Source: Talking about Li and other things

The overall market sentiment is still not bad at this stage. Many people seem to have lost motivation and patience for investing. Even some friends in the group left a message a few days ago telling me that they have quit (quit the circle) and are not playing anymore.

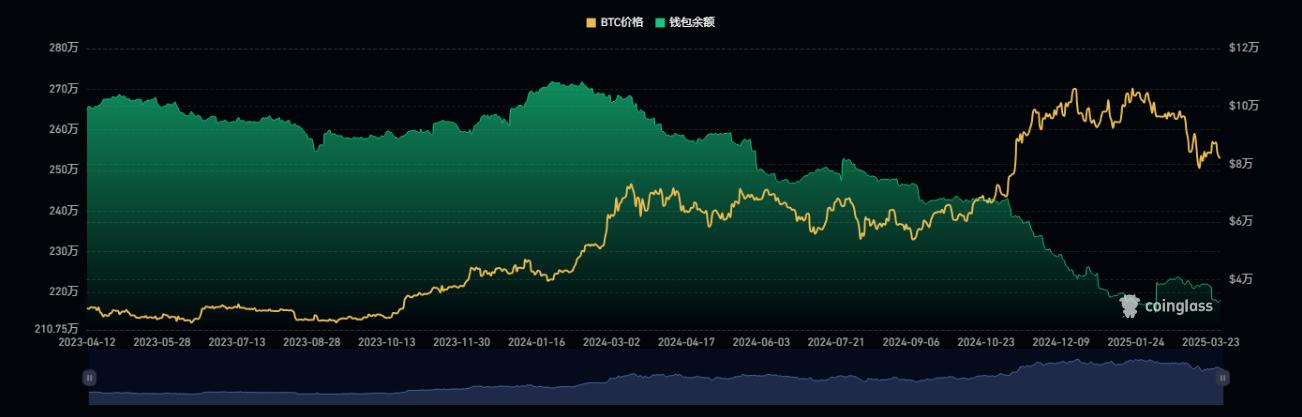

Judging from the current trends or data, the market seems to be in a rather interesting (or strange) state. On the one hand, the BTC balance of the exchange is declining, and the current stock has dropped to 2.18 million, as shown in the figure below.

On the other hand, the over-the-counter (OTC Desks) balance is also at an all-time low, as shown in the figure below.

This may indicate that spot demand continues to dry up, funds (including institutions) are remaining on the sidelines, and overall the market seems to be stuck in a boring state with no one selling or buying.

Since January this year, the market has experienced a relatively large-scale pullback. Many people have slowly woken up from the pleasure of the gains in the fourth quarter of last year. After experiencing a short-lived monkey market, we currently seem to be experiencing a crab market (i.e. sideways, because crabs walk sideways).

Now everyone seems to be waiting for an opportunity for the market to reverse. This opportunity may be some new policies from the United States (the first week of April will be a critical week because there are tariff policies, non-agricultural data, unemployment data, Powell's speech, etc.), or a new explosive innovation from the encryption field (i.e. internal catalyst), but no one knows at present. Assuming that we cannot wait for such external or internal catalysts in the short term, but you still want to stick to this field, then there are two things to pay attention to now:

- Try to stay away from things that can go back to zero at any time, and start focusing again on something truly useful.

- Maintain a positive attitude, continue to optimize your positions reasonably, and prepare for the next opportunity in advance

Because if you are always immersed in the current volatility or PvP speed run game and cannot get out, then even if new opportunities emerge in the market, you may continue to be hit hard (such as greater losses) if you are not prepared.

After experiencing a big market fluctuation or a roller coaster-like market, many people are not only hurt by their own positions (invested funds), but may also involve some psychological problems. For example, you hope that the market can give you another chance to make back your investment, you hope that others can directly tell you that a coin can help you turn things around quickly, you can't wait to open the exchange/wallet dozens of times a day to check the changes in the balance... But often the more this happens, the more you will regret your original decision, and you will fall more and more into a certain pessimism.

At this time, the market will take away not only your money, but also your physical and mental health.

So, how can we avoid the same problem from happening again or overcome it as much as possible?

1. Minimize the time you spend watching the market

The market is cyclical. As long as we are still in this field, there will be new opportunities, but new opportunities are often given to those who are prepared in advance. So, what have you prepared now?

As we have said in our previous article, if watching the market can change the market trend, then I would be willing to watch the market 24 hours a day, but this is unrealistic.

To put it bluntly, if you really can't hold on, and the XX coins you are holding now have seriously affected your sleep quality, then you should stop the loss in time and don't hesitate any longer.

It is better to stay away from some market noise for a while and make good use of this time to think about and review your past trading notes.

Learn to admit failure and learn to withstand failure. The most important thing is to use failure to improve your strategy or trading system.

