First, let's briefly introduce the protocol before we start. In a word, this protocol is a Ponzi scheme disguised as RWA US Treasury bond yields. Now that we have summarized it, let's get to the point.

USUAL has a total of 5 tokens, namely:

- USUAL: The governance token of the protocol (mining coin)

- USD0: Stable currency issued by the protocol (useless)

- USD0++: 4-year government bond issued by agreement (Yangmou Coin)

- USUALX: The pledged version of USUAL (Yangmou Coin)

- USUAL*: Team and investor exclusive version of the token (conspiracy coin)

The conspiracy implemented by the USUAL team is very simple: we have created a real yield (RWA) protocol to bring the stable yield of 4% of US Treasury bonds to the chain, and it is permissionless. Ondo's RWA protocols are all licensed, requiring KYC and an investment of at least $100,000. We can also get a 4% return with 1 dollar and it is permissionless.

Of course, for the cryptocurrency players, what? 4%? Just to feed the beggars? Why should I care? Don’t I get 20% when I deposit USDe? Why should I play with your protocol?

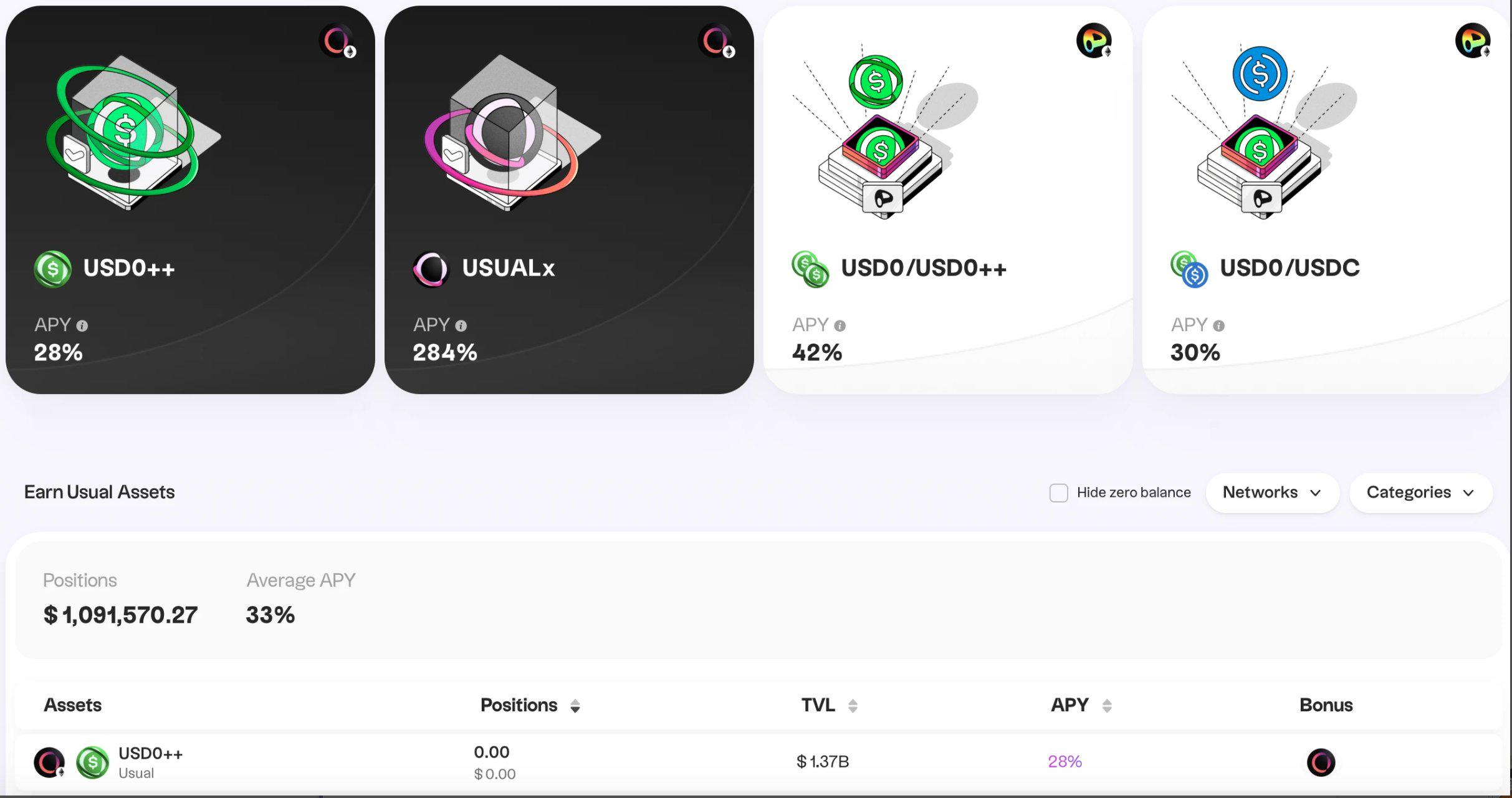

At this time, the first token $USUAL began to shine! You don’t like the 4% treasury bond, right? I have a 70% return, do you want to come? I have a good thing called $USD0++ (a 4-year locked version of the treasury bond token). You can mint it from me at the price of one USD0++ per coin, and then I will issue you my governance token $USUAL (mining coin). My governance token is listed on Binance, and the highest price is $1.5! So, if you buy my treasury bond token, I will give you 70% of the return. (Even if USUAL has fallen to 0.66 now, it still has an APY return of 28% if it is cut in half)

