Written by KarenZ, Foresight News

In the northwest of the South Asian subcontinent, Pakistan, a country with a young population of 241 million, is quietly nurturing a revolution in cryptocurrency.

Although the cryptocurrency market in Pakistan is still in a "gray area", with the continued growth of the user base and the gradual clarification of the regulatory framework, this land is expected to rise as an important hub for the crypto economy in South Asia.

On April 7, Zhao Changpeng announced that he would join the Pakistan Crypto Council (PCC) as a strategic advisor. This move not only highlights Zhao Changpeng's influence in the global cryptocurrency industry, but also indicates that Pakistan will take a milestone step in the field of cryptocurrency. As the official strategic advisor of PCC, Zhao Changpeng will provide guidance on regulatory frameworks, infrastructure, education and application promotion, and work closely with the Pakistani government and the private sector to jointly build a compliant, inclusive and globally competitive crypto ecosystem.

On this occasion, let’s take a closer look at the structure of the Pakistan Crypto Council and the current state of regulation and adoption in the cryptocurrency space in the country.

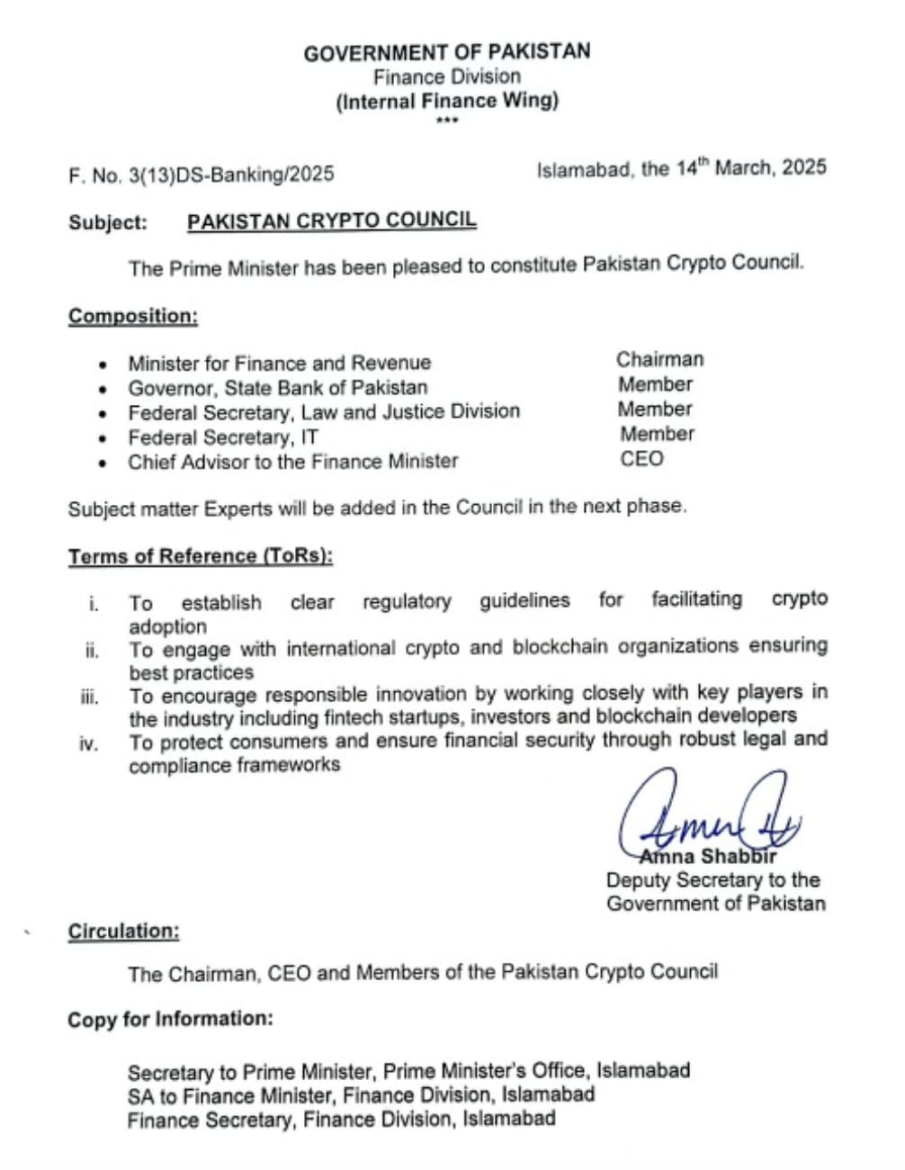

Pakistan Cryptocurrency Council Structure

The Pakistan Cryptocurrency Commission (PCC) was proposed by the Ministry of Finance in February 2025 and is affiliated to the Ministry of Finance. It was officially announced in March. Its main responsibility is to oversee the integration and adoption of blockchain technology and digital assets in the country's financial sector.

The committee's focus is not limited to regulation, but also aims to create an environment where blockchain and digital finance can flourish and avoid market chaos caused by regulatory gaps. In addition, PCC is also committed to promoting responsible innovation and promoting the innovative application of cryptocurrency technology in Pakistan while protecting consumers and ensuring financial security. The PCC organizational structure is as follows:

Finance Minister Muhammad Aurangzeb chairs the committee, demonstrating the Pakistani government's commitment to the growing digital economy. Bilal bin Saqib, who serves as the committee's CEO, is also the chief advisor to the committee's finance minister. Bilal bin Saqib is an entrepreneur from London with a master's degree in social innovation and entrepreneurship from the London School of Economics and Political Science (LSE) and was selected for the Forbes Under 30 list. In the Web3 field, Bilal bin Saqib is the founder of Pakistan's Web3 community Web3 Pak, and has also served as a growth consultant for African digital asset platform Busha. He is also a frequent speaker at some crypto-related