In the crypto market recently, good news has come one after another.

On the macro level, the China-US joint statement marked the end of the tariff war, and the global financial market ushered in a surge. Although Bitcoin fell back as expected, the altcoin market showed a thriving trend. Ethereum continued to lead the rise, reaching $2,700. The Defi sector rose across the board, triggering a wave of slogans for the return of the altcoin season.

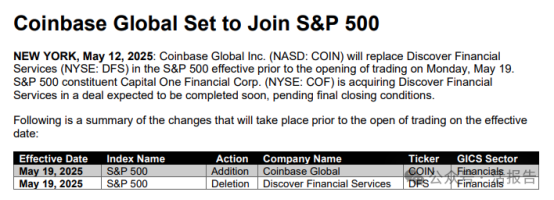

In addition to the improvement of the macro environment, in addition to favorable regulations, the industry has also ushered in new trends. On May 13, according to a press release from S&P Dow Jones Indices, Coinbase Global, the largest cryptocurrency exchange in the United States, will be included in the S&P 500 index, replacing Discover Financial Services, which is about to be acquired by Capital One Financial. This change will take effect before the start of trading on May 19.

In the mainstream market, the crypto industry has once again achieved a milestone, marking the start of a new era for the industry. At the same time, companies and institutions from all over the world are also eager to try.

On May 12, China and the United States reached a tariff truce in Geneva, which finally put a temporary pause on the protracted trade conflict. The agreement includes suspending the 24% mutual tariff for 90 days, retaining the 10% basic tariff rate, and establishing a third-country consultation mechanism. Influenced by this news, US stock indexes rose significantly, with S&P 500 futures rising more than 3% and Nasdaq closing up 4.35%.

Although Bitcoin fell from $106,000 to a low of $100,700, the overall crypto market quickly rebounded, with altcoins such as ETH, SOL, and BNB all seeing good gains. With the end of the tariffs, the impact of this news on the market will gradually slow down, the market will begin to return to normal, and the bottom prices of the currencies all show an upward trend.

The macroeconomic situation has improved, and the industry is not to be outdone. In recent days, there have been frequent reports of good news about the industry. First, the US state government's strategic reserves have won their first victory. New Hampshire passed the Strategic Bitcoin Reserve Act, which authorizes the state treasurer to purchase Bitcoin or digital assets with a market value of more than US$500 billion and sets the upper limit of holdings at 5% of the total reserve funds. Bitcoin is expected to usher in new growth; second, the new SEC chairman took office and made it clear that the core priority during his term is to establish a reasonable regulatory framework for the crypto asset market, which continues to release positive signals. BlackRock is also rumored to be discussing ETH pledge proposals with the SEC, and market confidence has rebounded.

With the macro environment improving and regulation improving simultaneously, crypto companies are undoubtedly entering the best era.

Just on May 13, according to official news, Coinbase Global, the largest cryptocurrency exchange in the United States, will be included in the S&P 500 index. This is the first time that a crypto company has been included in the S&P, creating another success in the mainstreaming process of the crypto industry.

For the crypto market, Coinbase is not a household name, but it is well-known. As the largest crypto exchange in the United States and one known for its compliance, Coinbase is also unique in the global crypto exchange field. Coinbase was founded in 2012, and it has a history of 13 years. In the past 13 years, it has experienced ups and downs in bull and bear markets, becoming the best window for traditional finance to observe the crypto industry.

In 2021, Coinbase landed on the Nasdaq with the stock code COIN. On the day of listing, not only did it not break the issue price like the previous crypto concept stock Canaan, but its stock price also soared all the way, reaching a high of $429.54, causing a sensation in the market. After that, Coinbase followed the industry cycle fluctuations, and its stock price was closely related to the trend of the crypto market. It fell to a low of $33.26 in the trough period of 2023, and then regained its growth. This year, Coinbase made history again, replacing Discover Financial Services and becoming the first crypto company to be included in the S&P 500. As a result, Coinbase rose 24% on the first day and is now trading at $256.90.