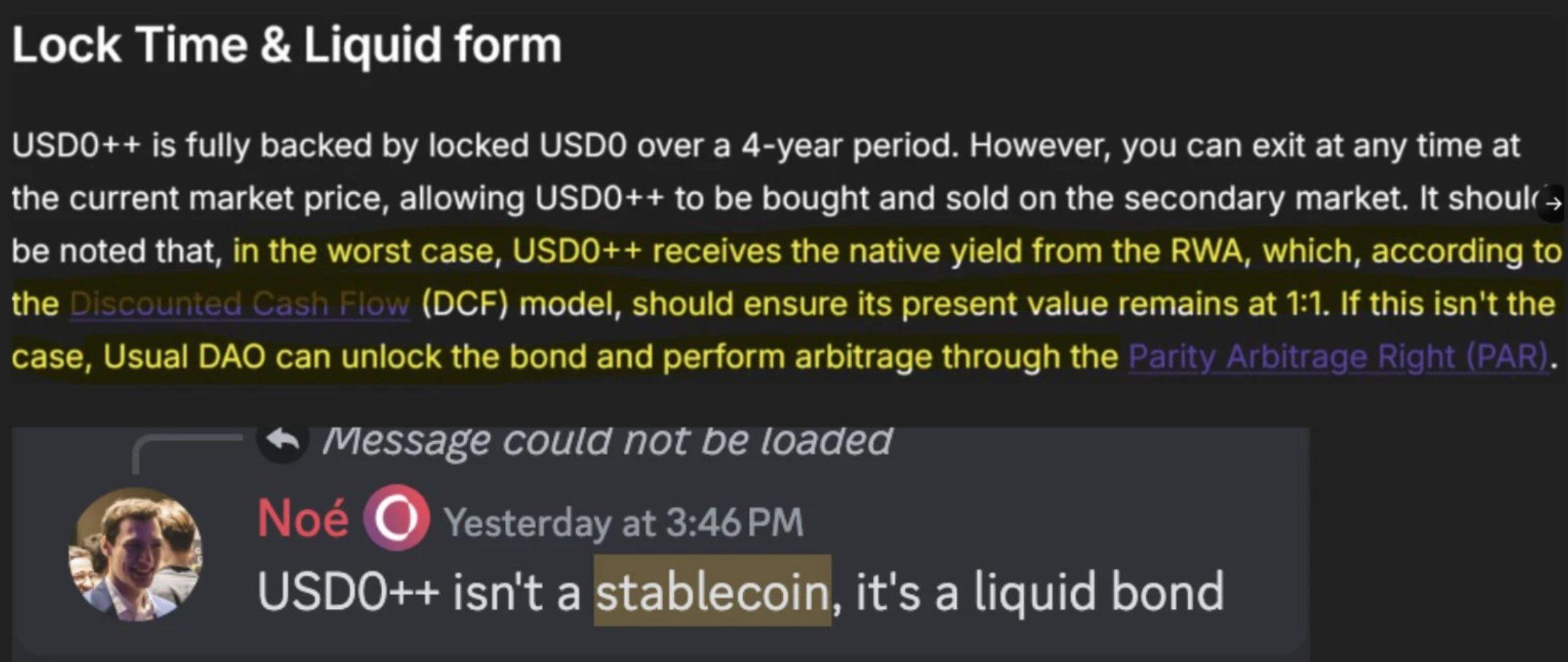

Seeing this, many novices just go all-in. However, everyone has been working in the cryptocurrency circle for so many years. After experiencing the so-called 20%-year UST stablecoin crash of LUAN, we can't help but ask, is there any trap with such high returns? Yes, there is. The trap is that although USD0++ is minted at a price of 1 US dollar, it is not a stablecoin, but a treasury bond token that is locked for 4 years. According to the 4% yield discount, the current value of USD0++ is actually only $0.84. The project party knows the doubts of many veterans, so they allow you to mint USD0++ at a price of 1:1, and they have always opened a 1:1 price to redeem USDC at any time. Are you relieved and do you want to get on board? Of course, the project party has done a few things to eliminate your doubts. They set up various vaults on Morpho, and did not use chainlink but directly used the oracle price of all markets of USD0++ to be fixed as a 1 US dollar oracle.

Therefore, many people began to have the illusion that USD0++ can be redeemed at any time for 1 US dollar, and its price is a knife. Some smart people or DeFi masters began to leverage. For example, I have 1 million US dollars, my annual yield is 70%, and I can earn 2,000 US dollars in $USUAL tokens a day. Now, the price of Morpho's vault oracle is hardcoded at 1, which means that there will be no liquidation. I can leverage up to 5 times, which means that I can use 1 million US dollars and reach 5 million US dollars through leverage. I can mine 10,000 US dollars a day, and then I only need to pay 30% of the annual yield interest, which is a lot of net profit. Indeed, leverage can magnify gains, but it can also magnify losses.

Let's look at an address 0x22a7. This big user used 27 million to stack 130 million USD0++, and earned 100,000 yuan a day. However, after the USUAL team's conspiracy was announced, the tragedy happened. The big user's 130 million USD++ first shrank by 13%, which means a loss of 16.9 million in principal, a loss of 62%. And now Morpho's loan interest is 140%, which means that the big user needs to pay nearly 500,000 yuan in interest every day.

