Author: Frank, PANews

As the leader of Ethereum Layer2 expansion solutions, ArbitrumDAO is highly anticipated, not only for its technical strength, but also for its large and active decentralized autonomous organization (DAO). Through the collective wisdom of ARB token holders, it leads the protocol to a broader future. However, a recent storm surrounding the election of DAO members has brought to the fore a "ghost" that has long been lurking in the deep waters of DeFi governance - vote buying (voting market).

The core of the incident is that a platform called LobbyFinance (LobbyFi) allows users to obtain ARB token voting rights worth up to $6.5 million at a very low cost (only 5ETH, about $10,000), and successfully influences the results of a key committee member election. This incident is like opening Pandora's box, not only exposing the fragility of the "one token, one vote" governance model, but also triggering deep concerns about the legitimacy, security and future direction of DAO governance. Is this an isolated "black swan" incident, or is it the tip of the iceberg that foreshadows the systemic crisis of the DAO governance model?

5 ETH leverages $6.5 million in voting rights, the capital "ghost" behind the election turmoil

In early April 2025, ArbitrumDAO was electing members for its newly established Oversight and Transparency Committee (OAT). This seemingly ordinary community governance activity caused an uproar due to a "small" transaction.

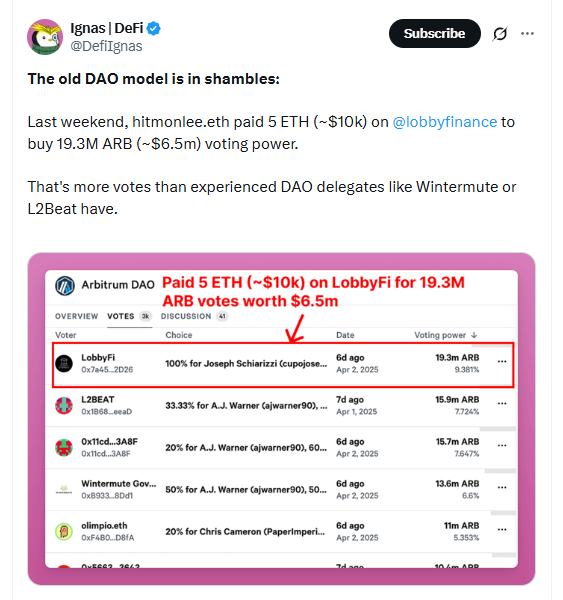

According to DeFi researcher @DefiIgnas, an address named hitmonlee.eth spent 5 ETH (about $10,000 at the time) through the LobbyFi platform to purchase voting rights for up to 19.3 million ARB tokens. These 19.3 million ARB tokens were worth about $6.5 million at the market price at the time. What's even more astonishing is that the number of voting rights purchased even exceeds the number of votes held by well-known representatives such as Wintermute and L2Beat who have been deeply involved in ArbitrumDAO for a long time and have a large number of community delegations.

Instead of distributing these votes, hitmonlee.eth voted all of them for one of the OAT committee candidates, Joseph Schiarizzi, a developer and expert in the DeFi field. This huge infusion of votes had a decisive impact on the election results, and ultimately helped Schiarizzi be successfully elected as a member of the OAT committee.

The core driver of this incident is LobbyFinance (LobbyFi). LobbyFi is positioned as a governance influence platform, or more bluntly, a "voting rights rental market". Its operating model is that coin holders can entrust token voting rights to LobbyFi in order to obtain certain rental returns. The sale of voting rights can be carried out in the form of an auction, with the highest bidder winning; it can also be carried out at a fixed price set by the platform ("instant purchase").

