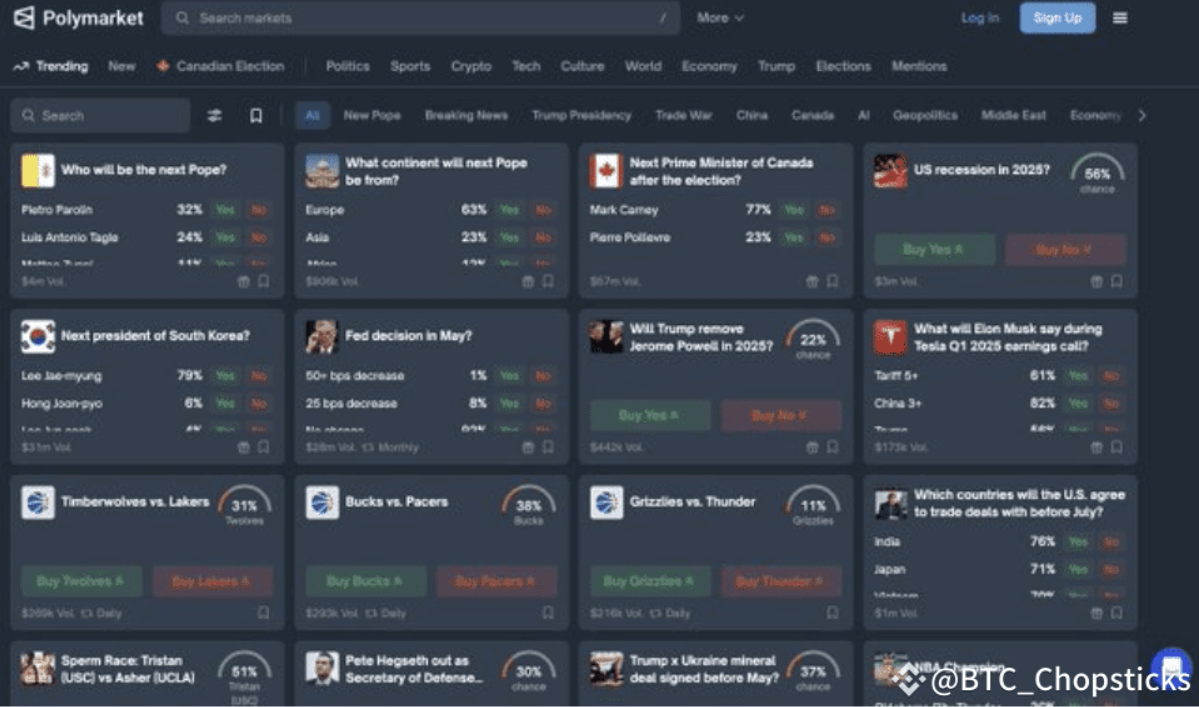

🔎 Step 1: Understand the nature of prediction markets

The prediction market is not a “truth market” but an “outcome market”.

📌 Example:

Platform A offers a contract for “ BTC breaking $100K before 2025” at a price of $0.40.

Platform B offers “BTC will not break $100K” at a price of $0.55.

You can buy two and place bets on both platforms for a total cost of $0.95.

No matter what happens, you get a $1 return, netting you $0.05 (5.3%)—a risk-free arbitrage.

🧠 Step 2: Focus on multi-outcome markets

The most profitable arbitrage opportunities are usually found in multi-choice markets, such as:

Who will win the 2024 US election?

Which team will win the Champions League?

The total price of these markets often exceeds $1 (e.g. $1.08), which indicates that there is a price distortion in the market and it is suitable for arbitrage:

📌 Example:

Biden: $0.38

Trump: $0.35

Others: $0.32

Total: $1.05 - you can find a lower price combination on other platforms for arbitrage.

🧭 Step 3: Practical ideas for cross-platform arbitrage

Find out the different pricing for the same event on multiple platforms:

Pick the lowest price for each possible outcome

If the combined price is less than $1, it is “free profit”

📌 Example:

Result A: $0.35

Result B: $0.30

Result C: $0.32

Total cost $0.97 → No matter which outcome happens, you get $1 in return, netting $0.03

📈 Step 4: Filter opportunities based on annualized yield (APY)

Not all arbitrage opportunities are worth taking, it depends on the capital efficiency.

📌 Use this formula:

APY = (profit difference ÷ remaining days) × 365

⛔ 2% profit/30 days → Annualized return is only 24%, not worth it

✅ 2% profit/7 days → 104% annualized, jump in now!

⚡ Step 5: Speed is king

The core of arbitrage is: "Delayed reaction = arbitrage window"

One platform reacts first, the other lags behind

The price difference only exists for a few minutes, so you must act immediately

📌 My approach:

- Set price alerts

-Join the prediction market Discord group

-Familiarize yourself with the operation process and improve muscle memory speed

💡 Step 6: Exit early and lock in profits

You don't need to wait for the event to end.

📌 Example: You buy the complete combination for $0.94

After the market fluctuates, the total value of the portfolio becomes $0.98 → You can sell it now to lock in profits and increase capital turnover.

🧩 Bonus strategy: mining “result synonyms” arbitrage

Many markets use different words to describe the same thing:

📌 Example:

"Democrats lose the Senate" vs "Republicans control the Senate"

The actual results are the same, but the odds may be different, which is a "soft arbitrage" opportunity.

🌱 Small Market = Potential Arbitrage

-Poor liquidity on niche platforms

- Slow market response

-It is easier to find 3%+ arbitrage opportunities

-You may also receive additional airdrops or platform token rewards, killing two birds with one stone!

✅ Conclusion:

This is not gambling or trading, but a practical technique for “precisely exploring market inefficiencies”.

You don’t need to predict who will win or which coin will rise. You just need to find out that the price is unreasonable faster than others, and then steadily accept the “red envelope” sent by the market.

Prediction markets are often zero-sum games, but arbitrageurs only receive certain benefits from “mispricing”.

📉 When the market diverges, you don’t argue about right or wrong, you just take profits.

You don't need to be a prophet, you just need to be sharp and quick enough, and six-figure profits will be within your reach.