https://debank.com/profile/0x22a709eECE6eE82293e5FcDeEA7ceeFdEfD499cD?chain=eth

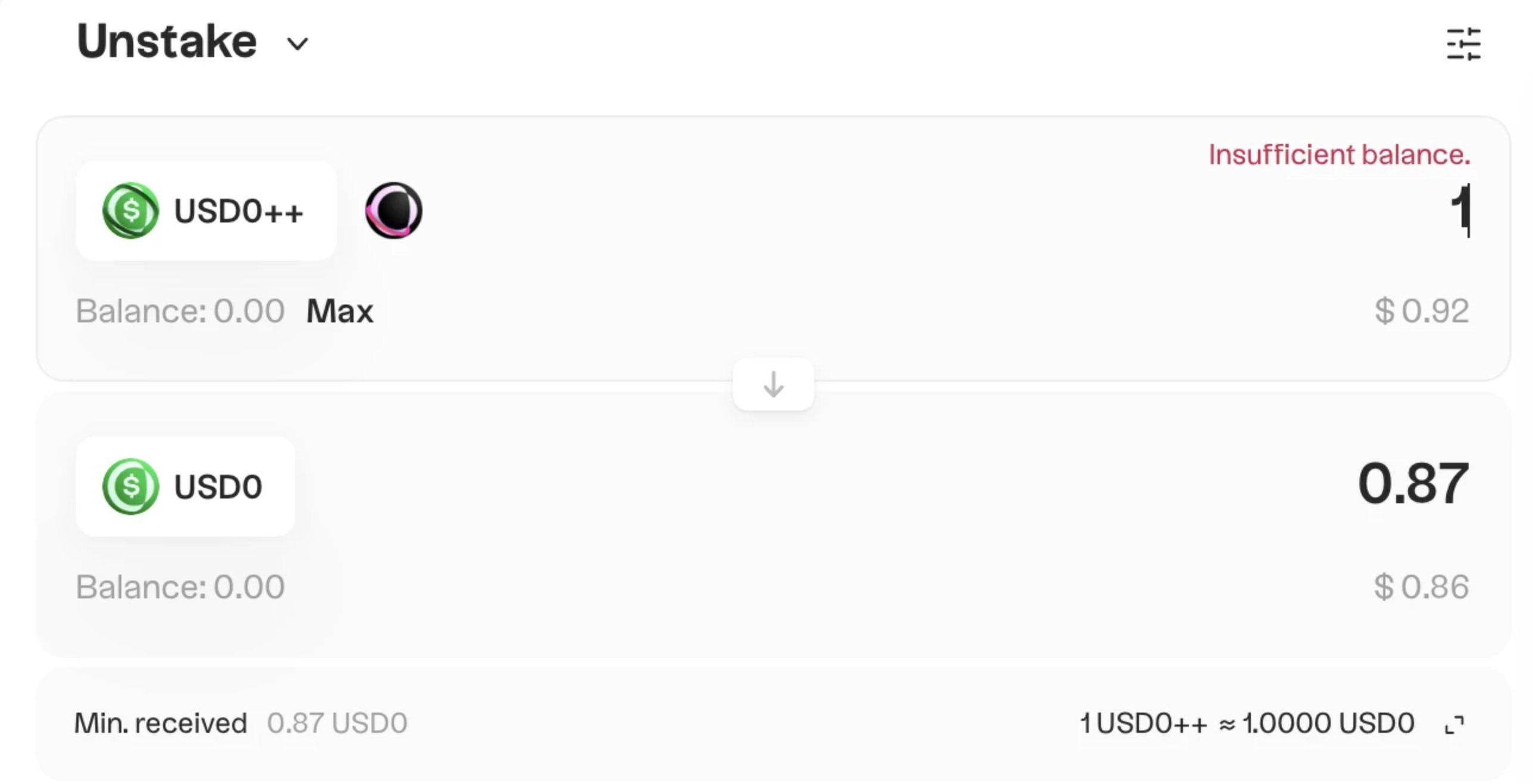

What is the conspiracy announced by the USUAL team? In fact, they suddenly closed the USD0++ 1:1 redemption channel without any warning, and you can only exit USD0++ at the floor price of 0.87 announced by the team. No, buddy, when I bought it, you sold it to me at 1 yuan, and