Author: Weilin, PANews

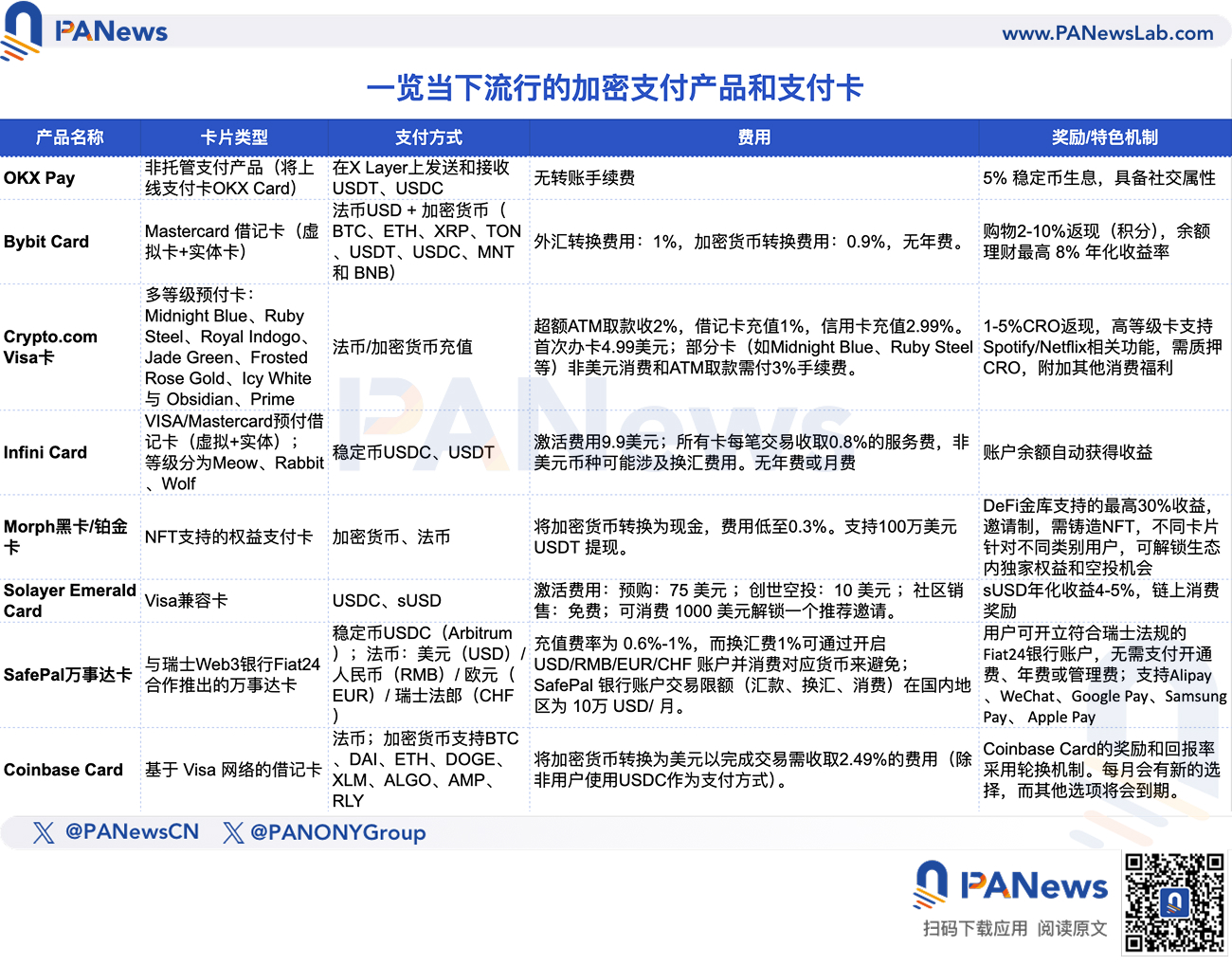

The market for crypto payment products and payment cards (U-cards) is becoming increasingly diverse. With the recent launch of new products such as OKX Pay, Infini Card, Solayer Emerald Card, and previous Bybit Card, Crypto.Com Visa Card, Morph Card, SafePal MasterCard, and Coinbase Card, discussions on crypto payment cards have heated up again.

Crypto payment cards allow users to use cryptocurrencies (such as Bitcoin and Ethereum) directly for daily consumption, similar to traditional debit or credit cards. They can instantly convert cryptocurrencies into legal currencies (such as US dollars and euros), eliminating the technical barriers for merchants to accept cryptocurrencies, while reducing the complexity of using cryptocurrencies (such as managing private keys or exchanges). Some Web3 payment cards integrate social functions, such as sending cryptocurrencies as red envelope gifts via messages. In the future, Web3 payment cards may also be integrated with more DeFi protocols to give users greater financial freedom.

In this article, PANews sorts out several currently popular Web3 payment products and payment cards, focusing on their payment functions and reward mechanisms. This information mainly comes from official websites, official social platforms, and publicly released content by project leaders.

