indicator for the global crypto industry. In this context, DeFi, RWA, stablecoins and other fields that were previously suppressed by strong regulation may usher in new development opportunities.

The feasibility of strategic national crypto-asset reserves

The executive order requires an assessment of the possibility of establishing a national digital asset reserve and considering using cryptocurrencies legally seized by federal law enforcement as a reserve source. Currently, the main crypto assets held by the US government include BTC, ETH, and USDT, and the scope of reserves may be further expanded in the future. This move may enhance the global financial status of crypto assets such as Bitcoin and enhance its credibility as a value storage tool.

Impact of repealing SAB-121

The revocation of SAB-121 will lower the threshold for banks to participate in crypto asset custody and accelerate the integration of traditional financial institutions with the crypto industry. Banks can legally custody crypto assets, and their security and compliance are much higher than on-chain lending platforms, which will bring new lending and financial service models to the crypto market. In the future, banks may become major crypto financial service providers, providing compliant financial services such as custody and lending, lowering the market entry threshold, improving fund security, and attracting more traditional capital to flow into the crypto market.

6.2 Solana price hits new high, but ETF approval remains uncertain in the short term

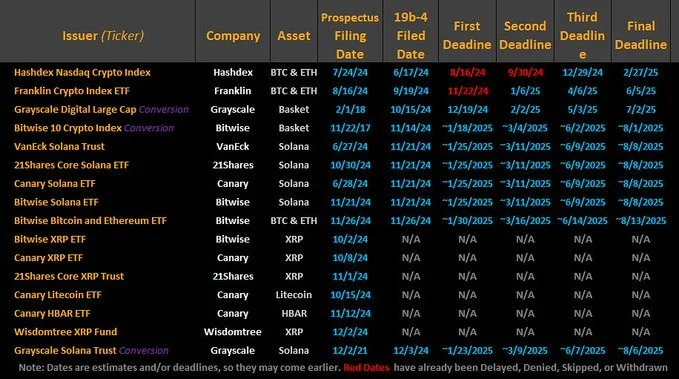

On January 19, with Trump's official inauguration and the overall market recovery, the price of SOL broke through its all-time high of $286. Investors are betting on the crypto-friendly regulatory policies that the Trump administration may bring, thereby increasing the possibility of approval of the Solana ETF. According to Bloomberg, the SEC will face the first Solana ETF approval deadline on January 25, and the SEC needs to make a decision on the Solana ETF applications submitted by VanEck, 21Shares, Canary Capital and Bitwise. However, the SEC previously sued Coinbase and Binance in 2023, accusing them of trading crypto assets including SOL as unregistered brokers and classifying Solana as a security, which has made the approval process of the Solana ETF face greater resistance.

Although SOL has risen sharply recently due to high market sentiment, the possibility of Solana ETF approval in the short term is still low. If the SEC postpones the approval or rejects the application, the market may cool down the expectations of Solana ETF, resulting in a certain degree of correction in the price of SOL. However, in the long run, with the adjustment of the regulatory environment, the support of the Trump administration for the crypto industry, and the successful precedents of Bitcoin and Ethereum ETFs, Solana ETF is still likely to be launched. In the future, changes in regulatory policies and the market's response to ETF expectations will become key factors affecting Solana's price trend.

Risk Warning:

All cryptocurrency investments, including income products, are highly speculative and involve significant risks. Past performance of a product does not guarantee future results. The cryptocurrency market is highly volatile. Before making any investment decisions, you should carefully evaluate whether it is appropriate to trade or hold digital currencies based on your personal investment objectives, financial situation and risk tolerance, and consult a professional financial advisor. The information in this article is for reference only and does not constitute any investment, legal or tax advice. The author and publisher are not responsible for any losses resulting from the use of the information in this article.