1. Attention Value-Market Key Points

1. Market conditions

(1) Macro environment:

l U.S. December non-farm payrolls data outlook: growth slows but market still pays attention

The situation in the US job market has become complicated in the past few months, with non-farm payrolls in October and November fluctuating significantly due to hurricanes and a massive Boeing strike. The December employment data released today is expected to more accurately reflect the current economic situation. According to analysts' forecasts from FactSet, the number of new jobs in December is expected to be 153,000, down from 227,000 in November and 36,000 in October. Brian Bethune, an economist at Boston College, is more optimistic and believes that the number of new jobs may be between 165,000 and 175,000. He pointed out that Federal Reserve Chairman Powell will regard this data as a "Goldilocks" balance, that is, neither overheating to cause inflation concerns nor cooling to the extent that suggests a recession. If the data falls within this range, Powell will feel reassured. Although the market is full of expectations for the non-farm report, early indicators show that job growth may slow down. For example, the ADP report showed that the number of new private sector jobs in December was only 122,000, which was lower than market expectations.

(2) Web3 field:

Analysts point out that the short-term negative Bitcoin funding rate may be a signal of a local bottom

Analyst James Van Straten pointed out today that when the price of Bitcoin approaches $100,000, market sentiment usually tends to be bullish, and investors actively promote the bull market. However, when the price approaches $90,000, market sentiment may turn bearish, such as in Thursday's trading. Bitcoin's price action tends to move toward the "maximum pain zone", which is located between the two price ranges mentioned above. During bull markets, Bitcoin usually has positive funding rates because traders generally expect prices to continue to rise. Similarly, in bear markets, price bottoms are gradually formed over time, and prices may also rebound quickly, prompting traders to rush to close their positions. In these cases, local bottoms tend to emerge. Recent data shows that the funding rate briefly turned negative to -0.001%, the first time since November 2024. This change triggered leverage liquidation and a shift in market sentiment, and then the price of Bitcoin rebounded to above $94,000.

2. Hot events

(1) Macro environment:

l Federal Reserve officials warned: Future interest rate cuts need to be more cautious as inflation risks rise

A Fed official said last month's rate cut was a "close call" because the current economic outlook is very different from when the Fed began cutting rates four months ago. St. Louis Fed President Moussallem noted that the risk of inflation hovering between 2.5% and 3% at last month's meeting had increased, so he believes that future rate cuts need to be more cautious. Moussallem supported the Fed's decision to cut rates by 50 basis points in September, but he now realizes that economic data has become stronger since September last year and inflation figures have been higher than expected. He said future rate cuts should be more gradual and more conservative than he thought in September. He mentioned that the job market is in good shape and deserves close attention, but the Fed still faces challenges with inflation.

(2) Web3 field:

Dar Open Network launches DeAI multi-agent framework and aiNFT to empower developers and NFT holders

Dar Open Network announced the launch of two new AI frameworks: DeAI Multi-Agent Framework and aiNFT. The DeAI Multi-Agent Framework is a platform designed for developers to build, deploy, and coordinate collaborative AI agents. The modular system enables users to create specialized agents that leverage multiple large language models (LLMs) as backends, providing flexibility and high performance to meet specific application needs. Meanwhile, aiNFT is an innovative tool designed to help NFT holders realize the full potential of their digital assets. With aiNFT, users can launch customized AI agents for the NFTs they own, giving these assets unique personalities and capabilities, and enabling dynamic interactions with users.

3. Hot topic narrative

l Aiccelerate DAO attracted attention and multiple AI coins rebounded strongly on the AI concept coins

Aiccelerate DAO attracted widespread attention despite the overall weak performance of the Crypto and AI markets at the time. The DAO focuses on accelerating the development of decentralized open source AI, aiming to drive innovation and build an ecosystem to support related projects by combining the power of AI and cryptography. Aiccelerate DAO brings together developers from multiple technical frameworks and plans to release a series of AI agents and tools to promote community collaboration. Its founding team consists of many industry experts, including Shaw, co-founder of ai16z. Aiccelerate DAO also plans to issue a token called AICC and manage its assets through a buyback mechanism. Although the token has not yet been officially released, the DAO is already raising funds with a goal of 500 SOL (about US$94,353), and has currently raised 378 SOL. The project's strong lineup of advisors and community support have made it a hot topic in the industry.