events to share his experience in the social impact of blockchain. In addition to his work in the field of fintech, Bilal bin Saqib previously won the 1632nd Point of Light Award (an award given by the British Prime Minister to individuals who have made outstanding contributions to the community), co-founded the non-profit organization Tayaba (providing clean water solutions to water-scarce communities in Pakistan), and launched the H2O Wheel (an innovative water transportation device that reduces the burden on rural communities). In 2023, he was awarded the MBE for his humanitarian efforts during the COVID-19 pandemic.

PCC’s immediate board of directors includes the Governor of the State Bank of Pakistan, the Chairman of the Securities and Exchange Commission of Pakistan (SECP), the Federal Minister of Law, and the Federal Minister of Information Technology. This diverse mix ensures that regulatory oversight, financial stability, legal framework, and technological advancement are closely aligned with Pakistan’s crypto ecosystem.

Muhammad Aurangzeb, Pakistan’s Minister of Finance and Chairman of the PCC, said, “We are sending a clear signal to the world that Pakistan is opening its doors to innovation. With CZ joining us, we will accelerate our vision of making Pakistan a regional powerhouse in Web3, digital finance, and blockchain-driven development.”

Pakistan Overview

Pakistan is located in the northwest of the South Asian subcontinent, bordering the Arabian Sea to the south, the Karakoram Mountains and the Himalayas to the north, and India, China, Afghanistan and Iran to the east, north and west respectively. It is a key country at the intersection of South Asia, the Middle East and Central Asia.

Pakistan has a land area of 796,000 square kilometers. In terms of population structure, the country has a significant demographic dividend and is the fifth most populous country in the world. People under 30 years old account for more than 60% of the total population. Naturally, the number of laborers is also among the highest in the world.

According to the seventh national census report released by the Pakistan National Bureau of Statistics in July 2024, Pakistan's total population has reached about 241 million, an increase of 15.87% compared with the sixth census in 2021, with an average annual population growth rate of 2.55%. About 79% of the population is under the age of 40, of which children under the age of 15 account for 40.56% of the total population, and young people aged 15 to 29 account for 26%.

In terms of economy, Pakistan's economy is currently facing multiple challenges such as high inflation, foreign debt crisis, and currency depreciation. However, the government is seeking breakthroughs through international aid, structural reforms and digital development.