In short, don’t let “losses” dominate your future path, but let your own strategy determine your future path. Up to now, although you may have suffered some losses, if we look at it from another perspective, you are actually or have already been ahead of many people, because you have now deeply experienced the cruelty of the market, and you also clearly understand what you should do next & what not to do.

2. Learn to take the initiative, not just wait

If someone tells you that there may be a new opportunity in the market this year, do you have a response plan?

If someone tells you that the market has entered a new bear market cycle, do you have any response plan?

As we mentioned in our previous article, although everyone is paying attention to the bull market and the bear market, the real composition of the market is nothing more than three structures: rising, falling, and sideways. That is, as long as the market is volatile, there will always be various opportunities to make money. What we have to do is to find those things that suit our time, energy, and risk preferences, and then keep doing them repeatedly.

Many people say that investing requires patience, but patience here does not mean simply waiting, but learning to take the initiative to respond. In other words, you have to find the right position for yourself, and then remain patient and persevere in executing your trading strategy.

So, what are the basic strategies or ideas that are more suitable for most people?

In last year’s e-book “Blockchain Methodology”, we have shared a lot about this topic. Here we briefly review a few aspects:

1) DCA-based execution strategy

DCA can be directly understood as a fixed investment strategy that requires sufficient patience. For example, if you insist on buying BTC during a bear market, you can do it on a weekly or monthly basis, and then wait patiently until the bull market begins to sell in batches.

In addition to persistence and patience, this strategy also requires several important considerations, including:

- Large positions are only used for long-term fixed investment in BTC, and the position is still at least 50%.

- If you like altcoins, be sure to choose projects that have real utility and long-term development vision, and pay attention to the batch ratio of your positions.

- Don't get addicted to any MemeCoin. If you want to speculate, only use a small position that can withstand zero losses.

- Don’t always try to buy at the bottom, DCA ≠ bottom fishing.

- Ignore the noise, stay focused, and persevere. The core of this strategy is the idea of "slow is fast".

2) Narrative-based approach

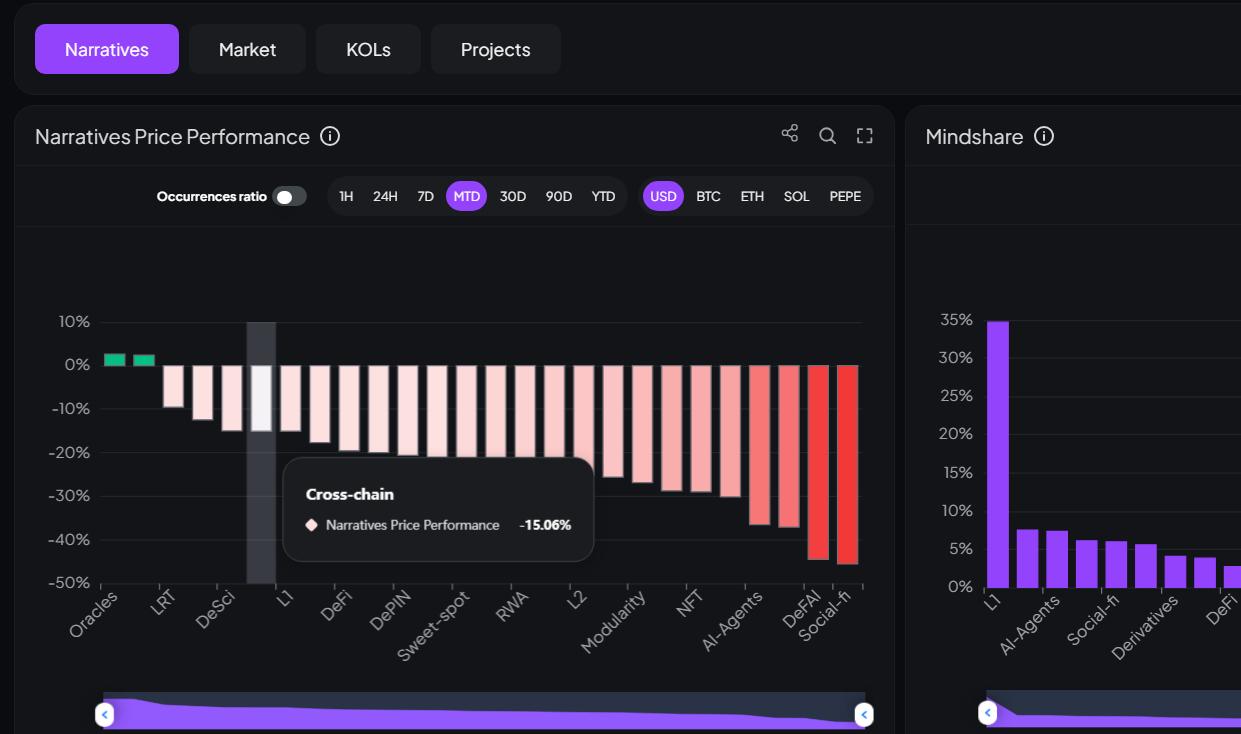

We mentioned above that if you like altcoins, you must choose projects that have practical utility and long-term development vision. The important thing here is a choice, and we believe that the best selection strategy must be based on narrative.

