1. Attention Value-Market Key Points

1. Market conditions

(1) Macro environment:

l The Fed meeting minutes revealed that inflation risks are rising and the pace of interest rate cuts may slow down

The minutes of the Federal Reserve's December meeting expressed widespread concerns about the upside risks to inflation, especially given the tariffs and immigration policies that the incoming Trump administration may implement. Almost all participants agreed that the Fed is close to slowing the pace of monetary policy easing, reflecting confidence that economic activity remains strong. At the meeting, the Fed lowered the target range for the federal funds rate by 25 basis points to 4.25%-4.5%. Despite the small rate cut, officials were cautious about the pace of future rate cuts, expecting only 75 basis points of rate cuts for the whole of 2025. The market generally expects the Fed to keep interest rates unchanged at its meeting at the end of this month, and the first rate cut may not come until June. The minutes noted that although inflation has eased over the past year, recent higher-than-expected inflation data and uncertainty about policy changes have made participants uneasy about the future inflation outlook. Fed Chairman Powell mentioned at the meeting that the current economic situation requires more prudent monetary policy decisions, which means that the Fed may slow the pace of rate cuts in the coming months to respond to the changing economic environment.

(2) Web3 field:

CFTC Chairman Behnam calls on Congress to speed up the process of cryptocurrency regulation legislation

Rostin Behnam, the outgoing chairman of the U.S. Commodity Futures Trading Commission (CFTC), has reiterated the urgency of Congress in regulating cryptocurrencies. He said that despite no longer serving as chairman, he will continue to actively promote the CFTC's progress in this area. In an interview with the Wall Street Journal, Behnam noted that the development of cryptocurrency legislation takes time and mentioned the impact of the new president and the composition of the Congress on the legislative process. He expects that the legislative process may take six to ten months, and the subsequent rulemaking may last as long as a year. Behnam believes that the acting chairman will play a key role in the new regulatory environment and pointed out that current committee members have been exploring the establishment of a "sandbox" environment to allow cryptocurrency participants to conduct business in a controlled framework without having to worry about the pressure of law enforcement or regulation. He also mentioned that the legislative efforts promoted by some lawmakers, including Debbie Stabenow and Patrick McHenry, are positive attempts, although imperfect. He believes that existing regulations cannot effectively address the challenges facing the cryptocurrency market and there is an urgent need to update and improve the regulatory framework.

2. Hot events

(1) Macro environment:

Rising global bond yields pose a challenge to the cryptocurrency bull market

The cryptocurrency market has been in a bull run since the end of 2024, however, the upward trend in global government bond yields has begun to attract widespread attention in the market. According to Coindesk analyst James Van Straten, the 10-year U.S. Treasury yield has risen to 4.70%, close to a multi-year high, and has risen by more than 100 basis points since the Federal Reserve first cut the federal funds rate in September. This change may have an impact on investor sentiment in the cryptocurrency market. At the same time, the yield on 30-year British government bonds also reached 5.35% on Wednesday, the highest level since 1998, and the yield has also risen by 105 basis points since the Federal Reserve cut interest rates in September. The rise in these interest rates not only reflects the changes in the global economic environment, but may also affect investors' choices between cryptocurrencies and other high-risk assets, thereby posing a challenge to the continued bull market in the crypto market. As bond yields rise, investors may reassess their risk appetite, which will have a potential impact on the demand for cryptocurrencies.

(2) Web3 field:

The US Department of Justice approved the sale of $6.5 billion of Silk Road Bitcoin, and the market reacted differently

The U.S. Department of Justice has been approved to sell 69,370 bitcoins seized in the Silk Road case, with a market value of approximately $6.5 billion. The U.S. government currently holds a total of 198,109 bitcoins, worth approximately $18.6 billion, and 54,753 Ethereum, worth approximately $180 million.

The Justice Department applied to sell these assets, citing the volatility of Bitcoin prices. When asked about the next move, a Justice Department spokesperson said: "The government will take the next step based on the verdict of this case." Although the sale has been approved, the specific time of the sale has not yet been determined. There are only 11 days left before Trump officially takes office on January 20, and Trump has said that he will not sell any Bitcoin after taking office, which makes future sales plans full of uncertainty. Related bets show that the probability of selling is 22%. Affected by this news, the price of Bitcoin fell by nearly 2% and is now quoted at $93,365.2.

3. Hot topic narrative

Sonic SVM and Galaxy Interactive jointly launch GAME Fund 1 to promote the development of Web3 games and AI agents

Sonic SVM and Galaxy Interactive announced the joint launch of GAME Fund 1, which aims to promote the development of Web3 games, AI agents and TikTok Web3 application layer in the Sonic SVM ecosystem. Although the specific size of the fund has not been disclosed, the first round of investment has been confirmed to be mobile casual game giant Gomble Games, which plans to become the first large-scale casual game to expand to the Sonic TikTok application layer. Gomble Games has been supported by Binance Labs and Animoca Brands and has more than 110 million global users.

GAME Fund 1 focuses on three key areas: Web3 gaming innovation, providing game developers with infrastructure and tools to build games on Sonic’s Solana virtual machine environment; AI agent development, working on creating autonomous virtual characters and enhancing collective intelligence; and TikTok content creation, providing specialized monetization tools and gaming experiences for TikTok users.

Chris Zhu, CEO of Sonic SVM, emphasized that this fund will promote the intersection between games, artificial intelligence and social platforms. He said: "The future of games lies in the combination of high-performance infrastructure, artificial intelligence and social connections."