In terms of education, Pakistan implements free primary and secondary education, but the number of schools is insufficient, the education coverage rate is low, and the lack of infrastructure and socio-economic factors have jointly restricted educational progress. According to data from UNICEF, Pakistan currently has the second largest number of out-of-school children in the world, with about 25 million children (5-16 years old) unable to go to school, accounting for 44% of the total population in this age group. This situation is particularly prominent and serious in rural areas and among girls.

In terms of infrastructure, power shortages and low Internet penetration (about 50%) limit technological development. It is worth mentioning that Islam is the state religion of Pakistan, and Muslims account for 97% of the country's total population.

Pakistan’s Crypto Regulatory Evolution in Three Steps

Crypto regulation in Pakistan is currently in the transition stage from prohibition to exploration of regulation. Although the law is still unclear, the government's easing of attitude, the establishment of the National Cryptocurrency Committee, international cooperation, and the high adoption rate among the public indicate that the country may soon introduce a clearer policy framework.

Prohibition phase (2018 to 2021): In April 2018, a ban issued by the State Bank of Pakistan (SBP) stated: "Virtual currency is not a legal tender issued or guaranteed by the Government of Pakistan. All banks, development financial institutions, microfinance banks/public service organizations/public service providers, etc. are advised not to handle, use, trade, hold, transfer value, promote and invest in virtual currency. Banks/development financial institutions/microfinance banks are also required not to assist their customers/account holders in virtual currency/ICO token transactions. Any such transactions should be immediately reported to the Financial Monitoring Unit (FMU) as suspicious transactions." The ban also advises the public to be cautious for their own benefit and not to participate in activities related to virtual currency mining, trading, exchange, value transfer, promotion and investment to avoid any potential financial losses and legal implications, but it does not explicitly restrict personal holding or P2P transactions, but has placed cryptocurrencies in a legal gray area. Shortly thereafter, Pakistan's Bitcoin trading platform Urdubit was completely shut down.

Exploration stage (2022-2024): The continuous expansion of the scale of cryptocurrencies has prompted central banks and financial regulators around the world to conduct research and analysis on the crypto ecosystem. In 2022, the State Bank of Pakistan (SBP) released the report "Crypto Assets - Potential Risks and Opportunities and Global Regulatory Approaches". Although it reiterated the previous ban on virtual currencies, it also pointed out that crypto assets are becoming increasingly popular among some groups around the world due to their convenience, anonymity, speculation and other advantages. It also listed a number of challenges facing crypto assets, including the impact on monetary policy, the impact on foreign exchange systems and capital flight, financial stability, and the risks of being used for money laundering and terrorist financing, tax evasion, etc.

In February of the same year (2022), according to the speech "The Rise and Future of Digital Currency" delivered by Reza Baqir, former governor of the State Bank of Pakistan on February 6, 2022, Pakistan is undergoing a rapid transition from cash to digital payments, with a large mobile user base (189 million telecom users, 108 million 3G/4G users, etc.), which provides favorable conditions for digitalization. Pakistan actively embraces digital transformation and regards it as a major opportunity for the development of the financial system, but is cautious about private digital currencies, believing that the risks of virtual currencies outweigh the benefits. At the same time, Reza Baqir is optimistic about CBDC and believes that it may help inclusiveness, innovation and cross-border payments. Reza Baqir also called on regulators not only to formulate rules, but also to take the initiative to innovate and promote the development of the financial ecosystem.

However, in March 2023, the Pakistani government intends to suspend cryptocurrency services provided online in the country to prevent illegal transactions of digital assets. Aisha Ghaus Pasha, former Minister of State for Finance of Pakistan, revealed that Pakistan "will never legalize cryptocurrency."

In June 2023, the State Bank of Pakistan announced plans to launch a central bank digital currency. In November 2024, the federal government proposed amending the State Bank of Pakistan Act to legalize digital currency (issued by the central bank) in Pakistan. The new amendment also proposes penalties for the unauthorized issuance of digital currency. Anyone found to have illegally issued digital currency will be fined twice the value of the illegal issuance.

