Author: Zen, PANews

In recent years, with the rise of cryptocurrencies such as Bitcoin and Ethereum, the global digital asset market has expanded rapidly. As of early April 2025, the total market value of the global cryptocurrency market has dropped to US$2.63 trillion after a sharp drop, but it is still an important pole in the global financial market.

At the same time, traditional banks have a clear gap in meeting customer needs - according to the latest survey by Bitpanda, less than 20% of European banks provide digital asset services, while more than 40% of commercial investors already hold crypto assets. In addition, Fnality CEO Michelle Neal pointed out that many international banks are accelerating their embrace of blockchain technology to achieve 24/7 real-time settlement and cost efficiency.

Against this backdrop, Singapore Gulf Bank (SGB), the world's first licensed bank to provide fully remote account opening services in the MENA region, is trying to break this situation. It combines crypto-friendly services with strict compliance supervision to provide a new banking solution for crypto users and digital nomads who are ignored by the traditional financial system.

The establishment and background of Singapore Gulf Bank

Singapore Gulf Bank was established at the end of 2023. This digital bank established in the Middle East Gulf country of Bahrain was initiated by Singapore Whampoa Group. Whampoa Group is an investment company active in the field of technology, founded by Lee Runying, niece of Singapore's founding Prime Minister Lee Kuan Yew, and Lee Hans, grandson of OCBC Bank founder Lee Kong Chian.

Soon after the bank was officially established and obtained a banking license from the Central Bank of Bahrain, it received investment from Bahrain Mumtalakat, the sovereign wealth fund of the Kingdom of Bahrain. The bank project was promoted to a national strategic development project, becoming a new benchmark for financial technology service innovation in the Kingdom of Bahrain and the Gulf region.

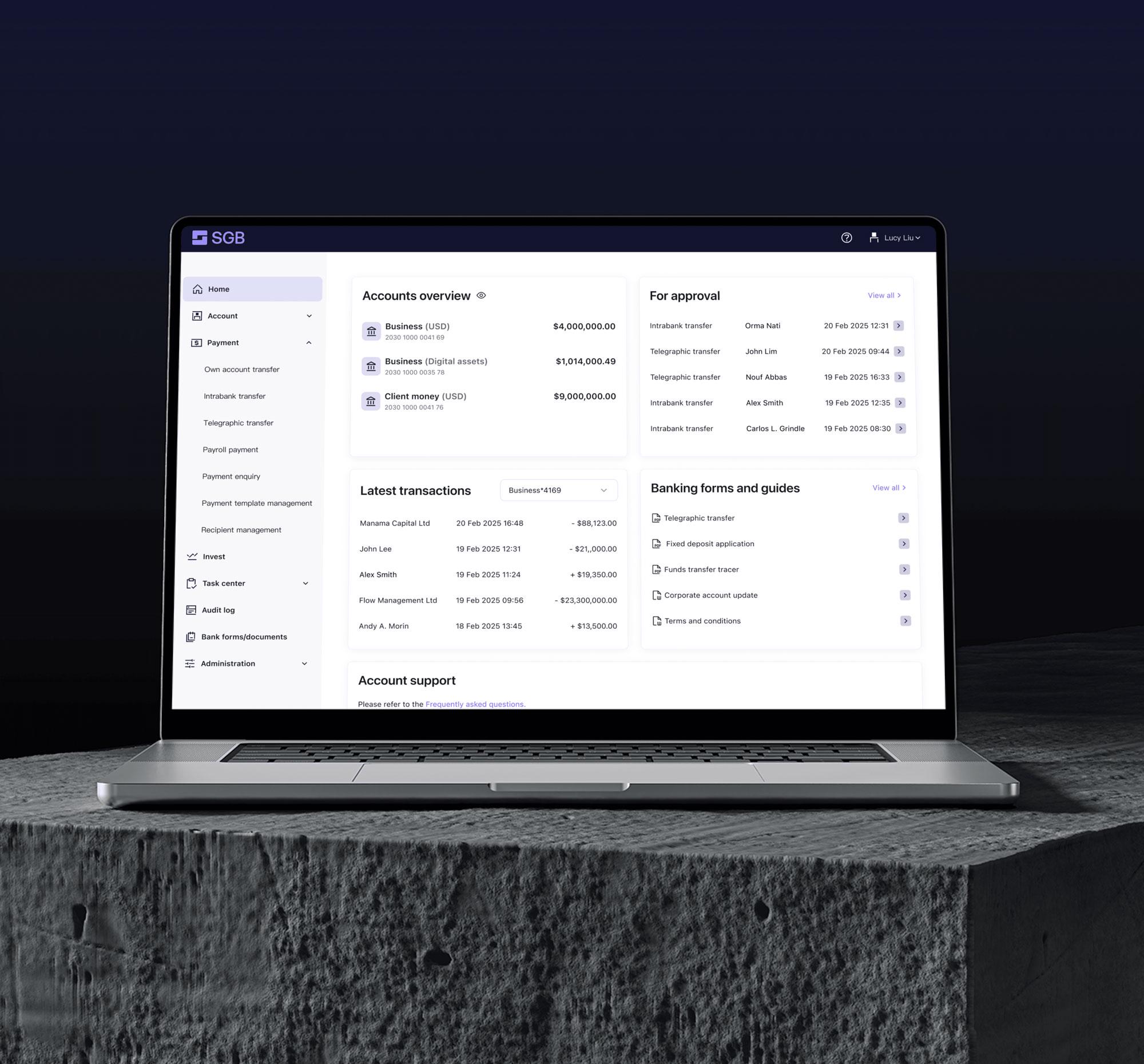

On November 4, 2024, Gulf Bank of Singapore, the Central Bank of Bahrain and the Bahrain Economic Development Board jointly announced that they would begin to provide corporate banking services to the global digital economy and become the first licensed bank in Bahrain to provide comprehensive cryptocurrency-compatible banking services. In addition to conventional corporate banking services, the bank will also provide real-time settlement networks, digital asset custody, and intuitive and efficient trading solutions. As its Chief Development Officer and Executive Vice President Cai Yile said, digital companies such as Web3 will constitute the main customer group served by the bank.