now it's less than a month, I want to sell it, and you tell me that I can only sell it at 0.87 now?

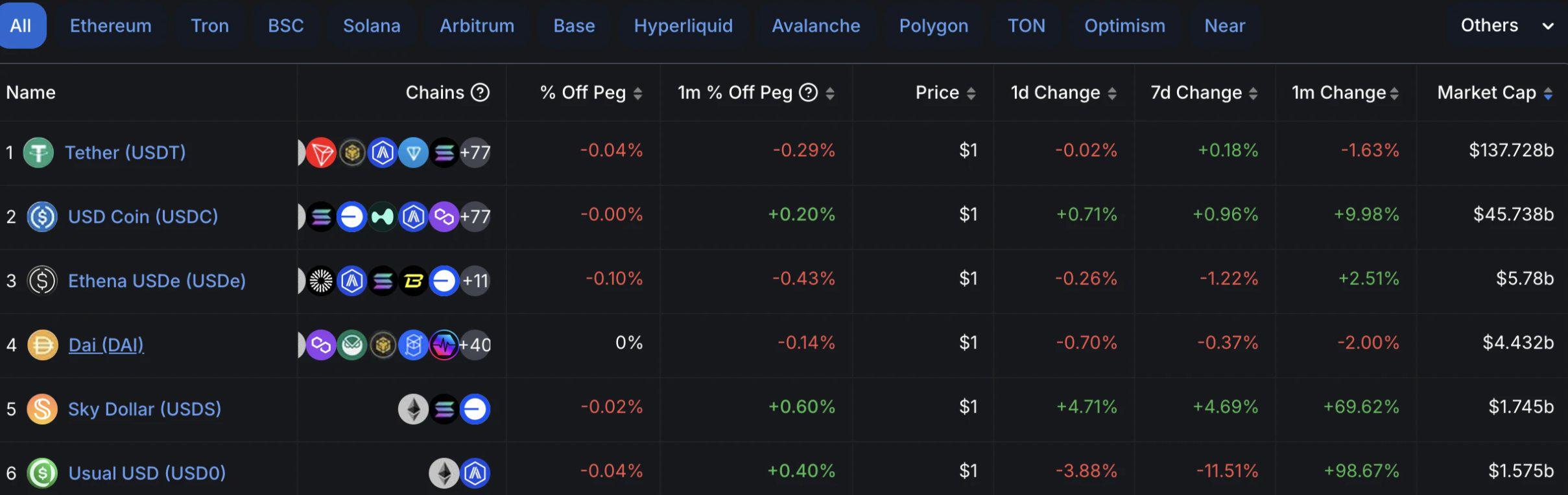

At the peak of the USUAL protocol, TVL was close to 2 billion. It is the fifth largest stablecoin after DAI. What does the 0.87 floor mean? It means that the project team grabbed 13% of the 2 billion, which is close to 260 million, into the protocol.