Ice-breaking stage (2025): Entering 2025, Pakistan's attitude towards digital currency has undergone a substantial change, and plans to create a legal framework for cryptocurrency transactions to attract international investment. In March this year, Pakistan officially established the Pakistan Cryptocurrency Commission (PCC). The commission's CEO Bilal Bin Saqib proposed using the country's excess energy to promote Bitcoin mining.

It is worth noting that in 2018, Pakistan was listed as a "jurisdiction requiring enhanced monitoring" (i.e., gray list) by the Financial Action Task Force (FATF), and for this reason, the government and the central bank reviewed the legality and potential risks of cryptocurrencies. With FATF removing Pakistan from the "gray list" in 2022 and the booming development of the global crypto market, the improved international financial environment may bring new opportunities to the cryptocurrency market, but it is also accompanied by stricter regulatory expectations. Bilal bin Saqib once said that the PCC is also exploring initiatives such as RWA and the establishment of a regulatory sandbox while ensuring compliance with FATF standards. The PCC's top priority is to establish a strong and transparent regulatory framework that requires all crypto activities to comply with KYC and AML regulations.

Cryptocurrency Adoption in Pakistan

In recent years, Pakistan has seen significant growth in cryptocurrency adoption, driven primarily by economic instability, currency devaluation, capital controls, and a young population with a high level of digitalization.

Bilal bin Saqib, CEO of Pakistan Crypto Council, said Pakistan ranks among the top ten countries in the world in terms of cryptocurrency adoption, with an estimated 25 million active users. Pakistan is optimistic about BTC mining, tokenization, and cryptocurrency regulation. Bilal bin Saqib said the country is working on blockchain technology to simplify remittances.

The Chainalysis report also shows that Pakistan ranks ninth in the world in terms of cryptocurrency adoption, with India, Nigeria and Indonesia ranking in the top three.

Secondly, Pakistan is the fifth largest recipient of remittances in the world (about US$33 billion in 2024), but traditional channels have high fees, which makes encrypted cross-border remittance tools more popular.

According to BeInCrypto, the five most popular crypto trading platforms in Pakistan include Binance, Bitget, Bisq, OKX and Paxful (all of which support P2P transactions). Since banks prohibit direct cryptocurrency transactions, Pakistani users usually choose alternative payment methods that are widely accepted on P2P platforms, including mobile wallets and fintech solutions such as JazzCash, Easypaisa and Redot Pay.

Summary: Opportunities and challenges coexist

Cryptocurrency has the potential to become a powerful tool for Pakistan to fight inflation and optimize cross-border payments. In addition, the country's young and digitally inclined population structure provides a natural advantage for the promotion of cryptocurrency and Web3 technology. The establishment of the Crypto Commission may accelerate this process through education and infrastructure construction.

It is worth mentioning that Zhao Changpeng said that the Web3 education platform Giggle Academy he founded can provide learning opportunities for out-of-school children in Pakistan. In addition, the establishment of the Pakistan Cryptography Committee may promote the training of local Web3 talents through encryption and blockchain education projects, enhance the public's awareness and acceptance of cryptocurrency, and may also cultivate a group of digital economy practitioners for Pakistan.

In addition, Zhao Changpeng has deep experience in the crypto industry, especially in dealing with global regulatory challenges, which may push the PCC to formulate clearer regulatory policies that can attract foreign investment and balance risks. In addition, this move itself is a signal to the global crypto community that the country is actively embracing Web3 and digital finance, which may attract international capital to the Pakistani market and stimulate the development of Pakistan's local Web3 entrepreneurial ecosystem.

However, Pakistan still has a high population share in rural areas, low Internet penetration and financial literacy, a relatively old power grid, and frequent power outages, which may become an obstacle to the promotion of cryptocurrencies.

In summary, Pakistan is at a critical turning point in cryptocurrency adoption. Positive signals from the government suggest that it may launch an initial regulatory framework soon. If successful, this will unlock huge market potential, especially in terms of remittances and financial inclusion. However, infrastructure improvement and international compliance remain key challenges. In addition, if Pakistan successfully builds a compliant crypto ecosystem, it may influence the policies of similar economies such as Bangladesh and Iran.