By: Matti, Zee Prime Capital

Compiled by: Yangz, Techub News

I’m back with another Peter Thiel-inspired mishmash of ideas. As a self-proclaimed Thielite, I often look at the future through the lens of his bible, Zero to One: The Secret to Unlocking Business and the Future. Thiel’s framework is highly extensible, dissecting ideas, trends, and movements with pinpoint accuracy. But sometimes it’s more like Wittgenstein’s ruler—whose reliability is highly dependent on the perspective from which it’s viewed—than a lens that’s always clear. (Note: The Wittgensteinian ruler theory states that unless you’re confident in the ruler’s reliability, if you use a ruler to measure a table, you’re probably also using the table to measure the ruler.)

As a cryptocurrency investor, I often capture opportunities through narrative analysis. Now that the industry is at a turning point and the arbitrage space in the emerging technology market is about to close, I can't help but think: How to discover and inspire more outstanding ideas and products?

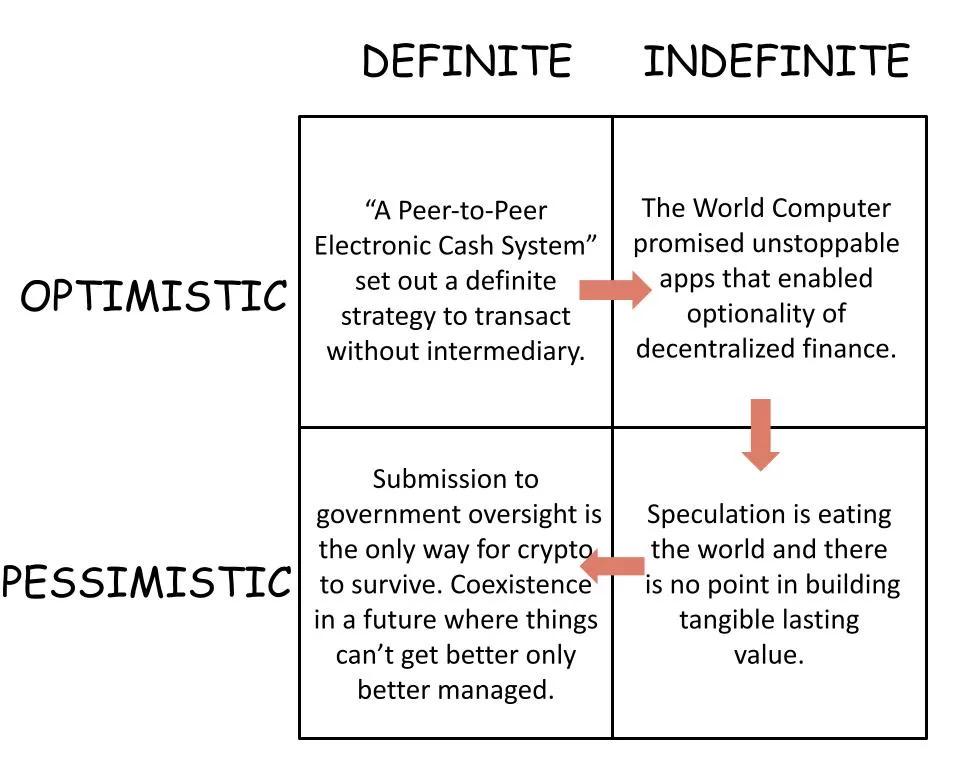

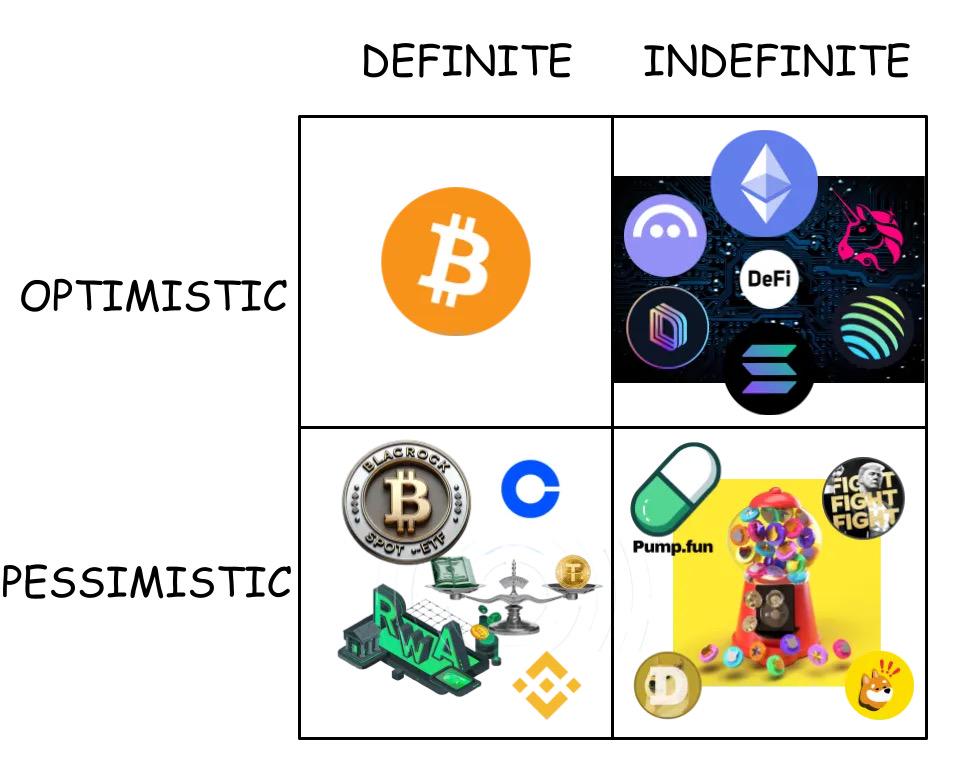

Through Thiel’s prism, the timeline of the cryptocurrency industry presents an arc: from the “clear optimism” of the early days of Bitcoin, to the “fuzzy optimism” in the grand vision of Web3 (finance eventually became the killer application), to the “fuzzy pessimism” of the Memecoin casino era, and today’s “clear pessimism” about regulatory compromise. This arc starts from the ideals of cypherpunks, passes through entrepreneurial frenzy, falls into degen culture, and finally moves towards standardization.

However, is this arc universal for all trends? When a revolutionary idea is partially proven, it becomes a hyped "universal antidote"; when it fails to deliver on the high expectations, it is spurned and eventually returns to the norm. For now, the revolution has not been fully realized, but we have still (for some people) completed a satisfying cycle along Gartner's technology maturity curve (hype cycle).

In the cryptocurrency space, the grand hype cycle is obscured by price fluctuations. Each cycle—Bitcoin, ICOs promising “world computers,” DeFi, Memecoin, and now regulatory and traditional finance (TradFi) integration—is like a fractal of a larger pattern. Right now, we are in the Trough of Disillusionment. And according to Carlotta Perez’s theory of technological revolution waves, we are at a turning point.