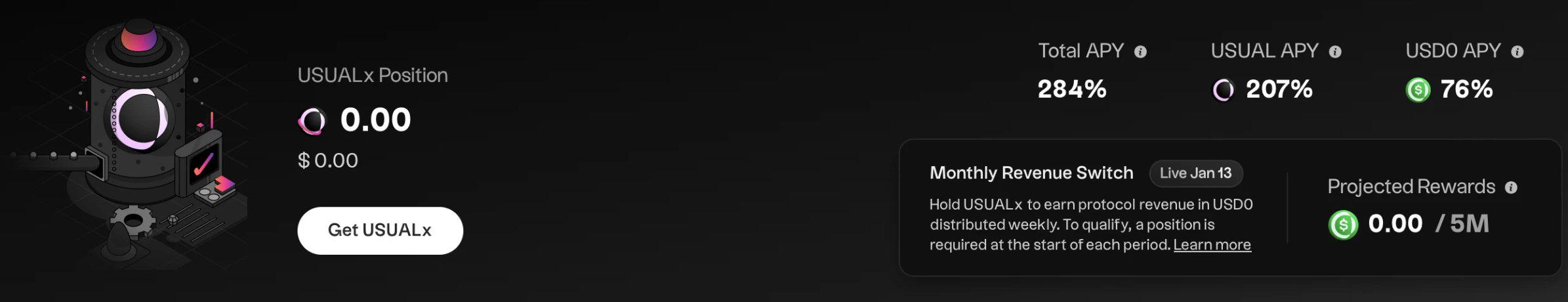

According to the project's description, all the stolen money was distributed to USUAL's pledger USUALX. They will turn on the fee distribution switch in advance on January 13. In short, the brothers who pledged USUAL can share the US dollar income + USUAL token emission income. What a wonderful mechanism, the mining coin receiver mines himself and mines USD0++ holders at the same time, and USD0++ holders mine USUAL mining coin receivers. The two groups of people dig at each other, which is a bit like the human centipede. As the saying goes, when the snipe and the clam fight, the fisherman benefits!

