There are still many uncertainties in the macro-economy, and the tariff policy implemented by Trump has hit many technology stocks in the US stock market. Since the launch of spot ETFs, Bitcoin has gone from a niche asset to a focus of traditional finance, which also means that the price trend of Bitcoin is increasingly affected by the macro-economy.

The current market has been fluctuating between 82,000 and 88,000 for two months. There is no new narrative in the secondary altcoin market, and the primary market has no sustainability. As investors, in addition to lying flat, it is also a good choice to mine the blue-chip currencies and stablecoins in our hands to earn passive income.

Berachain, a public chain with built-in DeFi mechanism, has also launched the PoL liquidity proof mechanism, with returns exceeding 100% APY. Let WOO X Research take you to mine on Berachain!

How PoL creates a flywheel effect

- Users provide liquidity: Users invest their assets into the dApp's liquidity pool, obtain receipt tokens, and pledge them into the reward pool to earn BGT, providing initial liquidity for the ecosystem;

- Validator allocation: Validators direct BGT emissions to the highest reward pool based on the incentives provided by dApps. As more BGT flows into popular pools, users' yields increase, further incentivizing more users to join;

- dApp competition: To attract BGT emissions from validators, dApps increase incentives (such as increasing native token rewards) and deepen liquidity;

- User delegation: The BGT earned by users can be delegated to validators with excellent performance, which will enhance the block proposal weight of these validators, thereby obtaining more share rewards and motivating validators to continuously optimize the BGT allocation strategy, thus forming positive feedback;

- Ecosystem expansion: As liquidity and user participation increase, transaction volume and dApp usage increase, network value increases, attracting more users and developers to join, and the flywheel accelerates.

This flywheel effect enables dApps, users, and validators to form a collaborative relationship, breaking the dilemma of insufficient liquidity and uneven asset distribution in traditional PoS.

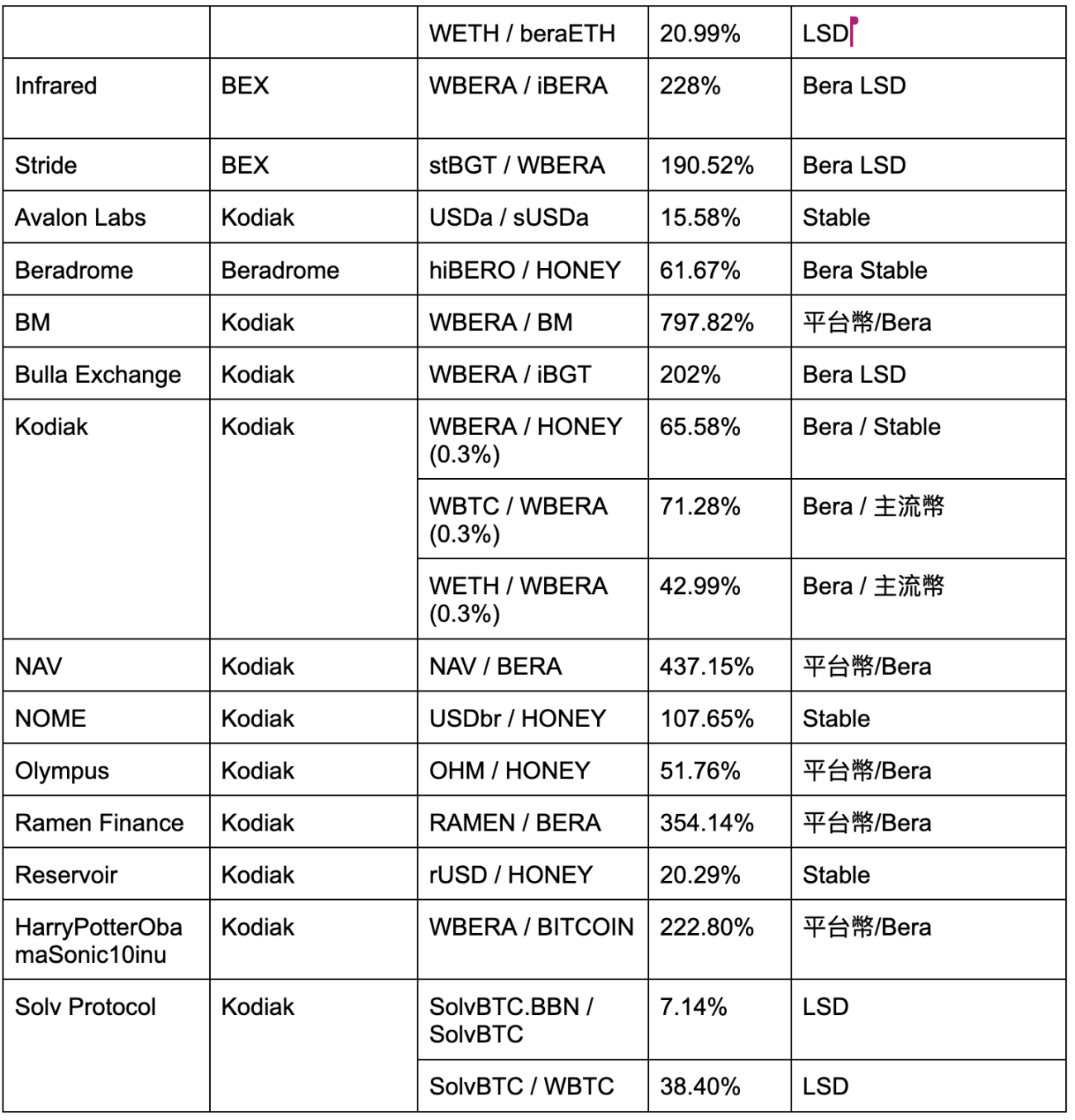

Current PoL reward pool summary

* The data changes greatly. The data in the table is for reference only. If you want to obtain real-time data, please refer to the following website: https://furthermore.app/

Mining strategy

1. "Steady layout" mainly based on core blue chips/LSD:

Core idea: Choose a portfolio of assets on Berachain that is relatively core, deep, and relatively volatile, for example:

- WBERA / LSD (such as iBERA, stBGT, beraETH, etc.)

