People spend two years learning to talk and a lifetime learning to shut up.

Amid the hustle and bustle of the cryptocurrency world, success and fame are synonymous. There is not even any distance between traffic and monetization, because it revolves around the asset issuance and recovery industry, which can also be called the redistribution of wealth. Becoming famous has become a rigid need for every practitioner.

VCs are no longer high-end, but are instead interested in daily Twitter surfing link projects;

CEXs became masters of emotional massage, shuffling information back and forth in the X/TG/ WeChat groups to ensure that the public relations crisis was under control;

Male and female BDs wander between traffic and wandering, working hard for high salaries to enter the second level in pursuit of the dream of getting rich quickly.

If you are lucky enough to avoid these traps, or if you are lucky enough to escape crisis PR, you will get the maximum traffic. By applying the following formula, the traffic can be instantly converted into trading volume. Some people say that Binance's profit is 50 billion US dollars, and some people say that Bitget's year-end bonus is 50 months.

True or false, the leading position is unquestionable, but how long can the lead last?

The Leader’s Dilemma: Too Much Weight

There is no need to FUD Solana or suspect that Binance is going to sell it. Solana has been following the "stand-alone chain" model from the beginning, which is the fundamental source of its high performance. Jump's trading ability and SBF's direct claims are just cooperating with Solana, not unilaterally exploiting it.

The logic of Binance is similar. There is no problem with Binance's operation. The problem is that the Binance in 2017 cannot survive in 2025. If CZ is forcibly pledged for 4 months and no latecomer can surpass it, then it is not a problem that CZ cannot keep up with the times now.

Binance’s only problem is itself, which can perhaps be described as “crushed by its own weight”:

Internal interest groups and people who are idle, from Trust Wallet being left behind by OKX Web3 Wallet to employees frequently clashing with users, it is co-founders He Yi and CZ who are calming the market. This is simply anti-Marxist black humor. Originally, the employees should support the company and the boss should exploit the employees, but now it is more like the hen protecting the weasel.

In 2017, Binance was engaged in global arbitrage. Under the ban, it took over the users and traffic that fled from Huobi and OK. This was the right time for Binance to start up, and the global migration maximized the advantages of offshore exchanges, which was the right place. In addition, it handled the conflicts between co-founders, and between external investors and companies, which was the right people. It is very obvious that the right time is no longer there. The US Department of Justice has actually become Binance's heaven. The right place has disappeared, Binance, Labs and BNB Chain are in different places, the ecological synergy cannot be clearly explained, and there is no right people. The highly educated employees do not have the pure desire to make money like college BDs.

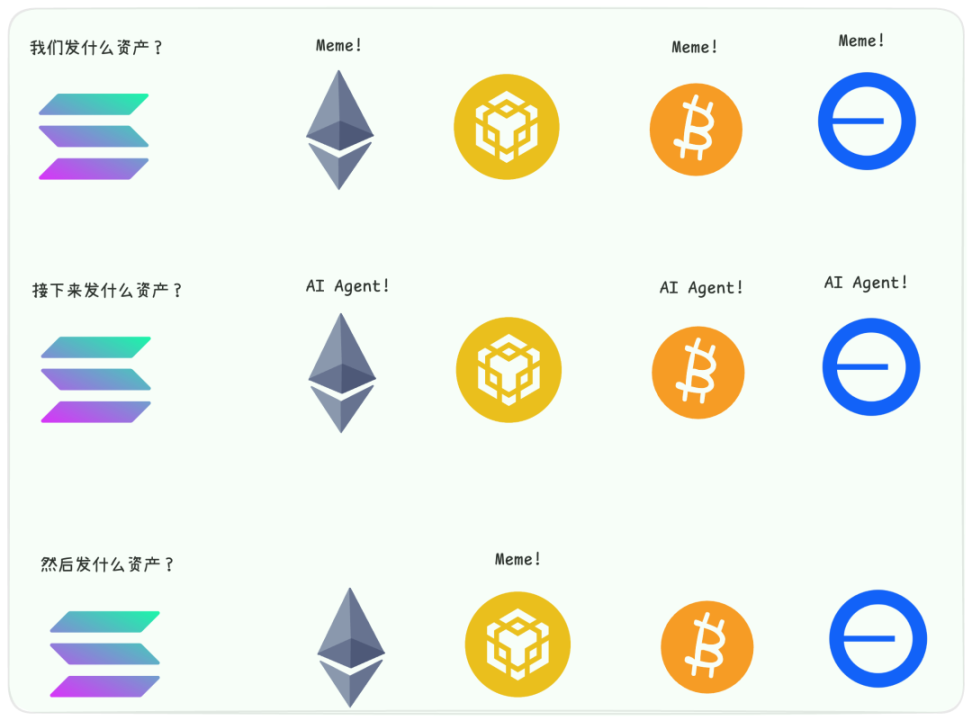

When the dramas of TST and CZ's Dog were staged one after another, Four.Meme started to exert its strength only after it made hundreds of millions of dollars in Pump.Fun. When AI Agent and Meme disappeared, CZ began to study the combination of AI Agent and BNB Chain.