The market first has a narrative, and then it drives the tokens of the corresponding sector to rise. Therefore, when we choose a project, we should give priority to starting from the narrative perspective, rather than just thinking about buying a certain token.

For example, if you think that among the narratives such as AICrypto, RWA, DeFi, DePIN, etc., there may be new opportunities in the future, then you just need to explore the corresponding narrative in advance. In this way, before the new round of bull market or new stage opportunities come, you may be able to seize the opportunity more easily than others.

Of course, for narrative issues, we can also use some on-chain tools to assist our research, such as:

First, let’s take a look at which narratives are starting to gain popularity. As shown in the figure below, it seems that Oracles is gaining popularity.

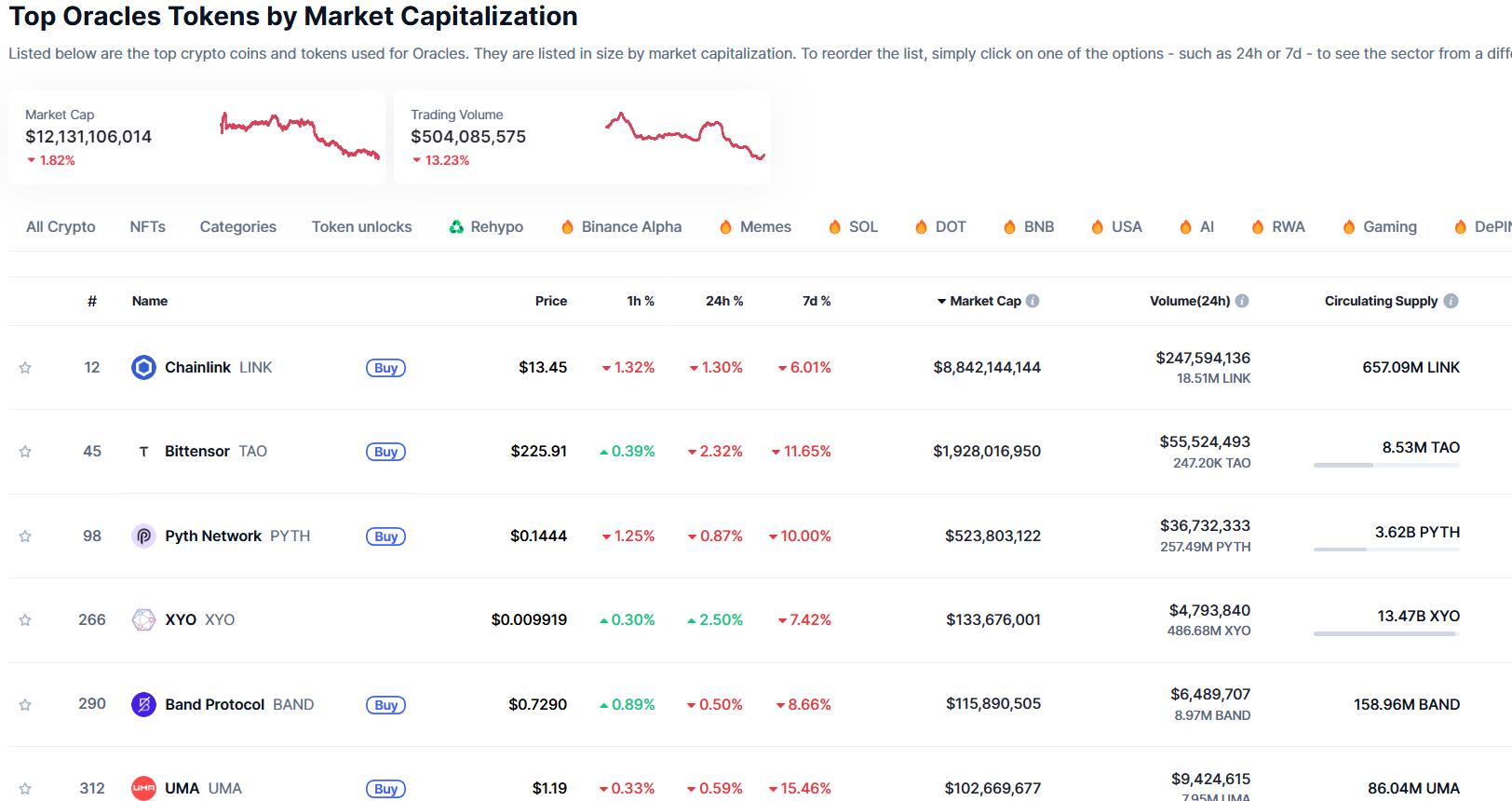

Secondly, go to the corresponding narrative and look at the corresponding project list. As shown in the figure below, let’s continue to see what projects are under the Oracles category.

