Vana is listed on Binance, the price is very attractive, some are happy and some are sad.

Those who make money with multiple accounts are happy because the cycle is short and the returns are high; those who speculate in NFTs are also happy because they can earn a lot of ETH in a short time. However, due to the snapshot time issue, those who buy NFTs at a high price at the secondary level are a bit uncomfortable.

In comparison, BNB holders are truly enjoying a stable happiness. The income this period seems to be higher than the previous ones, and with the recent Lanchpool and HODLer airdrops, BNB, this golden shovel, keeps digging, and the big holders are enjoying the benefits.

To be honest, I knew about the VANA project before, but I didn’t expect it to be launched so soon. Now I can only watch you get rich. Next, let’s not talk about right or wrong, but simply review what VANA does and why it can be listed on Binance. This may be helpful for subsequent ambush projects.

1. Originated from Massachusetts Laboratory

Public information shows that the birth of Vana can be traced back to a classroom in the MIT Media Lab.

There, Anna Kazlauskas and Art Abal met. They were obsessed with data democratization and hoped to let users truly control their own data through their own efforts, so they founded Vana together.

Subsequently, the Vana team used the innovative DLP (Data Liquidity Pool) mechanism and Proof of Contribution system to enable users to safely contribute private data, jointly own and benefit from the AI models trained with this data.

Their efforts were quickly recognized by the industry, and they had raised a total of US$25 million in financing before TGE, with investors including top VCs such as Coinbase Ventures, Paradigm, and Polychain.

Now, they have successfully landed on Binance, which can be regarded as a victory for the academic school and is also an encouragement for young people who are eager to change the world.

2. Collaborate and interact with the a16z team

Some time ago, a16z partners released a list of AI projects worth paying attention to, and Vana was the only Web3 project mentioned.

Interestingly, a16z is not an investor in Vana, which also indirectly reflects Vana's influence in the industry.

Co-founder Art admitted in an interview that although a16z did not directly invest in Vana, it received a lot of indirect and informal support from a16z.

“I think the reason they’ve been so helpful to us is because we’re very aligned in our goals of moving Web3 forward. We want to make Web3 more accessible and make sure it solves real problems.”

3. Data DAOs are everywhere

DLP (Data Liquidity Pool) is the core function of the Vana ecosystem. Users obtain tokens by contributing data, forming the so-called data liquidity. Each data DAO or liquidity pool focuses on a specific type of data.

For us, this is actually similar to "data mining": when you are optimistic about a DAO, you can directly contribute data according to their rules, and then you will receive corresponding rewards and airdrops.

Public data shows that since the launch of the developer testnet in June 2024, the Vana network has attracted 1.3 million users, more than 300 data DAOs, and 1.7 million daily transactions.

4. Two-layer token economic model

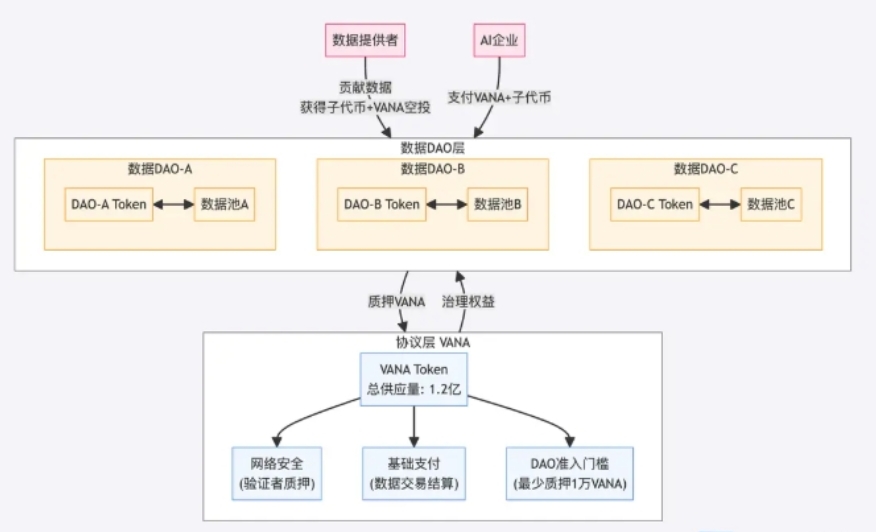

In the Vana ecosystem, data DAOs of all sizes have their own sub-coins, and have corresponding connections with the parent coin $VANA (such as airdrops, etc.).

This is the two-layer token economic model designed by Vana: setting a unified basic token $VANA at the protocol level, while allowing each data DAO to issue its own exclusive token, with the parent coin and sub-coin having different divisions of labor and functions.

For example, each data DAO must stake at least 10,000 $VANA to operate. In this way, the value of the parent currency is directly tied to the ecological construction, and the prosperity of the same will be shared by all.

5. Uncertainty about future development

From the design concept point of view, the emergence of Vana marks that the data economy is ushering in a paradigm shift. However, whether Vana will ultimately succeed still faces many uncertainties.

Rhythm once summarized this: technically, it needs to find a balance between openness and security; economically, it needs to prove that its model can generate sustainable value; on the social level, it also needs to deal with potential data ethics and regulatory challenges.

In any case, Vana provides us with a window to rethink data value, AI ethics, and technological innovation. We look forward to more innovative projects in this field in the future to help the data economy take off.