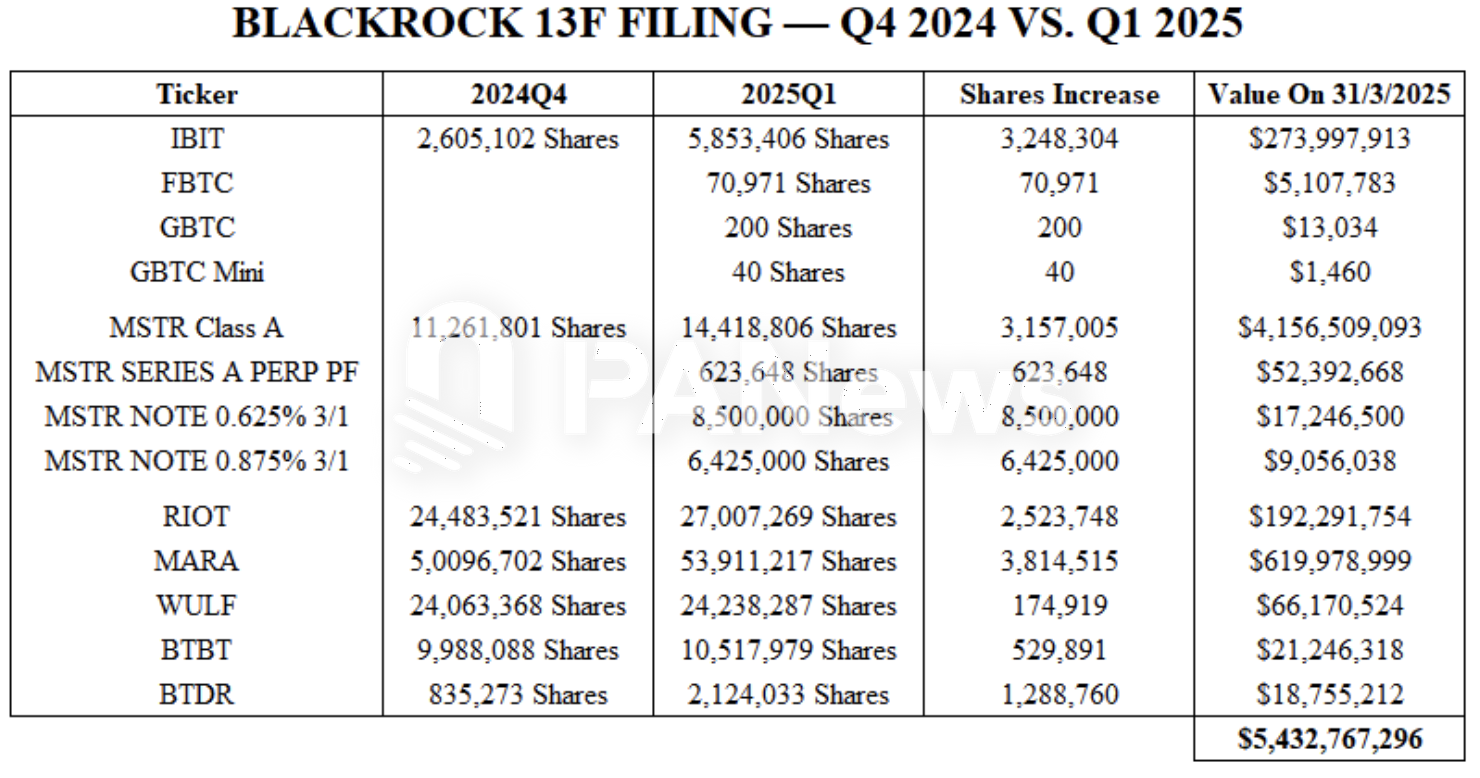

PANews reported on May 6 that according to the latest 13F report data from BlackRock, as of the end of the first quarter of 2025, the company has significantly increased its holdings of Bitcoin spot ETFs (such as IBIT and FBTC) and stocks of listed companies holding Bitcoin. Among them, IBIT increased its holdings to 5.85 million shares, worth US$274 million; MicroStrategy (MSTR) increased its holdings by more than 3.15 million shares, with a total market value of more than US$4.15 billion. The overall Bitcoin-related holdings increased from approximately US$3.9 billion in the fourth quarter of 2024 to US$5.4 billion in the first quarter, a quarterly increase of nearly 40%.