The hero is old, nothing more than that.

At this point, the only way is to save itself. BNB will become a true Web3 asset and need to assume the responsibilities of BNB Chain and Binance in the post-regulatory era. Empowering BNB can guarantee Binance's position in CEX. Kaito's airdrop to BNB holders is just an appetizer. What will happen next is how to make BNB Chain a real chain rather than a subsidiary chain of Binance. Wallets can no longer be relied upon, and CZ needs to leave himself a ticket to enter the future chain ecosystem.

In many people’s memories, the impression of BNB Chain still remains in the BSC Tugou era of the last cycle. Now CZ has begun to relearn how to play the currency circle. After completely withdrawing from Binance, the opportunity to verify whether he is the king of bargain hunting or a genuine entrepreneur has come.

The fate of the pursuer - the more you do, the more mistakes you make

PI's conquest of the city only verified one thing, that $TRUMP's breaking circle effect is not as good as Musk's call for Dogecoin in 21 years. I was very optimistic about Trumpcoin before, not because of the price, but because of the out-of-circle effect.

But unfortunately, Trump's PUMP was too strong, resulting in a huge DUMP and too short a time. Dogecoin rose slowly in 21 years, and Musk's choice to hint rather than publicly stand for it also allowed Dogecoin to develop an independent trend.

After Trump, all presidents chosen by the Solana coin issuance group have this problem. The collateral effects of harm to politicians are far more complicated than those to celebrities. Why are both the individual cycles and the entire cycle of the presidential coin so short (from Trump to Milley, a full month at most)? It may be that the backlash from deconstructing the seriousness of politics is too severe.

So OKX chose to surrender to PI, and the ripple effect shocked everyone. Whether Bybit accepted it or not, even Binance picked up the retro way of voting for listing coins. Although the coins may not be listed, it verified the correctness of OKX's risky move - let the industry follow its own rhythm, and even command the pace of industry leaders.

Of course, after PI is listed, it will inevitably go along Ponzi's established route, but the great advantage of the currency circle is that everyone knows that this is Ponzi. This is the biggest difference from traditional finance. Traditional finance does not admit to wearing the emperor's new clothes, but the currency circle chooses to admit it.

If you don’t like it, you can short it. This is He Yi’s answer. In the Bitget system, if I don’t like it, you have to say it out loud. You talk about the city gate tower and I talk about the hip axis. But the same thing applies. There are too few levels in the currency circle, and public opinion and private discourse are quantum entangled. The inseparable fate leads to infinite magnification of the crisis.

Image caption: Performance of coins listed on various CEXs. Image source: Animoca Brands Research

"Time flies by, it never stops day or night." Foreigners explained: Confucius stood by the river, pointed at a corpse floating by and said, "See? This is what you will be like in the future."

For the followers, you have to keep doing the right things to gain a little bit of user trust, but conversely, doing something wrong once could be a disaster. However, the followers cannot stop doing things, otherwise a stable structure will naturally benefit the leaders with the largest share. As a result, industry training camps with a continuous existence period of 4 months for employees were successfully born. Even if Yan Xishan came, he would not survive for half a year.

The leaders have many problems, but their size advantage outweighs everything. All mistakes can be covered up by a BNB token airdrop and a simple price increase, and then life will be peaceful.

Big companies in the cryptocurrency world will be more like the Internet, and the Internet will be more like state-owned enterprises. Everything is being institutionalized and becoming part of the existing order.

Conclusion

Pinduoduo caught up with JD.com and became the second in China by reducing the toilet time of its employees, while Temu started a war with Amazon. The second in the two markets is the first in the world. Now the followers in the currency circle will also learn the strategies of the Internet 5/6 years ago. In a word, more lucrative and more melon-filled CEXs will be the main theme in 2025. They will not be quickly replaced by DEXs such as Hyperliquid, not to mention the suicidal actions of Solana-based DEXs such as JUP.

Whether Solana will become the third chain after BTC/ETH remains undecided, and now BNB Chain is also joining the battle.