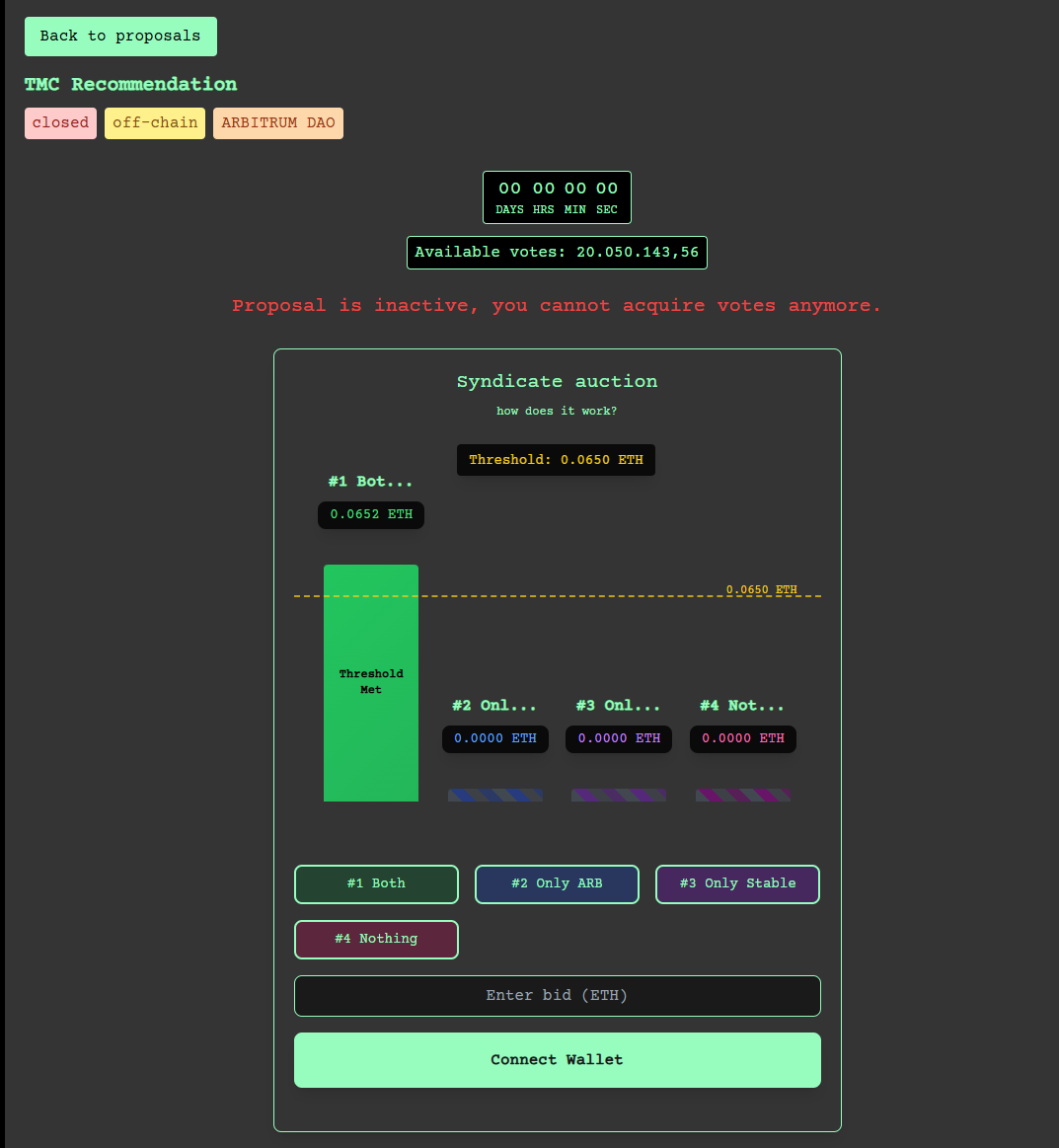

In the case of the Arbitrum OAT election, hitmonlee.eth took advantage of the 5ETH "instant purchase" option. LobbyFi claims that its operations are transparent, disclosing the proposal voting rights available for purchase and their prices, and giving the market time to react. However, the essence of this mechanism is to commoditize governance power, allowing short-term capital to obtain huge governance influence at a cost far lower than directly purchasing the same amount of tokens.

Economic motives behind election turmoil

The reason why this incident caused great controversy is the unbalanced economic incentives behind it. The position of OAT committee member is not a vain title, but comes with real economic rewards. It is estimated that this position can receive a reward of about 47.1 ETH (about US$7,500 per month) during the 12-month term, plus a bonus of up to 100,000 ARB (about 18.7 ETH at the time), with a total potential income of about 66 ETH.

This means that hitmonlee.eth only spent 5 ETH to help the candidate it supported obtain a position with a potential value of up to 66 ETH. This huge difference in benefits undoubtedly provides a strong economic motivation for vote buying.

The ultimate beneficiary, @CupOJoseph, himself publicly admitted that the current vote purchase is "underpriced and very risky", and believes that "getting $10,000 from the DAO shouldn't cost only $1,000". This statement seems to clear himself of the suspicion of participating in vote buying, but it also indirectly confirms the loopholes in the current system.

This is not the only low-price transaction on LobbyFi. According to @DefiIgnas, 20.1 million ARB votes were previously purchased for less than 0.07 ETH (worth less than $150 at the time). Such a low cost of influence makes the door to DAO governance seem to be opening to capital.

The official discussion proposal community has different opinions, and DAO governance may have attracted regulatory attention

Arbitrum’s voting controversy caused an uproar in the community, and also forced the Arbitrum Foundation and DAO members to face up to the challenges brought by the voting market and actively seek solutions.