Web3 promised to make Web2 profitable by on-chain, decentralized, and tokenized. However, Web2 or Web3 are not specific “places” — they are not separate “things.” As I said two years ago, they are more like “user preferences,” which are still a minority today. If you always have to refer to the old to explain the new, you are not building something truly new.

The cryptocurrency industry is no longer a frontier market, but opportunities still exist at the forefront of this increasingly mature space. Where are the biggest opportunities at this stage? Intuitively, they will come from growth dividends or latecomer advantages.

It is worth noting that centralized exchanges (CEX), once the “pioneers” in the popularization of cryptocurrencies, have now become “conservatives”, focusing only on defending market share rather than promoting on-chain adoption. Ironically, it is these exchanges and the L1 public chain that have created the most impressive returns for investors. In these tracks where competition is fierce and idealism gives way to pragmatism, the biggest winners are born.

So, does this mean that there are no more "secrets" in the industry? I firmly believe that "secrets" still exist, and today's "secrets" are precisely the revelations of the past: how many truly innovative companies and networks have we built?

The low-hanging fruit has already been picked. Most projects either clumsily imitate the routines of their predecessors or repackage old elements as so-called innovations. Too many solutions are solving non-existent needs, while others simply copy the traditional financial model on the blockchain.

Crypto is essentially an unfinished revolution that ultimately became a revisionist force. Now it is caught in a core (perhaps false) dilemma: "Is it the right path to stick to idealism, or succumb to the reality of "making money"? In other words, are you willing to sell your ideals for the price offered by the old system? After crying dry in the Memecoin casino, more and more revolutionaries are accepting this deal.

Those vague ideas based on the builders' wishful thinking (no, users don't care about data sovereignty at all), combined with the real commercial success of centralized service providers, have jointly created the current dilemma. Today, it is almost difficult to find "clear optimists" in the cryptocurrency field, but the word "almost" leaves investment opportunities for those who are willing to stick to the forefront.