Interestingly, when Srategy was included in the Nasdaq 100, it was considered the company with the greatest potential to be included in the S&P 500. However, due to the cumulative net profit requirement of the S&P 500, its competitiveness was slightly inferior. At that time, market analysis did not include Coinbase in core considerations. However, Coinbase steadily overtook and achieved this milestone in May.

Although there is no pull-up effect in the short term and the symbolic significance is more prominent, in the long run, the fact that crypto companies can enter the major US indexes just represents the recognition of the mainstream market, laying the foundation for the integration of the crypto industry and traditional finance, and opening up a broad space for the mainstreaming of the crypto industry. Specifically, this move not only opens up capital flow based on index allocation from the perspective of individual stocks, but also will serve as a typical corporate sample to enhance the awareness of the crypto industry, and is expected to further attract and expand traditional investors. In comparison with Discover Financial Services, which it is about to replace, the company's passive demand allocation can reach US$13.5 billion at an index weight of 0.1%.

On the other hand, this move has further promoted the IPO boom of crypto companies. Since last year, many companies such as Circle, eToro, Bgin Blockchain, Chia Network, Gemini, and Ionic Digital have been promoting IPOs. Kraken has already reorganized its organization to meet regulatory requirements. Coinbase has set an example and has become a typical example.

While Wall Street institutions are eager to take advantage of the crypto dividend, Hong Kong companies are also eager to try. Slightly different from US crypto companies rushing to IPO and institutions buying coins with real money and silver ETFs, Hong Kong, known as a financial center, is more cautious, and companies pay more attention to entity collaboration and aim at the RWA track. After the Ensemble project launched by the Hong Kong Monetary Authority (HKMA) opened a tokenization sandbox pilot, Hong Kong's RWA track has once again pressed the accelerator.

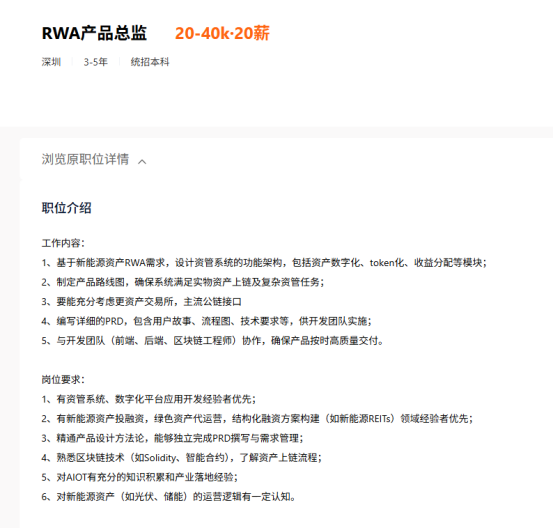

Judging from the progress, the trend of large companies taking the lead is prominent, and they have been active in recent months. JD.com's JD CoinChain Technology, which has attracted much attention for its entry into stablecoins, has begun to form a team. It has previously posted a number of RWA-related job recruitment information on recruitment websites such as BOSS Direct Recruitment and Liepin, recruiting product directors and solution directors for asset management systems to be responsible for the asset management system design, asset acquisition and industrialization of new energy asset RWA. In addition, CoinChain also announced a partnership with licensed virtual bank Tianxing Bank to provide financial compliance support for JD.com to explore cross-border payment solutions based on stablecoins. According to Dr. Jianguang Shen, vice president of JD.com Group, JD.com's stablecoin is a decentralized commercial issuance at the company level, and its fluctuations are small due to macroeconomic factors. JD.com's issuance of stablecoins is to further enhance JD.com's global supply chain and cross-border payment capabilities.

While JD is still in the process of organizing its business, Ant Digits has made faster progress and has already implemented some actual cases. Last year, Ant Digits cooperated with green energy service provider GCL Energy to successfully complete the first RWA case in China involving RMB 200 million based on photovoltaic physical assets. Subsequently, it has cooperated with Conflux, Patrol Eagle Group, Sui and other projects to promote the implementation of RWA projects.

