“When the tide goes out, you find out who is swimming naked.” This sentence by Buffett is probably the best way to describe the current Crypto market. Over the past period of time, we have always heard or seen some news about XXX "quitting" again. This kind of news is more likely to express the current status of the industry rather than complaining.

As for why these people choose to leave this industry, the author has roughly tracked them and found the following main reasons.

First of all, due to the bleak market conditions in the past period of time or the changes brought about by the market, some people have to temporarily leave the industry to seek "new life"; secondly, Web3 has been in a kind of "pathological" growth that is not popular in the past one or two years, and some value creators choose to leave this field because they cannot see real value growth; in addition, some people have seen the rise of AI and believe that Web3 has become a thing of the past, and they will pursue new blue ocean markets.

Of course, the above reasons are obviously different when broken down into individual ones, but all these reasons cannot be transformed from local to overall. After all, most people in the market still choose to wait and see or continue to build, because this industry, which has been developing for more than ten years, is not the first time to face such difficulties.

Just because some people who leave this industry may be some influential KOLs, it seems to affect the mentality of many people. But the author believes that the current stage is the real test of Builders. Putting aside these superficial impetuousness, we need to see more things in the industry that are changing or have not been changed. Here I will briefly describe it from the following three aspects.

Has the Web3 industry moved from the blue ocean to the red ocean?

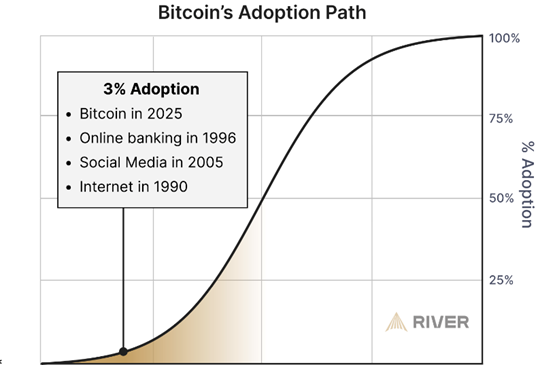

According to a research report released by BTC financial services company River in March, only 4% of the world's population currently holds BTC, with the highest proportion of BTC holders in the United States, with about 14% of people holding BTC. From the perspective of development stage, the current BTC adoption rate is equivalent to the Internet in 1990 or mobile social networking in 2005.

Through this simple data analysis, we can see that the current adoption rate of digital assets, led by BTC, is still in its early stages, far from the so-called red ocean market. Even from the perspective of industry influence, traditional financial giants such as BlackRock and Fidelity have just entered the market. Just imagine, will they be foolish enough to come in and take over?

From the perspective of logic and data analysis, we must admit that if digital assets are the future development direction or Web3 is the intersection of the Internet and AI, then the most likely possibility of this race is that it has just run from the starting point to the midpoint, and there is still a long way to go.

Is the Web3 market only left with exaggerated MEME narratives?

Of course, for many value creations in this industry, the most criticized thing in the past year is naturally the popularity of MEME, because MEME has attracted too much attention, and because of MEME, many people who entered this industry experienced a purge, and even lost confidence in the industry. But as the author said in the previous Weekly, MEME is in the process of evolution, and after experiencing the bubble, it needs new recovery and growth, and this growth may bring value to the industry.

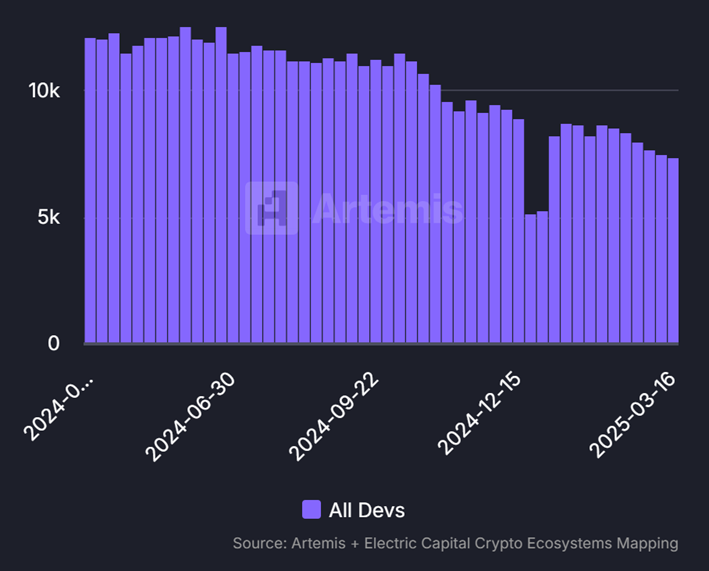

Secondly, we should not only see some superficial changes in hot spots. Builders are still building, and valuable projects are still looking for their own breakthroughs. Through the changes in the number of active developers in the past year, we can see that although it has declined, it is still at a high level.

Although the market seems to have become deserted and lacks major industry-breaking narratives like DeFi in the previous cycle, looking back at the past from the present is always leisurely and full of opportunities, while looking at the future from the present is less confident. But isn’t this the law of development and change of all things?

Even if we look back at the Web3 industry in 2018, it was still extremely bad, even dozens of times worse than it is now, but these did not prevent the subsequent explosion. We need time and patience to wait for the process from quantitative change to qualitative change.

Will the Web3 market continue to fall?

Finally, of course, there is the question of price. More than 90% of people will feel that this cycle is very different from the previous ones and there are not many similarities, so many "looking for a sword on a boat" predictions have become cannon fodder. But if the concept of cycle is still valid, then we are most likely still in this cycle, but without the crazy general rise of the past.

Recently, due to the GS problem, U.S. stocks plummeted, and nearly US$6.5 trillion in market value evaporated in two days. The three major U.S. stock indexes all recorded the largest two-day decline and the largest weekly decline since March 2020. This has also led to more extreme market conditions in the global financial market. Whether this fluctuation can be improved in the short term still needs to be viewed with caution.

Therefore, when BTC has retreated nearly 30% and when the financial market encounters a major change that occurs once in several years, can the entire Crypto market remain immune? Perhaps this is a difficult question to answer.

But our earliest economist, Fan Li, also known as the "God of Wealth", has a classic saying that is worth savoring: "When something is extremely expensive, it becomes cheap, and when something is extremely cheap, it becomes expensive; when something is expensive, it is like dirt, and when something is cheap, it is like pearls and jade." Perhaps we are now in a delicate moment of "treating everything as dirt."

Will BTC eventually reach $500,000 per coin? Seven years ago, it sounded like a joke to say that BTC would reach $1 million per coin. Now it seems that it is not far away. Living in the present, we must always face reality, but facing the future, we must remain cautious and optimistic, always on the road, and always build.