2. Attention Value-Hot Projects

1. Project Introduction

l $Smelt | meme | @holmes_terminal

- Narrative: $Smelt was inspired by a political controversy in California, where critics accused the governor of being "indifferent" to the fires in order to protect an endangered fish called smelt.

- Previously, California Governor Newsom refused to sign a water restoration declaration. If signed, this declaration would allow excess rain and snowmelt from the north to deliver millions of gallons of water to the California region every day, which would greatly alleviate the wildfire disaster.

- This incident will be used as one of the targets for the Republicans to attack the Democrats, and as the wildfires are still ongoing, there is still room for hype.

- $Smelt quickly sparked heated discussions in the community after its launch. With this dramatic background, $Smelt's market value reached 6M USD.

- Please note that this meme coin is automatically emitted by AI.

3. Attention Value-Sector Rotation

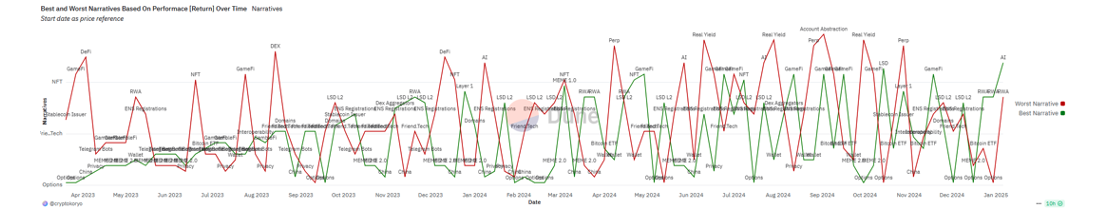

1. Hot topics

Source: Dune, Dot Labs

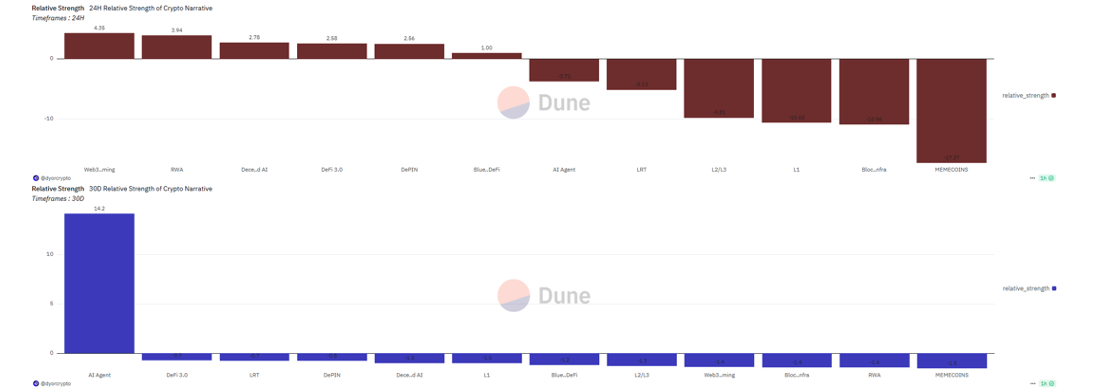

Source: Dune, Dot Labs

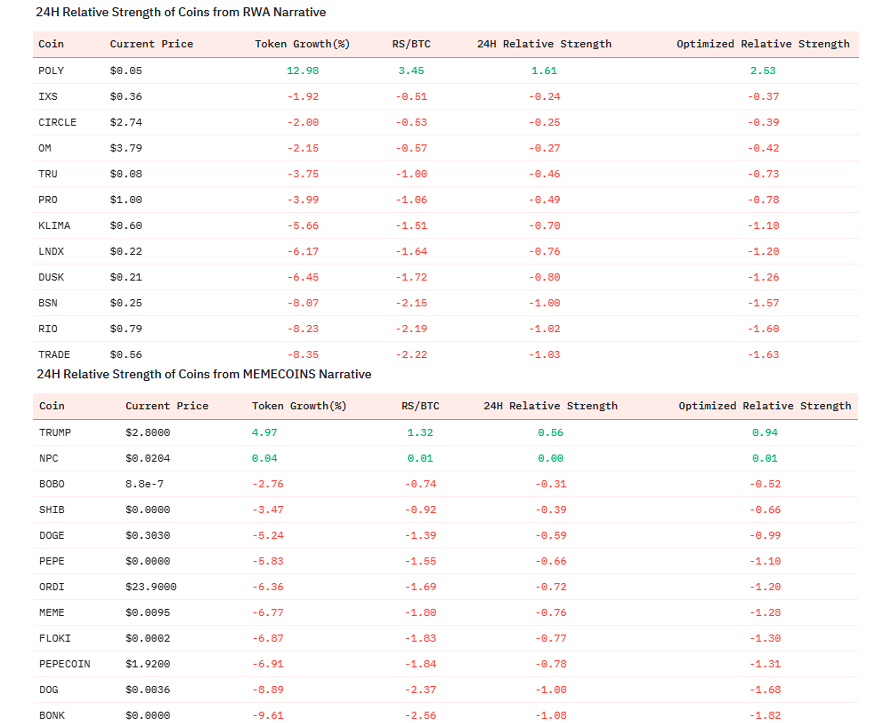

2. Inside the plate

Source: Dune, Dot Labs