OKX Pay

On April 28, OKX officially launched the first version of OKX Pay, a payment application that integrates non-custodial and compliance, embedded in the OKX App. The product was developed internally for 8-9 months and has gone through 4 internal iterations. It is currently a peer-to-peer payment and will work with MasterCard to launch the OKX Card payment card in the future. Currently, OKX Pay has a 5% stablecoin interest income, which is limited in time. In the future, it will connect to more on-chain interest-bearing protocols and hold more activities.

OKX Pay also integrates social features, such as a built-in messaging function to communicate with others, and send cryptocurrencies as personalized gifts.

According to the official introduction, OKX Pay can easily achieve non-custodial and convenient payment, aiming to allow users to have a smooth user experience in Web3 payment applications like Web2 applications. OKX Pay adopts a private key sharding management method, dividing the private key into two, half of which is stored in the user's Passkey and the other half is stored by OKX. OKX Pay will focus on stablecoin payments, initially supporting USDT and USDC, and will gradually connect to more stablecoins in the future. The core of OKX Pay is to achieve a non-custodial experience without the need for users to manage their own private keys - this has always been an important threshold that hinders many people from participating in the crypto field. At the compliance level, OKX Pay uses mechanisms such as real-name authentication (KYC), anti-money laundering (AML) and multi-signature (Multisig) to ensure the security of users and assets.

Bybit Card

Bybit Card is a Mastercard cryptocurrency debit card that allows users to easily and quickly access cryptocurrency funds and use cryptocurrency anytime, anywhere. It supports virtual and physical cards and is currently open to users in the EEA (European Economic Area) and CH (Switzerland) regions, AIFC (Astana International Financial Center), Australia, Brazil and Argentina.

The foreign exchange conversion fee for transactions is 1% (on top of the Mastercard exchange rate) and the cryptocurrency conversion fee is 0.9% (on top of the spot trading fee), with no annual fee.

Users can choose to pay with cryptocurrency or fiat currency balance. Supported fiat currencies include: USD; supported cryptocurrencies include: BTC, ETH, XRP, TON, USDT, USDC, MNT and BNB.

With this debit card, users can instantly pay for their purchases with the proceeds earned from Bybit’s full range of trading products. Users can enjoy 2-10% cashback (via points) on purchases, depending on Bybit VIP level. Turn on “Automatic Finance” and enjoy up to 8% annualized yield on the card balance without transferring funds between accounts.

According to official introduction, more than 90 million merchants currently support the use of Bybit cryptocurrency debit cards. Bybit cryptocurrency debit cards support EMV 3D security, an advanced anti-fraud technology that can authenticate consumer identities when making online payments.

Crypto.com Visa Card

The Crypto.com Visa Card is a prepaid card, similar to a debit card, that requires top-up. Users can top-up their Crypto.com Visa Card using bank account transfers, other credit cards, or cryptocurrency wallets.

Midnight Blue Crypto.com Visa Card does not require CRO staking or CRO Lockup when opening the card. If you want to apply for Ruby Steel, Royal Indogo, Jade Green, Frosted Rose Gold, Icy White and Obsidian Crypto.com Visa Card, users need to lock CRO for 365 days.

The Crypto.com Visa card has no annual fee and users can get 1-5% cashback in CRO (Crypto.com’s native token) when spending, with premium cards offering higher ratios.

All payment card rewards are paid in CRO and deposited into the user's cryptocurrency wallet in the Crypto.com App. Every eligible transaction will generate CRO rewards immediately. Consumption rewards will be rewarded in USD equivalent. Spotify and Netflix consumption rewards enjoyed by Royal Indigo, Jade Green, and Ruby Steel tier cardholders will expire six months after the payment card is opened.

In terms of fees, there is a 2% fee for withdrawals above the monthly free ATM withdrawal limit, a 1% fee for debit card top-ups, and a 2.99% fee for credit card top-ups. The first order of the Midnight Blue Crypto.com Visa card costs $4.99; for Midnight Blue, Ruby Steel, Royal Indigo, and Jade Green Cards, all non-US dollar purchases and ATM withdrawals are subject to a 3% fee.

Infini Card

Infini Card is a VISA/Mastercard prepaid debit card provided by Infini, which aims to provide users with a transparent and low-cost solution. With Infini Card, users can directly use their stablecoins to transact with millions of merchants around the world.

Infini Card has no annual or monthly fees. Infini account balance automatically earns interest. Supports payments at online and offline merchants worldwide. Card can be added to Apple Pay, Google Pay and Alipay.

Infini Lite Card (Meow) is a low-fee virtual card that belongs to the Mastercard network and is suitable for daily expenses. It can be used on multiple platforms such as Uber, WeChat, Alipay, etc.

Infini Tech Card (Rabbit) is a virtual card for subscription payments, belonging to the Visa network, and is more focused on US dollar merchants. It supports X, ChatGPT, OpenAI, and developer tools. The fee for non-US merchants or non-US dollar transactions is a fixed 1% plus $0.50, and there is also a minimum rate threshold of $0.01.