In addition to large companies, exchanges and institutions are also making intensive arrangements. In March this year, Hong Kong-based HashKey Chain successfully deployed the tokenized USD money market fund CPIC Estable MMF initiated and managed by China Pacific Insurance Investment Management (Hong Kong) on the chain. Subsequently, the Hong Kong dollar and USD money market ETF tokenization plan jointly launched with Bosera Funds (International) Co., Ltd. was also announced to have been approved by the Hong Kong Securities and Futures Commission (SFC). To date, HashKey Chain has carried out in-depth docking with more than 200 institutions, involving traditional financial institutions, asset management companies, technology companies and Web3 native projects and other fields to reach RWA on-chain cooperation intentions.

As the technical infrastructure becomes more complete, brokerage facilities are also keeping up. Guotai Junan International recently stated that the wealth management-related business plan it submitted in January covers tokenized securities types including structured products linked to multiple underlying assets, SFC-approved funds and non-approved funds, and bonds. According to the "Circular on Intermediaries Engaged in Tokenized Securities-Related Activities" issued by the Hong Kong Securities Regulatory Commission, the Hong Kong Securities Regulatory Commission issued a confirmation email on May 7, 2025, which means that the business plan has been confirmed by the regulator without further problems. Just today, Tiger Brokers (Hong Kong) also announced the launch of cryptocurrency deposit and withdrawal services, supporting virtual currency deposits, transactions and withdrawals.

Overall, whether it is the IPO of US crypto companies or the promotion of RWA by local Hong Kong companies, as the crypto industry is gradually gaining popularity, companies and institutions have shown an active attitude towards layout, but due to regional differences, the ways of participation are slightly different.

Due to the high degree of clarity of the regulatory environment in the United States and the strong support of existing leaders, the United States has shown a trend of no regulation and current market conditions. The means of participation by institutions and enterprises are simpler and cruder. For example, institutions have bought ETFs in large quantities and become the main supporters of the currency price. For example, Strategy borrowed money to buy coins to build a new paradigm, which triggered a boom, causing smaller listed companies to try to break through with cryptocurrencies to gain popularity and raise stock prices. Large institutions such as Block, PayPal and Visa have entered the market with stablecoins to grab market share and build a business matrix. The response of enterprises to favorable conditions is also faster. Strategy has been included in the Nasdaq 100 and Coinbase has landed on the S&P 500, which undoubtedly represents the entry of new buyers.

Strategy's stock price has soared in the past year

In comparison, Hong Kong is more conservative. Although the policy uniformity and consistency are maintained very well, Hong Kong's supervision of virtual assets continues to improve, and the application and pilot of tokenization are steadily promoted, but clear and strict compliance requirements mean that Hong Kong can only take small steps and run fast, rather than taking on too much and charging forward. It is necessary to exercise market power within the policy context. Therefore, companies and institutions mostly adhere to the principle of compliance. Although Hong Kong ETFs are also booming, their voice is limited. More institutions take business as the main line and develop through sectors. Related businesses have entered the fast lane, but profit points have not yet been fully reflected.

In this context, the attention paid to the trends in the mainland market is continuously increasing, and the opening of funds on the market is the focus of attention. Recently, there are even rumors that the mainland is expected to open a paper BTC spot ETF in the future, which is similar to a book transaction without spot delivery, similar to the paper gold model. This move can not only participate in cryptocurrency transactions to a certain extent under the compliance control of funds, but also avoid actual holding, and the transactions are transparent and traceable. Of course, rumors are just rumors. Considering the risks of cryptocurrencies to the financial market, especially under the current regulations, the feasibility can only be described as a fantasy, but it can also be seen from this that the market has expressed quite high expectations for the opening of mainland funds.

It can be foreseen that as crypto assets become increasingly mainstream, more and more companies will be involved in them, and funds, attention, and resources will further flow into the market. This round of institutional FOMO wave has just begun.