After selecting the narrative goal and a list of candidate projects, the next thing we need to do is to study different projects based on some dimensions that we think are valuable.

For example, we can score the project by decomposing it. Here we continue to list several dimensions of project research:

- Team dimension, that is, whether there is a reliable and experienced team behind the project who can continuously build the project.

- Development dimension, that is, whether the project has a clear business model, or a sustainable profit model.

- Market fit, that is, whether the product corresponding to the project can find a fit in the market, or whether the project product has a clear PMF (Product Market Fit).

- Token economics, that is, whether the project has good token economics, including the distribution ratio or method of tokens, whether the tokens can be shipped smoothly (with continuous buyers) when they are released, etc.

- Narrative attributes, that is, whether the project can keep pace with market trends. For example, if all markets are hyping AI, then AICrypto will have a tailwind advantage. For example, if major institutions are trying to promote asset tokens, then RWA will have a tailwind advantage, and so on.

You can tabulate the above dimensions using EXCEL, set different scores based on your own focus (i.e. your own priority), and make a survey form for each project. Finally, select specific projects based on your actual scoring results, and use some on-chain indicators (including K-line) to determine the timing of entry, and then bet on the corresponding projects for the long term.

We have already demonstrated the scoring of this project earlier. Those who are interested can look back at the corresponding historical articles, as shown in the figure below.

According to data from dextools, the number of tokens in the current on-chain DEX has exceeded 16.81 million (note that these are tokens that can be traded. If all the tokens created on the chain are added together, the current number is estimated to be 40 million). Therefore, through our narrative-based approach above, we can reduce the time and energy you spend on blindly choosing tokens to a certain extent.

In short, if you don’t have the time or energy to do research, but don’t want to miss the opportunities in this field, the easiest way is to insist on investing in BTC through the DCA strategy. If you still hope to get more and higher income opportunities through altcoins, you can try to customize a project research plan for yourself. As for you who still have the mentality of getting rich overnight and hope to quickly change your life by asking others for the secret of wealth, we don’t have any good suggestions for you, we can only wish you good luck.

3. Other options besides trading

In addition, in this field, in addition to making money by trading spot, contracts, and futures, there are actually other ways to choose from. This mainly depends on your own interests and whether you are willing to pay.

For example, there is almost zero-cost short interaction on the test network. You can experience the interaction of various dApps without risk and without worrying about the theft of your wallet (using multiple wallet users with small assets to interact). At the same time, you can also experience specific projects and learn from them, such as the interaction of Monad, MegaETH and other networks that have attracted much attention recently.

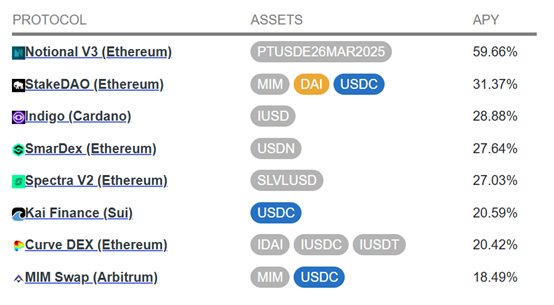

Another example is on-chain financial management, which at least will not incur losses. If you have some principal but do not want to bear the market fluctuations, then participating in some financial management is actually a good choice. There may even be additional airdrop opportunities for financial management (pledged financial management) of some new projects. If you do a good job of research, an annualized return of 10-15% is still achievable. Of course, you should also pay attention to the risks of the project. For example, you can only choose financial management of stablecoins. Don’t buy any altcoins for pledge for the so-called high returns. At the same time, pay attention to the risks of evaluating the project (running away or being stolen).

Or, if you also prefer writing, you can also consider opening a content column like Hualihuawai. If you like to show your face, you can even open a video column or a live broadcast column... and so on.

In short, different people should have different choices (stick to doing 1-2 things that you think are right and are willing to devote to for a long time), and different choices may bring different results. Bodhisattvas fear causes, and sentient beings fear consequences.

The market is cruel and the fluctuations are ruthless. Only those who are prepared in advance in the silence of the market and those who can remain calm when most people collapse can get the results they want in the new chaos. A person's return on investment is often determined by his trading discipline and personal mentality.

Peace of mind, Keep moving forward.