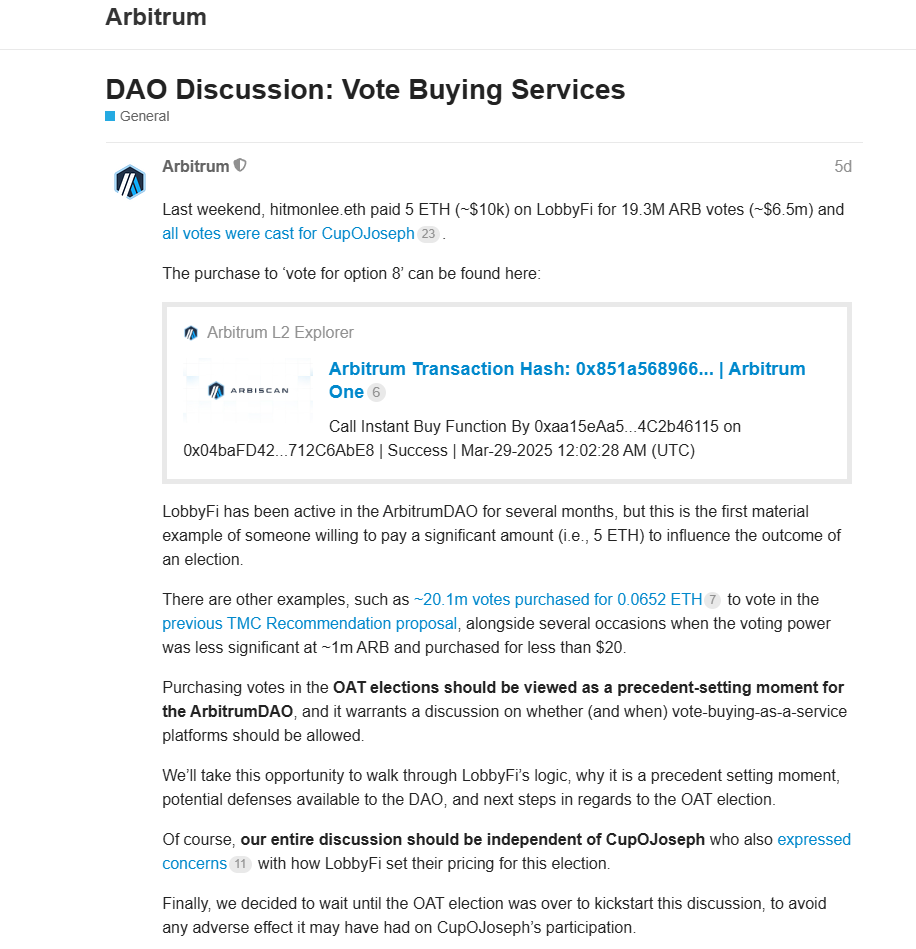

After the incident, the Arbitrum Foundation quickly launched a public discussion titled "DAO Discussion: Vote Purchase Service" on the official governance forum. The foundation acknowledged that this was a "groundbreaking moment", but did not immediately take tough measures such as unilateral prohibition. Instead, it chose to throw the problem to the community, still hoping to find a way forward through collective discussion.

According to the new proposal, LobbyFi has been active in the ArbitrumDAO for several months, but this is the first time someone has been willing to spend money to influence the outcome of an election.

Opinions within the community are sharply divided, with a hard-line minority advocating a zero-tolerance approach to vote buying and proposing to simply cancel or ignore votes identified as purchased.

