Recently, Boston Fed President Susan Collins sent out an unprecedented signal:

"Financial stability is a priority and the Fed will be ready to step in."

This is not verbal reassurance, but a clear forward guidance. The market is volatile, and the Federal Reserve is brewing a thorough monetary shift.

🏦 How will the Federal Reserve “save the market”?

Once market pressure accumulates, the Fed may quickly use four major tools:

✅ Early interest rate cut (may start in May)

✅ Restart quantitative easing (QE) or repurchase injection operations

✅ Relax bank collateral regulations to reduce pressure on the financial system

✅ Provide an emergency liquidity window (such as in March 2023)

Collins' speech was precisely to "lay the groundwork for public opinion" for the above policy.

📉 The macro structure is ready: May is the policy turning point

Inflation continues to cool

✅Economic growth has slowed significantly

✅Credit tightening, increasing pressure on businesses and consumers

✅The Fed is unwilling to wait until the "breaking point" before taking action. Once this wave of changes is implemented, BTC will be the first to detonate the entire asset market.

🚀 BTC is no longer a "slow bull" - it is a "vertical launch"

Bitcoin is not just "going up", but will enter a straight-up phase with no liquidity selling pressure + panic buying.

In this "bull frenzy" environment, altcoins are the center of the outbreak.

🧠 I analyzed more than 1,000 altcoins and selected 5 projects with high certainty and 100x potential:

1️⃣ $ ONDO | @OndoFinance

✅ Focus on the RWA (Real World Assets) sector

✅ Put government bonds and other assets on the chain and open them to global investors

✅ Bridge project connecting TradFi and DeFi

Market cap: $2.87 billion

Contract address: 0xfaba6f8e4a5e8ab82f62fe7c39859fa577269be3

2️⃣ $HYPE | @HyperliquidX

✅ CEX-like experience, KYC-free perpetual contract DEX

✅ Self-built high-performance L1, fully on-chain order book

✅ Just launched HyperEVM that supports smart contracts and native DeFi

Market cap: $5.31 billion

Contract address: 0x0d01dc56dcaaca66ad901c959b4011ec

3️⃣ $ AAVE | @aave

✅ Decentralized lending protocol with multi-chain deployment

✅ Support over-collateralized lending, stable returns

✅ Has become one of the core infrastructures of DeFi

Market cap: $2.24 billion

Contract address: 0x7fc66500c84a76ad7e9c93437bfc5ac33e2ddae9

4️⃣ $ DEXE | @DexeNetwork

✅ DAO construction and governance tool platform

✅ Support "social trading" copy strategy

✅ Strong community drive + programmable governance

Market cap: $853 million

Contract address: 0xde4ee8057785a7e8e800db58f9784845a5c2cbd6

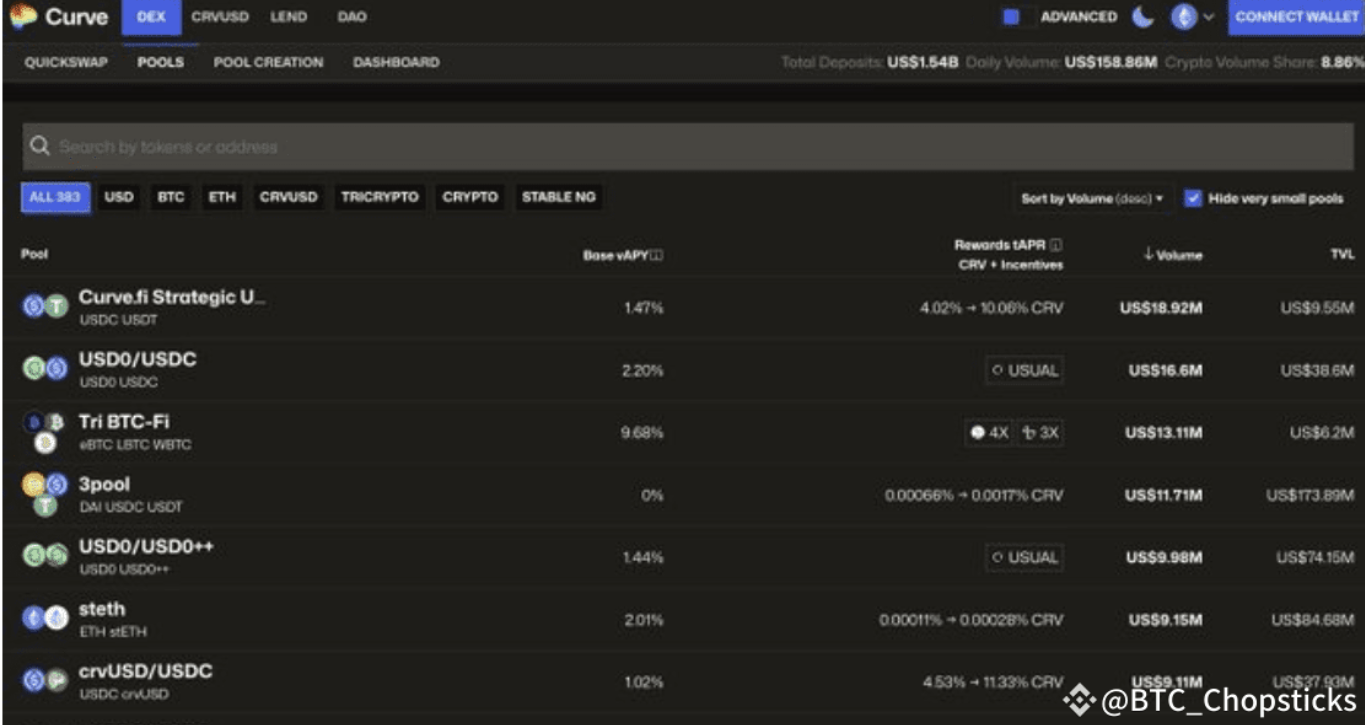

5️⃣ $ CRV | @CurveFinance

✅ DEX veteran with low slippage exchange between stablecoins

✅ CRV governance token is still the key to DeFi ecosystem governance

✅ Future VE model upgrades will release new power

Market cap: $836 million

Contract address: 0xd533a949740bb3306d119cc777fa900ba034cd52

in conclusion:

✅The Federal Reserve has clearly conveyed the signal that it is “ready to take action.”

✅Once the interest rate inflection point is confirmed + liquidity is injected, BTC 's $150K is not a fantasy, but a logical end point.

✅In this macro game, Bitcoin will take off first, while high-quality altcoins will achieve a hundredfold increase in panic buying.

✅If you are still waiting and watching, the real opportunity may have passed you by.

Now is the last window for layout before the overall situation changes.