The activation fee for both cards is $9.9, with no annual or monthly fees. In terms of commission fees, all cards charge a 0.8% service fee for each transaction, and non-US currencies involve corresponding exchange fees.

The upcoming third card, Infini Global Card (Woof), can be added to Apple Pay and Google Pay, and you can apply for a physical card.

Morph Black and Platinum Cards

According to the official website, Morph Black Card is a status symbol for cryptocurrency users, providing high-yield asset strategies, unlimited withdrawal options, low conversion fees and traditional banking services, as well as Morph ecosystem benefits, including token airdrops and event participation rights. An exclusive high-yield DeFi vault designed for Black Card holders, users can enjoy up to 30% asset yield. Convert cryptocurrency to cash with fees as low as 0.3%. Supports $1M USDT withdrawals. Invitation or whitelist required, NFT minting required.

Compared with the black card, which is aimed at high-net-worth users and "whales", the Morph Platinum Card is aimed at more popular users. DeFi income is the basic income, and the platinum card also needs to mint corresponding NFTs.

According to the official introduction, Morph card holders can enjoy a variety of exclusive rights and interests within the ecosystem and future airdrop rights.

Solayer Emerald Card

The Solayer Emerald Card combines real-world spending, on-chain rewards, and fully decentralized finance. It is a Visa-compatible payment card that is open to more than 40,000 users and fully supports Apple Pay, Google Pay, and the Visa global network.

Official introduction: Using USDC to spend like cash can earn on-chain rewards and experience the real-world practicality of cryptocurrency. Users can withdraw local cash at ATMs worldwide. Deposit USDC for immediate spending, or choose sUSD, a stablecoin backed by treasury bonds with an annualized yield of 4-5%. Users can mint/redeem sUSD instantly (no lock-up period, no minimum limit), and payment cards are non-custodial, aiming to achieve seamless switching between consumption and savings.

Emerald Card is built on Solayer’s InfiniSVM, a hardware-accelerated Solana Virtual Machine (SVM) that provides Visa-level throughput while enabling true on-chain execution.

Currently, the invitation-based waiting list for the card is now open, and the official service has been opened to 40,000 users of the Genesis Airdrop and Community Sales. Activation fee: Pre-order: $75; Genesis Airdrop: $10; Community Sales: Free. If users want to skip the waiting list, they can spend $1,000 to unlock a referral invitation.

It is worth noting that in this marketing, Solayer also directly played on the joke that Empress Dowager Cixi loved collecting jade, making the marketing "out of the circle".

SafePal MasterCard

SafePal's crypto payment card is a Mastercard launched in cooperation with Swiss Web3 bank Fiat24, aiming to provide users with convenient cryptocurrency consumption and fiat currency conversion services. The Mastercard supports direct recharge with stable currency USDC (Arbitrum), and can be bound to Alipay and WeChat for daily consumption in offline/online scenarios. It can also be used for membership subscription services of popular overseas platforms such as Twitter and Telegram. There is no card opening fee, management fee or annual or monthly fee.

This card supports four currencies: USD/RMB/EUR/CHF. You can open a USD/RMB/EUR/CHF account and top up funds. There is no exchange fee for spending these currencies. The top-up fee for SafePal MasterCard is 0.6%-1%, and the 1% exchange fee can be avoided by opening a USD/RMB/EUR/CHF account and spending the corresponding currency: for example, use a RMB account for domestic consumption, and open a GPT or Twitter membership account with a USD account to avoid the 1% exchange fee. The transaction limit of SafePal bank accounts (remittance, exchange, consumption) in China is 100,000 USD/month.

Coinbase Card

Coinbase Card is a Visa-based debit card issued by Pathward, NA, for US users outside Hawaii only. It allows users to spend cryptocurrencies or US dollars worldwide. Card fees are settled based on real-time exchange rates.

Supports cash and cryptocurrencies BTC, DAI, ETH, DOGE, XLM, ALGO, AMP, RLY. Coinbase automatically converts all cryptocurrencies into USD for shopping and ATM withdrawals. US users can quickly accumulate cryptocurrency rewards through daily spending.

Public reviews show that converting cryptocurrencies to U.S. dollars to complete a transaction costs a 2.49% fee (unless the user uses USDC as a payment method).

Coinbase allows cardholders to choose from a variety of cryptocurrencies, each with a specific percentage return. Here are some examples of past return rates: Cosmos: 14.04%, Ethereum: 2.09%, Polkadot: 10.2%, Solana: 6.51%. Coinbase Card's rewards and return rates are rotated. New options are added each month, while other options expire.

MetaMask to launch payment card soon

MetaMask, the Little Fox wallet, and MasterCard are also about to launch their own payment card. On April 29, financial technology companies CompoSecure, Baanx and MetaMask jointly launched the payment card "MetaMask Metal Card", which is scheduled to be launched globally in the second quarter. The card allows users to pay directly from the MetaMask self-hosted wallet, without pre-charging or converting fiat currency through centralized exchanges. All transactions are authorized within 5 seconds through smart contracts. Users must store cryptocurrencies on the Linea network.