- WETH/LSD (weETH, ezETH, beraETH, etc.)

- WBTC / Psychedelic

The intention is to:

- Reduce the risk of drastic price fluctuations (compared to small/meme coins);

- Enjoy better liquidity depth (official or large protocol resources often tend to be tilted towards the LSD ecosystem);

- You can “stack income” at the same time: holding LSD itself already has staking income, plus the BGT reward of PoL.

Possible sources of income:

- Liquidity Mining (LP Rewards + PoL Rewards)

- LSD built-in income (part of LSD will continue to accumulate staking rewards, making your LSD share increase in value over time)

- Protocol Bribe profit sharing (if the protocol where the LSD is located actively bribes Validators, the incentive will be higher)

Risks and precautions: The premium and discount issues between LSD tokens, such as iBERA, beraETH, etc. may be decoupled.

- The Validator's Commission and profit-sharing system requires you to choose the right validator to get the mining income.

- When the amount of funds is too large or insufficient, you need to consider the balance between the final annualized APR and the gas and handling fee costs.

2. Stablecoin/stablecoin pairing "low volatility strategy"

Core idea: Choose stablecoin pairs and stablecoin pools (such as USDa/sUSDa, rUSD/HONEY, or trading pairs between other stable assets to reduce the impermanent loss caused by currency price fluctuations.

Since there are already multiple decentralized stablecoins in the Berachain ecosystem (USDa, sUSDa, rUSD, USDbr, etc.), many protocols will bribe (Bribe) to attract more stablecoin TVL. The APR may not be as good as the high volatility pool, but the asset itself is relatively stable.

Possible sources of income

- PoL Incentives (BGT Emissions + Protocol Bribe)

- Transaction fee income (stablecoins/stablecoins sometimes have large trading volumes, and the fees are distributed to liquidity providers)

- Additional rewards or airdrops from protocol parties (some protocols will airdrop governance tokens to stablecoin providers, etc.)

Risks and precautions:

- Credit risk of the stablecoin itself: Determine whether the stablecoin’s collateral mechanism, excess collateral ratio or algorithmic mechanism is reliable.

- The APR is usually relatively low, and if you are looking for high returns, you may need to allocate a portion to other high APR pools.

- Bribe is unstable: the parties to the agreement may spend a lot of money on bribes at the beginning, but if the business is not doing well later, the incentive will drop rapidly.

3. High-risk Meme Coins/Emerging Token Pools: High APR Short-term Strategy

Core idea: Select newly launched or highly topical Meme coins/emerging tokens (such as HarryPotterObamaSonic10inu, BM, RAMEN, HOLD, etc.) and their trading pairs with WBERA, HONEY, BGT or LSD. These small coin pools often have exaggerated APRs of thousands of%.

- Short-term mining, withdrawal and selling: Earn rewards under high APR and cash out to blue-chip assets (BERA, ETH, BTC, etc.) or stablecoins in a timely manner to avoid a sudden drop in the token price in the future.

Possible sources of income:

- PoL Rewards: Since “new projects” often offer a large amount of Bribe, they guide BGT to be released into their own Vault.

- Extremely high APR or airdrop: To attract users in the short term, the protocol party will usually provide additional token subsidies.

Risks and precautions:

- Price volatility/Rug risk: Meme coins may rise or fall sharply in a short period of time; the security of the new protocol has not been tested by time.

- Impermanent Loss: If the price of an emerging token rises or falls dramatically, the price of one side of the LP pool may fluctuate too much, and eventually most of the mining rewards may be lost.

- Pay close attention to the data: especially TVL, transaction volume, and protocol Bribe remaining, which will affect the actual income of the pool.

Conclusion: There is no absolute strategy, dynamic observation is the most critical

The Berachain ecosystem under the PoL mechanism is essentially a "bribery competition between protocols." In order to attract more TVL and compete for BGT emissions, the protocol parties will offer Bribes of different sizes; and as the market environment and their own budgets adjust, the APR may also change rapidly.

The best strategy is often not to "lock a pool and leave it alone", but to "diversify + dynamically adjust":

- Part of the funds are allocated in the relatively stable LSD/blue chip/stable coin pool.

- A portion of small funds are allocated to high-risk, high-volatility small coins or Meme pools in pursuit of drastic returns.

- Frequently track the trends of each pool's APR, Validator Commission, and protocol Bribe, and optimize mining revenue in a timely manner.

Be sure to pay attention to security: the risks of new protocol contracts, whether the token model is reasonable, team background, etc., all need to be checked more. The high APY brought by PoL may be attractive, but Rug or contract loopholes also exist in projects in the early ecosystem.