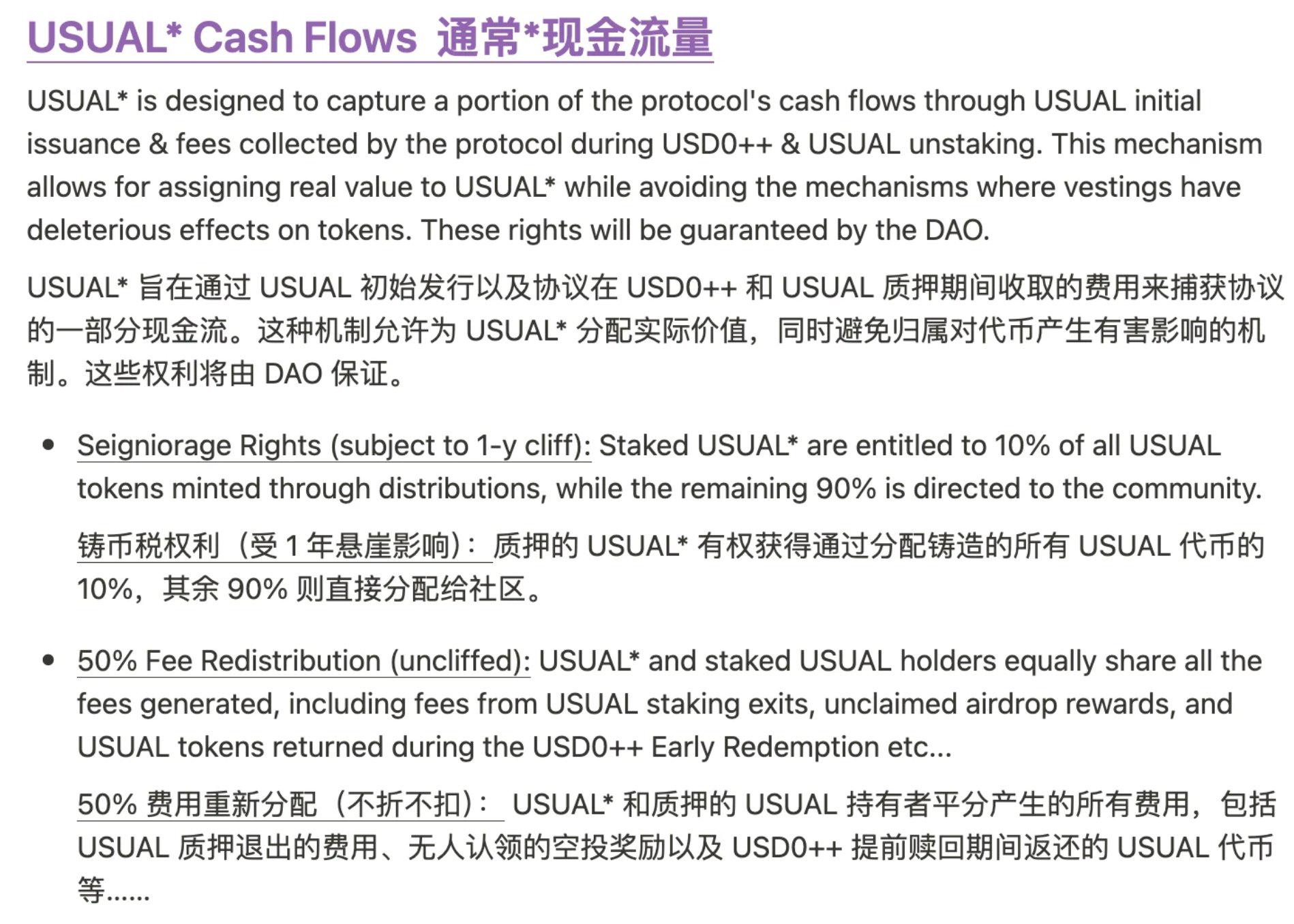

That's right, the project side is the one who is guaranteed to make money. Because there is another token called USUAL*, which is an equity token that retail investors cannot access and is only for investors and teams. It has all the rights and interests that USUALX enjoys, and it also has the rights and interests that USUALX does not enjoy. Looking directly at the key part, the share of TEAM+USUAL LAB exceeds 60%, with the team accounting for the majority and investors accounting for 40%.

Let’s look at the functions of USUAL*: 1. Seigniorage rights, directly share 10% of the total USUAL, which is 400 million USUAL. 2. 50% of the fee distribution. We just said that the project team got 260 million USUAL back, and they divided the spoils with USUALX holders 55-50. USUAL* gets 130 million, and the team accounts for 60% of USUAL*, so the team has earned 72 million US dollars, and this does not include the distribution of USUAL governance tokens. In addition, the total amount of USUAL* is fixed at 360 million, and it will not be diluted like USUALX. USUAL* token details: https://usualmoney.notion.site/USUAL-Recap-13eab2a39ead804e8f1aeca1c75b85bd

OK, so why do the project owners have no moral bottom line and choose to rob money directly? The answer is simple: the flywheel can no longer rotate, and the Ponzi scheme can no longer be maintained. If nothing is done, the protocol will go into a death spiral. Pull open the candlestick chart of $USUAL and see that it keeps falling! Therefore, if the project owners do not take some measures, USUAL will be mined and sold, APY will continue to fall, TVL will run away, and the protocol will no longer exist.

Therefore, the project team took a two-pronged approach: opening profit sharing and imposing a 13% head tax on TVL. This combination of punches, first, maintained TVL, and also grabbed a sum of money from TVL to share with USUALX, attracting people not to sell, increasing the demand for USUAL and reducing circulation. The price of USUAL was supported, and the APY was naturally high, which would attract new TVL. This allowed the Ponzi scheme to last a little longer.

But who are the sacrificed? All the participants! The entire protocol is a Ponzi scheme, and it will eventually go into a death spiral. It’s just a matter of time. USUAL will only go lower and lower, and eventually return to zero. The holders of USD0++ were robbed of a 13% tax, the leveragers of Morpho suffered huge losses, and the LPs of Pendle, whether YT or PT, all suffered.

Who are the beneficiaries? The project owner! The project owner! The project owner!

If you have never come into contact with USUAL before, don't do it. If you are playing and have been trapped, you can either admit the loss and stop the loss, or play with the project party to the end. However, playing with the project party to the end, even if you don't lose money, there is a huge opportunity cost. How many 4 years can the cryptocurrency circle have? In the cryptocurrency circle where supervision is lacking, the project party is not bound by the law, and there is no such thing as a moral bottom line!