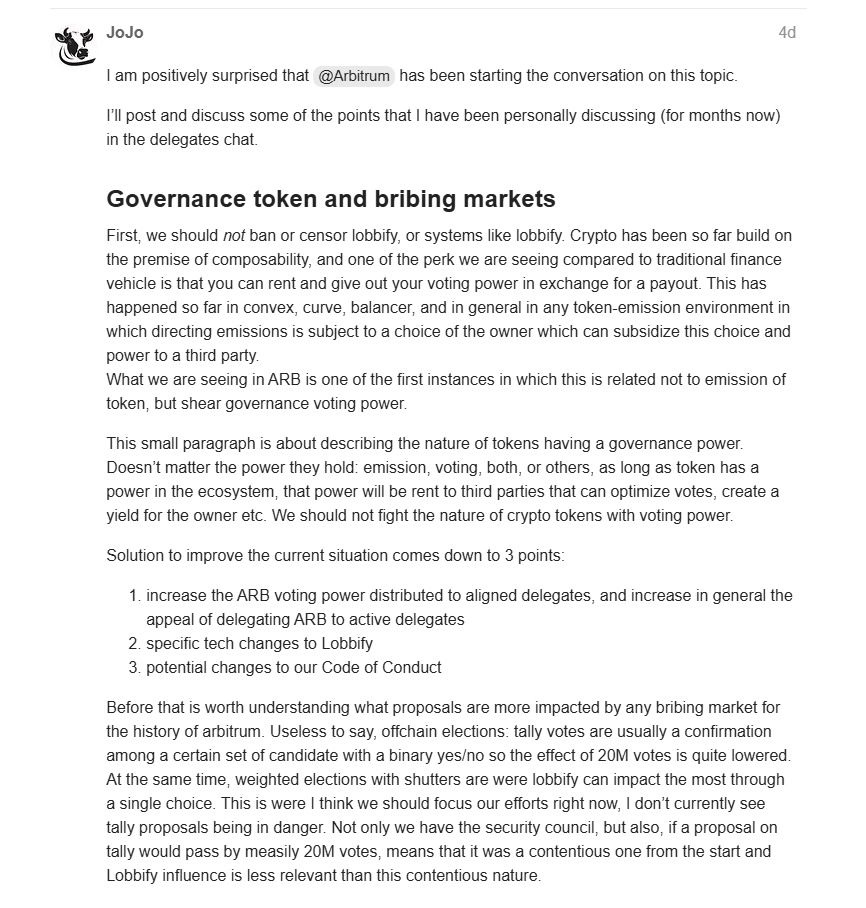

There are also some views that under the token-weighted governance system, vote buying is a manifestation of market forces and is difficult to completely prohibit. Forcible prohibition will only force it into a more hidden corner. They believe that platforms like LobbyFi, which at least provide a certain degree of traceability, may be better than untraceable private transactions. Some even believe that LobbyFi has activated previously dormant voting rights and increased overall participation.

More discussions focused on how to solve the problem fundamentally. The core idea is to reduce the attractiveness of vote buying while increasing the rewards for "honest" governance participation.

It is worth noting that the chaos and loopholes in DAO governance may also attract the attention of regulators. According to a report by Katten, agencies such as the US SEC and CFTC have begun to review DeFi and DAO. In its 2017 investigation report on "TheDAO", the SEC clearly pointed out that some tokens issued by DAOs may be considered securities. In the CFTC's lawsuit against OokiDAO, the court ruled that DAO could be held legally liable as an "unincorporated association" and even suggested that voting token holders may be jointly and severally liable. The SEC's investigation into the MangoMarkets case also focused on the governance tokens themselves for the first time. If DAO governance is widely considered to be susceptible to manipulation and lack of effective control, it will undoubtedly increase the risk of it being included in the existing financial regulatory framework, and may even affect the legal characterization of governance tokens.

Pandora's box opened? DAO governance becomes a hunting ground for capital

Arbitrum’s voting controversy is not an isolated case. It reveals the deep crisis that DAO governance in the DeFi field is generally facing. The rise of voting markets such as LobbyFi is exposing the inherent contradiction of the cornerstone of DAO governance, “one token, one vote”.

The core concept of DAO is decentralization and community autonomy. Ideally, decisions should be based on the community members' understanding of the protocol and long-term interests. However, the emergence of the voting market has made it possible to directly purchase governance influence with money, and the balance of decision-making has begun to tilt towards capital.

A more extreme case is the "coup" of BuildFinanceDAO: on February 9, 2022, a user gained control of the DAO by purchasing enough BUILD tokens on the open market, and then passed a proposal to give himself the power to mint new coins and control the treasury. He eventually took away about $470,000 in assets and reduced the value of the original tokens to zero.

In 2022, BeanstalkFarms suffered a flash loan attack, where the attacker borrowed a large number of governance tokens in a single block and looted $182 million in reserves through emergency proposals. These cases highlight the fragility of the DAO governance mechanism, and the voting market undoubtedly provides potential attackers with a more convenient and economical "weapon".

The voting controversy of ArbitrumDAO is like a prism, reflecting the dilemma of the current DAO governance model in finding a balance between efficiency, fairness and security. Behind the simplicity of "one token, one vote" is the potential erosion of the decentralized ideal by capital. The emergence of voting markets such as LobbyFi is the product of the market's spontaneous pursuit of efficiency and benefits, but it has indeed opened the door to governance manipulation and brought severe challenges.

At present, there is no permanent solution. A complete ban on the voting market may be difficult to implement and may push the problem to a more hidden corner. Completely letting the free market run wild may cause DAO to become a game of capital. This storm has sounded the alarm for all DAO participants: decentralized governance is not a utopia that can be achieved overnight. It is a complex system that requires continuous design, iteration, and game-playing. How to build a governance moat that is strong enough to resist capital erosion and malicious attacks while maintaining the open, permissionless spirit of Web3 will be the core proposition that the entire DeFi field must face and answer in the future.