After the strong market response to its corporate banking services, Gulf Bank of Singapore expanded its services to individual customers in April this year and officially launched personal banking services. As the first and only regulated bank in the Middle East and North Africa region that provides fully remote digital account opening services to global investors, innovators and institutions, SGB aims to provide remote account opening and banking solutions that integrate traditional and digital assets to millions of individuals around the world. Currently, personal banking services are launched by invitation registration.

Breaking through the limitations of traditional banks

Under the full supervision of the Central Bank of Bahrain, Singapore Gulf Bank provides global remote account opening services, allowing global investors, innovators and small businesses to open accounts without having to visit Bahrain in person, and use its settlement network to achieve cross-border payments and settlements. This not only greatly reduces the threshold for account opening, but also opens up new prospects for user groups that cannot enjoy high-quality financial services due to geographical restrictions.

Facing global Web3 users, Singapore Gulf Bank strives to break through the limitations of traditional banks in the field of digital asset services and pioneers crypto-friendly bank accounts. This account not only supports customers to deposit wages in fiat currency or cryptocurrency, but also has multiple functions such as payment, transfer and investment. Through deep integration with top licensed trading platforms and exchanges, SGB can achieve instant, secure and seamless conversion between fiat currency and cryptocurrency, greatly improving the efficiency and convenience of capital circulation.

In addition, in terms of cross-border payment and foreign exchange needs, Singapore Gulf Bank will combine the multiple advantages of wire transfer, its own bank card and cryptocurrency payment channels to provide global users with low-cost and efficient international remittance solutions. Whether it is studying abroad, business travel or daily cross-border transactions, SGB can provide flexible and convenient financial services to effectively deal with the complex problems faced by traditional banks in cross-border payment and settlement.

With comprehensive banking services, Gulf Bank Singapore also opens up diversified investment channels for customers. These channels not only include high-yield savings and fixed deposit accounts (with annual interest rates of up to 4%), but also include products with unique investment opportunities in Asia and the Middle East and North Africa, providing customers with more diversified asset allocation options.

Through its own settlement network, Singapore Gulf Bank has achieved 24/7 real-time payment services. This is not only suitable for fast transfers between individual users, but also meets the needs of high-frequency fund flows between institutions. Its fee-free instant transfer service has greatly improved the overall efficiency of financial transactions and improved user experience.

Practical exploration of building a "new type of bank" model

"The company has no intention to compete with traditional banks, but it hopes to be the first in areas where it can compete." Last year, Singapore Gulf Bank Chairman Lee Youqiang said in an exclusive interview with Lianhe Zaobao that he is firmly optimistic about the development prospects of digital assets and emphasized that it will focus on customer groups that are not fully served by traditional banks. SGB focuses on differentiated competition and crypto-friendly banking services, aiming to build an ecosystem covering transactions, transfers, payments and storage between digital assets and cash.

In building this new banking model, Singapore Gulf Bank fully relies on advanced digital technology and AI technology. By building an AI-driven risk control system, the bank is able to monitor customer behavior in real time and reduce fraud risks. At the same time, through the automated identity verification process, Singapore Gulf Bank has greatly improved account opening efficiency and ensured strict compliance management in various services. In this way, SGB not only achieves seamless integration of traditional banking and digital asset services, but also provides a unified and convenient banking service portal for global users.

In an exclusive interview with Lianhe Zaobao, Li Youqiang emphasized that Singapore Gulf Bank is not a cryptocurrency exchange, and he does not regard cryptocurrency as a speculative asset, but as a payment channel that can be used to promote cross-border trade. Based on this concept, Singapore Gulf Bank is clearly positioned for native cryptocurrency users and customers interested in cryptocurrency, and while ensuring that traditional financial needs are met, it focuses on building a comprehensive ecosystem for digital asset services.

As the global digital asset market continues to expand, countries are increasingly tightening their regulation of cryptocurrency transactions. In its new banking model, Singapore Gulf Bank has always adhered to the principle of legal and compliant operations, especially in cryptocurrency business. Under the comprehensive supervision of the Central Bank of Bahrain, SGB strictly follows international financial and regional compliance standards in the process of account opening, trading and asset management, ensuring that all links involving fiat currency and cryptocurrency transactions meet anti-money laundering (AML) and know your customer (KYC) requirements.

Can innovative models lead the new trend of digital banking?

"I come from a traditional banking background and I see a lot of disruptive changes happening. Technology allows us to do many things that we couldn't do before." In his 40-year banking career, Li Youqiang has served as chairman and CEO of DBS Vickers and vice chairman of JPMorgan Chase Asia Pacific. Today, he regards "developing Singapore Gulf Bank into the leading or largest digital bank in the industry" as the ultimate goal of his career. For this fledgling bank, this goal is a long way to go.

Currently, with its core competitiveness of crypto-friendliness, cross-border payments and strict compliance, Singapore Gulf Bank is gradually emerging as an important new force in the new banking field. Facing challenges in technology, regulation and the market, the bank provides global users with safe, convenient and diversified financial solutions through differentiated strategies and refined management. Its innovative model provides a new financial option for global individual users, and will continue to be tested by the market and time.