In addition, Binance also released an announcement today about the listing of AI concept coins COOKIE, AIXBT and CGPT, after which whales began hoarding.

Perhaps influenced by the news, AI concept coins rebounded strongly, with COOKIE, AIXBT and CGPT increasing by approximately 65%, 27% and 49% respectively.

2. Attention Value-Hot Projects

1. Project Introduction

$BIOS | AI | @biosphere3_ai

- The project of the Crypto Fintech Lab of the Hong Kong University of Science and Technology borrowed the concept of AI Town that became popular last year and built an open agent evolution arena. On this platform, AI agents can interact, test and evolve in a dynamic game theory sandbox.

- The advantage of the project lies in its strong academic background and real-name team, which ensures the reliability of developers. In addition, the concept of the project is relatively new. Although it has been involved in the Web2 era, it still appears to be technically reliable and complete in the Web3 environment.

- Currently, HKUST and the laboratory have not interacted with the project, its relationship with the university officials is unclear, and the high amount of funding may lead to potential negative effects.

3. Attention Value-Sector Rotation

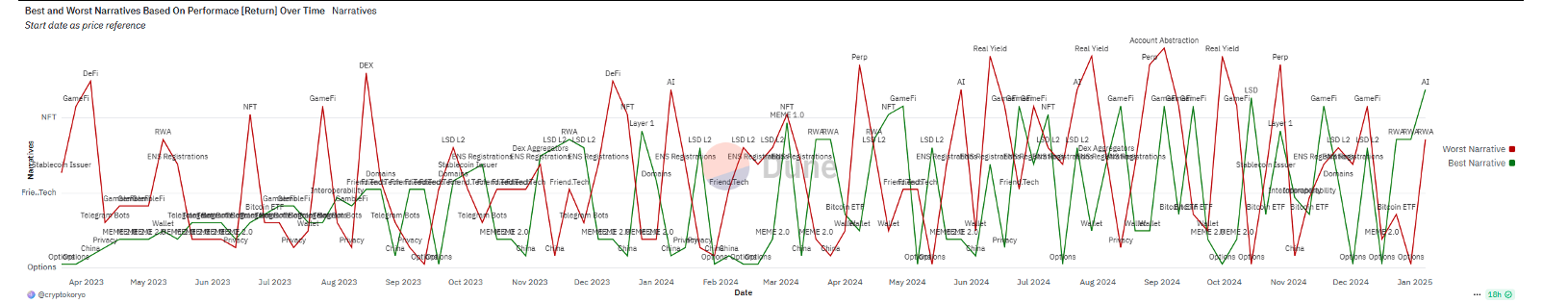

1. Hot topics

Source: Dune, Dot Labs

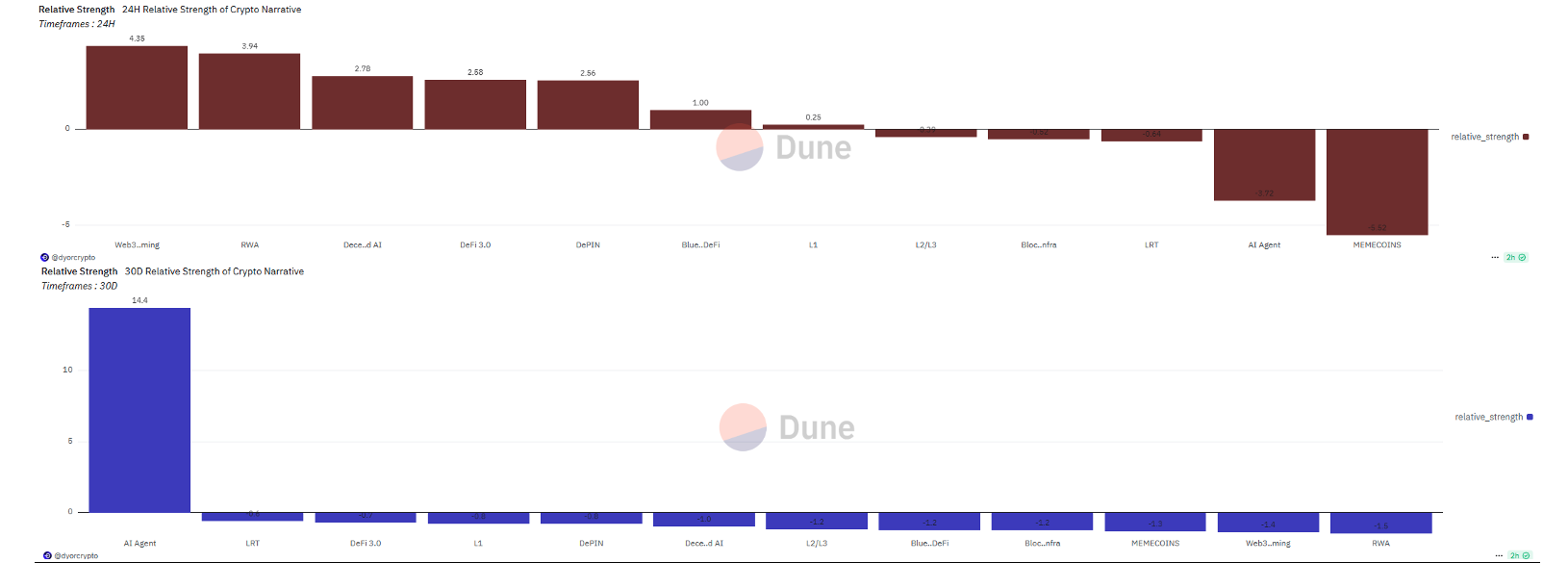

Source: Dune, Dot Labs

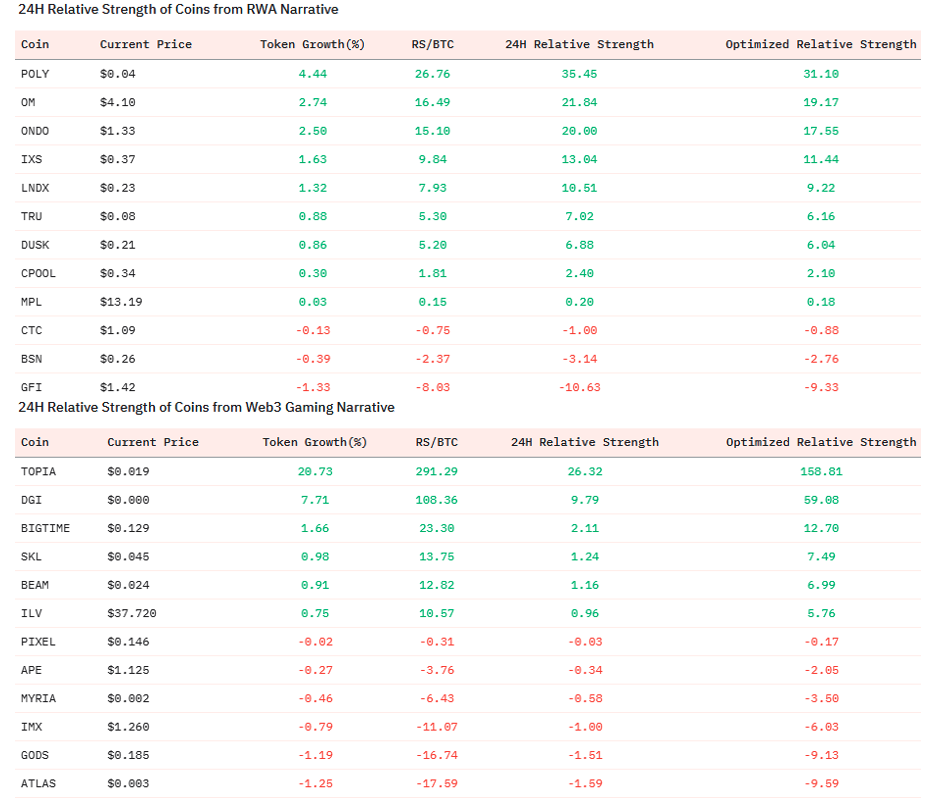

2. Inside the plate

Source: Dune, Dot Labs