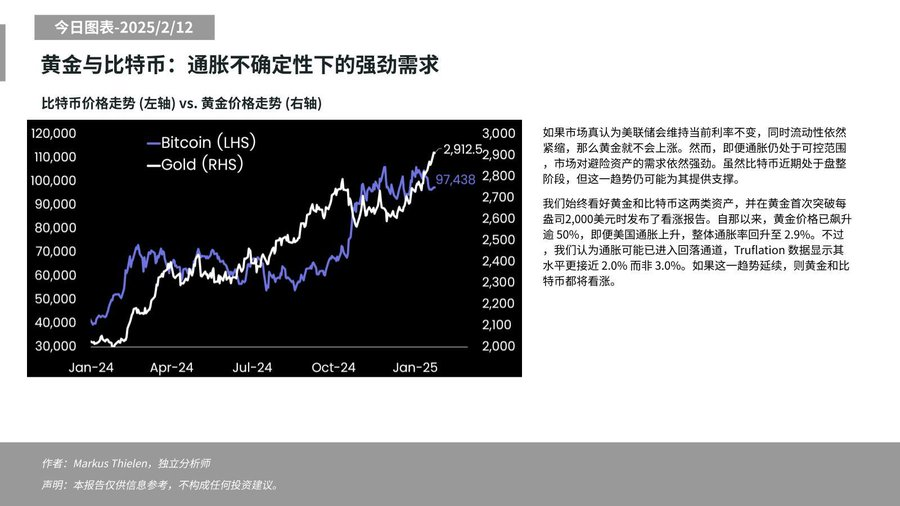

PANews reported on February 12 that Matrixport said that in the current context of inflation uncertainty, the market demand for safe-haven assets such as gold and Bitcoin remains strong. If the market expects the Fed to keep interest rates unchanged and liquidity tightens, gold will not rise in theory, but the actual situation shows that even if inflation is controllable, safe-haven demand still drives gold to strengthen.

Although Bitcoin has been consolidating recently, this trend may provide support for it. Matrixport recalled that it issued a bullish report when gold first broke through $2,000 per ounce, and the price of gold has since risen by more than 50%. Although the overall inflation rate in the United States has rebounded to 2.9%, Truflation data shows that the actual inflation level is closer to 2.0%. If the trend of inflation decline continues, the outlook for gold and Bitcoin remains bullish.