By: Bitcoin Magazine Pro

Compiled by: Vernacular Blockchain

Bitcoin's price movements are often analyzed through on-chain data, technical indicators, and macroeconomic trends. However, a severely underestimated but extremely important factor is global liquidity. Many investors may not fully utilize this indicator or even misunderstand how it affects Bitcoin's cyclical trends.

1. The impact of global liquidity on Bitcoin

As discussions about global liquidity heat up on platforms such as Twitter (X), and analysts delve deeper into liquidity data, understanding the relationship between global liquidity and Bitcoin prices has become a must for traders and long-term investors. However, recent trends deviate from traditional expectations, indicating that the market may require a more nuanced analytical perspective.

The global M2 money supply refers to the sum of all liquid money, including cash, demand deposits, and quasi-monetary assets that can be easily converted.

When global M2 expands, capital typically flows into high-yielding assets, including Bitcoin, stocks, and commodities, driving prices higher.

On the contrary, when M2 shrinks, market liquidity tightens and risky assets often face pressure for valuation decline.

In the current market environment, the traditional relationship between liquidity and asset prices may be changing, which requires investors to have a higher level of understanding.

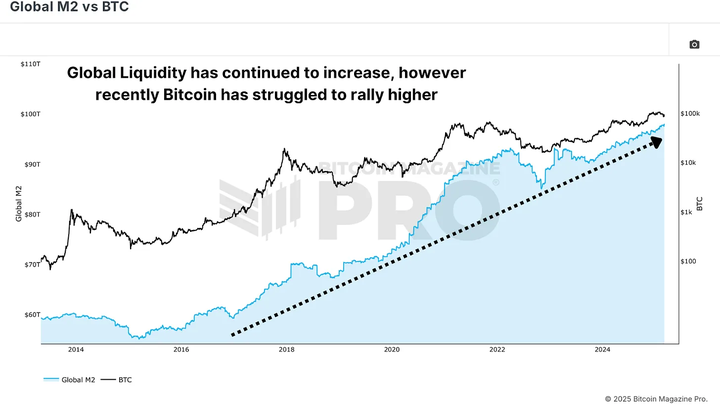

Figure 1: Global liquidity is rising, but Bitcoin prices have fallen recently

Historical trends: Divergence between Bitcoin prices and global M2 trends

In the past, Bitcoin prices have generally risen with the expansion of global M2 money supply, and faced pressure when liquidity contracted. However, in this cycle, we have observed a clear deviation: despite the continued growth of global M2, Bitcoin's price trend has shown inconsistency.

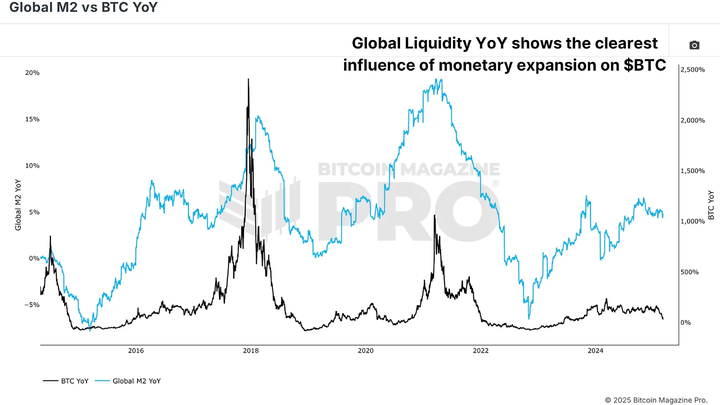

2. Year-on-year change: a more accurate measure of liquidity

Rather than simply focusing on the absolute value of global M2, a more insightful approach is to analyze its year-on-year rate of change (YoY). This indicator reflects the speed at which liquidity expands or contracts, thereby revealing a clearer correlation between Bitcoin price performance and liquidity.

When we compare Bitcoin's year-on-year return (YoY Return) with the year-on-year change (M2 YoY Change) of global M2, we can find that the correlation between the two has increased significantly.

Bitcoin’s strongest bull phases tend to occur during periods of rapid liquidity expansion.

Liquidity contraction usually precedes a pullback or long-term consolidation in Bitcoin prices.

This finding suggests that investors need to pay more attention to changes in the growth rate of global liquidity rather than just the absolute level of liquidity.

Figure 2: The annual change rate of global liquidity can more clearly reveal the liquidity cycle

For example, during the consolidation phase of Bitcoin in early 2025, although global M2 grew steadily, its growth rate tended to stabilize. Only when the M2 expansion rate accelerated significantly, Bitcoin would be able to break through new highs.

3. The hysteresis effect of liquidity

Another key observation is that the impact of global liquidity on Bitcoin is not immediate. Studies have shown that Bitcoin's price typically lags behind changes in global liquidity by about 10 weeks.

If the Global Liquidity Index is moved forward 10 weeks, Bitcoin’s price movement and its correlation will be significantly enhanced.

After further optimization, it was found that the most accurate lag period was approximately 56 to 60 days, or about 2 months.

This lag effect means that investors need to consider time delays when analyzing the impact of liquidity on Bitcoin, rather than just focusing on current liquidity levels.

Figure 3: The correlation is strongest when liquidity data is lagged by two months

4. Bitcoin Outlook

For most of 2025, global liquidity entered a sideways phase after a strong expansion in late 2024 that drove Bitcoin to new highs. This liquidity sideways period coincided with Bitcoin's consolidation and pullback to around $80,000.

However, if historical trends continue to hold true, the recent recovery in global liquidity is expected to bring a new round of increases in Bitcoin around the end of March.

Figure 4: Liquidity is surging, but it may take a few weeks for Bitcoin to truly benefit

5. Conclusion

Global Liquidity is an important macro indicator for predicting Bitcoin's trend. However, instead of relying on static M2 data, a more effective approach is to focus on the rate of change of M2 and understand the impact of Bitcoin prices, which usually lags by about two months.

As the global economic environment changes and central banks adjust their monetary policies, the price of Bitcoin will continue to be affected by liquidity trends. The next few weeks are crucial - if global liquidity continues to expand at an accelerated pace, Bitcoin may usher in a major rally.